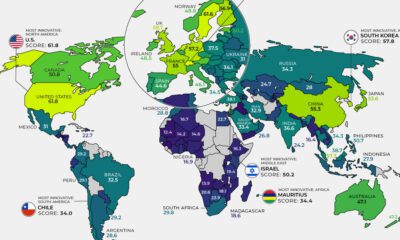

However, investors could consider expanding their geographic exposure. From Shanghai to London, 20 of the world’s stock exchanges have a market capitalization above $1 trillion. This infographic from MSCI highlights the possibilities in international equity investing. Let’s dive into some of the key concepts covered in the visualization.

Consider Correlations

For starters, by looking abroad, investors may be able to include markets in their portfolio that have relatively low correlation with their home market. This means the market movements are not as closely aligned, and the markets may behave differently from one another. For instance, the U.S. has varying degrees of correlation with international stock markets. A correlation of 0 indicates there is no relationship between the market movements, while a correlation of 1 indicates that they move the exact same percentage in the same direction. Daily correlations based on data from December 31 2015-December 31 2020. In the past, adding less correlated markets to a portfolio has helped to reduce overall volatility.

Manage Potential Concentration Risk

Technology companies have become more dominant in major U.S. stock indexes due to their strong performance. In the MSCI USA Index, for example, the weighting of FAANG stocks has doubled from about 8% in 2019 to more than 16% in 2021. This increased concentration means that more of the performance and risk of each index can be driven by this small number of stocks. Branching out geographically can help to reduce that concentration risk.

Access Alternative Revenue Sources

Investors that focus in the U.S. may find their exposure to revenues and potential growth from other regions is limited. For example, only 31% of the MSCI USA Index’s revenue exposure comes from areas outside North America. On the other hand, the MSCI All Country World Index derives about 70% of its revenue exposure from regions outside North America. As investors move towards a more global portfolio, they increase their exposure to revenue and potential growth from other regions.

Gain Exposure to Economic Growth From Other Regions

While GDP growth in developed economies has been more consistent, growth in emerging markets has been higher. For example, emerging markets typically experience higher GDP growth as they transition to industrial economies with higher standards of living. Here is historical and projected data for various regions, based on average annual GDP growth.

Historical and Projected GDP Growth by Region

Note: Projections as of April 2021. The Pacific region represents Japan, Hong Kong, Singapore, Australia, and New Zealand.

Emerging markets had GDP growth that outpaced other regions in the past, and the International Monetary Fund projects that they will continue to experience above average growth.

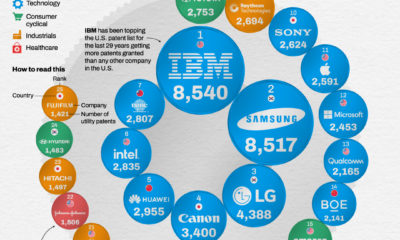

Increase Exposure to Innovation

Thematic investing is one way to gain exposure to innovation, and international investing is another potential method. Innovation goes far beyond Silicon Valley, and is heating up abroad. In fact, over 70% of total R&D spending in 2018 originated outside of North America. Israel, Korea, and Taiwan were the top spenders as a percentage of GDP. By taking part in international equity investing, investors can aim to capitalize on new developments.

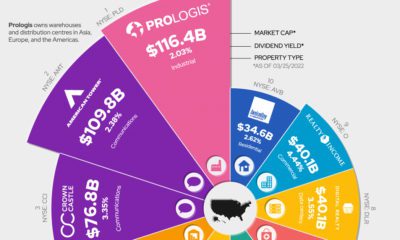

Access Attractive Valuations

Emerging markets have an attractive price relative to their return on equity, a measure of a stock’s profitability. Data as of December 2020.

Emerging markets offer the second highest return of equity of the group, at a much lower price to book value than U.S. stocks. In other words, emerging market stocks offer strong investor returns in comparison to the price paid to obtain them.

Broadening Horizons With International Equity Investing

While many investors succumb to home bias, they could consider a wider set of investment options around the world. By engaging in international equity investing, investors can:

Aim to increase diversification and manage risk Take advantage of growth opportunities Access emerging markets

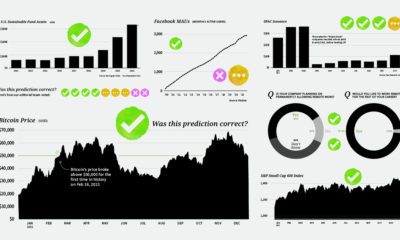

Global markets are changing. As innovation and growth accelerate outside North America, investors may want to consider new possibilities. on Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard.

How Has Asset Allocation Impacted Returns?

Based on data between 1926 and 2019, the table below looks at the spectrum of market returns of different asset allocations:

We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

A traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of 8.8%. As interest rates have climbed in recent years, this may widen its appeal once again as bond returns may rise.

Meanwhile, a 100% bond portfolio averaged 5.3% in annual returns over the period. Bonds typically serve as a hedge against portfolio losses thanks to their typically negative historical correlation to stocks.

A Closer Look at Historical Correlations

To understand how 2022 was an outlier in terms of asset correlations we can look at the graphic below:

The last time stocks and bonds moved together in a negative direction was in 1969. At the time, inflation was accelerating and the Fed was hiking interest rates to cool rising costs. In fact, historically, when inflation surges, stocks and bonds have often moved in similar directions. Underscoring this divergence is real interest rate volatility. When real interest rates are a driving force in the market, as we have seen in the last year, it hurts both stock and bond returns. This is because higher interest rates can reduce the future cash flows of these investments. Adding another layer is the level of risk appetite among investors. When the economic outlook is uncertain and interest rate volatility is high, investors are more likely to take risk off their portfolios and demand higher returns for taking on higher risk. This can push down equity and bond prices. On the other hand, if the economic outlook is positive, investors may be willing to take on more risk, in turn potentially boosting equity prices.

Current Investment Returns in Context

Today, financial markets are seeing sharp swings as the ripple effects of higher interest rates are sinking in. For investors, historical data provides insight on long-term asset allocation trends. Over the last century, cycles of high interest rates have come and gone. Both equity and bond investment returns have been resilient for investors who stay the course.