Whether the decision is related to paying back student debt or how to invest for the first time, the outcomes of these decisions have a long-term impact on the quality of our lives. Smart decisions can lead to achieving financial independence, while bad decisions can lead to years of being stuck in the “hole”. Even though it’s clear that financial literacy is important, there’s a big problem: it’s actually been dropping for years in the United States.

Diagnosing the Problem

Today’s infographic was done in conjunction with Next Gen Personal Finance, a non-profit that provides a free online curriculum of personal finance courses geared to students. The graphic paints a troubling picture of the current financial literacy situation in the country, while demonstrating why personal finance is a crucial area of study for our youth. Here are some of the indicators that show literacy is dropping:

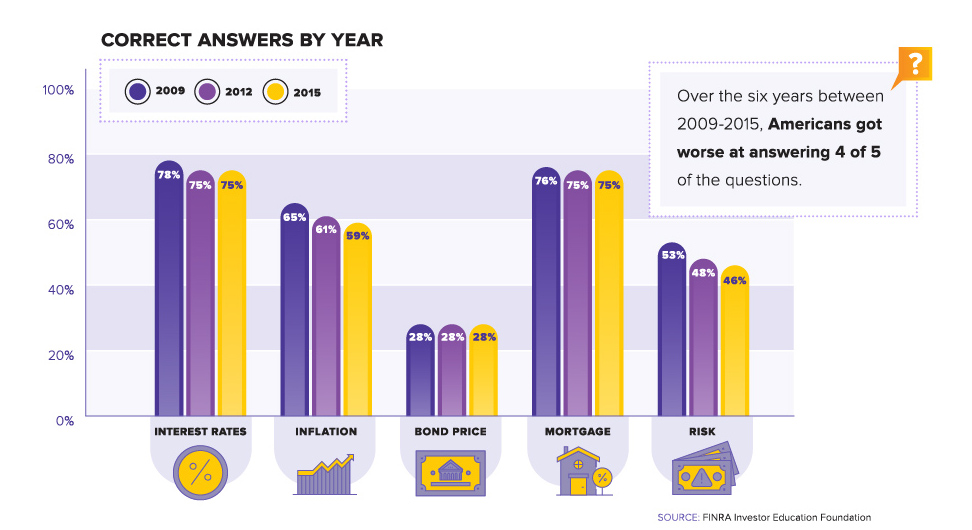

The U.S. ranks 14th globally in terms of financial literacy With a 57% literacy, the U.S. beats Botswana (52%) but gets edged out by countries like Germany (66%) or Canada (68%) Only 16.4% of U.S. students are required to take a personal finance class in schools 76% of millennials lack basic financial knowledge Between 2009-2015, Americans got worse at answering five key personal finance questions posed by FINRA – a major U.S. financial regulator

And worse, this lack of knowledge is translating into anxiety and even fear.

Four of five adults say they were never given the opportunity to learn about personal finance 70% of millennials are stressed and anxious about saving for retirement 22% of millennials feel overwhelmed about their finances 13% of millennials feel scared

Meanwhile, student debt is soaring to new highs – how do we put our students in a better spot to succeed?

The Road Ahead

As financial products continue to increase in complexity, the road ahead is not an easy one. However, there is still a great case for optimism: 60% of Americans say they know someday they will need to be more financially secure – they just don’t know how to get there. This number increases to 70% for those between the ages of 18-39 years old. This means there is actually a great thirst for financial education out there – the question is just how to best deliver that information in a compelling way. Another good sign? The youngest generation, Gen Z, is already starting to think about money differently: – Jason Dorsey, Center for Generational Kinetics

Real World Benefits

Increased financial literacy translates into real world benefits for individuals, and to the economy as a whole. People with strong financial skills are better at job planning and saving for retirement. Meanwhile, financial savvy investors are more likely to diversify risk, and students that take a personal finance course see up to a 5.2% increase in credit scores within two years. Lastly, consumers that understand compound interest:

Spend less on transaction fees Accrue less debt Incur lower interest rates on loans Save more money

And this is just scratching the surface of what could be possible. Making the right financial decisions can help people meet their own personal goals, live a life of abundance, get out of debt, and become financially independent. This infographic was originally published on the Wealth 101: A Crash Course in Personal Finance minisite, a collaboration between NGPF and Visual Capitalist on To see how the minimum wage differs around the world, we’ve visualized data from Picodi, which includes values for 67 countries as of January 2023.

Monthly Minimum Wage, by Country

The following table includes all of the data used in this infographic. Each value represents the monthly minimum wage a full-time worker would receive in each country. Picodi states that these figures are net of taxes and have been converted to USD. Generally speaking, developed countries have a higher cost of living, and thus require a higher minimum wage. Two outliers in this dataset are Argentina and Turkey, which have increased their minimum wages by 100% or more from January 2022 levels. Turkey is suffering from an ongoing currency crisis, with the lira losing over 40% of its value in 2021. Prices of basic goods have increased considerably as the Turkish lira continues to plummet. In fact, a 2022 survey found that 70% of people in Turkey were struggling to pay for food. Argentina, South America’s second-biggest economy, is also suffering from very high inflation. In response, the country announced three minimum wage increases throughout 2022.

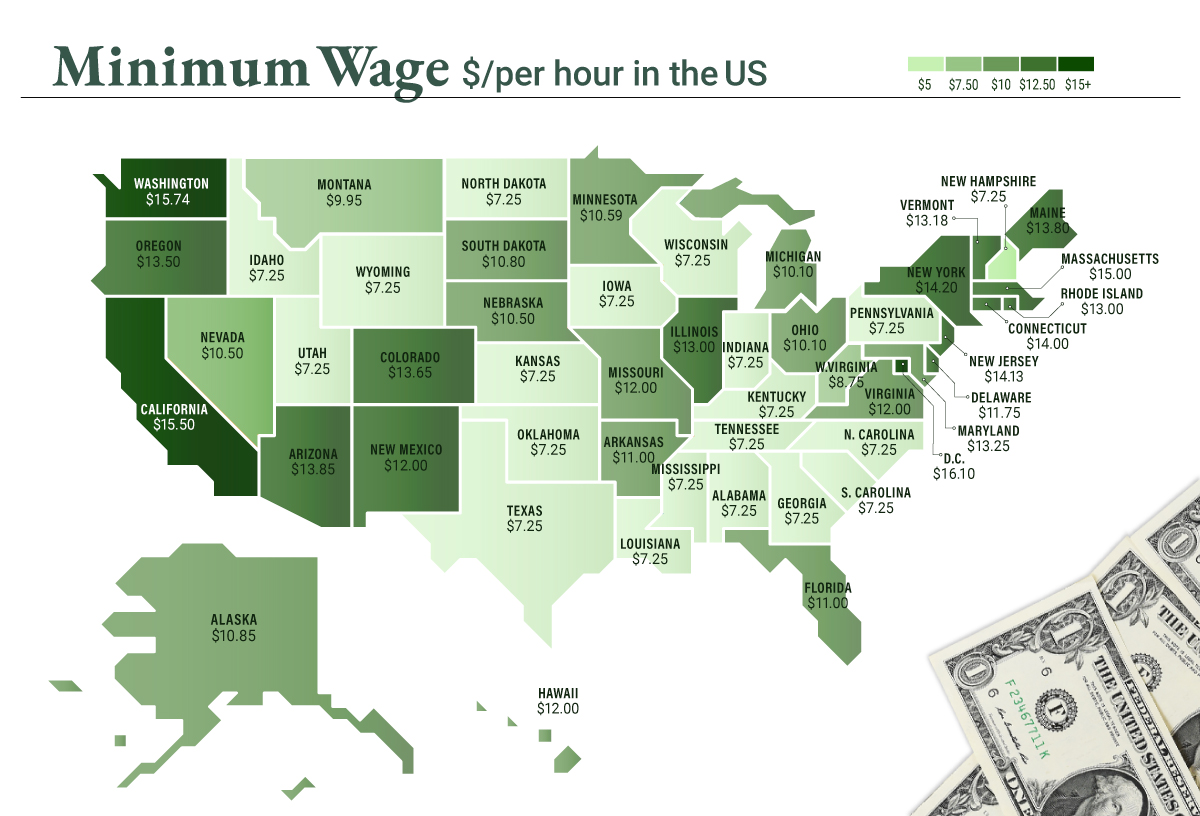

Minimum Wage in the U.S.

Within the U.S., minimum wage varies significantly by state. We’ve visualized each state’s basic minimum rate (hourly) using January 2023 data from the U.S. Department of Labor.

2023-03-17 Update: This map was updated to fix several incorrect values. We apologize for any confusion this may have caused. America’s federal minimum wage has remained unchanged since 2009 at $7.25 per hour. Each state is allowed to set their own minimum wage, as long as it’s higher than the federal minimum. In states that do not set their own minimum, the federal minimum applies. If we assume someone works 40 hours a week, the federal minimum wage of $7.25 translates to an annual figure of just $15,080 before taxes. California’s minimum wage of $15.50 translates to $32,240 before taxes. For further perspective, check out our 2022 infographic on the salary needed to buy a home across 50 U.S. cities.