Black Friday

Visualizing the surge in U.S. consumer debt and spending

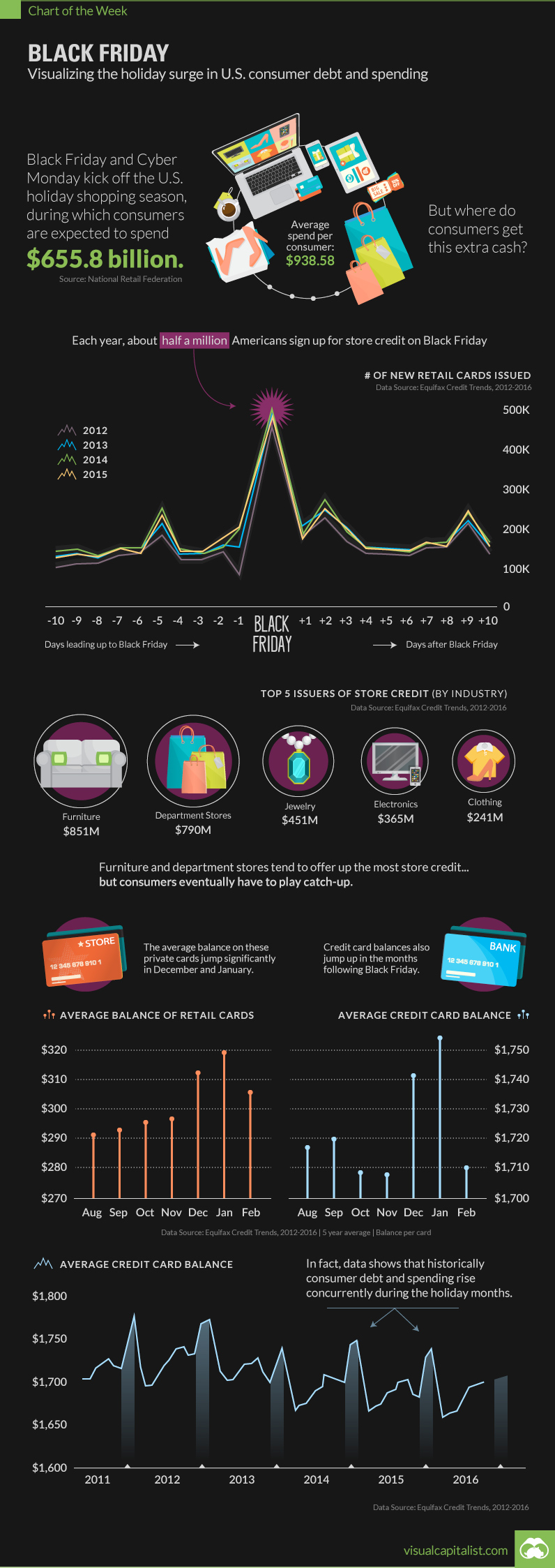

The Chart of the Week is a weekly Visual Capitalist feature on Fridays. Next week, Black Friday and Cyber Monday will kick off the start to the U.S. holiday shopping season, during which consumers are expected to spend a total of $655.8 billion this year. With the average bill coming in at $938.50 for holiday spending, where are people finding the extra cash? We looked back at the last five years of Equifax data to see how consumer debt correlates to holiday purchases.

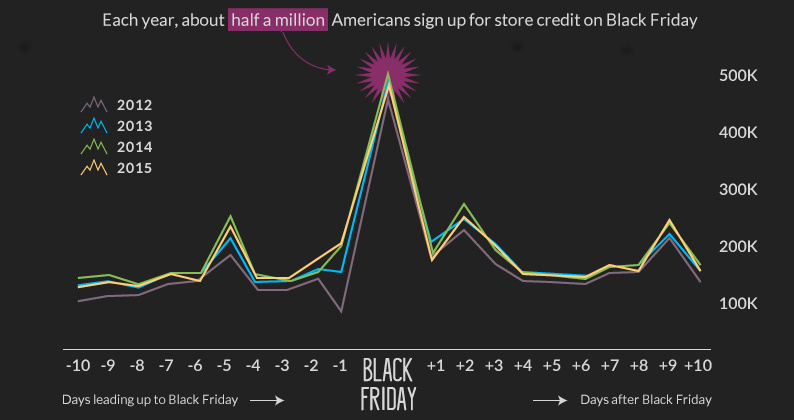

There’s Credit In Store

One way consumers take advantage of Black Friday deals is through the issuance of store credit. Specifically, Black Friday traditionally sees a noteworthy surge in signups to private label cards – the kind redeemed at stores like Macy’s. Each year, roughly half a million Americans are signing up for new accounts on Black Friday: Furniture and department stores are among the biggest providers of this type of credit to consumers. Here are the five-year averages by industry for the months of November and December:

Charge it, please

This bump in activity doesn’t stop with new signups for store credit. The average balances on store cards and credit cards both jump noticeably in the months following the holiday season: Every year is different, but the data always follows the same trend. Stocking up on Black Friday deals is not cheap, and extra dollars spent eventually make their way onto the credit card statement with the cost of interest added on. on In this infographic, we’ve visualized data from the Fed’s most recent consumer debt update.

Aggressive Borrowing

The first chart in this graphic shows the growth in outstanding car loans between Q2 2020 (start of the pandemic) to Q4 2022 (latest available). We can see that Americans under the age of 40 have grown their vehicle-related debt the most. It’s natural for Gen Z (ages 11-26) to have higher growth figures because many of them are buying their first car, but 31% is quite high relatively speaking. Part of this can be attributed to today’s inflationary environment, which has pushed used car prices to new highs. Supply chain issues have also resulted in over 30% of new cars being sold above MSRP. Because of these rising prices, the Fed reports that the average auto loan is now $24,000, up 41% from 2019’s value of $17,000.

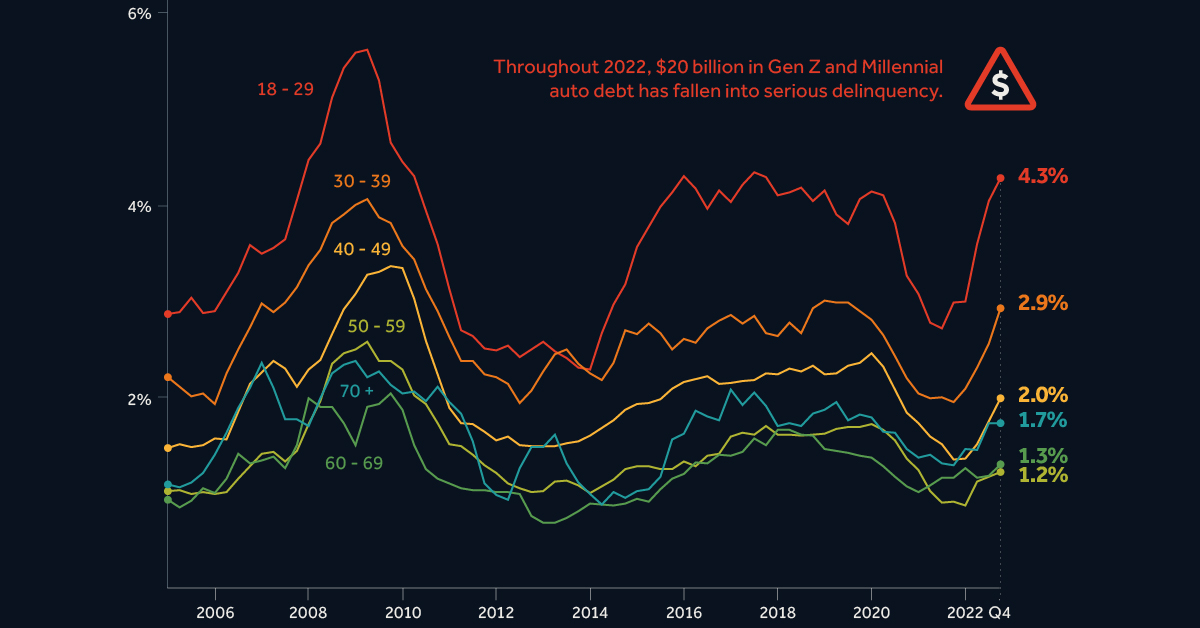

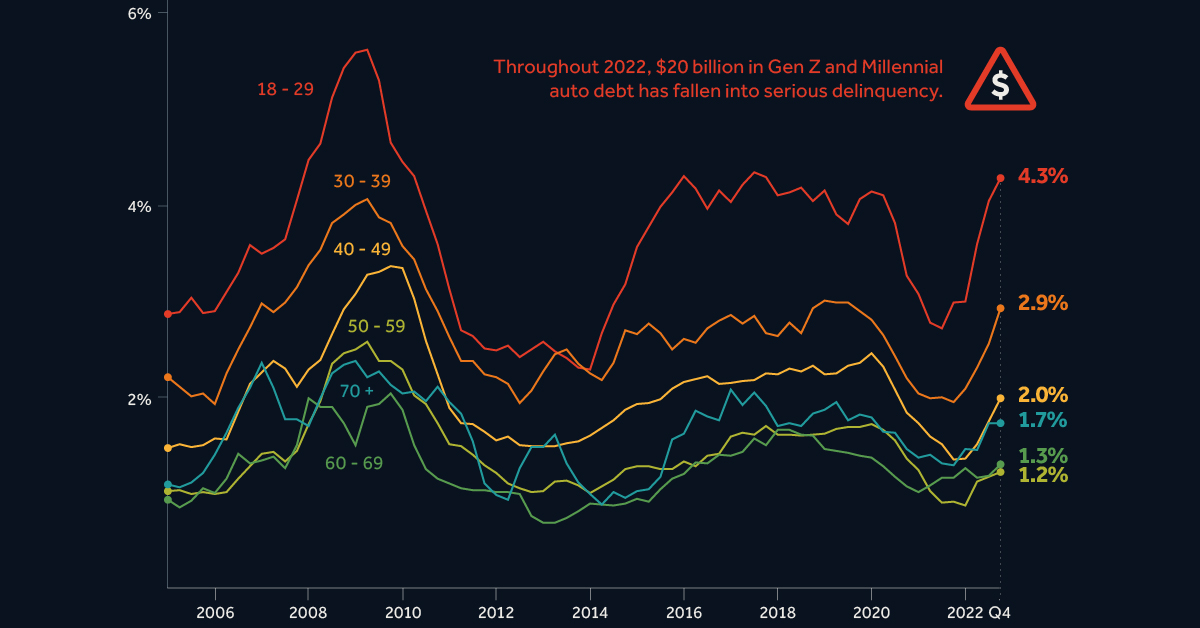

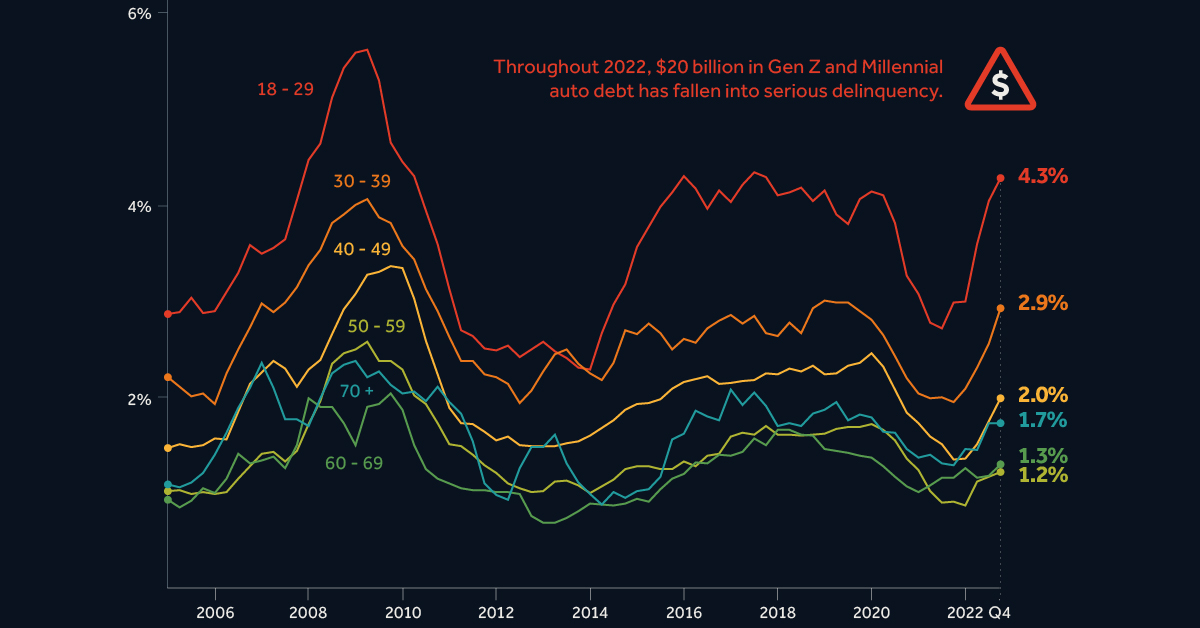

Spiking Delinquencies

Interest rates on auto loans are typically fixed, meaning many young Americans were able to take advantage of the low rates seen during the pandemic. Despite this, one in five Gen Zs say that their car payments account for over 20% of their after-tax income. Shown in the second chart of this infographic, the amount of auto debt transitioning into serious delinquency is much higher for Gen Z and Millennials. Throughout 2022, these generations saw $20 billion in auto debt fall 90+ days behind. The outlook for these struggling borrowers is bleak. First there’s inflation, which has pushed up the prices of most consumer goods. This eats into their ability to make car payments. Second is rising interest rates, which make credit card debt—another pain point for young borrowers—even more costly. Finally, there’s student loans, which are expected to resume in summer 2023. Payments on student debt have been suspended since the beginning of the COVID-19 pandemic.