High employee turnover can directly impact a company’s bottom line—with many studies suggesting poor leadership is one of the main causes. Today’s infographic from Online PhD Degrees explores what it takes to be an strong leader, and the behaviors of poor leaders that should be avoided at all costs. In today’s rapidly changing world, how can the qualities of a strong leader positively shape a company’s future?

The Benefits of Investing in Leadership

Effective leadership is worth its weight in gold, with 58% of employees claiming they would choose having a great boss over a higher salary. Not only that, 94% of employees with great bosses feel passionate about their jobーnearly twice as many as those working for a bad boss. A strong leader increases employee loyalty, creating a conducive environment for reaching a company’s goals. In fact, research shows that companies with strong leaders are crucial when it comes to outperforming industry competitors and are three times more prepared to react to the speed of change. Moreover, a company with a strong leader is almost five times more likely to have higher customer engagement and retention rates.

How to Lead Effectively

While each company has its own processes and demands different skill sets, there are core behaviors that separate leaders from managers:

Clear Purpose: Clearly articulating the company’s future vision to all levels of staff in a clear and concise way. Contagious Passion: While managers light fires under people to motivate them, leaders light fires in people. Self-Accountability: The expectation to work harder than employees and set a standard of excellence. Flexible Determination: Leaders are agile and open to change. Sustainable Outlook: Focusing on long-term goals proves to a team that a leader is invested in the long-haul. Dual Focus: Beyond thinking big picture, leaders provide employees with a clear and actionable strategy for success. Effective leaders are born from this combination of behaviors. However, one of them has the farthest-reaching impact, both on employees and a company’s bottom line: purpose. Purpose and Performance The Global Leadership Forecast finds that a strong and well-executed purpose can build organizational resilience and improve long-term financial performance. Leaders who amplify an organization’s purpose create a culture of optimism where employees feel safe in proposing new ideas that will shape the trajectory of a company. The Future of Leadership To stay competitive, continuous learning and re-skilling should be at the heart of every organization’s leadership strategy. Leaders of the future should possess the ability to redesign jobs in a more fluid way and lean in to the changing nature of work. “If we don’t disrupt our business, somebody else is going to do it for us.” —McKinsey Analysts While management is a foundational skill, organizations need to invest in their leaders to ensure constant growth. Embracing the traits of an effective leader can not only provide improved returns—it also empowers organizations to thrive in an uncertain future.

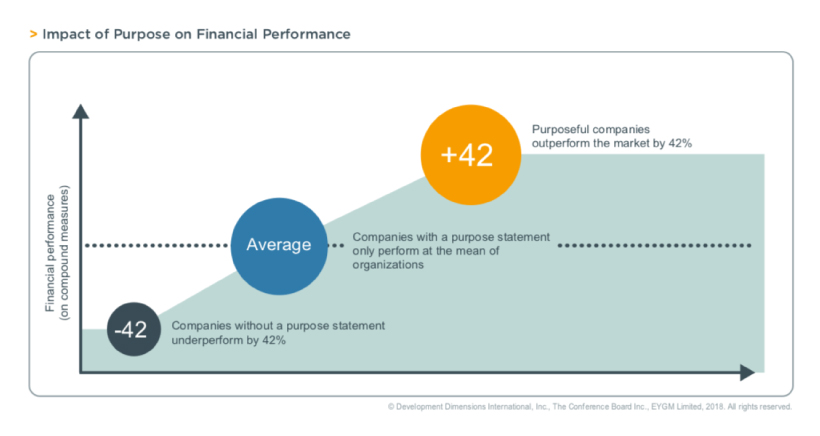

Purpose and Performance

The Global Leadership Forecast finds that a strong and well-executed purpose can build organizational resilience and improve long-term financial performance.

Leaders who amplify an organization’s purpose create a culture of optimism where employees feel safe in proposing new ideas that will shape the trajectory of a company.

The Future of Leadership

To stay competitive, continuous learning and re-skilling should be at the heart of every organization’s leadership strategy. Leaders of the future should possess the ability to redesign jobs in a more fluid way and lean in to the changing nature of work. —McKinsey Analysts While management is a foundational skill, organizations need to invest in their leaders to ensure constant growth. Embracing the traits of an effective leader can not only provide improved returns—it also empowers organizations to thrive in an uncertain future. on Similar to the the precedent set by the music industry, many news outlets have also been figuring out how to transition into a paid digital monetization model. Over the past decade or so, The New York Times (NY Times)—one of the world’s most iconic and widely read news organizations—has been transforming its revenue model to fit this trend. This chart from creator Trendline uses annual reports from the The New York Times Company to visualize how this seemingly simple transition helped the organization adapt to the digital era.

The New York Times’ Revenue Transition

The NY Times has always been one of the world’s most-widely circulated papers. Before the launch of its digital subscription model, it earned half its revenue from print and online advertisements. The rest of its income came in through circulation and other avenues including licensing, referrals, commercial printing, events, and so on. But after annual revenues dropped by more than $500 million from 2006 to 2010, something had to change. In 2011, the NY Times launched its new digital subscription model and put some of its online articles behind a paywall. It bet that consumers would be willing to pay for quality content. And while it faced a rocky start, with revenue through print circulation and advertising slowly dwindling and some consumers frustrated that once-available content was now paywalled, its income through digital subscriptions began to climb. After digital subscription revenues first launched in 2011, they totaled to $47 million of revenue in their first year. By 2022 they had climbed to $979 million and accounted for 42% of total revenue.

Why Are Readers Paying for News?

More than half of U.S. adults subscribe to the news in some format. That (perhaps surprisingly) includes around four out of 10 adults under the age of 35. One of the main reasons cited for this was the consistency of publications in covering a variety of news topics. And given the NY Times’ popularity, it’s no surprise that it recently ranked as the most popular news subscription.