What’s the biggest threat to achieving financial independence? Unfortunately, it’s your own brain. You can invest in all the right things, minimize fees and taxes, and even diversify your holdings. But if you fail to master your own psychology, it’s still possible to fall victim to financial self-sabotage.

The Brain’s Design

Today’s infographic is from Tony Robbins, and it uses data and talking points from his #1 Best Selling book Unshakeable: Your Financial Freedom Playbook, which is now available on paperback. The graphic is based on a chapter in the book that reveals the key psychological limitations of the human brain. It turns out that these fallible survival instincts have been hardwired into our brains over millions of years, and they become very troublesome when we try to make rational financial decisions. To overcome these instincts, investors need to adopt simple systems, rules, and procedures that can ensure the decisions around money we make are in our best long-term interest. – Tony Robbins

Six Psychological Pitfalls to Avoid

Remember these six pitfalls – and how to counteract them – and you’ll be able to avoid the biggest mistakes often made by investors.

Mistake #1:

Seeking confirmation of your own beliefs Your brain is wired to seek and believe information that validates your existing beliefs. Our minds love “proof” of how smart and right we are. Even worse, this is magnified by the online echo chambers of the modern world.

News media (MSNBC, Fox News, etc.) tend to favor one point of view Google and Facebook filter our search results Unsubstantiated rumors can run unchecked, as long as they reinforce existing points of view

This can be exceptionally detrimental in investing. Convincing yourself that a particular stock or strategy is correct, without taking into account contradicting evidence, can be the nail in the coffin of financial freedom. The Solution: Welcome opinions that contradict your own The best investors know they are vulnerable to confirmation bias, and actively ask questions and seek qualified opinions that disagree with their own. Ray Dalio, for example, seeks the smartest detractor of his idea, and then tries to find out their full reasoning behind their contrary opinion. – Ray Dalio

Mistake #2:

Conflating recent events with ongoing trends One of the most common – and dangerous – investing mistakes is to believe that the current trend of the day will continue. In psychology speak, this is known as recency bias, or putting more weight on recent events when evaluating the odds of something happening in the future For example, an investor might think that because a stock has performed well recently, that it will also do well in the future. Therefore, she buys more – effectively buying at a high point in the stock. The Solution: Re-balance Our memories are short, so what can we do? The best way to avoid this impulsive and faulty decision making is to commit to portfolio allocations (i.e. 60% stocks, 40% bonds) in advance, and then re-balancing on a regular basis. This effectively ensures you are buying low, and selling high. When stocks to well, you sell some of them to buy other assets in the underweighted part of your portfolio, and vice versa.

Mistake #3:

Overconfidence Very successful and driven people often assume they will be just as good at investing as they are at other aspects of their life. However, this overconfidence is a common cognitive bias: we constantly overestimate our abilities, our knowledge, and our future prospects. The Solution: Get Real, and Get Honest By admitting you have no special advantage, you give yourself an enormous advantage – and you’ll beat the overconfident investors that delude themselves in believing they can outperform. – Howard Marks

Mistake #4:

Swinging for the Fences It’s tempting to go for the big wins in your quest to build financial wealth. But swinging for the fences also means more strikeouts – many which can be difficult to recover from. The Solution: Think Long Term The best way to win the game of investing is to achieve sustainable long-term returns that compound over time. Don’t get distracted by the short-term noise on Wall Street, and re-orient your approach to build wealth over the long term. – Warren Buffett

Mistake #5:

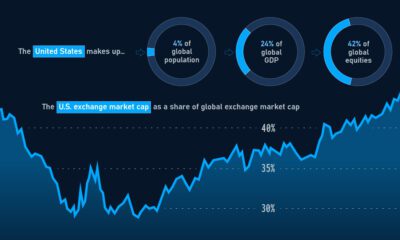

Staying Home This psychological bias is known as “home bias”, and it is the tendency for people to invest disproportionately in markets that are familiar to them. For example, investing in:

Your employer’s stock Your own industry Your own country’s stock market Only one asset class

Home bias can leave you overweighted in “what you know”, which can wreak havoc on your portfolio in some circumstances. The Solution: Diversify Diversify broadly, in different asset classes and in different countries. From 2000 to 2009, the S&P 500 only returned 1.4% per year, but foreign markets picked up the slack:

International stocks: 3.9% per year Emerging markets: 16.2% per year

A well-diversified portfolio would have done well, no matter what.

Mistake #6:

Negativity Bias Our brains are wired to bombard us with memories of negative experiences. In fact, one part of our brain – the amygdala – is a biological alarm system that floods the body with fear signals when we are losing money. The problem with this? When markets plunge, fear takes over and it’s easy to act irrationally. Some people panic, selling their entire portfolios to go into cash. The Solution: Prepare The best way to avoid negativity bias is to:

Keep record of why you invested in certain securities in the first place Maintain the right asset allocation that will help you through volatility Partner with the right financial advisor to offer advice Focus on the long term, and avoid short-term market distractions

– Benjamin Franklin

Conclusion

These simple rules and procedures will make it easier for you to invest for the long term. They’ll help you:

Trade less Lower investment fees and transaction costs Be more open to views that differ from your own Reduce risk by diversifying globally Control the fears that could otherwise derail you

Will you be perfect? No. But will you do better? You bet! And the difference this makes over a lifetime can be substantial. on Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard.

How Has Asset Allocation Impacted Returns?

Based on data between 1926 and 2019, the table below looks at the spectrum of market returns of different asset allocations:

We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

A traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of 8.8%. As interest rates have climbed in recent years, this may widen its appeal once again as bond returns may rise.

Meanwhile, a 100% bond portfolio averaged 5.3% in annual returns over the period. Bonds typically serve as a hedge against portfolio losses thanks to their typically negative historical correlation to stocks.

A Closer Look at Historical Correlations

To understand how 2022 was an outlier in terms of asset correlations we can look at the graphic below:

The last time stocks and bonds moved together in a negative direction was in 1969. At the time, inflation was accelerating and the Fed was hiking interest rates to cool rising costs. In fact, historically, when inflation surges, stocks and bonds have often moved in similar directions. Underscoring this divergence is real interest rate volatility. When real interest rates are a driving force in the market, as we have seen in the last year, it hurts both stock and bond returns. This is because higher interest rates can reduce the future cash flows of these investments. Adding another layer is the level of risk appetite among investors. When the economic outlook is uncertain and interest rate volatility is high, investors are more likely to take risk off their portfolios and demand higher returns for taking on higher risk. This can push down equity and bond prices. On the other hand, if the economic outlook is positive, investors may be willing to take on more risk, in turn potentially boosting equity prices.

Current Investment Returns in Context

Today, financial markets are seeing sharp swings as the ripple effects of higher interest rates are sinking in. For investors, historical data provides insight on long-term asset allocation trends. Over the last century, cycles of high interest rates have come and gone. Both equity and bond investment returns have been resilient for investors who stay the course.