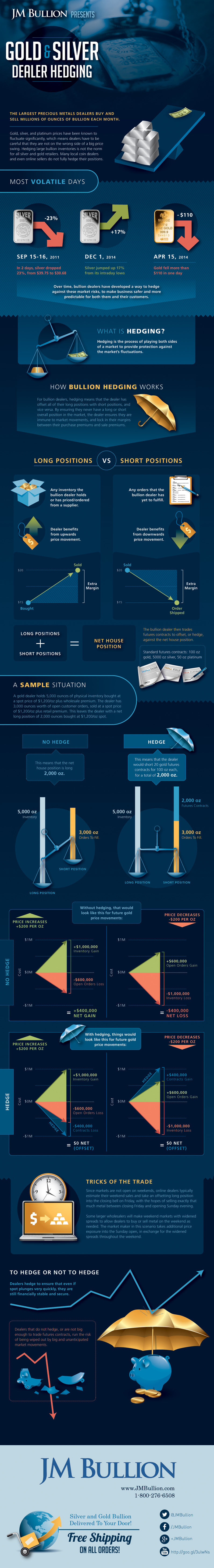

Gold and Silver Dealer Hedging

Gold, silver, and platinum prices have been known to fluctuate significantly. Just last year, for example, the gold price dropped $110 in just one day (April 15th). Later on in 2014, the typically more volatile silver jumped 17% from its intraday lows in the course of a day (Dec 1st). The largest precious metals dealers buy and sell millions of ounces of bullion each month, which means they have to be careful that they are not on the wrong side of one of these big price swings. Large price movements, both up and down, can potentially wipe out or endanger smaller dealers that aren’t careful with their inventory. Over time, bullion dealers have developed a way to hedge against these market risks, to make business safer and more predictable for both them and their customers.

What is Hedging?

Hedging is the process of playing both sides of a market to provide protection against the market’s fluctuations. For bullion dealers, hedging means that the dealer has to offset all of their long positions with short positions, and vice versa. By ensuring they never have a long or short overall position in the market, the dealer ensures they are immune to market movements, and lock in their margins between their purchase premiums and sale premiums. Long positions: Any inventory the bullion dealer holds or has priced/ordered from a supplier. The dealer benefits from upwards price movement in the gold or silver price. Short positions: Any orders that the bullion dealer has yet to fulfill. The dealer benefits from downwards price movement in the gold or silver price. Net house position: Equal to the bullion dealer’s long position minus short position.

A Sample Situation

A gold dealer holds 5,000 ounces of physical inventory bought at a spot price of $1,200/oz plus wholesale premium. The dealer has 3,000 ounces worth of open customer orders, sold at a spot price of $1,200/oz plus retail premium. This leaves the dealer with a net long position of 2,000 ounces bought at $1,200/oz spot. With no hedging, the dealer has a net long house position of 2,000 oz. With hedging, the dealer offsets this position by shorting 20 gold futures contracts for 100 oz gold each, for a total short of 2,000 oz. If the price of gold swings $200, it will have an unanticipated $400,000 positive or negative effect on the dealer who does not hedge. For the dealer that hedges the net long position with short futures contracts, everything will be a wash. This allows the dealer to not have to worry about swings, and instead to focus on making margin on premiums alone.

A Sample Situation

Since markets are not open on weekends, online dealers typically estimate their weekend sales and take an offsetting long position into the closing bell on Friday, with the hopes of selling exactly that much metal between closing Friday and opening Sunday evening. Some larger wholesalers will make weekend markets with widened spreads to allow dealers to buy or sell metal on the weekend as needed. The market maker in this scenario takes additional price exposure into the Sunday open, in exchange for the widened spreads throughout the weekend.

To Hedge or Not to Hedge

Dealers hedge to ensure that even if spot plunges very quickly, they are still financially stable and secure. Dealers that do not hedge, or are not big enough to trade futures contracts, run the risk of being wiped out by big and unanticipated market movements. Hedging large bullion inventories is not the norm for all silver and gold retailers. Many local coin dealers and even online sellers do not fully hedge their positions.

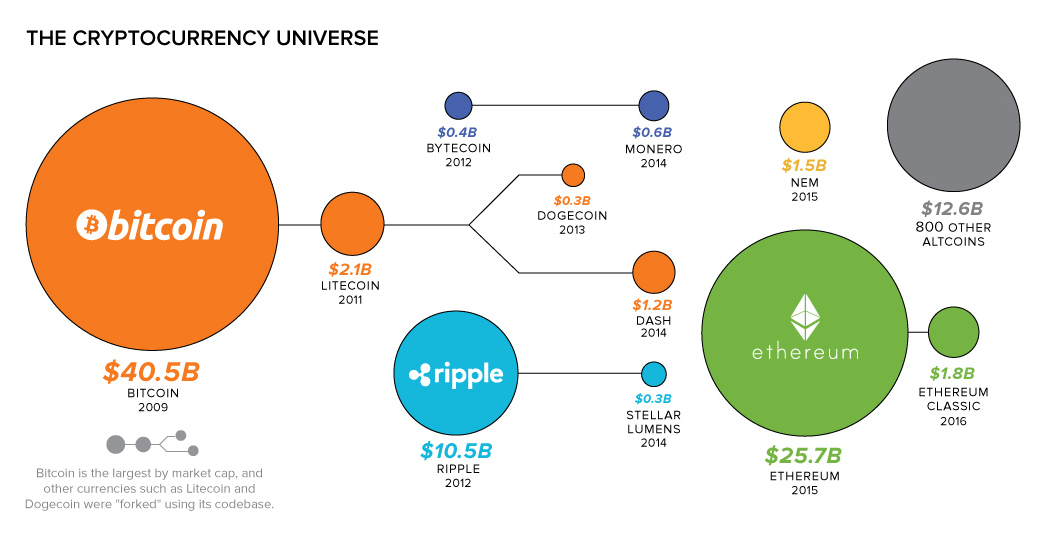

on Did you know that nearly one-fifth of all the gold ever mined is held by central banks? Besides investors and jewelry consumers, central banks are a major source of gold demand. In fact, in 2022, central banks snapped up gold at the fastest pace since 1967. However, the record gold purchases of 2022 are in stark contrast to the 1990s and early 2000s, when central banks were net sellers of gold. The above infographic uses data from the World Gold Council to show 30 years of central bank gold demand, highlighting how official attitudes toward gold have changed in the last 30 years.

Why Do Central Banks Buy Gold?

Gold plays an important role in the financial reserves of numerous nations. Here are three of the reasons why central banks hold gold:

Balancing foreign exchange reserves Central banks have long held gold as part of their reserves to manage risk from currency holdings and to promote stability during economic turmoil. Hedging against fiat currencies Gold offers a hedge against the eroding purchasing power of currencies (mainly the U.S. dollar) due to inflation. Diversifying portfolios Gold has an inverse correlation with the U.S. dollar. When the dollar falls in value, gold prices tend to rise, protecting central banks from volatility. The Switch from Selling to Buying In the 1990s and early 2000s, central banks were net sellers of gold. There were several reasons behind the selling, including good macroeconomic conditions and a downward trend in gold prices. Due to strong economic growth, gold’s safe-haven properties were less valuable, and low returns made it unattractive as an investment. Central bank attitudes toward gold started changing following the 1997 Asian financial crisis and then later, the 2007–08 financial crisis. Since 2010, central banks have been net buyers of gold on an annual basis. Here’s a look at the 10 largest official buyers of gold from the end of 1999 to end of 2021: Rank CountryAmount of Gold Bought (tonnes)% of All Buying #1🇷🇺 Russia 1,88828% #2🇨🇳 China 1,55223% #3🇹🇷 Türkiye 5418% #4🇮🇳 India 3956% #5🇰🇿 Kazakhstan 3455% #6🇺🇿 Uzbekistan 3115% #7🇸🇦 Saudi Arabia 1803% #8🇹🇭 Thailand 1682% #9🇵🇱 Poland1282% #10🇲🇽 Mexico 1152% Total5,62384% Source: IMF The top 10 official buyers of gold between end-1999 and end-2021 represent 84% of all the gold bought by central banks during this period. Russia and China—arguably the United States’ top geopolitical rivals—have been the largest gold buyers over the last two decades. Russia, in particular, accelerated its gold purchases after being hit by Western sanctions following its annexation of Crimea in 2014. Interestingly, the majority of nations on the above list are emerging economies. These countries have likely been stockpiling gold to hedge against financial and geopolitical risks affecting currencies, primarily the U.S. dollar. Meanwhile, European nations including Switzerland, France, Netherlands, and the UK were the largest sellers of gold between 1999 and 2021, under the Central Bank Gold Agreement (CBGA) framework. Which Central Banks Bought Gold in 2022? In 2022, central banks bought a record 1,136 tonnes of gold, worth around $70 billion. Country2022 Gold Purchases (tonnes)% of Total 🇹🇷 Türkiye14813% 🇨🇳 China 625% 🇪🇬 Egypt 474% 🇶🇦 Qatar333% 🇮🇶 Iraq 343% 🇮🇳 India 333% 🇦🇪 UAE 252% 🇰🇬 Kyrgyzstan 61% 🇹🇯 Tajikistan 40.4% 🇪🇨 Ecuador 30.3% 🌍 Unreported 74165% Total1,136100% Türkiye, experiencing 86% year-over-year inflation as of October 2022, was the largest buyer, adding 148 tonnes to its reserves. China continued its gold-buying spree with 62 tonnes added in the months of November and December, amid rising geopolitical tensions with the United States. Overall, emerging markets continued the trend that started in the 2000s, accounting for the bulk of gold purchases. Meanwhile, a significant two-thirds, or 741 tonnes of official gold purchases were unreported in 2022. According to analysts, unreported gold purchases are likely to have come from countries like China and Russia, who are looking to de-dollarize global trade to circumvent Western sanctions.

There were several reasons behind the selling, including good macroeconomic conditions and a downward trend in gold prices. Due to strong economic growth, gold’s safe-haven properties were less valuable, and low returns made it unattractive as an investment.

Central bank attitudes toward gold started changing following the 1997 Asian financial crisis and then later, the 2007–08 financial crisis. Since 2010, central banks have been net buyers of gold on an annual basis.

Here’s a look at the 10 largest official buyers of gold from the end of 1999 to end of 2021:

Source: IMF

The top 10 official buyers of gold between end-1999 and end-2021 represent 84% of all the gold bought by central banks during this period.

Russia and China—arguably the United States’ top geopolitical rivals—have been the largest gold buyers over the last two decades. Russia, in particular, accelerated its gold purchases after being hit by Western sanctions following its annexation of Crimea in 2014.

Interestingly, the majority of nations on the above list are emerging economies. These countries have likely been stockpiling gold to hedge against financial and geopolitical risks affecting currencies, primarily the U.S. dollar.

Meanwhile, European nations including Switzerland, France, Netherlands, and the UK were the largest sellers of gold between 1999 and 2021, under the Central Bank Gold Agreement (CBGA) framework.

Which Central Banks Bought Gold in 2022?

In 2022, central banks bought a record 1,136 tonnes of gold, worth around $70 billion. Türkiye, experiencing 86% year-over-year inflation as of October 2022, was the largest buyer, adding 148 tonnes to its reserves. China continued its gold-buying spree with 62 tonnes added in the months of November and December, amid rising geopolitical tensions with the United States. Overall, emerging markets continued the trend that started in the 2000s, accounting for the bulk of gold purchases. Meanwhile, a significant two-thirds, or 741 tonnes of official gold purchases were unreported in 2022. According to analysts, unreported gold purchases are likely to have come from countries like China and Russia, who are looking to de-dollarize global trade to circumvent Western sanctions.