Today’s infographic, from Cartwright King Solicitors, cuts through the mystique and provides an entertaining and practical overview of the Deep Web and the Dark Web.

Layers (Part 1)

Much like the ocean, the internet is divided into defined layers. The internet most people are familiar with is called the Surface Web. Websites in this layer tend to be indexed by search engines and can be easily accessed using standard browsers. Believe it or not, this familiar part of the web only comprises less than 10% of the total data on the internet. The next layer down, we encounter the largest portion on the internet – the Deep Web. Basically, this is the layer of the internet that is quasi-accessible and not indexed by search engines. It contains medical records, government documents, and other, mostly innocuous information that is password protected, encrypted, or simply not hyperlinked. To reach beyond this layer of the internet, users need to use Tor or a similar technology.

Layers (Part 2)

Tor, which stands for “The Onion Router”, is how the majority of people anonymously access the Dark Web. Tor directs internet traffic through complex layers of relays to conceal a user’s location and identity (hence the onion analogy).

In 2004, Tor was released as an open source software. This allowed the Dark Web to grow as people could anonymously access websites. Since anonymity is sacrosanct in the deep reaches of the Internet, transactions are typically conducted using cryptocurrencies like Bitcoin or Ethereum. People making purchases in Dark Web markets are (understandably) concerned with privacy, so they often use a series of methods to transfer funds. Below is a common transaction flow on the Dark Web.

Tumblers are used as an extra step to ensure privacy. A conventional equivalent would be moving funds through banks located in countries with strict bank-secrecy laws (e.g. Cayman Islands, Panama).

What’s Going on Down There?

The concept of the Dark Web isn’t vastly different from the Surface Web. There are message boards (e.g. 8chan, nntpchan), places you can buy things (e.g. Alphabay, Hansa), and blogs (e.g. OnionNews, Deep Web Radio). The rules, or rather a lack thereof, is what makes the Dark Web unique. Anything that is illegal to sell (or discuss) on the Surface Web is available in the Dark Web. Personal information, drugs, weapons, malware, DDoS attacks, hacking services, fake accounts for social media, and contract killing services are all available for sale. The Dark Web is full of criminal activity, but it’s also place where dissidents and whistle-blowers can anonymously share information. In countries with restrictive internet surveillance, the Dark Web may be the only place to safely voice criticisms against government and other powerful entities.

Measuring in the Dark

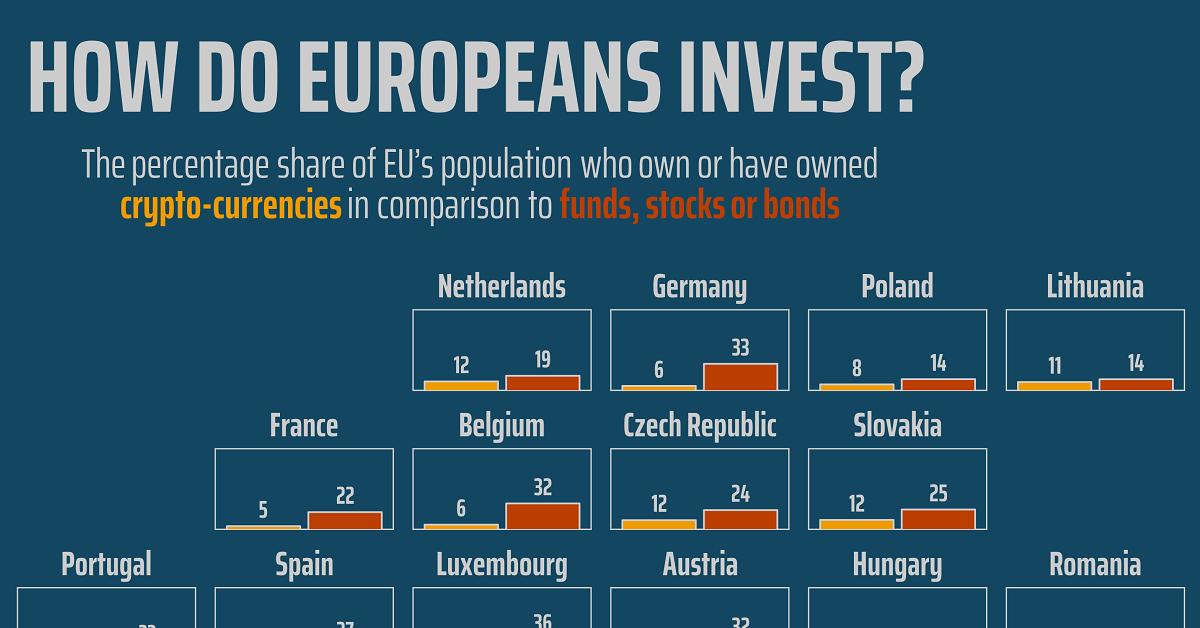

Many .onion sites are only up temporarily, so determining the true size of the Dark Web is nearly impossible. That said, Intelliagg and Darksum recently attempted to map out the Tor-based Dark Web by using a script to crawl reachable sites. They found 29,532 websites; however, 54% of them disappeared during the course of their research. Another recent study found that 87% of Dark Web sites don’t link to any other sites. – Graph Theoretic Properties of the Dark-web Recent changes to Tor, such as 50-character hidden service URLs, have made the Dark Web an even more untraceable place, so we may never fully know what lies beneath the surface of the internet. Based on the parts we have seen, perhaps that’s for the best. on For a modern example, we can see how different countries (and regions) act when it comes to cryptocurrency. Within the European Union—one of the regions dealing with faster crypto adoption—attitudes towards investing can vary considerably. This graphic from Gilbert Fontana looks at crypto popularity amongst investors in the EU using data from the European Commission’s Eurobarometer. It compares exposure to cryptocurrencies relative to stocks, funds, and bonds.

Crypto Popularity in Europe in 2022

Given that crypto has experienced bubble-like asset rallies, including a dramatic rise to over a trillion dollars in value before crashing, it’s fair to say it’s well known by now. But even with a vast rise in awareness, there are still discrepancies between the level of investment crypto receives amongst European Union nations. Let’s see which countries have the highest proportion of citizens invested in crypto: Topping the list is Slovenia, considered by some the most crypto-friendly nation in the world. According to the survey, 18% of the country’s population has some sort of investment in it. Cyprus also ranks high in its crypto-friendly rank and hits an investment figure of 13%. Also notable is the Grand Duchy of Luxembourg, which despite having a small population of 640,000 also has a strong reputation as a global financial hub. When it comes to crypto, 14% of the population owns or has owned the asset, relative to 36% for stocks, bonds, or funds.

Crypto Unpopularity?

In regards to the countries with lower levels of crypto investment, one observation is that they tend to be wealthier and more developed EU nations. Here’s how the nations at or below the 10% crypto-investment threshold rank: At the “bottom” of crypto interest are France, Germany and Italy, also the EU’s largest economies. At a glance, this might suggest that citizens of stronger economies invest less in crypto. However, it’s important to note that the countries with higher levels of crypto investment tend to have lower levels of wealth on average. Though less of their investors seem to engage in crypto trading, countries like France and Germany might have more comparable levels of crypto investment on a pure dollar-basis.