Following the recent trend of tech IPOs outnumbering and out-hyping the competition, software has led the way. Cloud storage company Snowflake raised $3.4 billion in the largest ever software IPO, while gaming software developer Unity completed an IPO above its target price for a total of $1.3 billion and big data firm Palantir opted for a direct listing for a valuation of $22 billion. More big names are still on the horizon. DoorDash just completed an above-range IPO and ended up raising $3.37 billion, and Airbnb raised $3.5 billion before shares opened more than 100% above the IPO price. It’s a big recovery for an IPO market that in 2019 saw major IPOs from Uber and Lyft underperform estimates. But it was the last-minute cancellation of Ant Group’s IPO in November that would have been the largest public offering ever. At $34.5 billion, it would have eclipsed the massive $25.9 billion raised by energy giant Saudi Aramco in 2019. How would this have stacked up against the world’s largest IPOs in history? We took the 25 largest global IPOs by nominal offering size as tracked by research firm Renaissance Capital, and adjusted them for inflation to October 2020 dollars.

NTT Docomo Tops the (Adjusted) Chart

Unicorn IPOs might be the current flavor in 2020, but they pale in comparison to communication and resource giants. When adjusted for inflation, the largest ever IPO was Japan’s major mobile phone carrier NTT Docomo. The company went public as NTT Mobile Communications Network for a then-record $18 billion in 1998, which is $28.7 billion when adjusted for inflation to 2020. Despite the recent flurry of IPO activity, only two of the largest 10 inflation-adjusted IPOs occurred in the last two years, with second place Saudi Aramco and Japan’s communications and tech conglomerate SoftBank. Including NTT Docomo, three of the top 10 occurred in the 1990’s. Italy’s energy giant ENEL SpA raised the equivalent of $25.9 billion in 1999, and German communications company Deutsche Telekom raised the equivalent of $21.3 billion in 1996. Communications services accounted for five of the top 25 IPOs, and four of the top 10. Only the financials were more prominent with six of the top 25.

Final IPO Numbers can Outperform (and Underperform)

One important consideration to make is that the final amount raised by an IPO can vary from the original deal size. Though they are underwritten by a large financial institution for a set amount at a specific price range, companies often grant underwriters the “greenshoe option” to sell more shares than the original issue amount, usually up to 15% more. This over-allotment option lets an underwriter capitalize on a strong market by offering more shares at a surging share price (which they cover at the original price). In the opposite case of falling share prices, the underwriter can buy back shares at market rate to stabilize the price and cover their short position. Many of the largest ever IPOs have managed to capitalize on their much-hyped debuts. Saudi Aramco ended up raising $29.4 billion, almost $4 billion more than its original offering. In similar fashion, Chinese e-commerce giant Alibaba raised $25 billion on an offering of $21.8 billion, and Visa raised $19.7 billion on an offering of $17.9 billion. Additionally, large corporations can take advantage of market sentiment by going public in multiple equity markets. Alibaba’s $25 billion debut on the New York Stock Exchange in 2014 was followed by a secondary offering on the Hong Kong Stock Exchange in 2019 for $11.2 billion. Likewise, the Agricultural Bank of China listed on both the Hong Kong and Shanghai Stock Exchanges in 2010 for a combined $22.1 billion haul.

More IPOS on the Docket for 2021

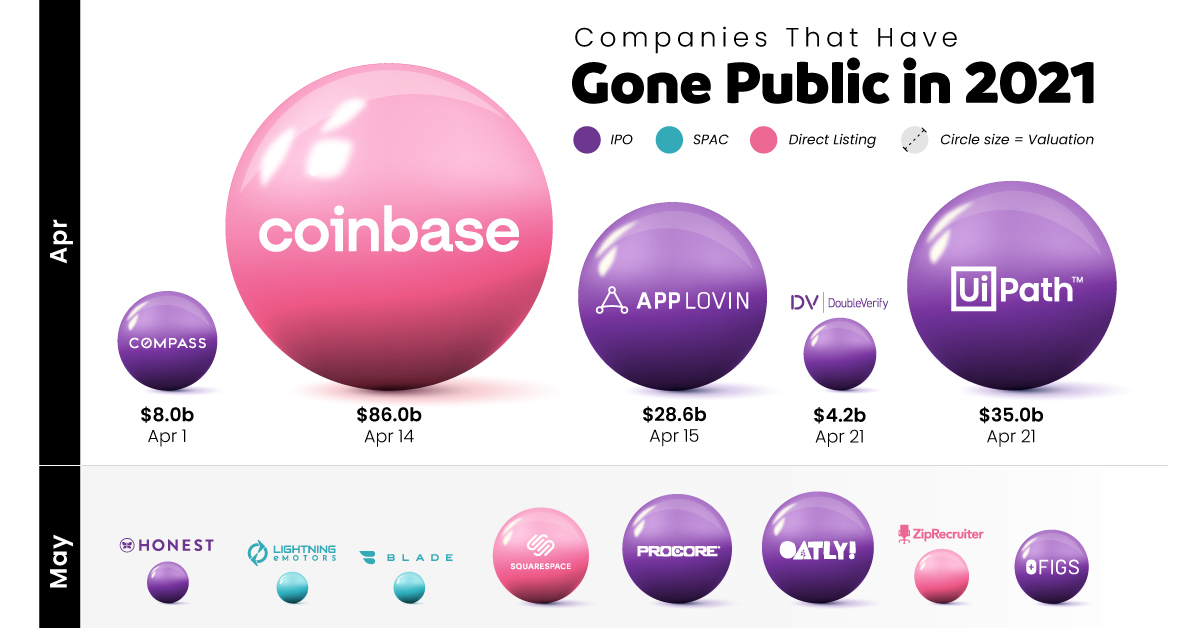

With excitement around IPOs bubbling once again, more companies are lining up to become the next big breakthrough on public markets. 2021’s list of IPO candidates include shopping app Wish (which has already filed for an offering), gaming companies Epic Games and Roblox, payment processing firm Stripe and even dating app Bumble. And Ant Group’s massive potential IPO shadow looms over all, though regulatory overhauls in China might push it back to 2022 and lower the size of the offering. For now, the list of the world’s largest IPOs looks to be relatively stable. But with social media giant Facebook cracking the Top 10 list in 2012, and SoftBank’s massive IPO in 2018, the next +$10 billion dollar IPO is always around the corner. on From much-hyped tech initial public offerings (IPOs) to food and healthcare services, many companies with already large followings have gone public this year. Some were supposed to go public in 2020 but got delayed due to the pandemic, and others saw the opportunity to take advantage of a strong current market. This graphic measures 68 companies that have gone public in 2021 — including IPOs, SPACs, and Direct Listings—as well as their subsequent valuations after listing.

Who’s Gone Public in 2021?

Historically, companies that wanted to go public employed one main method above others: the initial public offering (IPO). But companies going public today readily choose from one of three different options, depending on market situations, associated costs, and shareholder preference:

Initial Public Offering (IPO): A private company creates new shares which are underwritten by a financial organization and sold to the public. Special Purpose Acquisition Company (SPAC): A separate company with no operations is created strictly to raise capital to acquire the company going public. SPACs are the fastest method of going public, and have become popular in recent years. Direct Listing: A private company enters a market with only existing, outstanding shares being traded and no new shares created. The cost is lower than that of an IPO, since no fees need to be paid for underwriting.

The majority of companies going public in 2021 chose the IPO route, but some of the biggest valuations resulted from direct listings. Though there are many well-known names in the list, one of the biggest through lines continues to be the importance of tech. A majority of 2021’s newly public companies have been in tech, including multiple mobile apps, websites, and online services. The two biggest IPOs so far were South Korea’s Coupang, an online marketplace valued at $60 billion after going public, and China’s ride-hailing app Didi Chuxing, the year’s largest post-IPO valuation at $73 billion. And there were many apps and services going public through other means as well. Gaming company Roblox went public through a direct listing, earning a valuation of $30 billion, and cryptocurrency platform Coinbase has earned the year’s largest valuation so far, with an $86 billion valuation following its direct listing.

Big Companies Going Public in 2022

As with every year, some of the biggest companies going public were lined up for the later half. Tech will continue to be the talk of the markets. Payment processing firm Stripe was setting up to be the year’s biggest IPO with an estimated valuation of $95 billion, but got delayed. Likewise, online grocery delivery platform InstaCart, which saw a big upswing in traction due to the pandemic, has been looking to go public at a valuation of at least $39 billion. Of course, it’s common that potential public listings and offerings fall through. Whether they get delayed due to weak market conditions or cancelled at the last minute, anything can happen when it comes to public markets. This post has been updated as of January 1, 2022.