As investors re-evaluate their portfolios and exposure, it’s worth exploring some of the major themes and trends that are expected to drive markets in 2018.

Predictions for 2018

Today’s infographic was done in collaboration with Swissquote, a Swiss banking group, and it highlights their five most important predictions for the rest of the year ahead. Taken from their 2018 Market Outlook Report, which can be downloaded for free, the following graphic discusses key themes of the year such as central bank policy, European unity, China, cryptocurrencies, and emerging markets.

Enjoy the infographic? Get the full report for free from the Swissquote 2018 Market Outlook page.

Swissquote’s Predictions

Here are the high level points of Swissquote’s predictions:

- Fed in Inflation Fighting Stance Despite a strong economy, specifically tight labor markets, inflation has perplexingly not appeared. In Swissquote’s view, expansionary monetary policy by central banks is the primary reason for the current stretched valuations. And of the central banks, the Fed is not only the most important – but also the most active. Expecting a sudden kick from ultra-tight labor markets to boost wage growth and consumer inflation, the Fed is again ready to act in 2018. As a result, Swissquote sees U.S. GDP growing 2.2%, the labor market tightening, and annual core PCE inflation hitting 1.8%. Prediction: The Fed will hike three times.

- Unified Europe Will Emerge from Spain The start of 2017 brought fears of the EU’s demise, as rising political populism suggested an end to EU federalism. However, despite recent events in Catalonia, Swissquote sees Europe actually emerging from 2018 more united. Heading into 2018, economic sentiment in Europe is at 10-year highs. Further, the election of Macron in France – and the re-election of Merkel in Germany – will mean a continued push for deeper EU integration. In 2018, Swissquote sees the following headwinds in Europe: uncertainty around independence in Catalonia, the Italian elections, and austerity in Greece. Prediction: The powerful trio of Macron, Merkel, and Draghi will weather the storm – and their unity will have a profound effect on pricing in events such as Brexit and the Italian elections.

- China Grabs the Political Void China’s economy will slow in growth slightly in 2018, but the country’s regional economic dominance is undisputed. With a GDP (PPP) of $21.5 trillion, it even dwarfs India ($8.7 trillion), Japan ($5.3 trillion) and Russia ($3.4 trillion) combined. And empowered by the volatile behavior of President Trump, China has embraced its new role as regional and global leader. Judging from the 2017 World Economic Forum in Davos and the Chinese Communist party congress, Xi Jinping and China are ready to step into the light. Prediction: China will step up efforts to further entrench its hybrid model, which includes politics and economics.

- Cryptocurrencies are the Real “Populist” Vote While the Brexit and Trump votes represent the protest of existing systems – there’s also a monetary component to that populism that is hiding in plain sight. Central banks have created trillions of dollars out of thin air since the 2008 crisis, and people no longer trust the government to protect their money and wealth. As a result? People have been pouring money into bitcoins and altcoins instead. Prediction: This “populist” vote against the monetary policy of global central banks will continue in full form.

- Emerging Markets Lead the Growth Charge GDP growth in emerging markets for 2017 is expected to be 4.5% – its highest point since 2015 – versus 2.1% for developed markets. Although protectionism will continue to make the headlines, any real action will be limited, even by the Trump administration. Prediction: The story for EM in 2018 will be a further increase in international trading. Following a trend, China has reached 15 free-trade agreements with 23 countries and regions. And like in 2017, emerging markets will continue to have more growth and higher returns as a result.

on The good news is that the Federal Reserve, U.S. Treasury, and Federal Deposit Insurance Corporation are taking action to restore confidence and take the appropriate measures to help provide stability in the market. With this in mind, the above infographic from New York Life Investments looks at the factors that impact bonds, how different types of bonds have historically performed across market environments, and the current bond market volatility in a broader context.

Bond Market Returns

Bonds had a historic year in 2022, posting one of the worst returns ever recorded. As interest rates rose at the fastest pace in 40 years, it pushed bond prices lower due to their inverse relationship. In a rare year, bonds dropped 13%.

Source: FactSet, 01/02/2023.

Bond prices are only one part of a bond’s total return—the other looks at the income a bond provides. As interest rates have increased in the last year, it has driven higher bond yields in 2023.

Source: YCharts, 3/20/2023.

With this recent performance in mind, let’s look at some other key factors that impact the bond market.

Factors Impacting Bond Markets

Interest rates play a central role in bond market dynamics. This is because they affect a bond’s price. When rates are rising, existing bonds with lower rates are less valuable and prices decline. When rates are dropping, existing bonds with higher rates are more valuable and their prices rise. In March, the Federal Reserve raised rates 25 basis points to fall within the 4.75%-5.00% range, a level not seen since September 2007. Here are projections for where the federal funds rate is headed in 2023:

Federal Reserve Projection*: 5.1% Economist Projections**: 5.3%

*Based on median estimates in the March summary of quarterly economic projections.**Projections based on March 10-15 Bloomberg economist survey. Together, interest rates and the macroenvironment can have a positive or negative effect on bonds.

Positive

Here are three variables that may affect bond prices in a positive direction:

Lower Inflation: Reduces likelihood of interest rate hikes. Lower Interest Rates: When rates are falling, bond prices are typically higher. Recession: Can prompt a cut in interest rates, boosting bond prices.

Negative

On the other hand, here are variables that may negatively impact bond prices:

Higher Inflation: Can increase the likelihood of the Federal Reserve to raise interest rates. Rising Interest Rates: Interest rate hikes lead bond prices to fall. Weaker Fundamentals: When a bond’s credit risk gets worse, its price can drop. Credit risk indicates the chance of a default, the risk of a bond issuer not making interest payments within a given time period.

Bonds have been impacted by these negative factors since inflation started rising in March 2021.

Fixed Income Opportunities

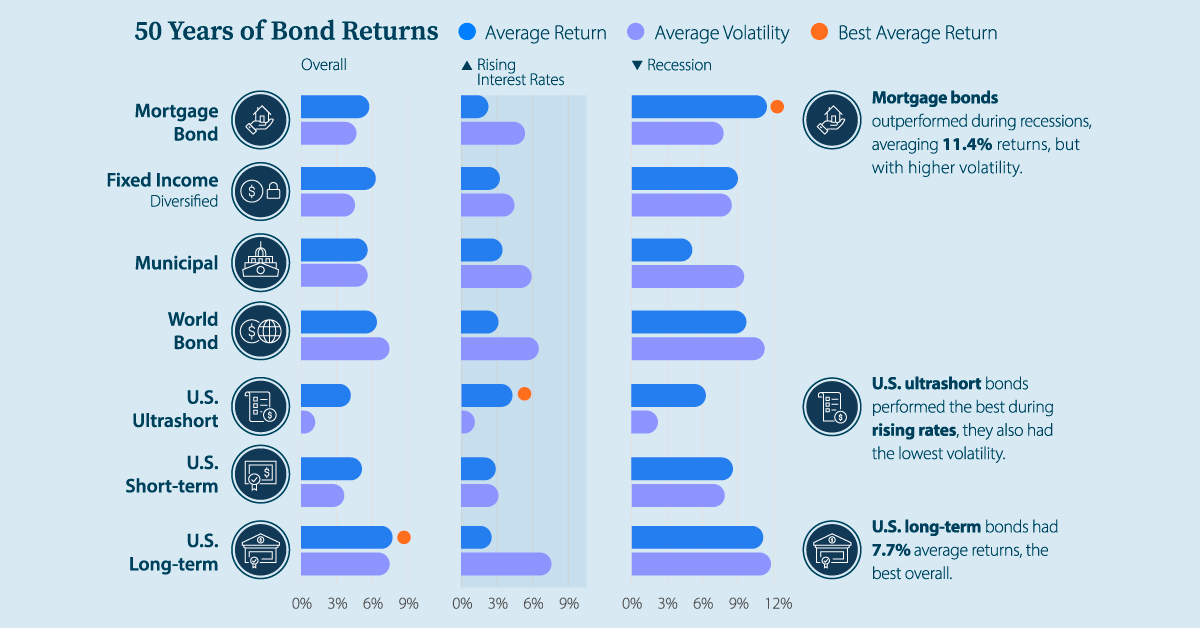

Below, we show the types of bonds that have had the best performance during rising rates and recessions.

Source: Derek Horstmeyer, George Mason University 12/3/2022. As we can see, U.S. ultrashort bonds performed the best during rising rates. Mortgage bonds outperformed during recessions, averaging 11.4% returns, but with higher volatility. U.S. long-term bonds had 7.7% average returns, the best across all market conditions. In fact, they were also a close second during recessions. When rates are rising, ultrashort bonds allow investors to capture higher rates when they mature, often with lower historical volatility.

A Closer Look at Bond Market Volatility

While bond market volatility has jumped this year, current dislocations may provide investment opportunities. Bond dislocations allow investors to buy at lower prices, factoring in that the fundamental quality of the bond remains strong. With this in mind, here are two areas of the bond market that may provide opportunities for investors:

Investment-Grade Corporate Bonds: Higher credit quality makes them potentially less vulnerable to increasing interest rates. Intermediate Bonds (2-10 Years): Allow investors to lock in higher rates.

Both types of bonds focus on quality and capturing higher yields when faced with challenging market conditions.

Finding the Upside

Much of the volatility seen in the banking sector was due to banks buying bonds during the pandemic—or even earlier—at a time when interest rates were historically low. Since then, rates have climbed considerably. Should rates moderate or stop increasing, this may present better market conditions for bonds. In this way, today’s steep discount in bond markets may present an attractive opportunity for price appreciation. At the same time, investors can potentially lock in strong yields as inflation may subside in the coming years ahead. Learn more about bond investing strategies with New York Life Investments.