Today’s charts come from a report by the independent think tank Pew Research on the partisan divide between the two major U.S. political parties, Democrats and Republicans. The data is based on surveys of over 5,000 adults to gauge public sentiment, tracking the dramatic shifts in political polarization in the U.S. from 1994 to 2017. The results are a fascinating deep dive into America’s shifting political sentiment.

Over Two Decades of Differences

The animation above demonstrates how the political divide by party has grown significantly and consistently over 23 years. In 1994, the general public was more mixed in their allegiances, but a significant divergence started to occur from 2011 onward. By 2017, the divide had significantly shifted towards the two extremes of the consistently liberal/conservative scale. Median Democrat and Republican sentiment also moved further apart, especially for politically engaged Americans. How have Americans’ feelings across major issues evolved over time? NOTE: For brevity, any mention of Democrats and Republicans in the post below will also refer to survey respondents who “lean Democratic/ lean Republican”.

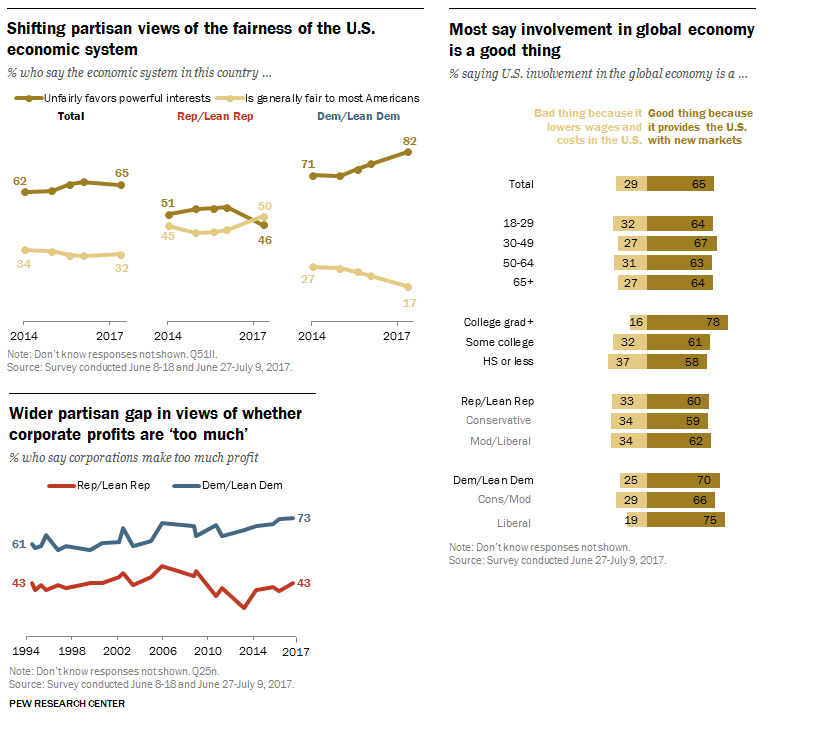

Americans on the Economy

Original charts from Pew Research Center, Washington, D.C. (October 2017). Several survey questions were designed to assess Americans’ perceptions of the economy. Surprisingly, between 60–70% of Democrats and Republicans agree that U.S. involvement in the global economy is positive, because it provides the country with access to new markets. However, they diverge when asked about the fairness of the economic system itself. 50% of Republicans think it is fair to most Americans, but 82% of Democrats think it unfairly favors powerful interests. Finally, 73% of Democrats think corporations make ‘too much’ profit, while only 43% of Republicans think so. Since 1994, Democrats have become more convinced of this point, gaining 10 percentage points (p.p.), while Republican impressions have fluctuated marginally.

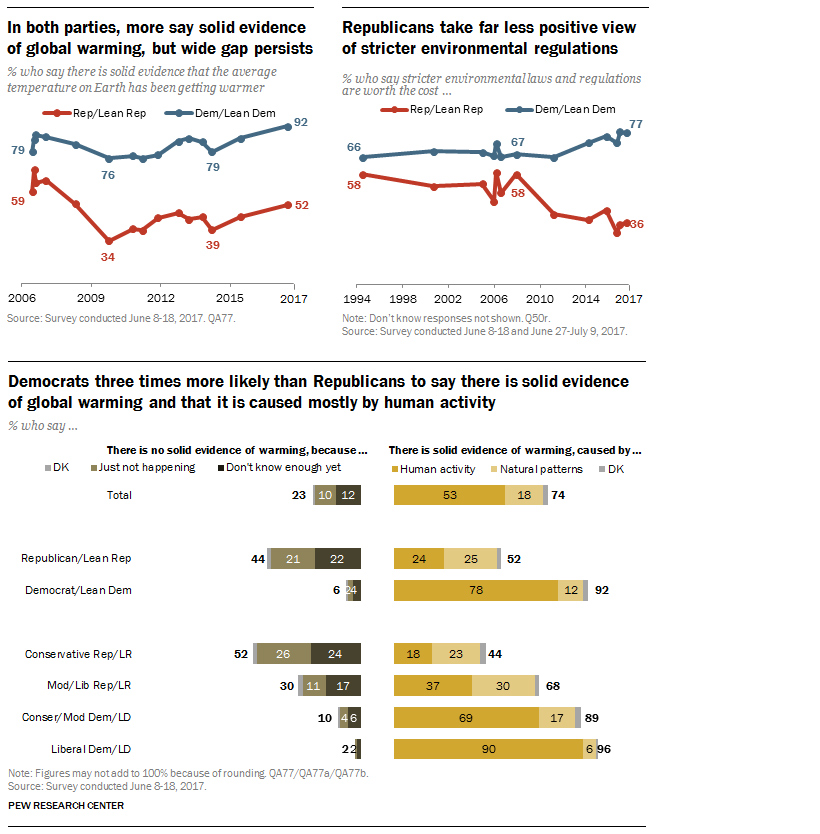

Americans on the Environment

Original charts from Pew Research Center, Washington, D.C. (October 2017). When it comes to climate change, both Democrats and Republicans see that there is growing evidence for global warming, but they are not sold on the reasons why. 78% of Democrats see human activity as the cause, while only 24% of Republicans agree. Americans also disagree on whether stricter sustainability laws are worth the cost—77% of Democrats think so, but only 36% of Republicans are on the same page. The position of Democrats on this issue has increased by 11 p.p. since 1994, but dropped by double (22 p.p.) for Republicans during this time.

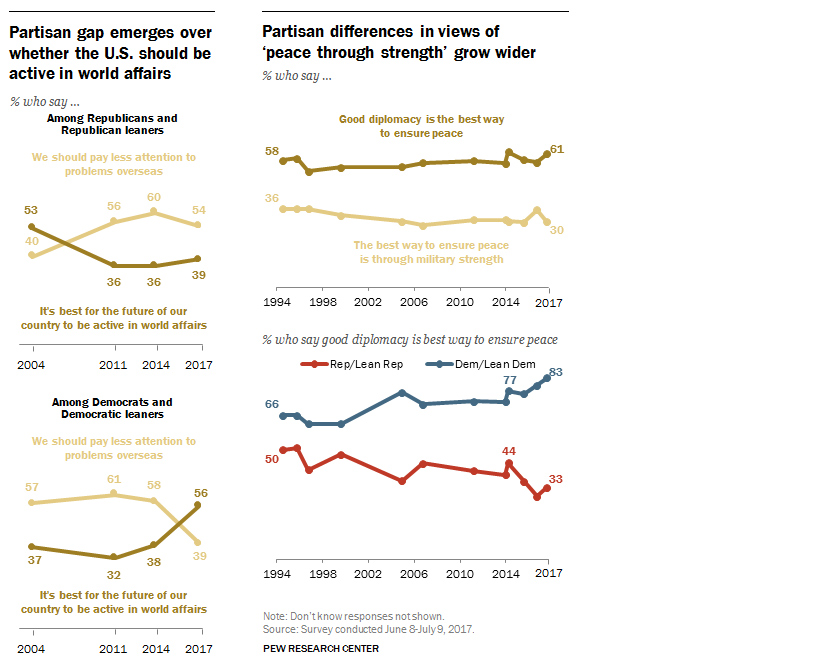

Americans on the Government

Original charts from Pew Research Center, Washington, D.C. (October 2017). Americans are highly concerned about the U.S. presence on the global stage. Over half (56%) of Democrats think the U.S. should be active in world affairs, while 54% of Republicans think such attention should be focused inward instead of overseas. This filters into what they consider the best strategy for peace—83% of Democrats believe in democracy to achieve this, while only 33% of Republicans agree, preferring military strength instead. Democrats have cemented their position on diplomacy by 17 p.p. since 1994, growing the political divide.

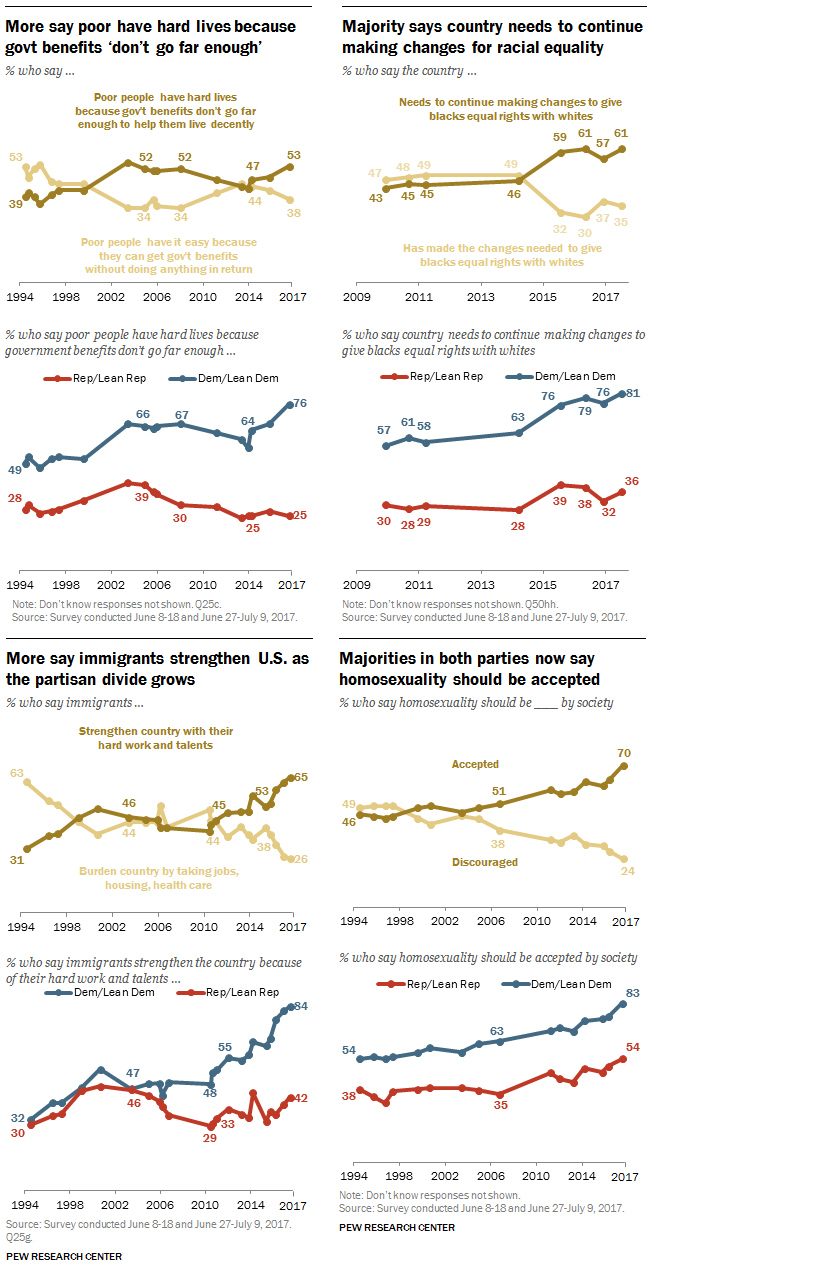

Americans on Their Society

Original charts from Pew Research Center, Washington, D.C. (October 2017). On several social issues, both parties have become more liberal in their opinions over the decades, especially on immigration and homosexuality. Democrats have seen the biggest advancement on their views of immigration, from 32% in favor in 1994, to 84% in 2017. However, there’s still a wide partisan divide between Democrats and Republicans on their ideas of government aid (51 p.p. gap), racial equality (45 p.p. gap), immigration (42 p.p. gap), and homosexuality (29 p.p. gap).

Americans on Each Other

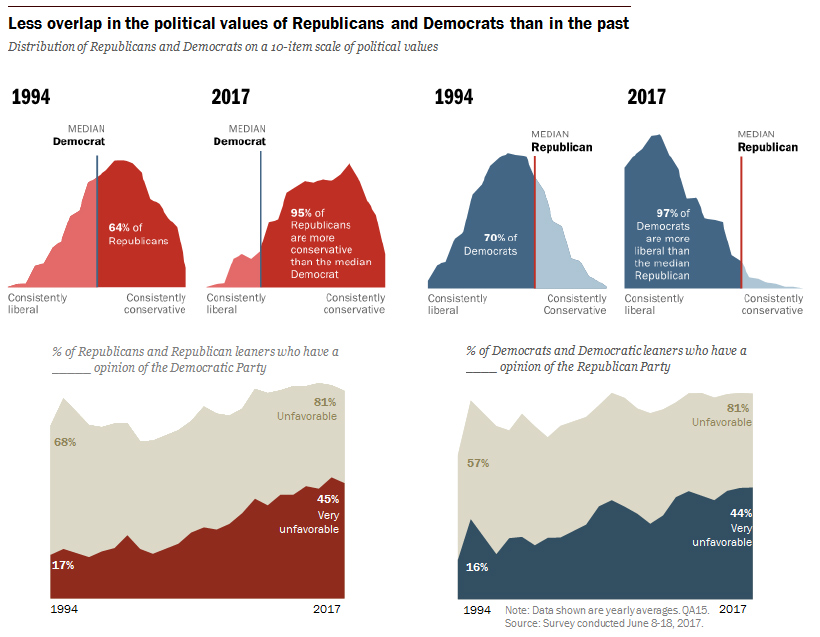

Original charts from Pew Research Center, Washington, D.C. (October 2017). It’s evident that not only does the American public hold less of a mix of liberal and conservative values, but the center of this political divide has also moved dramatically on both ends of the spectrum. In simple terms, it means that Americans are less willing to consider the other side of debates, preferring to stay entrenched in the group think of their political affiliation. Not only this, but partisan animosity is on the rise—81% of Republicans and Democrats find those belonging to the other party equally unfavorable. In fact, both parties have seen a 28 p.p. increase in ‘very unfavorable’ views of people in the other party, compared to 1994.

Can the Rift be Repaired?

While the above data on group polarization ends in 2017, it’s clear that the repercussions continue to have ripple effects into today and the future. These differences mean there is no consensus on the nation’s key priorities. In 2019, Republicans believe that terrorism, the economy, social security, immigration, and the military should be top of mind, while Democrats refer to healthcare, education, environment, Medicare, and the poor and needy as their leads. With Trump’s presidential term up for contest in 2020, the lack of common ground on pressing issues will continue to cause a stir among both Democratic and Republican bases. Is there anything Americans will be willing to cross the aisle for? on Both figures surpassed analyst expectations by a wide margin, and in January, the unemployment rate hit a 53-year low of 3.4%. With the recent release of February’s numbers, unemployment is now reported at a slightly higher 3.6%. A low unemployment rate is a classic sign of a strong economy. However, as this visualization shows, unemployment often reaches a cyclical low point right before a recession materializes.

Reasons for the Trend

In an interview regarding the January jobs data, U.S. Treasury Secretary Janet Yellen made a bold statement: While there’s nothing wrong with this assessment, the trend we’ve highlighted suggests that Yellen may need to backtrack in the near future. So why do recessions tend to begin after unemployment bottoms out?

The Economic Cycle

The economic cycle refers to the economy’s natural tendency to fluctuate between periods of growth and recession. This can be thought of similarly to the four seasons in a year. An economy expands (spring), reaches a peak (summer), begins to contract (fall), then hits a trough (winter). With this in mind, it’s reasonable to assume that a cyclical low in the unemployment rate (peak employment) is simply a sign that the economy has reached a high point.

Monetary Policy

During periods of low unemployment, employers may have a harder time finding workers. This forces them to offer higher wages, which can contribute to inflation. For context, consider the labor shortage that emerged following the COVID-19 pandemic. We can see that U.S. wage growth (represented by a three-month moving average) has climbed substantially, and has held above 6% since March 2022. The Federal Reserve, whose mandate is to ensure price stability, will take measures to prevent inflation from climbing too far. In practice, this involves raising interest rates, which makes borrowing more expensive and dampens economic activity. Companies are less likely to expand, reducing investment and cutting jobs. Consumers, on the other hand, reduce the amount of large purchases they make. Because of these reactions, some believe that aggressive rate hikes by the Fed can either cause a recession, or make them worse. This is supported by recent research, which found that since 1950, central banks have been unable to slow inflation without a recession occurring shortly after.

Politicians Clash With Economists

The Fed has raised interest rates at an unprecedented pace since March 2022 to combat high inflation. More recently, Fed Chairman Jerome Powell warned that interest rates could be raised even higher than originally expected if inflation continues above target. Senator Elizabeth Warren expressed concern that this would cost Americans their jobs, and ultimately, cause a recession. Powell remains committed to bringing down inflation, but with the recent failures of Silicon Valley Bank and Signature Bank, some analysts believe there could be a pause coming in interest rate hikes. Editor’s note: just after publication of this article, it was confirmed that U.S. interest rates were hiked by 25 basis points (bps) by the Federal Reserve.