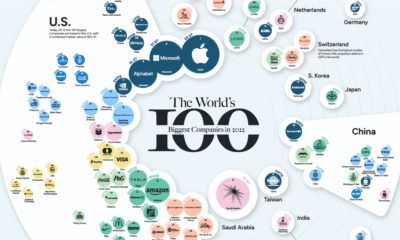

These tech giants also have a consumer-facing aspect to their business that is front and center. With billions of people using their platforms globally, these companies leverage user data to tighten their grip even more on market share. At the same time, this data is a double-edged sword, as these same companies often find themselves in the crosshairs for mishandling personal information. Finally, all of these companies have a similar origin story: they were founded or incubated on the fertile digital grounds of the West Coast. The company that has the weakest claim to such origins would be Facebook, but even it has been based in Silicon Valley since June 2004.

Sizing Up the Tech Giants

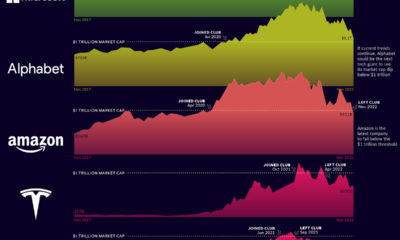

For all of their commonalities, it seems that there is less of a mold for how these tech giants end up generating cashflow. But before we get to how Big Tech makes its money, let’s start by looking at the financials at a higher level. The following data comes from the 2018 10-K reports filed last year. Together, the Big Five tech giants combined for just over $800 billion of revenue in 2018, which would be among the world’s 20 largest countries in terms of GDP. More precisely, they would just edge out Saudi Arabia ($684 billion GDP) in terms of size. Meanwhile, they generated a total of $139 billion of net income for their shareholders, good for a 17.3% profit margin.

How Big Tech Makes Money

Let’s dig deeper, and see the differences in how these companies generate their revenue.

You are the Customer

In the broadest sense, three of the tech giants make money in the same way: you pay them money, and they give you a product or service. Apple (Revenue in 2018: $265.6 billion)

Apple generates a staggering 62.8% of its revenue from the iPhone The iPad and Mac are good for 7.1% and 9.6% of revenues, respectively All other products and services – including Apple TV, Apple Watch, Beats products, Apple Pay, AppleCare, etc. – combine to just 20.6% of revenues

Microsoft (Revenue in 2018: $110.4 billion)

Microsoft has the most diversified revenue of any of the tech giants This is part of the reason it currently has the largest market capitalization ($901 billion) of the Big Five Microsoft has eight different segments that generate ~5% or more of revenue The biggest three are “Office products and cloud services” (25.7%), “Server products and cloud services” (23.7%), and Windows (17.7%)

The remaining tech giants charge you nothing as a consumer, so how are they worth so much?

You are the Product

Both Alphabet and Facebook also generate billions of dollars of revenue, but they make this money from advertising. Their platforms allow advertisers to target you at scale with incredible precision, which is why they dominate the online ad industry. Here’s how their revenues break down: Alphabet (Revenue in 2018: $136.8 billion)

Despite having a wider umbrella name, ad revenue (via Google, YouTube, Google Maps, Google Ads, etc.) still drives 85% of revenue for the company Other Google products and services, like Google Play or the Google Pixel phone, help to generate 14.5% of total revenue Other Bets count to 0.4% of revenue – these are Alphabet’s moonshot attempts to find the “next Google” for its shareholders

Facebook (Revenue in 2018: $55.8 billion)

Facebook generates almost all revenue (98.5%) from ads Meanwhile, 1.5% comes from payments and other fees Despite Facebook being a free service for users, the company generated more revenue per user than Netflix, which charges for its service In 2018 Q4, for example, Facebook made $35 per user. Netflix made $30.

So while the tech giants may have many similarities, how they generate their billions can vary considerably. Some are marketing products to you, while others are marketing you as the product. on Today’s chart measures the extent to which 41 major economies are reopening, by plotting two metrics for each country: the mobility rate and the COVID-19 recovery rate: Data for the first measure comes from Google’s COVID-19 Community Mobility Reports, which relies on aggregated, anonymous location history data from individuals. Note that China does not show up in the graphic as the government bans Google services. COVID-19 recovery rates rely on values from CoronaTracker, using aggregated information from multiple global and governmental databases such as WHO and CDC.

Reopening Economies, One Step at a Time

In general, the higher the mobility rate, the more economic activity this signifies. In most cases, mobility rate also correlates with a higher rate of recovered people in the population. Here’s how these countries fare based on the above metrics. Mobility data as of May 21, 2020 (Latest available). COVID-19 case data as of May 29, 2020. In the main scatterplot visualization, we’ve taken things a step further, assigning these countries into four distinct quadrants:

1. High Mobility, High Recovery

High recovery rates are resulting in lifted restrictions for countries in this quadrant, and people are steadily returning to work. New Zealand has earned praise for its early and effective pandemic response, allowing it to curtail the total number of cases. This has resulted in a 98% recovery rate, the highest of all countries. After almost 50 days of lockdown, the government is recommending a flexible four-day work week to boost the economy back up.

2. High Mobility, Low Recovery

Despite low COVID-19 related recoveries, mobility rates of countries in this quadrant remain higher than average. Some countries have loosened lockdown measures, while others did not have strict measures in place to begin with. Brazil is an interesting case study to consider here. After deferring lockdown decisions to state and local levels, the country is now averaging the highest number of daily cases out of any country. On May 28th, for example, the country had 24,151 new cases and 1,067 new deaths.

3. Low Mobility, High Recovery

Countries in this quadrant are playing it safe, and holding off on reopening their economies until the population has fully recovered. Italy, the once-epicenter for the crisis in Europe is understandably wary of cases rising back up to critical levels. As a result, it has opted to keep its activity to a minimum to try and boost the 65% recovery rate, even as it slowly emerges from over 10 weeks of lockdown.

4. Low Mobility, Low Recovery

Last but not least, people in these countries are cautiously remaining indoors as their governments continue to work on crisis response. With a low 0.05% recovery rate, the United Kingdom has no immediate plans to reopen. A two-week lag time in reporting discharged patients from NHS services may also be contributing to this low number. Although new cases are leveling off, the country has the highest coronavirus-caused death toll across Europe. The U.S. also sits in this quadrant with over 1.7 million cases and counting. Recently, some states have opted to ease restrictions on social and business activity, which could potentially result in case numbers climbing back up. Over in Sweden, a controversial herd immunity strategy meant that the country continued business as usual amid the rest of Europe’s heightened regulations. Sweden’s COVID-19 recovery rate sits at only 13.9%, and the country’s -93% mobility rate implies that people have been taking their own precautions.

COVID-19’s Impact on the Future

It’s important to note that a “second wave” of new cases could upend plans to reopen economies. As countries reckon with these competing risks of health and economic activity, there is no clear answer around the right path to take. COVID-19 is a catalyst for an entirely different future, but interestingly, it’s one that has been in the works for a while. —Carmen Reinhart, incoming Chief Economist for the World Bank Will there be any chance of returning to “normal” as we know it?