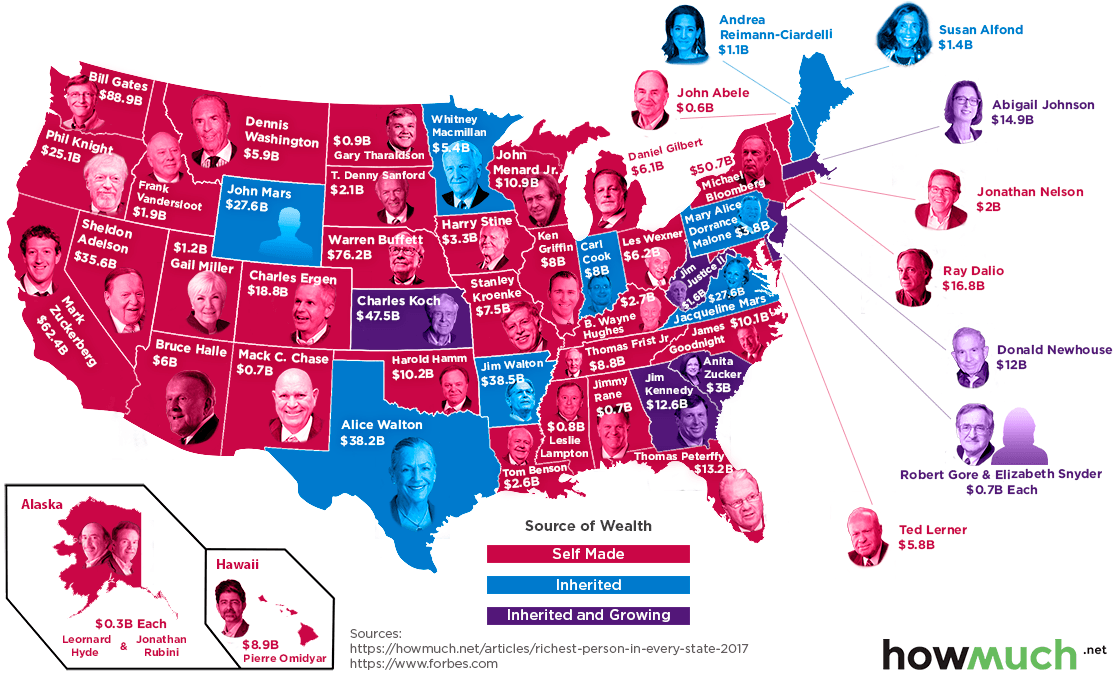

That’s because while some of the wealthiest people in their respective states are household names, such as Ray Dalio (Connecticut) or Michael Bloomberg (New York), the majority of people on this list fly below the radar at both the national and international levels. Further, the dropoff from the largest to smallest fortunes on the list is also steeper than you might think.

Examining the Top 10 States

Today’s visualization, which shows the richest person in every U.S. state in 2017, comes from cost information site HowMuch.net while using the latest information from Forbes. Here’s how the list of the top 10 states round out: While their fortunes don’t quite compare to the richest people in human history, the numbers above are still very impressive. The list is topped by Bill Gates, who was briefly overtaken as richest person in the world by fellow Seattleite Jeff Bezos for a short period of time in July, but now again sits in the #1 position. Not surprisingly, Mark Zuckerberg (California) and Michael Bloomberg (New York) also sit high, outranking other high net worth individuals from those states like Larry Ellison ($62.2 billion) or George Soros ($25.2 billion). The list is dominated by those who are self-made or growing their fortunes, but the second half has billionaire siblings that inherited their family fortunes such as Jim and Alice Walton (Walmart), or John and Jacqueline Mars (Mars).

Flying Under the Radar

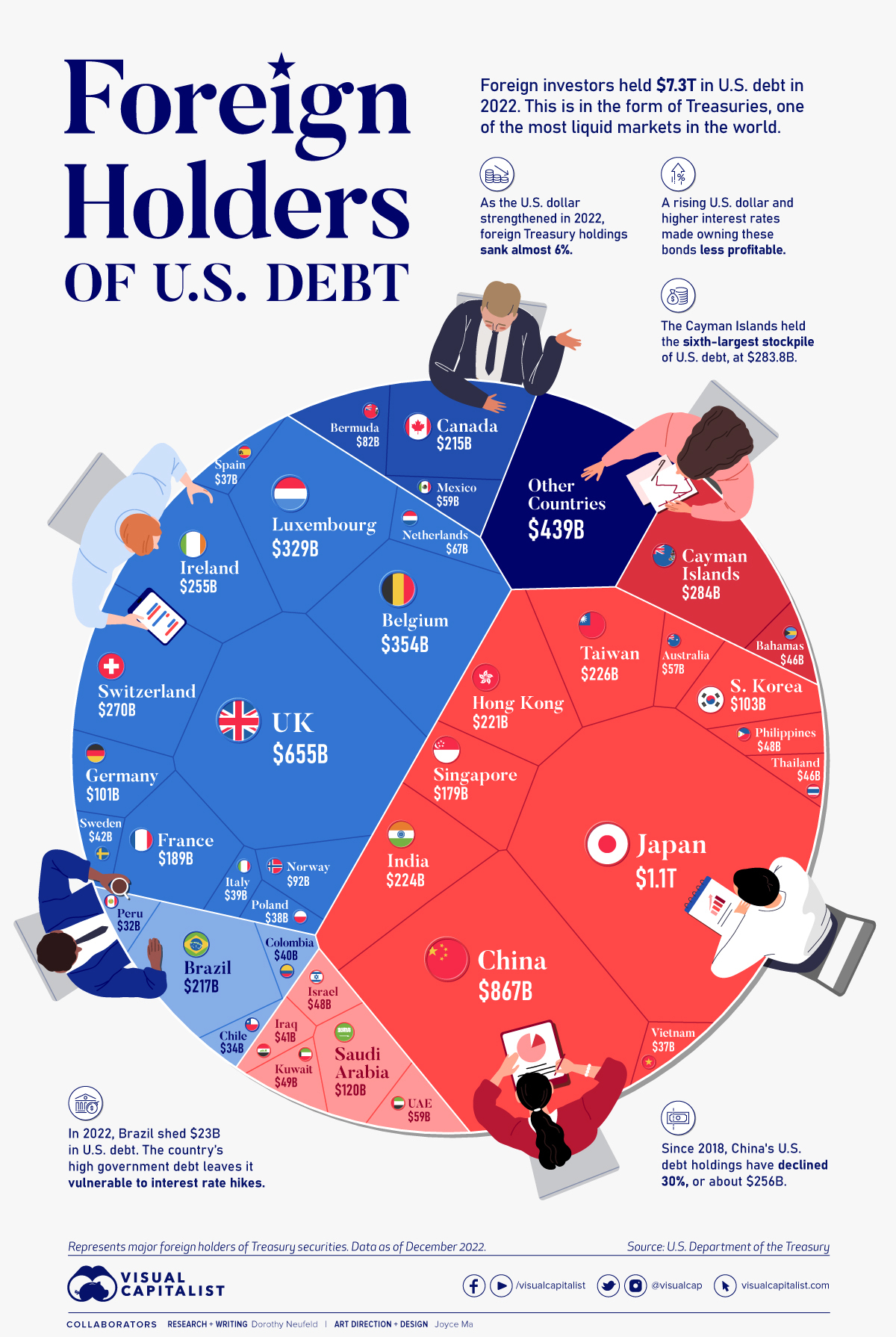

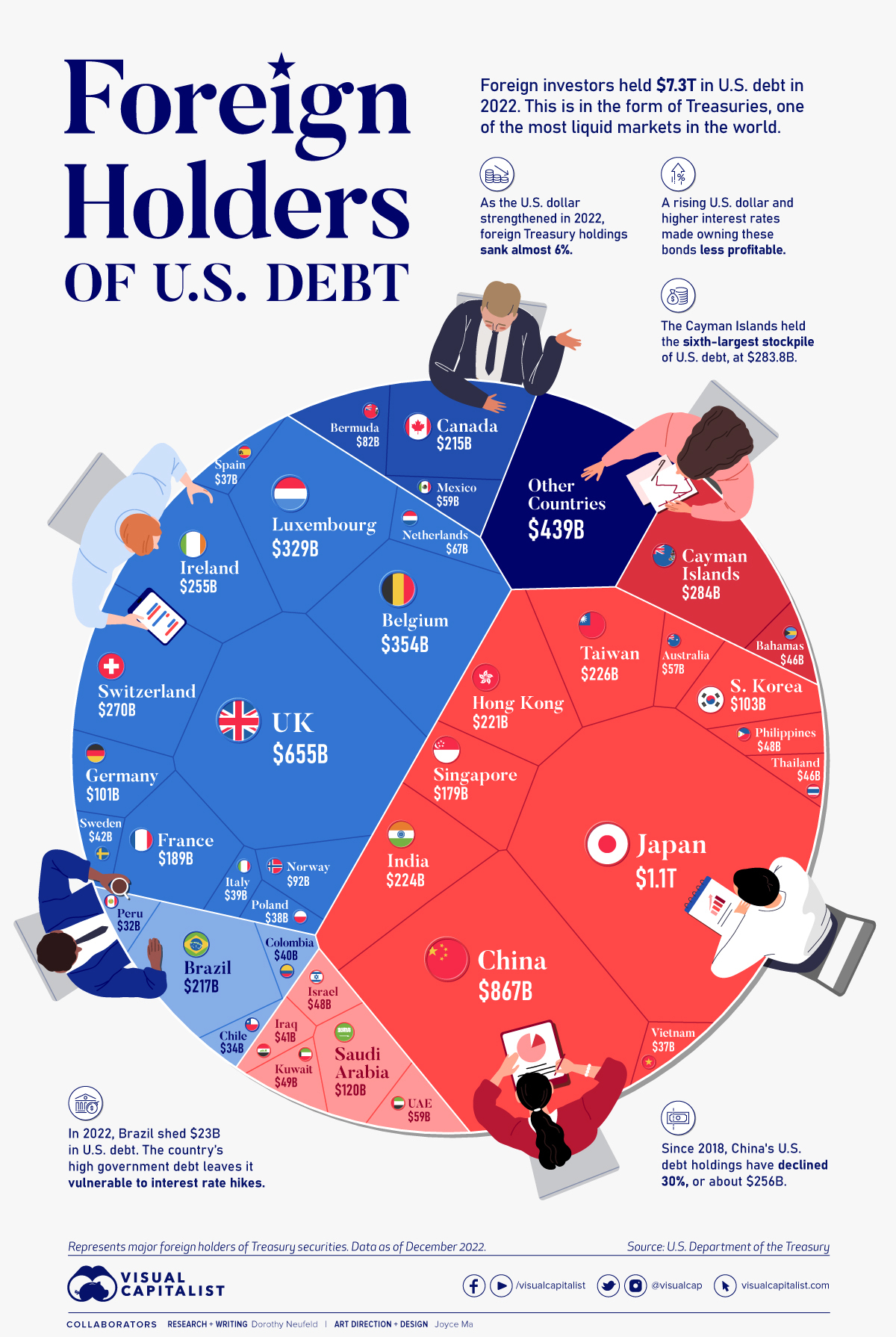

In some ways, the bottom portion of the rankings for the Richest Person in Every U.S. State is just as interesting. Many of these people are lesser known, and the disparity between these fortunes and those on the Top 10 list show how hard it really is to grow a fortune to the >$20 billion range. Just one person in the Bottom 10 is a billionaire – the rest have fortunes in the hundreds of millions. The sources of the fortunes near the end of the list are also quite diverse. Robert Gore and Elizabeth Snyder (and their four other siblings) were the heirs to the Gore-Tex empire, each owning 7% of the company. Meanwhile, Mack C. Chase is an oil tycoon, John Abele has made his money from making medical devices, and Leonard Hyde and Jonathan Rubini are partners in a real estate firm that owns much of the Anchorage skyline. on These are in the form of Treasury securities, some of the most liquid assets worldwide. Central banks use them for foreign exchange reserves and private investors flock to them during flights to safety thanks to their perceived low default risk. Beyond these reasons, foreign investors may buy Treasuries as a store of value. They are often used as collateral during certain international trade transactions, or countries can use them to help manage exchange rate policy. For example, countries may buy Treasuries to protect their currency’s exchange rate from speculation. In the above graphic, we show the foreign holders of the U.S. national debt using data from the U.S. Department of the Treasury.

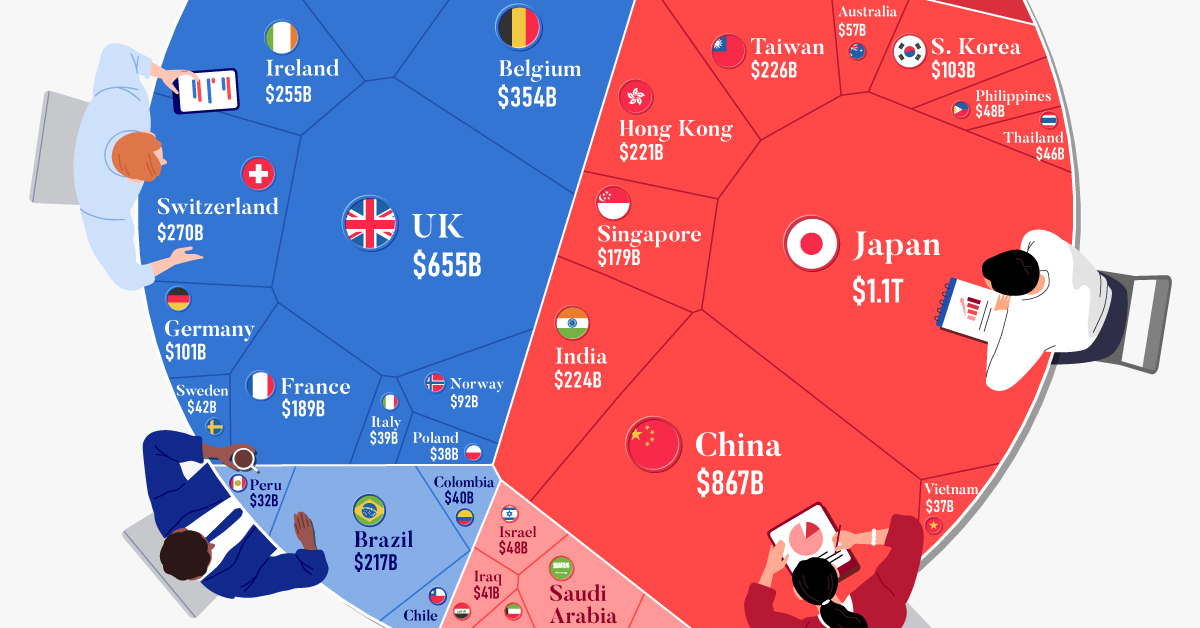

Top Foreign Holders of U.S. Debt

With $1.1 trillion in Treasury holdings, Japan is the largest foreign holder of U.S. debt. Japan surpassed China as the top holder in 2019 as China shed over $250 billion, or 30% of its holdings in four years. This bond offloading by China is the one way the country can manage the yuan’s exchange rate. This is because if it sells dollars, it can buy the yuan when the currency falls. At the same time, China doesn’t solely use the dollar to manage its currency—it now uses a basket of currencies. Here are the countries that hold the most U.S. debt: As the above table shows, the United Kingdom is the third highest holder, at over $655 billion in Treasuries. Across Europe, 13 countries are notable holders of these securities, the highest in any region, followed by Asia-Pacific at 11 different holders. A handful of small nations own a surprising amount of U.S. debt. With a population of 70,000, the Cayman Islands own a towering amount of Treasury bonds to the tune of $284 billion. There are more hedge funds domiciled in the Cayman Islands per capita than any other nation worldwide. In fact, the four smallest nations in the visualization above—Cayman Islands, Bermuda, Bahamas, and Luxembourg—have a combined population of just 1.2 million people, but own a staggering $741 billion in Treasuries.

Interest Rates and Treasury Market Dynamics

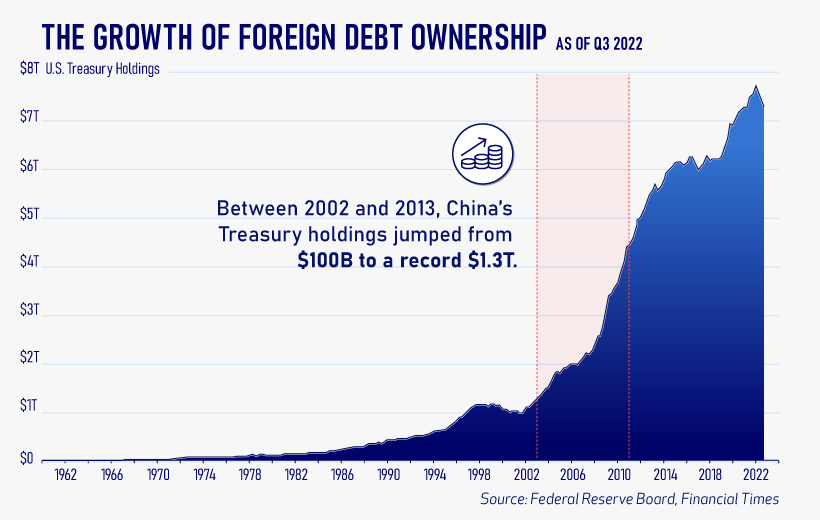

Over 2022, foreign demand for Treasuries sank 6% as higher interest rates and a strong U.S. dollar made owning these bonds less profitable. This is because rising interest rates on U.S. debt makes the present value of their future income payments lower. Meanwhile, their prices also fall. As the chart below shows, this drop in demand is a sharp reversal from 2018-2020, when demand jumped as interest rates hovered at historic lows. A similar trend took place in the decade after the 2008-09 financial crisis when U.S. debt holdings effectively tripled from $2 to $6 trillion.

Driving this trend was China’s rapid purchase of Treasuries, which ballooned from $100 billion in 2002 to a peak of $1.3 trillion in 2013. As the country’s exports and output expanded, it sold yuan and bought dollars to help alleviate exchange rate pressure on its currency. Fast-forward to today, and global interest-rate uncertainty—which in turn can impact national currency valuations and therefore demand for Treasuries—continues to be a factor impacting the future direction of foreign U.S. debt holdings.