“Markets can remain irrational longer than you can remain solvent.” – John Maynard Keynes The last time we gave a good run down of Canada’s housing market was in May 2015, when we noted that The Economist gave it the dubious title of the most overvalued housing market in the world. Since then, in just 10 months, prices in Vancouver and Toronto have soared to marks that are 14.1% and 8.7% higher respectively. Frothy prices, million-dollar shacks, and buying frenzies have prompted world-class short-sellers to come out of the woodwork. For a speculator such as Marc Cohodes, who advises hedge funds on Wall Street that want to bet against the Canadian housing market, this type of classic bubble behavior is music to his ears. “The cross currents are beyond crazy in Vancouver — it’s a mix of money laundering, speculation, low interest rates,” says Cohodes, who was once profiled as Wall Street’s highest-profile short-seller by the New York Times. “A house is something you live in, but in Vancouver you guys are trading them like the penny stocks on Howe Street.” Mr. Cohodes has recently said that Canadian real estate has reached “peak insanity”, and it’s part of the reason that investors around the world are trying to find a way to bet against the market. Home Capital Group, one of Canada’s largest financial institutions, was one of the most-shorted stocks last year on Canadian exchanges. The same alternative mortgage lender recently also came under scrutiny for suspending 45 of its brokers for falsifying borrower income.

Dominos Falling

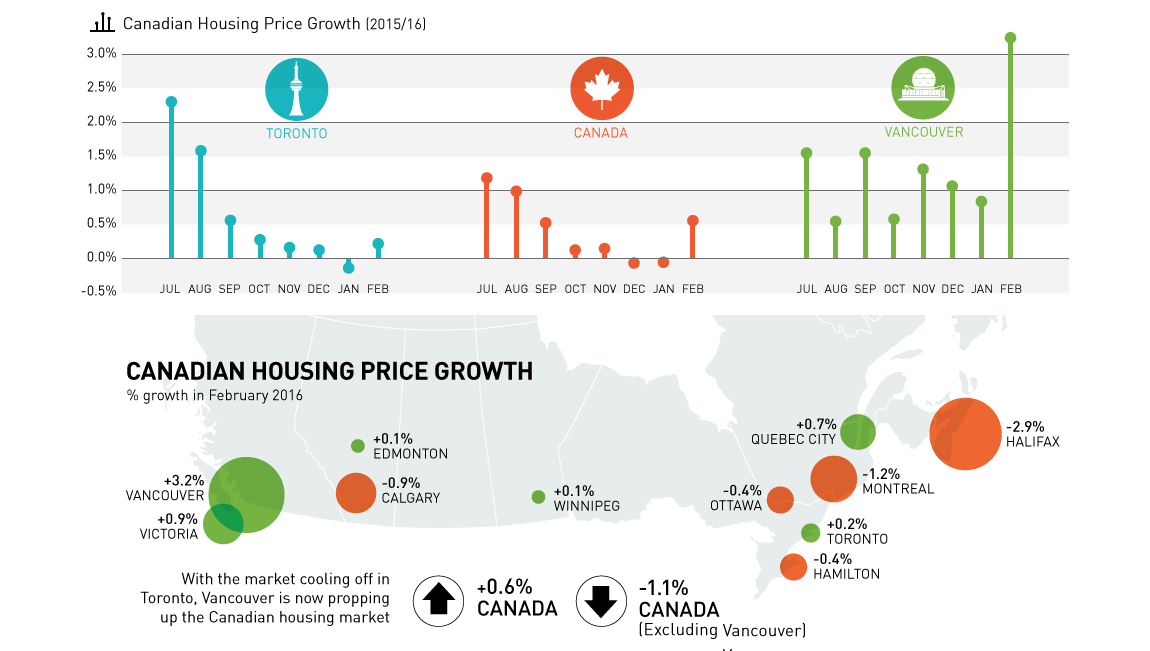

Just as falling oil prices helped to drag the Canadian dollar down, the “lower for longer” price environment for crude has had a similar effect on house prices in the Prairies. Homes in Fort McMurray, the epicenter of the Canadian oil sands, have crashed an average of $117,000 in just a year. Meanwhile, price tags in the once-strong housing market of Calgary have declined from their peak in October 2014 by -5.4%. The city, which is a financial center for Canadian energy, is bracing for a particular tough year ahead as well. Houses are spending more time on the market, and sales volume and prices continue to fall. But it’s not just Canada’s oilpatch that is starting to see the writing on the wall. Toronto, which has helped to buoy the rest of the country’s housing growth for years, has also started to cool down. According to the Teranet – National Bank House Price Index, prices have risen just 0.3% since October in Canada’s largest real estate market. With the prospect of rising interest rates in the future, it’s not expected to heat back up, either. In fact, TD Bank expects that Toronto will have a “moderate” decline in 2017.

And Then There was One…

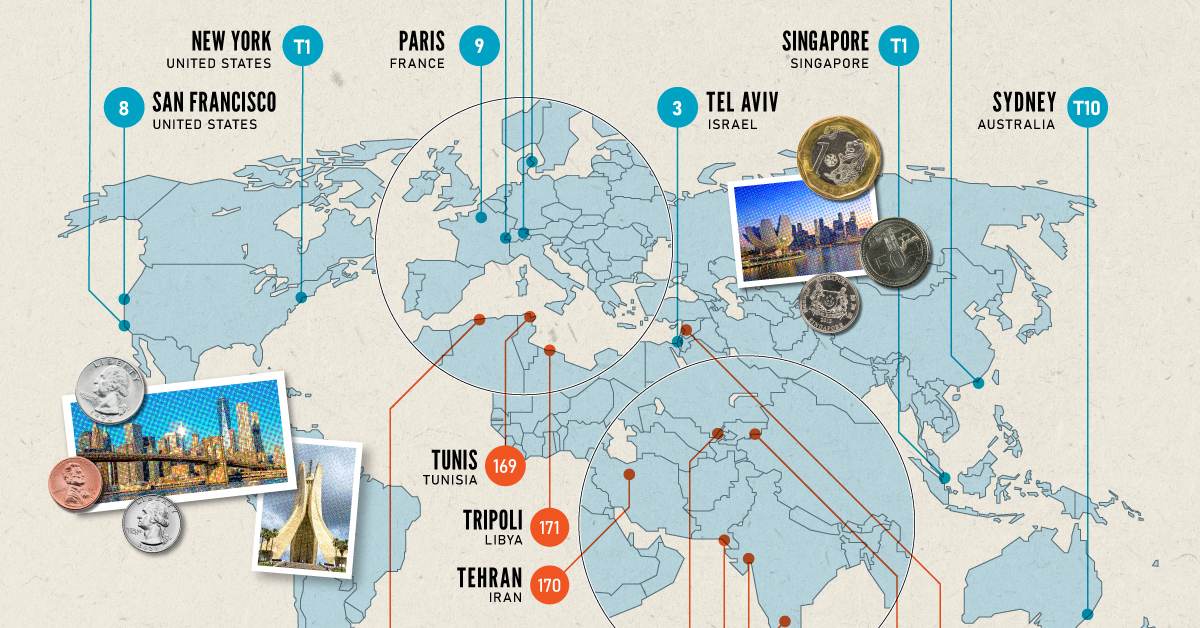

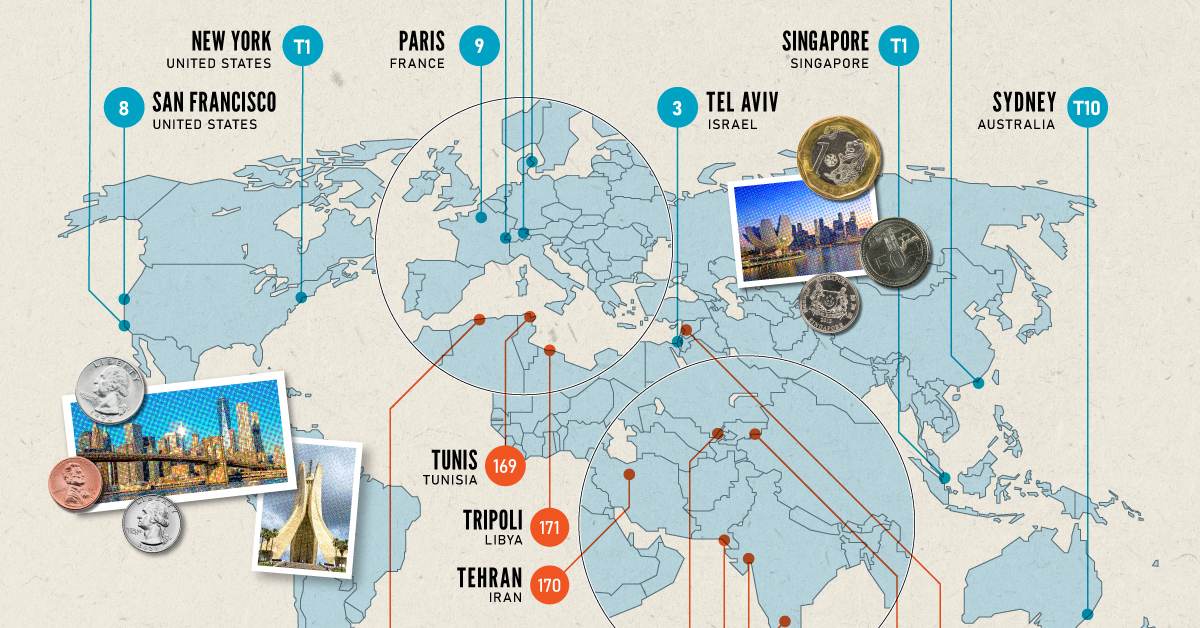

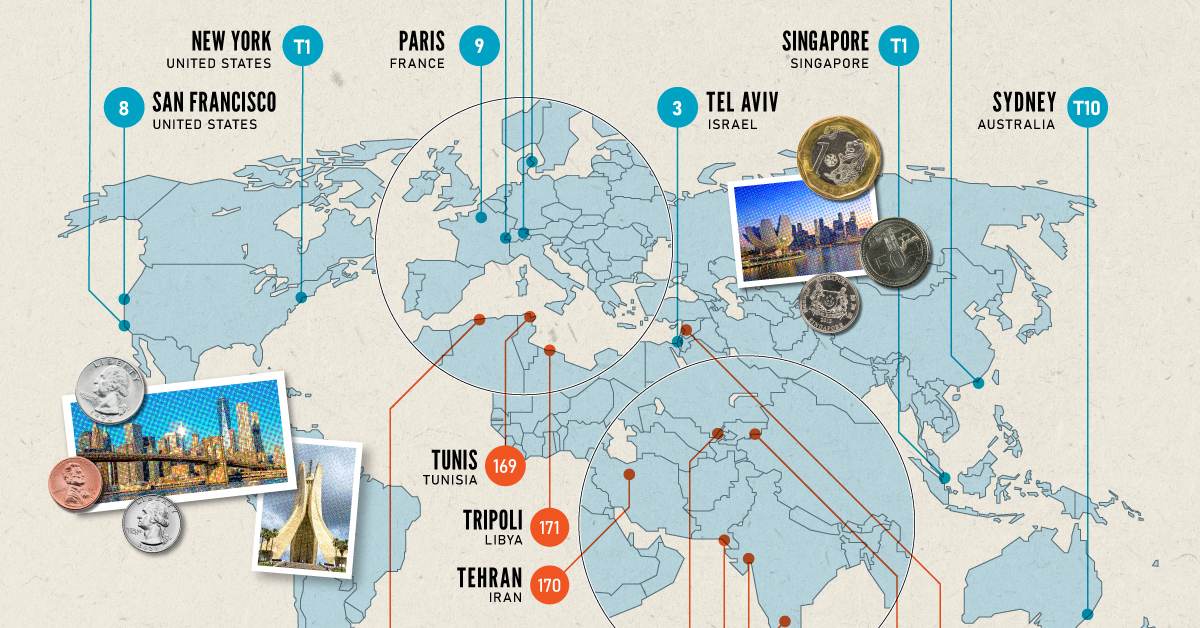

For investors bullish on near-term gains in Canada’s housing sector, there is one last hope that resides on the West Coast. Vancouver’ housing market sailed again in February, shooting up a record 3.2% in just one month. This is the best month for the market since August 2006. It was so good, in fact, that it single-handedly propped up Canada’s national index for housing. Canada’s market as a whole saw gains of 0.6% in the month, but it would have dropped to a lacklustre -1.1% without the inclusion of Vancouver in the 11-city index. The only problem? The city, which has been a primary beneficiary of rampant foreign buying, is continually cited as the market most ripe for a deep correction, as it continues to defy all common sense. While Keynes is right in that markets can remain irrational for longer than one can stay solvent, it seems that Canadian housing has turned a corner: regional markets in other parts of the country have stumbled, and the last remaining pillar is Vancouver. It may continue to buck the trend for now, but it is a wobbly pillar at best. on Cities become “expensive” due to a variety of factors such as high demand for housing, a concentration of high-paying businesses and industries, and a high standard of living. Additionally, factors such as taxes, transportation costs, and availability of goods and services can also contribute to the overall cost of living in global cities. The infographic above uses data from EIU to rank the world most and least expensive cities to live in. To make the list, the EIU examines 400+ prices for over 200 products and services in 172 cities, surveying a variety of businesses to track price fluctuations over the last year.

Inflation + Strong Currency = Expensive Cities

If you live in a city where many residents find it challenging to put a roof over their heads, food on their plates, and make ends meet, you live in an expensive city. But if this inflation is compounded with a strong national currency, you may live in one of the world’s most expensive cities. Singapore and New York City tied for the first rank amongst the world’s most expensive cities in 2022, pushing Israel’s Tel Aviv from the first place in 2021 to the third place in 2022. Both these cities had high inflation and a strong currency. Surprisingly, this is the Big Apple’s first time atop the ranking. The city with one of the most expensive real estate markets worldwide, Hong Kong ranked fourth in this list, followed by Los Angeles, which moved up from its ninth rank in 2021.

Poor Economies = Cheaper Cities

Asia continues to dominate the list of the world’s least expensive cities, followed by parts of North Africa and the Middle East. Though affordability sounds good at face value, sitting at the bottom of the ranking isn’t necessarily a coveted position. While the cost of living in some of the cities in these nations is low, it comes at the price of a weak currency, poor economy, and, in many cases, political and economic turmoil. The decade-long conflict in Syria weakened the Syrian pound, led to a spiraling inflation and fuel shortages, and further collapsed its economy. It’s no surprise that its capital city of Damascus has maintained its position as the world’s cheapest city. Tripoli and Tehran, the capitals of Libya and Iran, respectively, follow next on this list, reflecting their weakened economies. Meanwhile, seven cities in Asia with the common denominator of high-income inequality and low wages dominate the list of the world’s cheapest cities. These include three Indian cities, Tashkent in Uzbekistan, Almaty in Kazakhstan, Pakistan’s most populous city of Karachi, and Sri Lankan capital–Colombo.