Since then, instant messaging has revolutionized how we communicate, and today over 2.5 billion people are signed up for at least one messaging app. The present IM experience is seamless, and it intuitively integrates features like video, photos, voice, e-commerce, and gaming with plain-old messaging. However, despite the impressive features of dominant apps like Snapchat, Facebook Messenger, and Whatsapp, today’s technology would simply not be possible without the earlier breakthroughs of their more rudimentary predecessors.

Instant Messaging: Past, Present, and Future

The following infographic from Hello Pal, a messaging app allowing for instant translation, shows the evolution of instant messaging. It pays homage to the advancements made in the early days by apps such as ICQ or AIM, while also looking at the trends in IM that will surface in the coming years.

While messaging is commonplace today, it was only two decades ago that chatting with friends and strangers online was a revolutionary concept.

The History of Instant Messaging

1961 – MIT’s Compatible Time-Sharing System (CTSS), along with other multi-user operating systems, helps to pioneer instant messaging by allowing up to 30 users to chat in real-time. 1988 – Internet Relay Chat (IRC) allows users to connect to networks with client software to chat with groups in real-time. IRC peaked in popularity in the 1990s, but still has hundreds of thousands of users today. The late 1990s sees the first major competing IM platforms arrive: ICQ, AIM, MSN, and Yahoo all fight for market share in the new instant messaging market. 1992 – The first SMS message, “Merry Christmas”, is sent over the Vodafone GSM network in the U.K. in December. 1996 – Israeli company Mirabilis launches ICQ, which allowed users to chat one-on-one or in groups, exchange files, and search for other users. At its peak in 2001, ICQ had over 100 million accounts registered. 1997 – AOL launches AOL Instant Messenger (AIM), which pioneers the “Buddy List” concept. By the mid-2000s, AIM has the largest share of the instant messaging market in North America with 52%. 1998 – Yahoo! Messenger launches, allowing users with a Yahoo! ID to connect. 1999 – Microsoft releases MSN Messenger, a competitor to AIM and Yahoo. By 2005, roughly 2.5 billion messages are sent each day on the platform. 1999 – Across the Pacific Ocean, Tencent Holdings launches its first successful app. It’s called QQ, and it is initially a near-exact clone of ICQ. To many, the 2000s is a Golden Age for instant messaging. Sharing photos, making video calls, and playing games are now common platform features 2001: By this time, only 30 million SMS text messages are sent per month in the United States. 2002: Apple launches iChat for its Mac OS X operating system, which is compatible with AIM. 2003: Skype allows Internet users to communicate with others through video, voice and instant messaging. 2005: Google Talk, available in a Gmail user’s window, is launched to allow easy communication between email contacts. 2006: MySpace launches the first instant messaging platform built within a social network: MySpaceIM. 2006: Market Snapshot (US Market)

AIM: 53 million MSN: 27 million Yahoo: 22 million Google: 866,000

2006: By this time, 12.5 billion SMS text messages were sent each month in the United States 2008: Facebook Chat is released, allowing Facebook users to message friends or groups of friends on the social network. (Later on, Facebook would release a standalone mobile app version called Facebook Messenger in 2011.) 2009: An upstart WhatsApp allows users to text, send video, and audio for free. Instant messaging undergoes a renaissance in the 2010s, as new apps like Snapchat, WhatsApp, and WeChat change how the game is played. The popularity of new platforms change the concept of messaging entirely: WeChat (2011) Initially started by Tencent as a clone of WhatsApp, WeChat is now much more than a chat app. It’s a fully integrated mobile platform with shopping, payments, games, and much more. WeChat processed $46 billion in payments in January 2016 – that’s about as twice as much as Paypal. Snapchat (2011) Snapchat, which is popular with millennials, allows users to send “snaps” which disappear after an allotted amount of time. The app has evolved into a mix of private and public content, including brand networks and coverage of live events. Slack (2013) Slack’s workplace collaboration software allows teams to communicate easily and efficiently. Slack was the fastest company to hit “unicorn” status ever, taking just 1.25 years to be worth over $1 billion.

on But fast forward to the end of last week, and SVB was shuttered by regulators after a panic-induced bank run. So, how exactly did this happen? We dig in below.

Road to a Bank Run

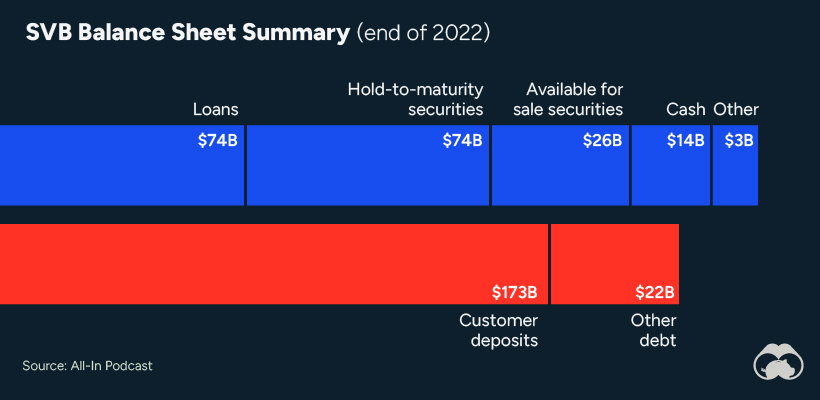

SVB and its customers generally thrived during the low interest rate era, but as rates rose, SVB found itself more exposed to risk than a typical bank. Even so, at the end of 2022, the bank’s balance sheet showed no cause for alarm.

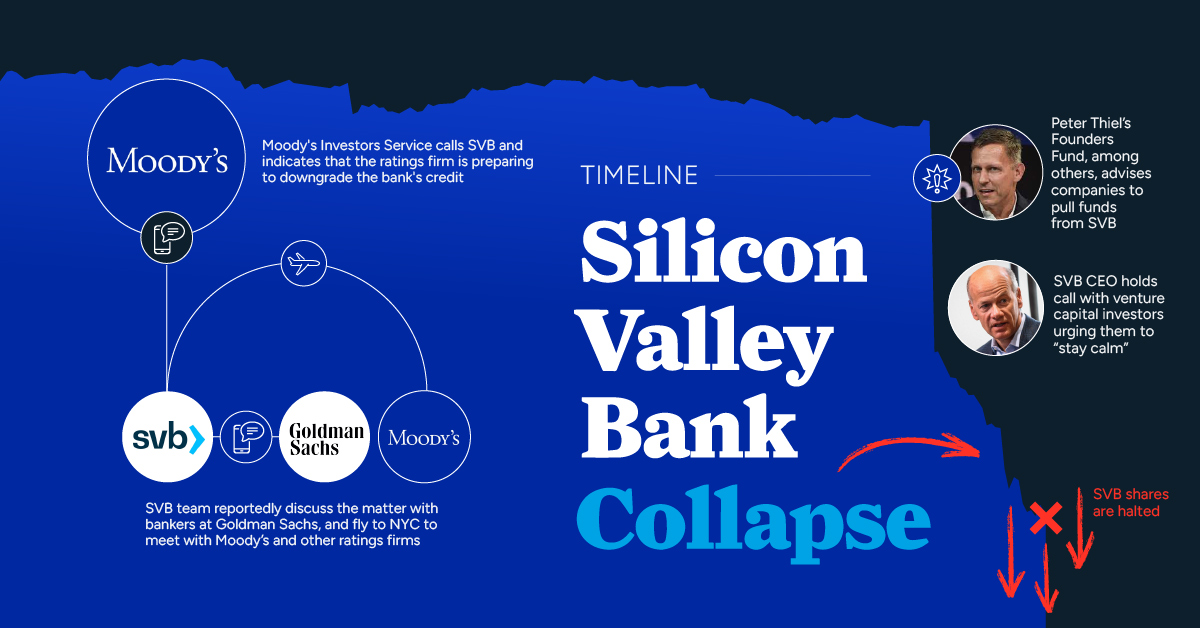

As well, the bank was viewed positively in a number of places. Most Wall Street analyst ratings were overwhelmingly positive on the bank’s stock, and Forbes had just added the bank to its Financial All-Stars list. Outward signs of trouble emerged on Wednesday, March 8th, when SVB surprised investors with news that the bank needed to raise more than $2 billion to shore up its balance sheet. The reaction from prominent venture capitalists was not positive, with Coatue Management, Union Square Ventures, and Peter Thiel’s Founders Fund moving to limit exposure to the 40-year-old bank. The influence of these firms is believed to have added fuel to the fire, and a bank run ensued. Also influencing decision making was the fact that SVB had the highest percentage of uninsured domestic deposits of all big banks. These totaled nearly $152 billion, or about 97% of all deposits. By the end of the day, customers had tried to withdraw $42 billion in deposits.

What Triggered the SVB Collapse?

While the collapse of SVB took place over the course of 44 hours, its roots trace back to the early pandemic years. In 2021, U.S. venture capital-backed companies raised a record $330 billion—double the amount seen in 2020. At the time, interest rates were at rock-bottom levels to help buoy the economy. Matt Levine sums up the situation well: “When interest rates are low everywhere, a dollar in 20 years is about as good as a dollar today, so a startup whose business model is “we will lose money for a decade building artificial intelligence, and then rake in lots of money in the far future” sounds pretty good. When interest rates are higher, a dollar today is better than a dollar tomorrow, so investors want cash flows. When interest rates were low for a long time, and suddenly become high, all the money that was rushing to your customers is suddenly cut off.” Source: Pitchbook Why is this important? During this time, SVB received billions of dollars from these venture-backed clients. In one year alone, their deposits increased 100%. They took these funds and invested them in longer-term bonds. As a result, this created a dangerous trap as the company expected rates would remain low. During this time, SVB invested in bonds at the top of the market. As interest rates rose higher and bond prices declined, SVB started taking major losses on their long-term bond holdings.

Losses Fueling a Liquidity Crunch

When SVB reported its fourth quarter results in early 2023, Moody’s Investor Service, a credit rating agency took notice. In early March, it said that SVB was at high risk for a downgrade due to its significant unrealized losses. In response, SVB looked to sell $2 billion of its investments at a loss to help boost liquidity for its struggling balance sheet. Soon, more hedge funds and venture investors realized SVB could be on thin ice. Depositors withdrew funds in droves, spurring a liquidity squeeze and prompting California regulators and the FDIC to step in and shut down the bank.

What Happens Now?

While much of SVB’s activity was focused on the tech sector, the bank’s shocking collapse has rattled a financial sector that is already on edge.

The four biggest U.S. banks lost a combined $52 billion the day before the SVB collapse. On Friday, other banking stocks saw double-digit drops, including Signature Bank (-23%), First Republic (-15%), and Silvergate Capital (-11%).

Source: Morningstar Direct. *Represents March 9 data, trading halted on March 10.

When the dust settles, it’s hard to predict the ripple effects that will emerge from this dramatic event. For investors, the Secretary of the Treasury Janet Yellen announced confidence in the banking system remaining resilient, noting that regulators have the proper tools in response to the issue.

But others have seen trouble brewing as far back as 2020 (or earlier) when commercial banking assets were skyrocketing and banks were buying bonds when rates were low.