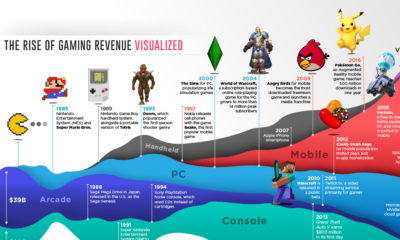

Since these humble beginnings, video games have rode waves of technological advancements to burgeon into a $100+ billion industry. To visualize this success, today’s infographic from TitleMax lists the top 50 highest-grossing video games franchises. While this feat is impressive on its own, the way many of these franchises generate their revenue may come as a shock.

How Do Video Games Generate Billions?

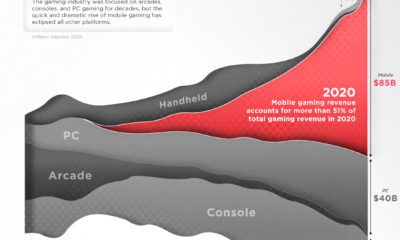

Video games first saw large-scale commercial success in the 1980s, in what some describe as the “golden age of arcade games”. As arcades popped up across America, renowned classics like Pac-man and Space Invaders raked in large sums of money, one coin at a time. Today, there are two revenue models generally followed by video game publishers—the traditional pay-to-play (P2P) model, and the newer free-to-play (F2P) model. For much of the industry’s modern history, P2P models have been the default option. A developer incurs costs to produce its games, so it sells them to consumers to recover costs and make a profit. Under a F2P model, however, the developer essentially distributes its games for free. Players don’t have to pay anything if they don’t want to, and the developer runs the risk that it may never recoup its costs. So why would a developer ever choose a F2P model? Let’s look at industry data from 2019: Source: SuperData Those aren’t typos. F2P games accounted for a whopping 82% of industry revenue in 2019. What’s more, is that this gap continues to grow: since the previous year, F2P revenue grew 6%, while P2P revenue fell by 5%.

The Power of Discretionary Spending

There’s a number of F2P franchises listed in today’s graphic which have grossed well over a billion dollars in total revenue. ¹wholly-owned subsidiary of Tencent, ²majority-owned subsidiary of Tencent, ³wholly-owned subsidiary of Activision Blizzard, ⁴Tencent owns a 40% stake. Because these types of games are often published for PC or mobile phone (most people have at least one of these), their accessibility becomes a key advantage. This is especially true in China, where video game consoles like Xbox have been banned in the past. Yet, simply amassing a large player base isn’t enough. With no money being paid upfront, developers must create compelling incentives for players to willingly part with their cash.

League of Legends

League of Legends, one of the world’s most popular video games, is widely considered a successful pioneer in this regard. When developer Riot Games chose a F2P model for its game, it took a gamble. The model was largely unproven for titles of its genre, and it’s main source of revenue was set to be the sale of purely cosmetic items called “character skins”. —Marc Merrill, Co-founder of Riot Games Part of the game’s incentive to spend comes from its longevity—League of Legends has just entered its 11th year. Rather than release a new title, the developer makes continuous improvements to the existing game, with each iteration dubbed as a new “season”. If a traditional P2P game represents a movie, League of Legends could then be considered a long-running TV show. For example, while there’s been one League of Legends since 2009, there’s been 11 Call of Duty titles over that same time frame.

Joining the Party

Some of the world’s most successful video game franchises, which have historically published games under the P2P model, are also expanding into free games with great success. For Pokémon (#1 in gross revenue), product diversification is nothing new. While the franchise manages a universe of offerings from physical merchandise to movies, its free mobile augmented reality (AR) game, Pokémon Go, may be one of its most successful endeavors. The game, which leads players out into the real world to catch virtual monsters, was a massive sensation when it launched in 2016. In fact, it was so popular (and distracting) it’s been estimated to have contributed to more than 100,000 car accidents. Four years since its release, Pokémon Go is a shining example of what the F2P model can achieve—the game has racked up over 1 billion downloads and generated an incredible $3 billion in revenues. Source: Sensor Tower Store Intelligence Part of Pokémon Go’s incentive to spend comes from its incredibly unique social experience—it turns real world landmarks into hubs where players can gather. By simply leveraging the capabilities of existing smartphones, it’s also extremely accessible.

Is Free the New Norm?

As more and more franchises successfully expand into free games, it’s clear that the F2P model will be the primary driver of future growth. The relatively higher accessibility of F2P games is also crucial to tap into the quickly growing esports industry. However, traditional P2P games, which are now being called “premium games”, still have some merit to them. These games are often associated with a higher level of quality which people are happy to pay for. Yet, as the legitimacy and success of the F2P model continues to develop, this quality gap could also shrink in the future. Editor’s note: The revenue figures in today’s infographic include merchandise and other related products. on But fast forward to the end of last week, and SVB was shuttered by regulators after a panic-induced bank run. So, how exactly did this happen? We dig in below.

Road to a Bank Run

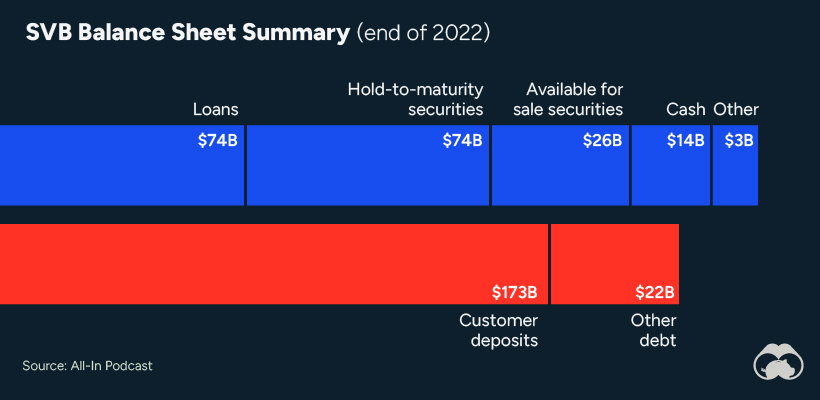

SVB and its customers generally thrived during the low interest rate era, but as rates rose, SVB found itself more exposed to risk than a typical bank. Even so, at the end of 2022, the bank’s balance sheet showed no cause for alarm.

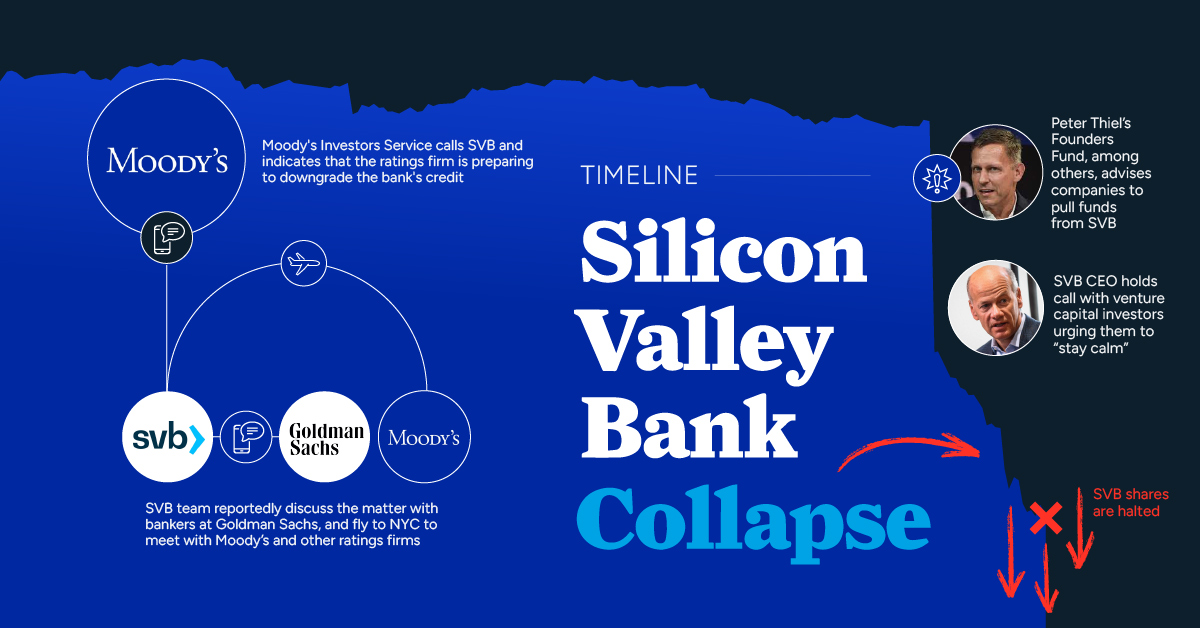

As well, the bank was viewed positively in a number of places. Most Wall Street analyst ratings were overwhelmingly positive on the bank’s stock, and Forbes had just added the bank to its Financial All-Stars list. Outward signs of trouble emerged on Wednesday, March 8th, when SVB surprised investors with news that the bank needed to raise more than $2 billion to shore up its balance sheet. The reaction from prominent venture capitalists was not positive, with Coatue Management, Union Square Ventures, and Peter Thiel’s Founders Fund moving to limit exposure to the 40-year-old bank. The influence of these firms is believed to have added fuel to the fire, and a bank run ensued. Also influencing decision making was the fact that SVB had the highest percentage of uninsured domestic deposits of all big banks. These totaled nearly $152 billion, or about 97% of all deposits. By the end of the day, customers had tried to withdraw $42 billion in deposits.

What Triggered the SVB Collapse?

While the collapse of SVB took place over the course of 44 hours, its roots trace back to the early pandemic years. In 2021, U.S. venture capital-backed companies raised a record $330 billion—double the amount seen in 2020. At the time, interest rates were at rock-bottom levels to help buoy the economy. Matt Levine sums up the situation well: “When interest rates are low everywhere, a dollar in 20 years is about as good as a dollar today, so a startup whose business model is “we will lose money for a decade building artificial intelligence, and then rake in lots of money in the far future” sounds pretty good. When interest rates are higher, a dollar today is better than a dollar tomorrow, so investors want cash flows. When interest rates were low for a long time, and suddenly become high, all the money that was rushing to your customers is suddenly cut off.” Source: Pitchbook Why is this important? During this time, SVB received billions of dollars from these venture-backed clients. In one year alone, their deposits increased 100%. They took these funds and invested them in longer-term bonds. As a result, this created a dangerous trap as the company expected rates would remain low. During this time, SVB invested in bonds at the top of the market. As interest rates rose higher and bond prices declined, SVB started taking major losses on their long-term bond holdings.

Losses Fueling a Liquidity Crunch

When SVB reported its fourth quarter results in early 2023, Moody’s Investor Service, a credit rating agency took notice. In early March, it said that SVB was at high risk for a downgrade due to its significant unrealized losses. In response, SVB looked to sell $2 billion of its investments at a loss to help boost liquidity for its struggling balance sheet. Soon, more hedge funds and venture investors realized SVB could be on thin ice. Depositors withdrew funds in droves, spurring a liquidity squeeze and prompting California regulators and the FDIC to step in and shut down the bank.

What Happens Now?

While much of SVB’s activity was focused on the tech sector, the bank’s shocking collapse has rattled a financial sector that is already on edge.

The four biggest U.S. banks lost a combined $52 billion the day before the SVB collapse. On Friday, other banking stocks saw double-digit drops, including Signature Bank (-23%), First Republic (-15%), and Silvergate Capital (-11%).

Source: Morningstar Direct. *Represents March 9 data, trading halted on March 10.

When the dust settles, it’s hard to predict the ripple effects that will emerge from this dramatic event. For investors, the Secretary of the Treasury Janet Yellen announced confidence in the banking system remaining resilient, noting that regulators have the proper tools in response to the issue.

But others have seen trouble brewing as far back as 2020 (or earlier) when commercial banking assets were skyrocketing and banks were buying bonds when rates were low.