It’s said that in China, a new skyscraper is built every five days. China is building often, and they are building higher. In fact, just last year, China completed 77 of the world’s 144 new supertall buildings, spread through 36 different Chinese cities. These are structures with a minimum height of 656 feet (200 meters). For comparison’s sake, there are only 113 buildings in New York City’s current skyline that are over 600 feet.

Unbelievable Scale

It’s always hard to put China’s size and scope in perspective – and we’ve tried before by showing you 35 Chinese cities as big as countries, or highlighting the growing prominence of the domestic tech scene. Today’s chart also falls in that category, and it focuses in on the raw materials that are needed to make all this growth possible. Note: Because this data is not all in one easy place, it is sourced from many different industry associations, banks, and publications. Most of the data comes from 2017, but some is from 2016.

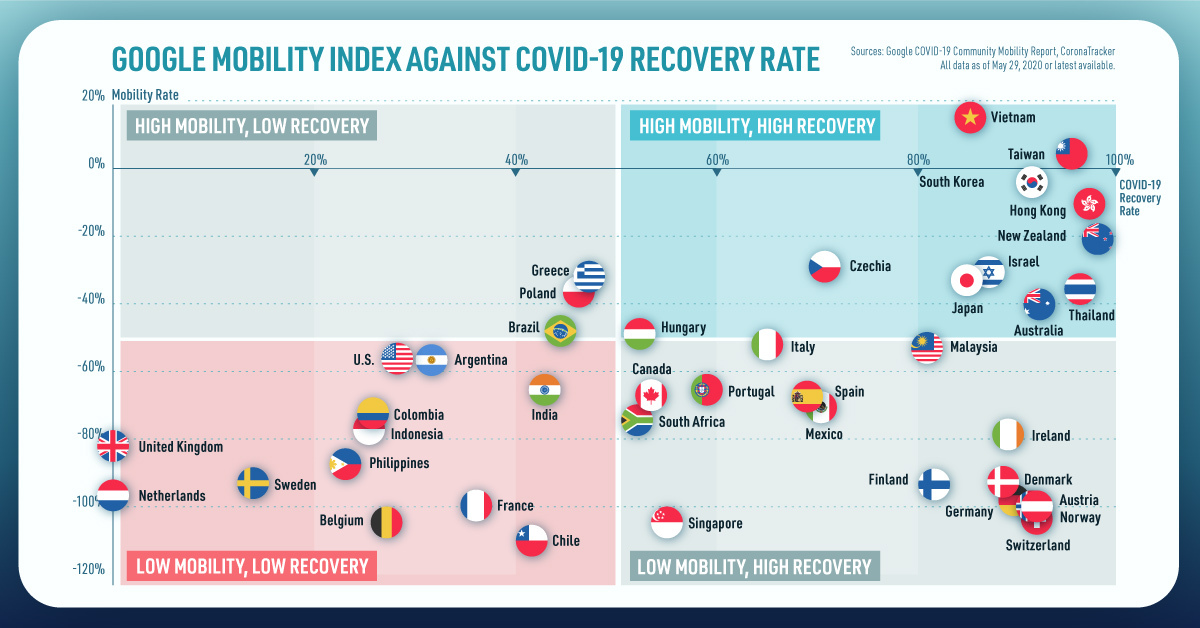

China Demand > World

There are five particularly interesting commodity categories here – and in all of them, China’s demand equals or exceeds that of the rest of the world combined. Cement: 59% The primary ingredient in concrete is needed for roads, buildings, engineering structures (bridges, dams, etc.), foundations, and in making joints for drains and pipes. Nickel: 57% Nickel’s primary use is in making stainless steel, which is corrosion resistant. It also gets used in superalloys, batteries, and an array of other uses. Steel: 50% Steel is used for pretty much everything, but demand is primarily driven by the construction, machinery, and automotive sectors. Copper: 50% Copper is one of the metals driving the green revolution, and it’s used in electronics, wiring, construction, machinery, and automotive sectors, primarily. Coal: 50% China’s winding down coal usage – but when you have 1.4 billion people demanding power, it has to be done with that in mind. China has already hit peak coal, but the fossil fuel does still account for 65% of the country’s power generated by source. on Today’s chart measures the extent to which 41 major economies are reopening, by plotting two metrics for each country: the mobility rate and the COVID-19 recovery rate: Data for the first measure comes from Google’s COVID-19 Community Mobility Reports, which relies on aggregated, anonymous location history data from individuals. Note that China does not show up in the graphic as the government bans Google services. COVID-19 recovery rates rely on values from CoronaTracker, using aggregated information from multiple global and governmental databases such as WHO and CDC.

Reopening Economies, One Step at a Time

In general, the higher the mobility rate, the more economic activity this signifies. In most cases, mobility rate also correlates with a higher rate of recovered people in the population. Here’s how these countries fare based on the above metrics. Mobility data as of May 21, 2020 (Latest available). COVID-19 case data as of May 29, 2020. In the main scatterplot visualization, we’ve taken things a step further, assigning these countries into four distinct quadrants:

1. High Mobility, High Recovery

High recovery rates are resulting in lifted restrictions for countries in this quadrant, and people are steadily returning to work. New Zealand has earned praise for its early and effective pandemic response, allowing it to curtail the total number of cases. This has resulted in a 98% recovery rate, the highest of all countries. After almost 50 days of lockdown, the government is recommending a flexible four-day work week to boost the economy back up.

2. High Mobility, Low Recovery

Despite low COVID-19 related recoveries, mobility rates of countries in this quadrant remain higher than average. Some countries have loosened lockdown measures, while others did not have strict measures in place to begin with. Brazil is an interesting case study to consider here. After deferring lockdown decisions to state and local levels, the country is now averaging the highest number of daily cases out of any country. On May 28th, for example, the country had 24,151 new cases and 1,067 new deaths.

3. Low Mobility, High Recovery

Countries in this quadrant are playing it safe, and holding off on reopening their economies until the population has fully recovered. Italy, the once-epicenter for the crisis in Europe is understandably wary of cases rising back up to critical levels. As a result, it has opted to keep its activity to a minimum to try and boost the 65% recovery rate, even as it slowly emerges from over 10 weeks of lockdown.

4. Low Mobility, Low Recovery

Last but not least, people in these countries are cautiously remaining indoors as their governments continue to work on crisis response. With a low 0.05% recovery rate, the United Kingdom has no immediate plans to reopen. A two-week lag time in reporting discharged patients from NHS services may also be contributing to this low number. Although new cases are leveling off, the country has the highest coronavirus-caused death toll across Europe. The U.S. also sits in this quadrant with over 1.7 million cases and counting. Recently, some states have opted to ease restrictions on social and business activity, which could potentially result in case numbers climbing back up. Over in Sweden, a controversial herd immunity strategy meant that the country continued business as usual amid the rest of Europe’s heightened regulations. Sweden’s COVID-19 recovery rate sits at only 13.9%, and the country’s -93% mobility rate implies that people have been taking their own precautions.

COVID-19’s Impact on the Future

It’s important to note that a “second wave” of new cases could upend plans to reopen economies. As countries reckon with these competing risks of health and economic activity, there is no clear answer around the right path to take. COVID-19 is a catalyst for an entirely different future, but interestingly, it’s one that has been in the works for a while. —Carmen Reinhart, incoming Chief Economist for the World Bank Will there be any chance of returning to “normal” as we know it?