But did you know there’s a way to get an even more out of Visual Capitalist, all while helping support the work we do?

New to VC+ in January 2020

VC+ is our newly launched members program that gives you exclusive access to extra visual content and insightful special features. It also gets you access to The Trendline, our new members-only graphic newsletter. So, what is getting sent to VC+ members in the coming days?

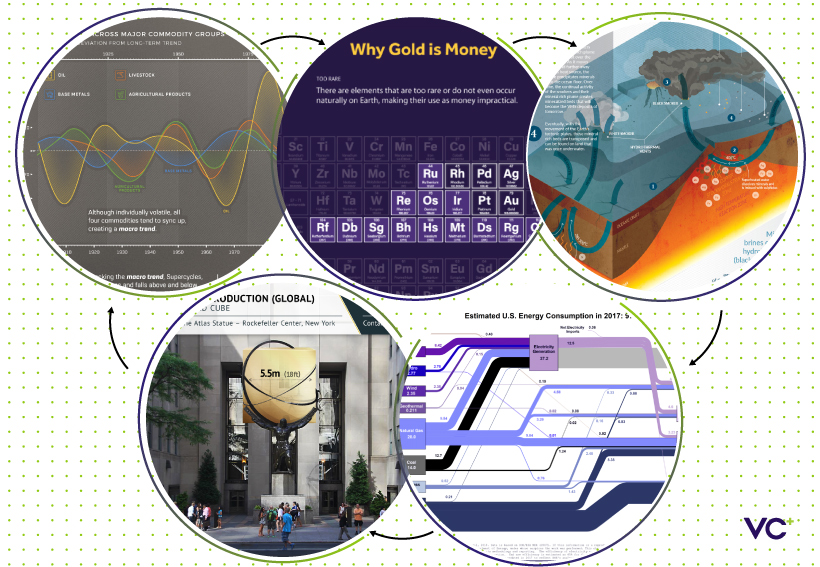

“Commodities: Explained Through Powerful Visuals”

SPECIAL DISPATCH: 9 Techniques We Use to Make Commodity Markets Easier to Understand

No two commodities are alike, and each has different market dynamics. Luckily, visuals such as charts, infographics, and data visualizations can help us approach commodities in a way that helps to improve your understanding of how things fit together. Whether it’s explaining the special “safe haven” status ascribed to gold or a flow diagram of how energy sources are used, this VC+ feature will dive into the innovative techniques we’ve successfully used to approach topics on energy, metals, and agriculture. Publishing date: Jan 17 (Get VC+ to access)

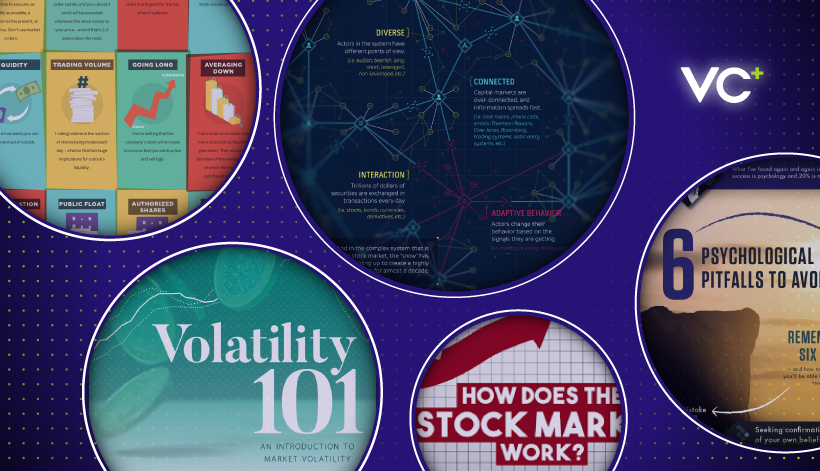

“Investing 101: Breaking Down the Basics for Beginners”

SPECIAL DISPATCH: Summing up our best infographic recommendations for new investors

Investing can be a daunting subject for newbies. Luckily, visuals have a powerful way of cutting through the complexity. From defining industry terms to visualizing volatility in the market, this VC+ special feature will round up our favorite data-driven graphics to help new investors get started. Publishing date: Jan 23 (Get VC+ to access)

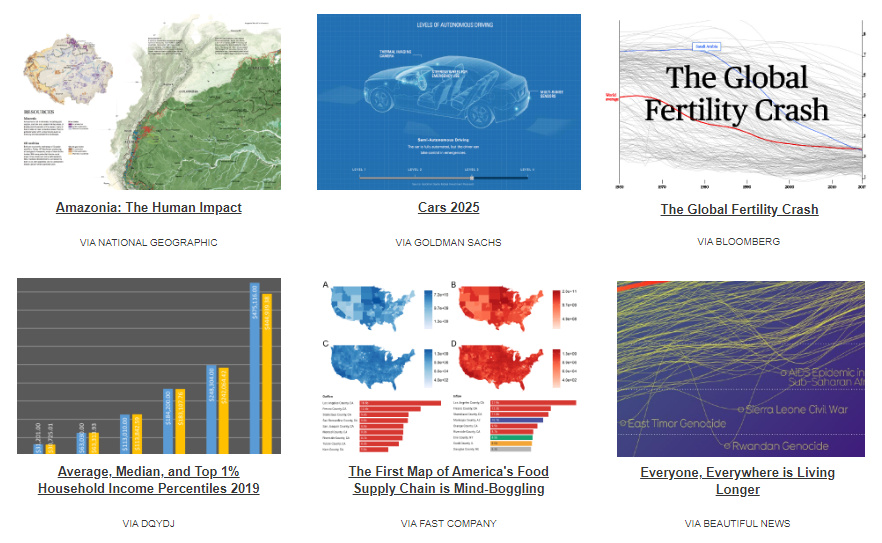

The Trendline

PREMIUM NEWSLETTER: Our weekly members-only newsletter for VC+ members Every week, VC+ members also get our premium graphic newsletter, The Trendline. With The Trendline, we’ll send you the best visual content, datasets, and insightful reports relating to business that our editors find each week. Publishing Date: Every Sunday

More Visuals. More Insight. More Understanding.

Get access to these upcoming features by becoming a VC+ member. For a limited time, get 25% off, which makes your VC+ membership the same price as a coffee each month:

PS – We look forward to sending you even more great visuals and data! on To reach net-zero by 2050, immediate action and $9.2 trillion in annual investment is required, or about 7-9% of global GDP. This would be $3.5 trillion annually more than today, which in 2020 was equal to roughly:

50% of corporate profits25% of tax revenues7% of household spending

This infographic sponsored by Carbon Streaming Corporation shows how carbon credits can help accelerate a net-zero future by funding climate action.

Closing the Funding Gap With Carbon Credits

Carbon credits play a vital role in channelling finance to help close this funding gap. Here are some ways in which carbon credits can be used: Thanks to a growing number of initiatives listed below, 2023 is anticipated to bring greater credibility and transparency to the carbon credit market.

The Integrity Council for the Voluntary Carbon MarketScience Based Targets initiative (SBTi)Climate Action Data TrustVoluntary Carbon Markets Integrity Initiative

Not Every Carbon Credit is Equal

Identifying high-quality carbon credits is important because not every type of credit offers the same scope of benefits. Carbon credit buyers look for credits that offer tangible benefits that go beyond CO₂ reduction or removal, such as:

Advancing Sustainable Development GoalsCreating jobs in local communitiesProtecting biodiversityProviding education and job training

Often, credits that offer these types of benefits command a price premium. At the same time, demand for carbon credits is expected to increase. Within the decade, the value of the voluntary carbon market could grow from $2 billion up to $50 billion. Voluntary carbon markets refer to the transactions in which carbon credits are purchased by corporate and other buyers that voluntarily (not required by a regulatory act) want to compensate for their emissions or advance sustainability goals.

Source: Ecosystem Marketplace, McKinsey, UNFCCC Today, over 8,300 corporate, 1,100 municipal, and 52 regional net-zero commitments are set to drive market growth.

Carbon Streaming’s Innovative Approach to Climate Action

Carbon Streaming is a publicly listed company that invests capital in high integrity carbon credit projects on a global scale. It uses the proven, flexible streaming model to create long-term partnerships. This model aligns interests to benefit all stakeholders. Carbon Streaming’s growing portfolio of carbon credits includes over 20 projects across six different project types in 12 countries that aim to accelerate a net-zero future.

Transformative Year Ahead

By the end of 2023, carbon credits are expected to be issued from 10 or more projects. Importantly, all of Carbon Streaming’s carbon projects aim to advance multiple UN Sustainable Development Goals. Carbon Streaming intends to continue growing and diversifying its portfolio while selling carbon credits received to maximize value for all stakeholders.

Interested in learning more about Carbon Streaming? Click here to learn more.