Mobile payments, for example, is a market growing at a 39.2% annual clip, and it will be worth nearly $3 trillion by 2020. At the same time, it’s almost impossible to keep up with the growth in the blockchain world. Every day, new technical problems are being solved, coin market caps are hitting new highs, and Bitcoin is dominating the news cycle. But, payments hasn’t always been this fast-moving or exciting. In fact, right now is an anomalous moment in the sector – and we’re actually witnessing a rare intersection of multiple disruptive technologies coming to age at the same time.

A Timeline of Payment Disruptions

Today’s infographic comes from Glance Technologies, and it shows a historical timeline of the major disruptions that have occurred in payments, ranging from the Chinese invention of paper money to the birth of Paypal. It keys in on the new wealth created by these incredible technological advancements – and it also highlights the origins behind many of the crucial pieces of today’s payments landscape.

It took roughly 1,100 years to go from paper money to plastic, 50 years to go from plastic to digital, and just 10 years to go from digital to mobile. What fundamental change in payments is the next big one that will be visible across all levels of society?

The Next Big Shift

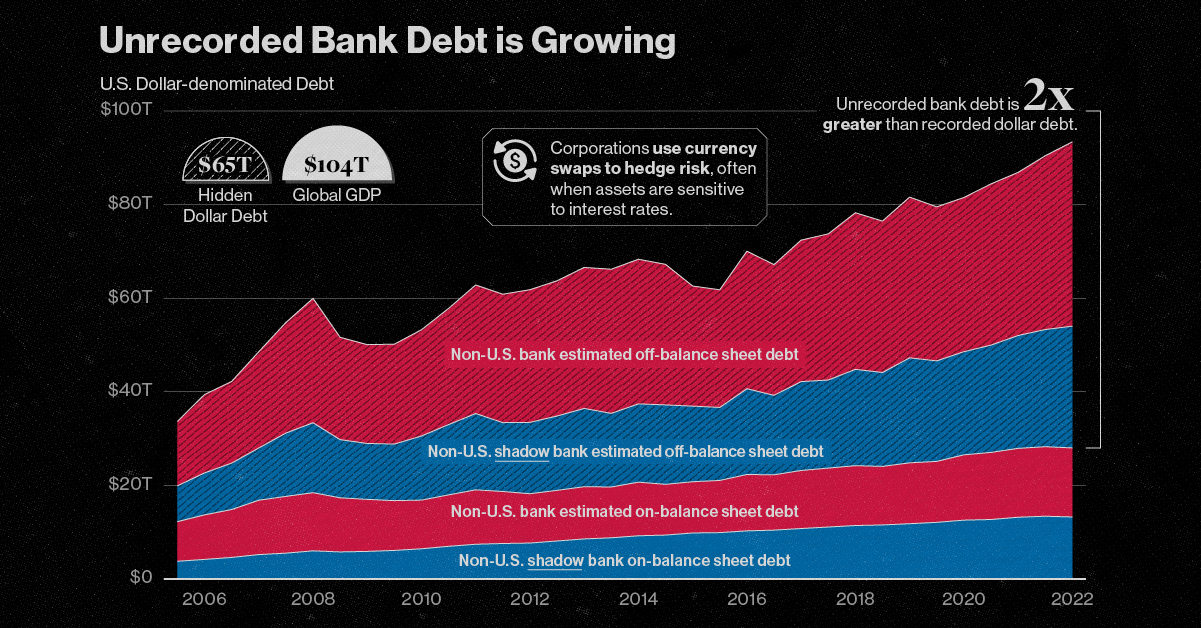

It may be too early to tell for sure what the next society-wide shift in payments will be, but there are definitely some obvious candidates. Blockchain Even with the precipitous rise of Bitcoin and its incredible journey to $10,000 and beyond, it’s still easy to underestimate the real possibilities in a decentralized, blockchain-based payments world. Various types of payments will be automated with smart contracts, and many of the world’s largest banks are already deep in experimentation with digital currencies. In an ultra rosy scenario, it’s even imaginable to say that fiat currency may one day be obsolete. There are still many challenges to overcome, of course, but the blockchain could soon be ubiquitous in everyday payments at a societal level. 100% Cash-Free Just like the blockchain, the idea of going cashless already has growing adoption – however, it is not yet something that dominates all facets of payments on a societal level. Right now, in the United States, just 38% of people said they would be willing to go completely cash-free. With the market for mobile payments increasing at a 39.2% CAGR, a fully cash-free world might not be that far off, though. Other While the two above trends are the most obvious, there are some dark horses out there. For example, biometrics is one that could change how payments are verified, adding a new layer of security to transactions. Instead of using a smartphone, plastic, or cash, could you be paying for every purchase with a simple fingerprint soon? Regardless of which of these is the next ubiquitous technology, the next five years of the payments space will certainly be exciting to watch. on The scale of hidden dollar debt around the world is huge. No less than $65 trillion in unrecorded dollar debt circulates across the global financial system in non-U.S. banks and shadow banks. To put in perspective, global GDP sits at $104 trillion. This dollar debt is in the form of foreign-exchange swaps, which have exploded over the last decade due to years of monetary easing and ultra-low interest rates, as investors searched for higher yields. Today, unrecorded debt from these foreign-exchange swaps is worth more than double the dollar debt officially recorded on balance sheets across these institutions. Based on analysis from the Bank of International Settlements (BIS), the above infographic charts the rise in hidden dollar debt across non-U.S. financial institutions and examines the wider implications of its growth.

Dollar Debt: A Beginners Guide

To start, we will briefly look at the role of foreign-exchange (forex) swaps in the global economy. The forex market is the largest in the world by a long stretch, with trillions traded daily. Some of the key players that use foreign-exchange swaps are:

Corporations Financial institutions Central banks

To understand forex swaps is to look at the role of currency risk. As we have seen in 2022, the U.S. dollar has been on a tear. When this happens, it hurts company earnings that generate revenue across borders. That’s because they earn revenue in foreign currencies (which have likely declined in value against the dollar) but end up converting earnings to U.S. dollars. In order to reduce currency risk, market participants will buy forex swaps. Here, two parties agree to exchange one currency for another. In short, this helps protect the company from unfavorable foreign exchange rates. What’s more, due to accounting rules, forex swaps are often unrecorded on balance sheets, and as a result are quite opaque.

A Mountain of Debt

Since 2008, the value of this opaque, unrecorded dollar debt has nearly doubled.

*As of June 30, 2022

Driving its rise in part was an era of rock-bottom interest rates globally. As investors sought out higher returns, they took on greater leverage—and forex swaps are one example of this.

Now, as interest rates have been rising, forex swaps have increased amid higher market volatility as investors look to hedge currency risk. This appears in both non-U.S. banks and non-U.S. shadow banks, which are unregulated financial intermediaries.

Overall, the value of unrecorded debt is staggering. An estimated $39 trillion is held by non-U.S. banks along with $26 trillion in overseas shadow banks around the world.

Past Case Studies

Why does the massive growth in dollar debt present risks? During the market crashes of 2008 and 2020, forex swaps faced a funding squeeze. To borrow U.S. dollars, market participants had to pay high rates. A lot of this hinged on the impact of extreme volatility on these swaps, putting pressure on funding rates. Here are two examples of how volatility can heighten risk in the forex market:

Exchange-rate volatility: Sharp swings in USD can spur a liquidity crunch U.S. interest-rate volatility: Sudden rate fluctuations can mean much higher costs for these trades

In both cases, the U.S. central bank had to step in to provide liquidity in the market and prevent dollar shortages. This was done through pumping cash into the system and creating swap lines with other non-U.S. banks such as the Bank of Canada or the Bank of Japan. These were designed to protect from declining currency values and a liquidity crunch.

Dollar Debt: The Wider Implications

The risk from growing dollar debt and these swap lines arises when a non-U.S. bank or shadow bank may not be able to hold up their end of the agreement. In fact, on a daily basis, there is an estimated $2.2 trillion in forex swaps exposed to settlement risk. Given its vast scale, this dollar debt could have greater systemic spillover effects. If participants fail to pay it could undermine financial market stability. Because demand for U.S. dollars increases during market uncertainty, a worsening economic climate could potentially expose the forex market to more vulnerabilities.