Since the collapse of the Berlin Wall in 1989, the world has had one undisputed economic superpower: the United States. But while the U.S. has enjoyed its moment in the sun, the balance of power has been slowly shifting towards the inevitable rise of China. It’s been a long time coming, but China now has the manpower, influence, and economic might to compete at a similar level – and if you ask people around the world, they’ve certainly taken notice.

Economic Superpowers

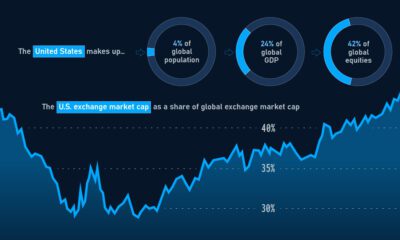

The United States and China combine for 39% of global GDP, 53% of estimated economic growth in the coming years, and 23% of the world’s population. But which one is perceived as the more dominant economic power? According to a recent survey by Pew Research Center, the vary wildly depending on the people and country surveyed. However, on an aggregate level that uses the results from the people in 38 countries surveyed, Pew determined that a median of 42% of people list the United States as the world’s leading economic power, while 32% name China as top dog. Which one of the following do you think is the world’s leading economic power? While the U.S. maintains a narrow lead in aggregate, things get much more interesting when we look at individual countries.

Different Perspectives

Do America’s closest allies view it as the clear global superpower? What about the countries that neighbor China – surely, they must witness China’s economic might firsthand. Weirdly, the dominant perspectives in these places are not as obvious as one would think. More people living in Canada, Australia, and major European countries like France, Germany, Sweden, Spain, and the United Kingdom tend to view China as the global economic superpower. Meanwhile, the majority of people in South American and African countries see the United States as the world’s major economic power – and people in countries near China (such as South Korea, Japan, Philippines, Indonesia, and Vietnam) all tend to agree with that sentiment as well. on Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard.

How Has Asset Allocation Impacted Returns?

Based on data between 1926 and 2019, the table below looks at the spectrum of market returns of different asset allocations:

We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

A traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of 8.8%. As interest rates have climbed in recent years, this may widen its appeal once again as bond returns may rise.

Meanwhile, a 100% bond portfolio averaged 5.3% in annual returns over the period. Bonds typically serve as a hedge against portfolio losses thanks to their typically negative historical correlation to stocks.

A Closer Look at Historical Correlations

To understand how 2022 was an outlier in terms of asset correlations we can look at the graphic below:

The last time stocks and bonds moved together in a negative direction was in 1969. At the time, inflation was accelerating and the Fed was hiking interest rates to cool rising costs. In fact, historically, when inflation surges, stocks and bonds have often moved in similar directions. Underscoring this divergence is real interest rate volatility. When real interest rates are a driving force in the market, as we have seen in the last year, it hurts both stock and bond returns. This is because higher interest rates can reduce the future cash flows of these investments. Adding another layer is the level of risk appetite among investors. When the economic outlook is uncertain and interest rate volatility is high, investors are more likely to take risk off their portfolios and demand higher returns for taking on higher risk. This can push down equity and bond prices. On the other hand, if the economic outlook is positive, investors may be willing to take on more risk, in turn potentially boosting equity prices.

Current Investment Returns in Context

Today, financial markets are seeing sharp swings as the ripple effects of higher interest rates are sinking in. For investors, historical data provides insight on long-term asset allocation trends. Over the last century, cycles of high interest rates have come and gone. Both equity and bond investment returns have been resilient for investors who stay the course.