This year Christmas will be a little different.

There’s uncertainty on whether family and friends will be able to gather over the holidays, and your annual work Christmas party may be virtual instead. That’s why this year, the act of giving is more important than ever. We’ve pulled together 6 reasons why our new book Signals is the perfect gift to inspire and encourage, and why your loved ones deserve Signals under the tree.

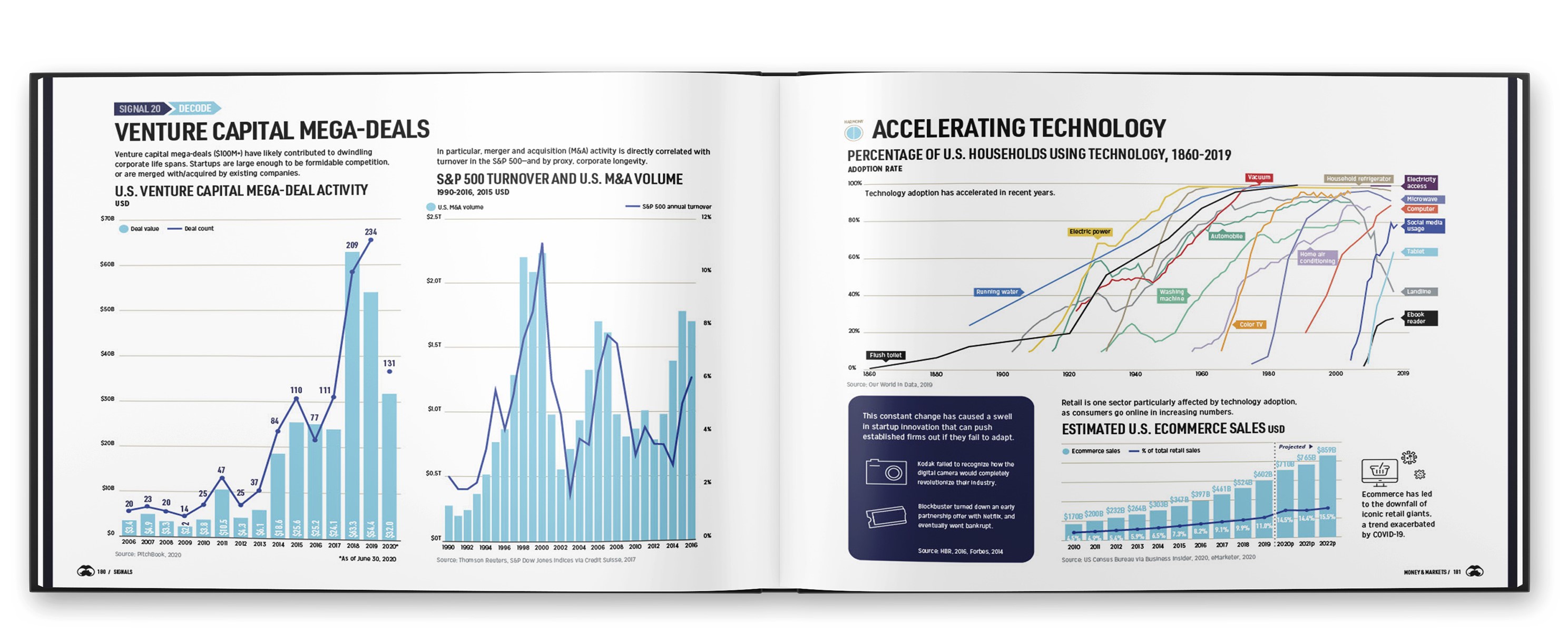

1. It’s packed with brand new charts and visualizations.

The graphics in Signals were designed exclusively by our team for the book, so all 258 pages feature fresh new infographics, charts, and maps. Signals is custom printed on high quality paper to make the visuals really stand out, and is protected by a strong hardcover.

2. It’s a great gift for clients.

Keep your brand at the top-of-mind going into 2021 by sending Signals as a corporate gift. Our customized bulk orders include custom book jackets, your company logo and colors, a personalized note, and discounted bulk pricing. Place your customized bulk order before November 30th to guarantee delivery before Christmas. Bulk orders typically take 7-8 working days to process. Please note that some international orders are experiencing shipping delays due to COVID-19.

3. As a result of the pandemic, people are reading more.

With no social obligations, no commute, and more time on our hands, there’s plenty opportunity to dive into a good book. Our latest book has 27 signals to explore, with hundreds of different charts and visualizations to check out when there’s a spare minute.

4. Left your holiday shopping too late?

If you cut it too fine for shipping, Signals is available as a PDF eBook, so readers can dive into all chapters on their phone, tablet, or desktop for an affordable $9.95 USD. The eBook is instantly downloadable, so it can be enjoyed right away.

5. It’s the gift that keeps on giving.

Signals identifies simple and clear takeaways on the trends that will define the next decade. The powerful data found throughout the book can be used as a reference point to better understand the factors shaping the future direction of the economy, enabling professionals and investors around the world to make smarter decisions.

6. There’s something for everyone.

Readers can take a closer look at topics that interest them, while learning something new about areas they are less familiar with. Chapters in the book include:

Money & Markets Society & Demographics Technological Innovation Environment Digital World Geopolitical Landscape

Take a look at the full table of contents below.

Other Useful Links

Learn more about the book on our Kickstarter page. See our article on the 6 Powerful Signals That Reveal the Future of Financial Markets.

Buy Signals as the perfect holiday gift now – don’t miss out.

on To reach net-zero by 2050, immediate action and $9.2 trillion in annual investment is required, or about 7-9% of global GDP. This would be $3.5 trillion annually more than today, which in 2020 was equal to roughly:

50% of corporate profits25% of tax revenues7% of household spending

This infographic sponsored by Carbon Streaming Corporation shows how carbon credits can help accelerate a net-zero future by funding climate action.

Closing the Funding Gap With Carbon Credits

Carbon credits play a vital role in channelling finance to help close this funding gap. Here are some ways in which carbon credits can be used: Thanks to a growing number of initiatives listed below, 2023 is anticipated to bring greater credibility and transparency to the carbon credit market.

The Integrity Council for the Voluntary Carbon MarketScience Based Targets initiative (SBTi)Climate Action Data TrustVoluntary Carbon Markets Integrity Initiative

Not Every Carbon Credit is Equal

Identifying high-quality carbon credits is important because not every type of credit offers the same scope of benefits. Carbon credit buyers look for credits that offer tangible benefits that go beyond CO₂ reduction or removal, such as:

Advancing Sustainable Development GoalsCreating jobs in local communitiesProtecting biodiversityProviding education and job training

Often, credits that offer these types of benefits command a price premium. At the same time, demand for carbon credits is expected to increase. Within the decade, the value of the voluntary carbon market could grow from $2 billion up to $50 billion. Voluntary carbon markets refer to the transactions in which carbon credits are purchased by corporate and other buyers that voluntarily (not required by a regulatory act) want to compensate for their emissions or advance sustainability goals.

Source: Ecosystem Marketplace, McKinsey, UNFCCC Today, over 8,300 corporate, 1,100 municipal, and 52 regional net-zero commitments are set to drive market growth.

Carbon Streaming’s Innovative Approach to Climate Action

Carbon Streaming is a publicly listed company that invests capital in high integrity carbon credit projects on a global scale. It uses the proven, flexible streaming model to create long-term partnerships. This model aligns interests to benefit all stakeholders. Carbon Streaming’s growing portfolio of carbon credits includes over 20 projects across six different project types in 12 countries that aim to accelerate a net-zero future.

Transformative Year Ahead

By the end of 2023, carbon credits are expected to be issued from 10 or more projects. Importantly, all of Carbon Streaming’s carbon projects aim to advance multiple UN Sustainable Development Goals. Carbon Streaming intends to continue growing and diversifying its portfolio while selling carbon credits received to maximize value for all stakeholders.

Interested in learning more about Carbon Streaming? Click here to learn more.