Since the S&P 500 market high on February 19, 2020, market capitalizations across BEACH industries—booking, entertainment, airlines, cruises, and hotels—have tumbled. The global airline industry alone has seen $157B wiped off valuations across 116 publicly traded airlines. Investor confidence in cruise lines has also dropped. Between Carnival, Royal Caribbean, and Norwegian Cruise Line Holdings, over half of their market value has evaporated—equal to at least $42B in combined market capitalization. Today’s infographic profiles the steep losses across BEACH companies. It looks at the ripple effects across individual companies and industries from the February 19 peak to date*. *All numbers as of market close on March 24, 2020

Falling Off A Cliff

As the COVID-19 pandemic has spread to over 100 countries, many governments have implemented sweeping travel restrictions. The impact across BEACH industries is far-reaching, with some valuations declining to nearly a quarter of their previous total. For instance, the consequences on various travel bookings brands have been severe. Booking Holdings, the parent company to Booking.com, Priceline, Kayak and OpenTable, witnessed share price declines of over 35% since the peak.

Empty Stadiums

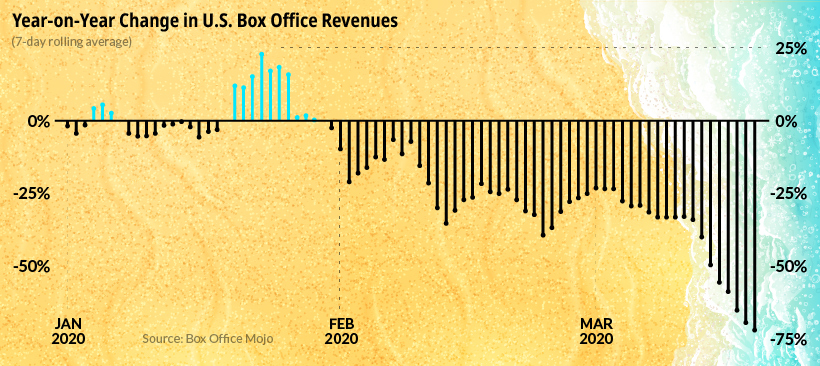

Across the entertainment industry, ticket sales for concerts, movies, and other events are falling precipitously due to cancellations or postponements.

Upwards of $5B in global film industry losses could result from the COVID-19 pandemic. Chilling footage of the Las Vegas strip, as well as other tourist epicenters around the world, shows deserted streets as visitors opt to stay home instead.

Bracing For Impact Meanwhile, worldwide airline revenue is estimated to fall by as much as $113B in 2020. In under two months, the share price of Delta Airlines has fallen over 50% as the company anticipates a capacity reduction of 40%, the largest in its history. The global airline industry—which employs over 10M people—supports $2.7T in global economic activity across an average of 12M passengers per day.

Aruba, Jamaica No More

As for the cruise line industry, global operations came to a 30-day standstill in mid-March. Over 800 COVID-19 cases and 10 deaths across three cruise ships have been discovered. —CDC Carnival, a Miami-based company, has witnessed its share price fall to around one third of its February 19 value. Similarly, Royal Caribbean Cruises, which has seen its market cap plummet almost 70%, announced that it will suspend trips until mid-May.

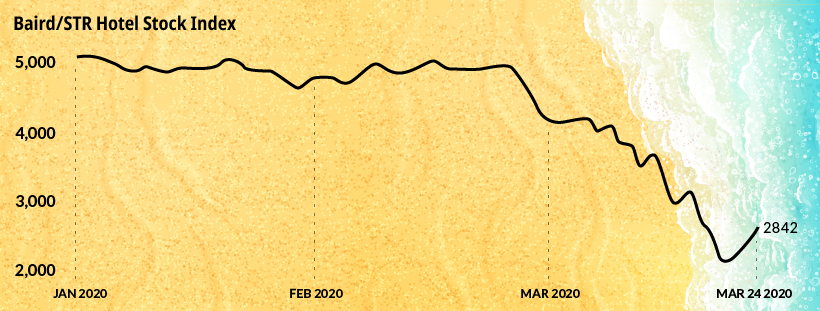

Occupancy Dilemma

As the hotel industry is impacted by the global outbreak, share prices have also realized a significant slump. In the U.S., an estimated $1.4B in revenue is vanishing each week. If occupancy levels fall by just 30% this year, the U.S. hotel industry could see approximately 4 million jobs wiped out. The Baird/STR Hotel Stock Index, which serves as a benchmark for the sector’s overall health, has declined over 47% year-to-date.

Global Stimulus Response

A number of travel industries around the world are calling for stimulus packages. On March 25, the U.S. Congress finalized a historic $2T deal, which includes $25B in grants for the airline industry. In the UK, officials are providing small businesses in hospitality and leisure grants that are worth up to $30,000 as part of its $400B bailout plan. China, Germany, Italy, and Spain have outlined multibillion dollar proposals in response to COVID-19. Overall, at least eleven countries have announced stimulus plans along with the European Commission and the IMF.

When Will the Travel Wave Hit Again?

Amid the COVID-19 pandemic one thing is clear: the impact on the travel industry will have a marked effect on the broader economy. Travel is closely linked with oil, as transportation accounts for over 60% of global demand. In Q2 2020, global oil consumption is projected to fall by 25M barrels per day. Along with this, discretionary consumer spending makes up over one third of America’s GDP. The impact of the pandemic across this sector is expected to contribute to a 10% decline or more in U.S. GDP for the second quarter. As conditions materially improve around the world—with China beginning to open up flights—positive signs are emerging from under the surface. Will BEACH industries quickly bounce back as infection rates drop, or will a slow and painful recovery unfold in the months ahead? on Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard.

How Has Asset Allocation Impacted Returns?

Based on data between 1926 and 2019, the table below looks at the spectrum of market returns of different asset allocations:

We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

A traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of 8.8%. As interest rates have climbed in recent years, this may widen its appeal once again as bond returns may rise.

Meanwhile, a 100% bond portfolio averaged 5.3% in annual returns over the period. Bonds typically serve as a hedge against portfolio losses thanks to their typically negative historical correlation to stocks.

A Closer Look at Historical Correlations

To understand how 2022 was an outlier in terms of asset correlations we can look at the graphic below:

The last time stocks and bonds moved together in a negative direction was in 1969. At the time, inflation was accelerating and the Fed was hiking interest rates to cool rising costs. In fact, historically, when inflation surges, stocks and bonds have often moved in similar directions. Underscoring this divergence is real interest rate volatility. When real interest rates are a driving force in the market, as we have seen in the last year, it hurts both stock and bond returns. This is because higher interest rates can reduce the future cash flows of these investments. Adding another layer is the level of risk appetite among investors. When the economic outlook is uncertain and interest rate volatility is high, investors are more likely to take risk off their portfolios and demand higher returns for taking on higher risk. This can push down equity and bond prices. On the other hand, if the economic outlook is positive, investors may be willing to take on more risk, in turn potentially boosting equity prices.

Current Investment Returns in Context

Today, financial markets are seeing sharp swings as the ripple effects of higher interest rates are sinking in. For investors, historical data provides insight on long-term asset allocation trends. Over the last century, cycles of high interest rates have come and gone. Both equity and bond investment returns have been resilient for investors who stay the course.