It’s a fast-growing field of science. In fact, by 2026, the SynBio market’s global revenue is expected to reach $34.5 billion, at a CAGR of 21.9%. While this fascinating area of research is worth paying attention to, it might be daunting to wrap your head around—especially if you don’t come from a scientific background. With this in mind, here’s an introduction to synthetic biology, and how it works.

What is Synthetic Biology?

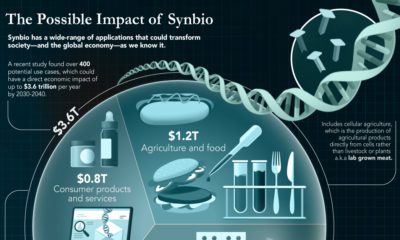

As we touched on in the introduction, SynBio is an area of scientific research that involves editing and redesigning the biological components, systems, and interactions that make up life. By doing this, SynBio can grant organisms new abilities that are beneficial to humans. It’s similar to genetic engineering, however, it’s slightly more granular. While genetic engineering transfers ready-made genetic material between organisms, SynBio builds new genetic material from scratch. SynBio has applications across a myriad of fields, with research covering everything from space exploration to drug discovery. Here’s a look at five of its real-world applications:

1. Medical Technologies

SynBio has a wide range of medical applications, including drug discovery, antibody production, and vaccine innovation (it’s been key in the fight against COVID-19). It also plays a significant role in “living drug” development, which is the use of living microbes to treat chronic or severe illnesses.

2. Sustainable Energies

Biofuel, which is renewable energy that’s derived from living matter, could replace petroleum and diesel in the near future—and synthetic biology technology is helping develop fermentation processes that will produce biofuel more efficiently.

3. Bioremediation

Bioremediation uses living organisms to restore polluted sites to their original condition. This field uses SynBio to try and make the decontamination process more efficient, and to expand the list of contaminants that bioremediation can target.

4. Food and Agriculture

SynBio plays a significant role in cellular agriculture, which is the production of agricultural products directly from cells rather than livestock or plants. These modified foods might have higher nutritional value, or might be void of allergens. For instance, this can be used to make plant-based burgers taste more like meat.

5. Space Systems and Exploration

Synthetic biology and 3-D printing have huge potential to sustain life during space exploration. Using SynBio technology, cells and bacteria could be modified to produce a myriad of materials—from plastic to medicine, and even food—and astronauts could print these synthetically engineered materials on-demand while in space.

Zooming in: the Science Behind Synthetic Biology

Now that we’ve touched on SynBio’s use in a wide range of industries, let’s dive into the science behind it. In order to understand the mechanics of SynBio, it’s important to explore the relationship between DNA and protein production. Proteins are the drivers of life in a cell—they’re responsible for carrying out all of life’s functions. They are created through a process called protein synthesis, which relies heavily on DNA. Why is DNA so important in protein production? Because it houses all the information a cell needs for protein synthesis. Once a protein is formed, it embarks on a complex journey throughout the cell, interacting with a number of other proteins and cellular components to perform functions needed for the cell’s survival. This process of protein production and cellular interaction is an example of a biological system. And it’s this biological system that synthetic biologists investigate, and try to manipulate.

The Five Main Areas of Research

After combing through the literature, we identified five major areas of SynBio research:

In silico Synthetic Biology Meaning “via computer”, this area of SynBio research uses computational simulations to design and predict new biological systems. It’s like using a drawing board before starting a project. “Unnatural” Molecular Biology An area of research focused on altering the smallest unit of DNA—nucleotides. Bioengineering This area of research deals with larger segments of DNA like genes or chromosomes, and sometimes other cell components that interact with DNA. It aims to create new proteins or protein systems and is the most popular area of SynBio research. Synthetic Genomics Focused on altering and manipulating whole genomes (which is the complete set of a cell’s DNA). Protocell Synthetic Biology This field of research aims to construct whole cells. This is a step towards creating organisms that are entirely synthetic

While early research in SynBio struggled to finish real-world projects, innovation in this field has ramped up quickly in the last decade. Synthetic biology products are becoming increasingly more pervasive in everyday life—so much so that by 2030, some scientists believe most people will have eaten, worn, or used something created through synthetic biology. on But fast forward to the end of last week, and SVB was shuttered by regulators after a panic-induced bank run. So, how exactly did this happen? We dig in below.

Road to a Bank Run

SVB and its customers generally thrived during the low interest rate era, but as rates rose, SVB found itself more exposed to risk than a typical bank. Even so, at the end of 2022, the bank’s balance sheet showed no cause for alarm.

As well, the bank was viewed positively in a number of places. Most Wall Street analyst ratings were overwhelmingly positive on the bank’s stock, and Forbes had just added the bank to its Financial All-Stars list. Outward signs of trouble emerged on Wednesday, March 8th, when SVB surprised investors with news that the bank needed to raise more than $2 billion to shore up its balance sheet. The reaction from prominent venture capitalists was not positive, with Coatue Management, Union Square Ventures, and Peter Thiel’s Founders Fund moving to limit exposure to the 40-year-old bank. The influence of these firms is believed to have added fuel to the fire, and a bank run ensued. Also influencing decision making was the fact that SVB had the highest percentage of uninsured domestic deposits of all big banks. These totaled nearly $152 billion, or about 97% of all deposits. By the end of the day, customers had tried to withdraw $42 billion in deposits.

What Triggered the SVB Collapse?

While the collapse of SVB took place over the course of 44 hours, its roots trace back to the early pandemic years. In 2021, U.S. venture capital-backed companies raised a record $330 billion—double the amount seen in 2020. At the time, interest rates were at rock-bottom levels to help buoy the economy. Matt Levine sums up the situation well: “When interest rates are low everywhere, a dollar in 20 years is about as good as a dollar today, so a startup whose business model is “we will lose money for a decade building artificial intelligence, and then rake in lots of money in the far future” sounds pretty good. When interest rates are higher, a dollar today is better than a dollar tomorrow, so investors want cash flows. When interest rates were low for a long time, and suddenly become high, all the money that was rushing to your customers is suddenly cut off.” Source: Pitchbook Why is this important? During this time, SVB received billions of dollars from these venture-backed clients. In one year alone, their deposits increased 100%. They took these funds and invested them in longer-term bonds. As a result, this created a dangerous trap as the company expected rates would remain low. During this time, SVB invested in bonds at the top of the market. As interest rates rose higher and bond prices declined, SVB started taking major losses on their long-term bond holdings.

Losses Fueling a Liquidity Crunch

When SVB reported its fourth quarter results in early 2023, Moody’s Investor Service, a credit rating agency took notice. In early March, it said that SVB was at high risk for a downgrade due to its significant unrealized losses. In response, SVB looked to sell $2 billion of its investments at a loss to help boost liquidity for its struggling balance sheet. Soon, more hedge funds and venture investors realized SVB could be on thin ice. Depositors withdrew funds in droves, spurring a liquidity squeeze and prompting California regulators and the FDIC to step in and shut down the bank.

What Happens Now?

While much of SVB’s activity was focused on the tech sector, the bank’s shocking collapse has rattled a financial sector that is already on edge.

The four biggest U.S. banks lost a combined $52 billion the day before the SVB collapse. On Friday, other banking stocks saw double-digit drops, including Signature Bank (-23%), First Republic (-15%), and Silvergate Capital (-11%).

Source: Morningstar Direct. *Represents March 9 data, trading halted on March 10.

When the dust settles, it’s hard to predict the ripple effects that will emerge from this dramatic event. For investors, the Secretary of the Treasury Janet Yellen announced confidence in the banking system remaining resilient, noting that regulators have the proper tools in response to the issue.

But others have seen trouble brewing as far back as 2020 (or earlier) when commercial banking assets were skyrocketing and banks were buying bonds when rates were low.