In the modern system, central banks now control everything from interest rates to the issuance of currency, while government regulators, corporations, and intergovernmental organizations wield unparalleled influence at the top of this crucial food chain. There is no doubt that this centralization has led to the creation of massive amounts of wealth, especially to those properly connected to the financial system. However, the same centralization has also arguably contributed to many global challenges and risks we face today.

Flaws of the Global Financial System

Today’s infographic comes to us from investment app Abra, and it highlights the seven major flaws of the global financial system, ranging from the lack of basic access to financial services to growing inequality.

- Billions of people globally remain unbanked To participate in the global financial sector, whether it is to make a digital payment or manage one’s wealth, one must have access to a bank account. However, 1.7 billion adults worldwide remain unbanked, having zero access to an account with a financial institution or a mobile money provider.

- Global financial literacy remains low For people to successfully use financial services and markets, they must have some degree of financial literacy. According to a recent global survey, just 1-in-3 people show an understanding of basic financial concepts, with most of these people living in high income economies. Without an understanding of key concepts in finance, it makes it difficult for the majority of the population to make the right decisions – and to build wealth.

- High intermediary costs and slow transactions Once a person has access to financial services, sending and storing money should be inexpensive and fast. However, just the opposite is true. Around the globe, the average cost of a remittance is 7.01% in fees per transaction – and when using banks, that rises to 10.53%. Even worse, these transactions can take days at a time, which seems quite unnecessary in today’s digital era.

- Low trust in financial institutions and governments The financial sector is the least trusted business sector globally, with only a 57% level of trust according to Edelman. Meanwhile, trust in governments is even lower, with only 40% trusting the U.S. government, and the global country average sitting at 47%.

- Rising global inequality In a centralized system, financial markets tend to be dominated by those who are best connected to them. These are people who have:

Access to many financial opportunities and asset classes Capital to deploy Informational advantages Access to financial expertise

In fact, according to recent data on global wealth concentration, the top 1% own 47% of all household wealth, while the top 10% hold roughly 85%. On the other end of the spectrum, the vast majority of people have little to no financial assets to even start building wealth. Not only are many people living paycheck to paycheck – but they also don’t have access to assets that can create wealth, like stocks, bonds, mutual funds, or ETFs. 6. Currency manipulation and censorship In a centralized system, countries have the power to manipulate and devalue fiat currencies, and this can have a devastating effect on markets and the lives of citizens. In Venezuela, for example, the government has continually devalued its currency, creating runaway hyperinflation as a result. The last major currency manipulation in 2018 increased the price of a cup of coffee by over 772,400% in six months. Further, centralized power also gives governments and financial institutions the ability to financially censor citizens, by taking actions such as freezing accounts, denying access to payment systems, removing funds from accounts, and denying the retrieval of funds during bank runs. 7. The build-up of systemic risk Finally, centralization creates one final and important drawback. With financial power concentrated with just a select few institutions, such as central banks and “too big too fail” companies, it means that one abject failure can decimate an entire system. This happened in 2008 as U.S. subprime mortgages turned out to be an Achilles Heel for bank balance sheets, creating a ripple effect throughout the globe. Centralization means all eggs in one basket – and if that basket breaks it can possibly lead to the destruction of wealth on a large scale.

The Future of the Global Financial System?

The risks and drawbacks of centralization to the global financial system are well known, however there has never been much of a real alternative – until now. With the proliferation of mobile phones and internet access, as well as the development of decentralization technologies like the blockchain, it may be possible to build an entirely new financial system. But is the world ready? on Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard.

How Has Asset Allocation Impacted Returns?

Based on data between 1926 and 2019, the table below looks at the spectrum of market returns of different asset allocations:

We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

A traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of 8.8%. As interest rates have climbed in recent years, this may widen its appeal once again as bond returns may rise.

Meanwhile, a 100% bond portfolio averaged 5.3% in annual returns over the period. Bonds typically serve as a hedge against portfolio losses thanks to their typically negative historical correlation to stocks.

A Closer Look at Historical Correlations

To understand how 2022 was an outlier in terms of asset correlations we can look at the graphic below:

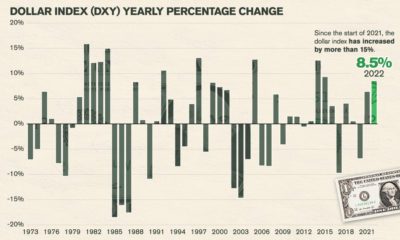

The last time stocks and bonds moved together in a negative direction was in 1969. At the time, inflation was accelerating and the Fed was hiking interest rates to cool rising costs. In fact, historically, when inflation surges, stocks and bonds have often moved in similar directions. Underscoring this divergence is real interest rate volatility. When real interest rates are a driving force in the market, as we have seen in the last year, it hurts both stock and bond returns. This is because higher interest rates can reduce the future cash flows of these investments. Adding another layer is the level of risk appetite among investors. When the economic outlook is uncertain and interest rate volatility is high, investors are more likely to take risk off their portfolios and demand higher returns for taking on higher risk. This can push down equity and bond prices. On the other hand, if the economic outlook is positive, investors may be willing to take on more risk, in turn potentially boosting equity prices.

Current Investment Returns in Context

Today, financial markets are seeing sharp swings as the ripple effects of higher interest rates are sinking in. For investors, historical data provides insight on long-term asset allocation trends. Over the last century, cycles of high interest rates have come and gone. Both equity and bond investment returns have been resilient for investors who stay the course.