Impact of Tourism by Country and State

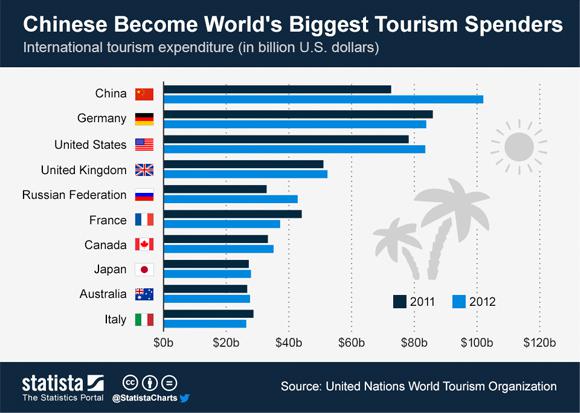

Over the last 30 years, the price of airfare has fallen over 50%. It goes to show, since airlines have lost money every other year since 1981. The industry bled $51 billion in the 10 year span between 2001 and 2011 as more competition entered the space. However, this is a boon for consumers and for the regions getting attention from international tourists. In terms of sheer volume, the travel industry has never been as good. The global share of GDP for the travel industry is now 9.5%. In 2012, it is also worth noting that China overtook every other country in travel spending abroad with a hefty $102 billion of expenditures.

While it is not the easiest thing to play from an investment perspective, it is a continuing trend that arches above everything else. There are also some interesting Chinese companies to consider such as Ctrip.com (NASDAQ: CTRP) which essentially aggregates hotel and flight deals in China. Original graphic from: Online Accounting Degrees

on Similar to the the precedent set by the music industry, many news outlets have also been figuring out how to transition into a paid digital monetization model. Over the past decade or so, The New York Times (NY Times)—one of the world’s most iconic and widely read news organizations—has been transforming its revenue model to fit this trend. This chart from creator Trendline uses annual reports from the The New York Times Company to visualize how this seemingly simple transition helped the organization adapt to the digital era.

The New York Times’ Revenue Transition

The NY Times has always been one of the world’s most-widely circulated papers. Before the launch of its digital subscription model, it earned half its revenue from print and online advertisements. The rest of its income came in through circulation and other avenues including licensing, referrals, commercial printing, events, and so on. But after annual revenues dropped by more than $500 million from 2006 to 2010, something had to change. In 2011, the NY Times launched its new digital subscription model and put some of its online articles behind a paywall. It bet that consumers would be willing to pay for quality content. And while it faced a rocky start, with revenue through print circulation and advertising slowly dwindling and some consumers frustrated that once-available content was now paywalled, its income through digital subscriptions began to climb. After digital subscription revenues first launched in 2011, they totaled to $47 million of revenue in their first year. By 2022 they had climbed to $979 million and accounted for 42% of total revenue.

Why Are Readers Paying for News?

More than half of U.S. adults subscribe to the news in some format. That (perhaps surprisingly) includes around four out of 10 adults under the age of 35. One of the main reasons cited for this was the consistency of publications in covering a variety of news topics. And given the NY Times’ popularity, it’s no surprise that it recently ranked as the most popular news subscription.