How Normal Investors Can Use the Same Strategies as Hedge Funds

In a Warren Buffett note from 2006, he credits the famous value investor Benjamin Graham as the co-creator of the first-ever hedge fund in the mid-1920s. “It involved a partnership structure, a percentage-of-profits compensation arrangement for Ben as general partner, a number of limited partners and a variety of long and short positions,” Buffett’s letter says. That means that hedge funds have been around for nearly a century – and they have almost exclusively existed as a vehicle for institutions and wealthy, private investors.

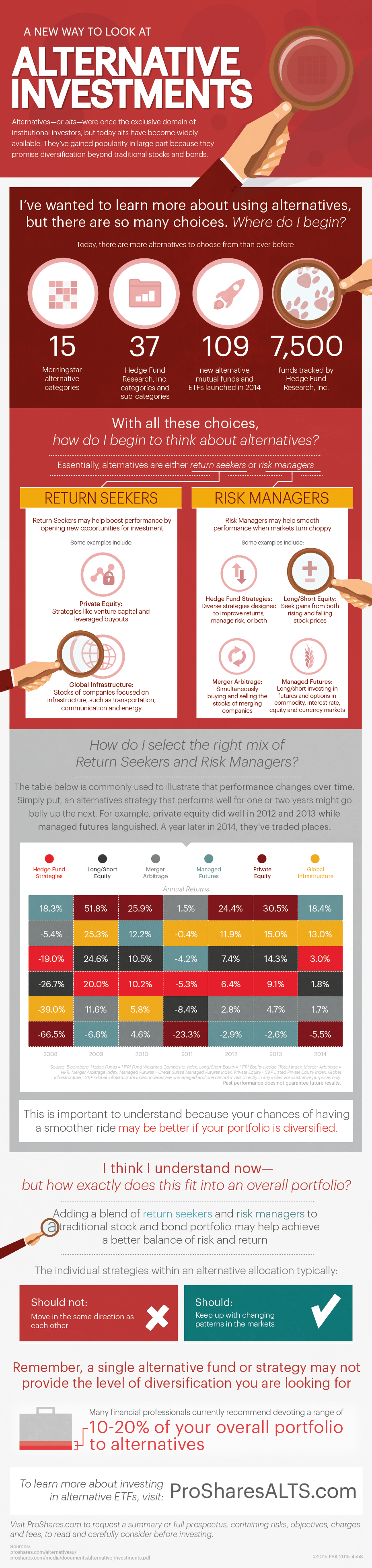

Alternative Investments

The initial use of the hedge fund was to “hedge” specific investments against the general volatility of the market. Despite this namesake, today hedge funds use a number of strategies to target gains. While retail investors rarely had access to these types of strategies, today it is possible to buy mutual funds or ETFs that try to emulate similar tactics. These alternative investment funds, or alt-investments, come in mainly two varieties: Return Seekers: Designed to help boost performance by opening up new opportunities to investment, such as private equity or global infrastructure. Risk Managers: Designed to help smooth performance when markets turn choppy. Strategies include long/short equity, merger arbitrage, managed futures, and other hedge fund strategies.

Today’s Market

The key here, in our opinion, is that these strategies may allow investors to diversify out of traditional markets such as stocks and bonds. The timing for alternative investments could be good as well, as the start to 2016 was the worst in history for markets and the average investor already lost 3.1% in 2015. Although funds specializing in alt-investments typically have significant diversification benefits, they also usually come with higher fees in comparison to more traditional offerings. Investors should weigh the cost-benefit accordingly. Original graphic by: ProShares

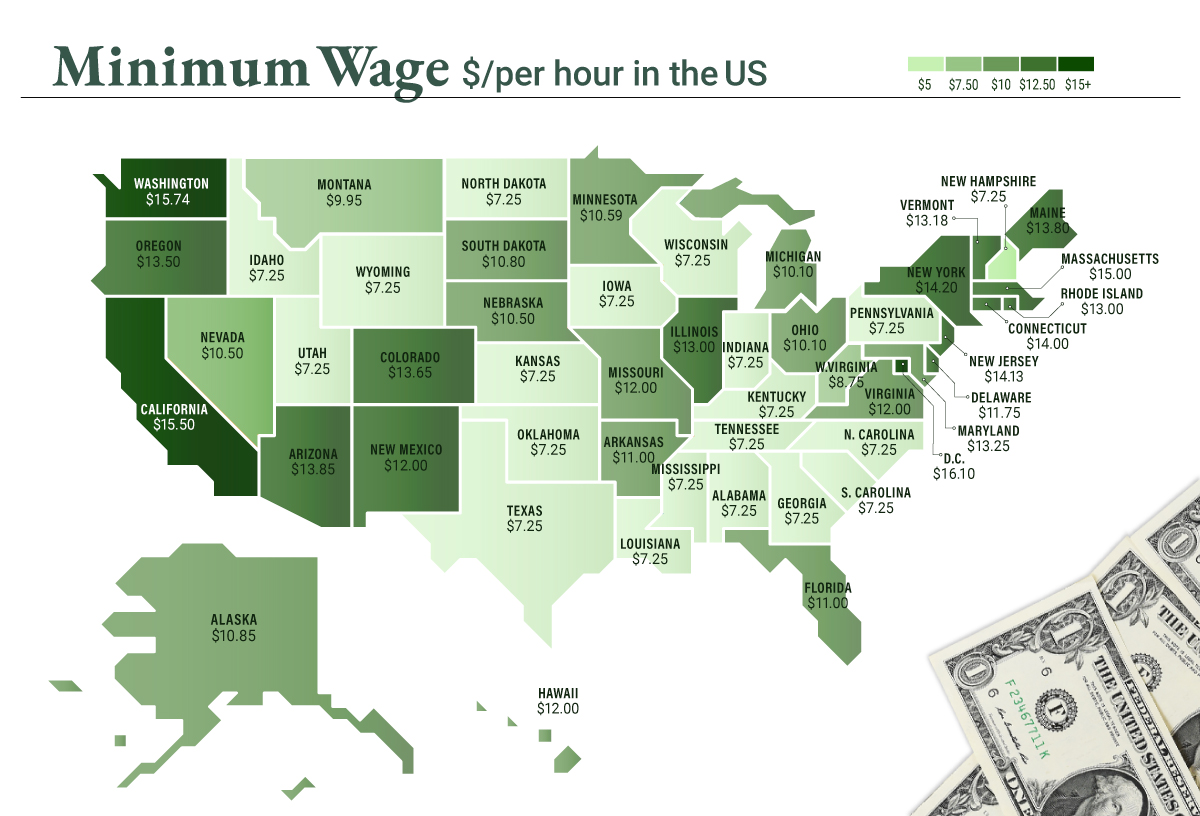

on To see how the minimum wage differs around the world, we’ve visualized data from Picodi, which includes values for 67 countries as of January 2023.

Monthly Minimum Wage, by Country

The following table includes all of the data used in this infographic. Each value represents the monthly minimum wage a full-time worker would receive in each country. Picodi states that these figures are net of taxes and have been converted to USD. Generally speaking, developed countries have a higher cost of living, and thus require a higher minimum wage. Two outliers in this dataset are Argentina and Turkey, which have increased their minimum wages by 100% or more from January 2022 levels. Turkey is suffering from an ongoing currency crisis, with the lira losing over 40% of its value in 2021. Prices of basic goods have increased considerably as the Turkish lira continues to plummet. In fact, a 2022 survey found that 70% of people in Turkey were struggling to pay for food. Argentina, South America’s second-biggest economy, is also suffering from very high inflation. In response, the country announced three minimum wage increases throughout 2022.

Minimum Wage in the U.S.

Within the U.S., minimum wage varies significantly by state. We’ve visualized each state’s basic minimum rate (hourly) using January 2023 data from the U.S. Department of Labor.

2023-03-17 Update: This map was updated to fix several incorrect values. We apologize for any confusion this may have caused. America’s federal minimum wage has remained unchanged since 2009 at $7.25 per hour. Each state is allowed to set their own minimum wage, as long as it’s higher than the federal minimum. In states that do not set their own minimum, the federal minimum applies. If we assume someone works 40 hours a week, the federal minimum wage of $7.25 translates to an annual figure of just $15,080 before taxes. California’s minimum wage of $15.50 translates to $32,240 before taxes. For further perspective, check out our 2022 infographic on the salary needed to buy a home across 50 U.S. cities.