With wild price swings, massive up-cycles, exciting resource discoveries, and extreme weather events all playing into things, there’s usually never a dull day in the sector. That being said, it’s hard to remember a more lackluster period for commodities than in the last couple of years. For commodity bulls, the good news is that the sector is no longer tanking. The bad news, however, is that all the recent action has been in relatively niche sectors, as metals like cobalt, zinc, and lithium all have their day in the sun. At the same time, the big commodities (gold, oil, copper) have all slid sideways, having yet to revisit their former periods of glory.

Commodity Winners So Far

Before we highlight why commodities could still be cheap, let’s look at recent performance to get some context. Here are the commodities that have positive returns in H1 2017 so far:

Palladium is the best performer in 2017 so far, and it has now almost passed platinum in price. That would be the first time since 2001 that this has happened, and for the stretch of 2007-2012 it was even true that palladium traded at a $1,000 deficit to platinum. Agricultural goods like rough rice, lean hogs, oats, and and wheat have also gotten more expensive so far this year. Meanwhile, metals like gold, copper, and silver have seen modest gains – but these are only after dismal performances from the last part of 2016.

The Losers So Far

Here is the scoreboard for the commodities in negative territory, with the most noticeable losses in sugar and energy.

Are Commodities Cheap?

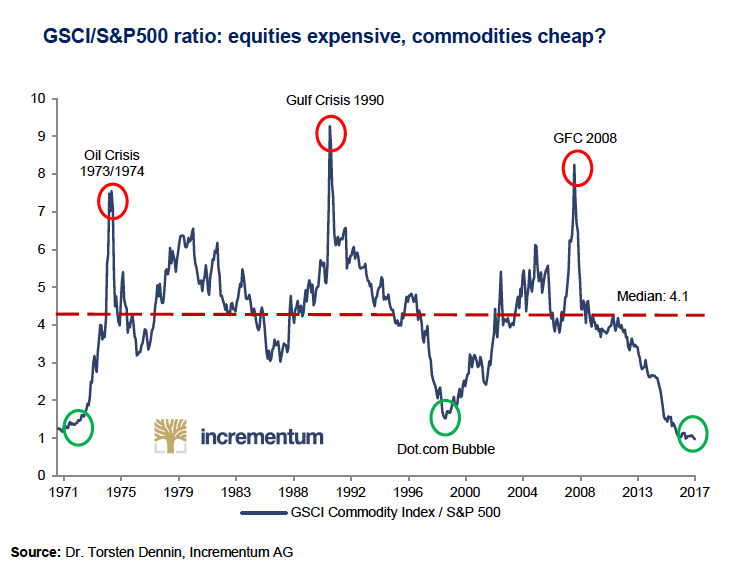

From the post-crisis bottom in 2009 until today, the S&P 500 is up a staggering 215.4%. During that same timeframe, most major commodities crashed and then went sideways. The Goldman Sachs Commodity Index (GSCI) is down roughly -31.2%, which is a strong juxtaposition to how equities have done. This extreme divergence can be best seen in this long-term chart, which compares the two indices since 1971.

In other words: despite the lack of action in commodities that we noted earlier, the sector has never been cheaper relative to equities even going back 45 years. That means that there could be some much-needed action soon.

on Volatility is a double-edged sword, particularly when it comes to commodity investing. During the good times, it can create skyrocketing returns. But during bad times, it can turn ugly. Today’s infographic comes to us from Prospector Portal, and shows how investing in precious metals equities can outperform or underperform the broader metals market.

Capitalizing on Volatility: Timing Matters

Just like most investments, timing matters with commodities. Due to the complex production processes of commodities, unexpected demand shocks are met with slower supply responses. This, along with other factors, creates commodity supercycles—extended periods of upswings and downswings in prices. Investors must time their investments to take advantage of this volatility, and there are multiple ways to do so.

Three Ways to Invest in Commodities

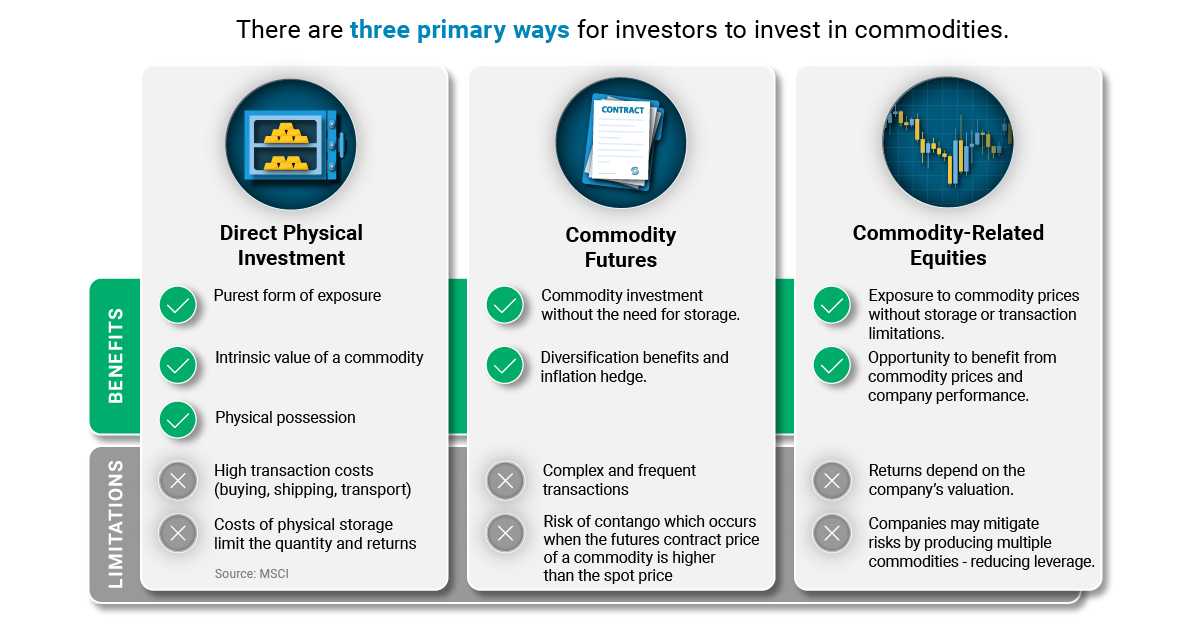

There are three primary routes investors can take when it comes to investing in commodities. Among these, commodity-related equities offer by far the most leverage to changes in prices. Let’s dive into how investors can use this leverage to their advantage with volatile metal prices.

The Fundamentals of Investing in Mining Equities

When it comes to commodity investing, targeting miners and mineral exploration companies presents fundamental benefits and drawbacks. As metal prices rise, the performance of mining companies improves in several ways—while in deteriorating conditions, they do the opposite: With the right timing, these ups and downs can create explosive opportunities. Mining companies, especially explorers, use these price swings to their advantage and often produce market-beating returns during an upswing. But how?

The Proof: How Mining Equities React to Metal Prices

Not only do price increases translate into higher profits for mining companies, but they can also change the outlook and value of exploration companies. As a result, investing in exploration companies can be a great way to gain exposure to changing prices. That said, these types of companies can generate greater equity returns over a shorter period of time when prices are high, but they can also turn dramatically negative when prices are low. Below, we compare how producers and exploration companies with a NI-43-101 compliant resource perform during bull and bear markets for precious metals. All figures are in U.S. dollars unless otherwise stated. During the bear market period, the price of gold declined by 2.66%, and despite engaging in exploration activity, most companies saw a slump in their share prices. In particular, exploration companies, or juniors, took a heavier hit, with returns averaging -31.66%. But even during a bear market, a discovery can make all the difference—as was the case for producer Wesdome Gold Mines, generating a 109.95% return over 2018.

Average returns for gold producers including Wesdome: 24.83% Average returns for gold producers excluding Wesdome: -17.65%

During the bull market period for gold, gold mining companies outperformed the price of gold, with juniors offering the highest equity returns averaging 153.43%. Gold producers outperformed the commodity market, the value of their equities increased 69.61%—less than half of that of exploration companies.

Silver: Bears vs Bulls

Similar to gold mining companies, performances of silver producers and explorers reflected the volatility in silver prices: During the bear market period for silver, its price decreased by 9.8%. Explorers and producers both saw a dip in their share prices, with the equity of silver producers decreasing by 21.63%. However, the discovery of a high-quality silver deposit again made the difference for SilverCrest Metals, which generated a 116.85% return over the year.

Average returns for silver exploration companies including SilverCrest: 8.32% Average returns for silver exploration companies excluding SilverCrest: -27.86%

On the other hand, during the bull market period, the price of silver increased by 34.33%. Silver exploration companies surpassed the performance of the price of silver.

Average returns for silver producers: 69.04% Average returns for silver exploration companies: 95.36%

The potential to generate massive returns and losses is evident in both cases for gold and silver.

The Investment Potential of Exploration

Mining equities tend to outperform underlying commodity prices during bull markets, while underperforming during bear markets. For mining exploration companies, these effects are even more pronounced—exploration companies are high-risk but can offer high-reward when it comes to commodity investing. To reap the rewards of volatile returns, you have to know the risks and catch the market at the right time.