A CBDC adopts certain characteristics of everyday paper or coin currencies and cryptocurrency. It is expected to provide central banks and the monetary systems they govern a step towards modernizing. But what exactly are CBDCs and how do they differ from money we use today?

The ABCs of CBDCs

To better understand a CBDC, it helps to first understand the taxonomy of money and its overlapping properties. For example, the properties of cash are that it’s accessible, physical and digital, central bank issued, and token-based. Here’s how the taxonomy of money breaks down:

Accessibility: The accessibility of money is a big factor in determining its place within the taxonomy of money. For instance, cash and general purpose CBDCs are considered widely accessible. Form: Is the money physical or digital? The form of money determines distribution and the potential for dilution, and future CBDCs issued will be completely digital. Issuer: Where does the money come from? CBDCs are to be issued by the central bank and backed by their respective governments, which differs from cryptocurrencies which mostly have no government affiliations. Technology: How does the currency work? CBDCs break down into token-based and account-based approaches. A token-based CBDC operates like banknotes today, where your information is not known nor needed by a cashier when accepting your payment. An account-based system, however, requires authorization to partake on the network, akin to paying with a digital wallet or card.

Digital Currency vs Digital Coins

In essence, digital currency is the electronic form of banknotes that exists today. Therefore, it’s viewed by some as a modern and efficient version of the cash you hold in your wallet or purse. On the other hand, cryptocurrencies like Bitcoin are a store of value like gold that is secured by encryption. Cryptocurrencies are privately owned and fueled by blockchain technology, compared to digital currencies which do not use decentralized ledgers or blockchain technology.

Digital Currency: Regulatory Authority and Stability

Digital currencies are issued by a central bank, and therefore, are backed by the full power of a government. According to the Bank for International Settlements, over 20% of central banks surveyed say they have legal authority in issuing a CBDC. Almost 10% more said laws are currently being changed to allow for it. As more central banks issue digital currencies, there’s likely to be favorability between them. This is similar to how a few currencies like the U.S. dollar and Euro dominate the currency landscape.

The Benefits of Issuing a CBDC

There are several positives regarding the issuance of a CBDC over other currencies. First, the cost of retail payments in the U.S. is estimated to be between 0.5% and 0.9% of the country’s $20 trillion in GDP. Digital currencies can flow much more effectively between parties, helping reduce these transaction fees. Second, large chunks of the global population are still considered unbanked. In this case, a CBDC opens avenues for people to access the global financial system without a bank. Even today, 6% of Americans do not have a single bank account. Other motivations for a CBDC include:

Financial stability Monetary policy implementation Increased safety, efficiency, and robustness Limit on illicit activity

An example of payments efficiency can be seen during the onset of the COVID-19 pandemic, when some Americans failed to receive their stimulus check. Altogether, some $2 billion in funds have gone unclaimed. A functioning rollout of a CBDC and a more direct relationship with citizens would minimize such a problem.

Status of CBDCs

Although widespread adoption of CBDCs is still far away, research and experiments are making notable strides forward:

81 countries representing 90% of global GDP are exploring CBDCs. The share of central banks actively engaging in CBDC work grew to 86% in the last 4 years. 60% of central banks are conducting experiments on CBDCs (up from 42% in 2019) and 14% are moving forward to development and pilot arrangement. The Bahamas is one of five countries currently working with a CBDC – the Bahamian Sand Dollar. Sweden and Uruguay have shown interest in a digital currency. Sweden began testing an “e-krona” in 2020, and Uruguay announced tests to issue digital Uruguayan pesos as far back as 2017. The People’s Bank of China has been running CBDC tests since April 2020. In all, tens of thousands of citizens have participated, spending 2 billion yuan, and the country is poised to be the first to fully launch a CBDC.

The U.K. central bank is less optimistic about a rolling out a CBDC in the near future. The proposed digital currency—dubbed “Britcoin”—is unlikely to arrive until at least 2025.

Disrupting The World of Money

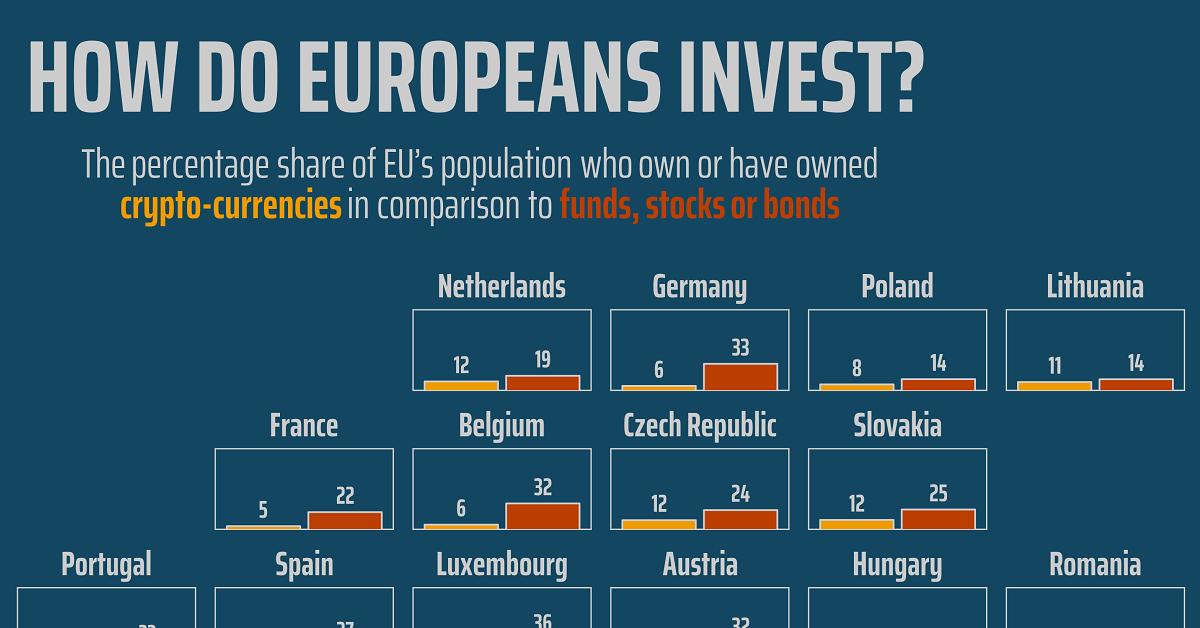

Wherever you look, technology is disrupting finance and upending the status quo. This can be seen through the rising market value of fintech firms, which in some cases are trumping traditional financial institutions in value. It is also evident in the rapid rise of Bitcoin to a $1 trillion market cap, making it the fastest asset to do so. With the rollout of central bank digital currencies on the horizon, the next disruption of financial systems is already beginning. on For a modern example, we can see how different countries (and regions) act when it comes to cryptocurrency. Within the European Union—one of the regions dealing with faster crypto adoption—attitudes towards investing can vary considerably. This graphic from Gilbert Fontana looks at crypto popularity amongst investors in the EU using data from the European Commission’s Eurobarometer. It compares exposure to cryptocurrencies relative to stocks, funds, and bonds.

Crypto Popularity in Europe in 2022

Given that crypto has experienced bubble-like asset rallies, including a dramatic rise to over a trillion dollars in value before crashing, it’s fair to say it’s well known by now. But even with a vast rise in awareness, there are still discrepancies between the level of investment crypto receives amongst European Union nations. Let’s see which countries have the highest proportion of citizens invested in crypto: Topping the list is Slovenia, considered by some the most crypto-friendly nation in the world. According to the survey, 18% of the country’s population has some sort of investment in it. Cyprus also ranks high in its crypto-friendly rank and hits an investment figure of 13%. Also notable is the Grand Duchy of Luxembourg, which despite having a small population of 640,000 also has a strong reputation as a global financial hub. When it comes to crypto, 14% of the population owns or has owned the asset, relative to 36% for stocks, bonds, or funds.

Crypto Unpopularity?

In regards to the countries with lower levels of crypto investment, one observation is that they tend to be wealthier and more developed EU nations. Here’s how the nations at or below the 10% crypto-investment threshold rank: At the “bottom” of crypto interest are France, Germany and Italy, also the EU’s largest economies. At a glance, this might suggest that citizens of stronger economies invest less in crypto. However, it’s important to note that the countries with higher levels of crypto investment tend to have lower levels of wealth on average. Though less of their investors seem to engage in crypto trading, countries like France and Germany might have more comparable levels of crypto investment on a pure dollar-basis.