The user metrics continue to impress, and the app just recently passed Twitter with 150 million daily active users. Snapchat has also vaulted past Instagram in time spent by users, making it the second-most used app by iPhone users, trailing only Facebook. With a median user age of 18, Snapchat’s business premise is that it allows marketers to tap into the mysterious Millennial and Gen Z audiences that continue to perplex many brands. However, the jury is out on whether the app is delivering on this promise. There’s now more than $2.65 billion of venture capital at stake that depends on solving the Snapchat monetization problem.

The Snapchat Monetization Problem

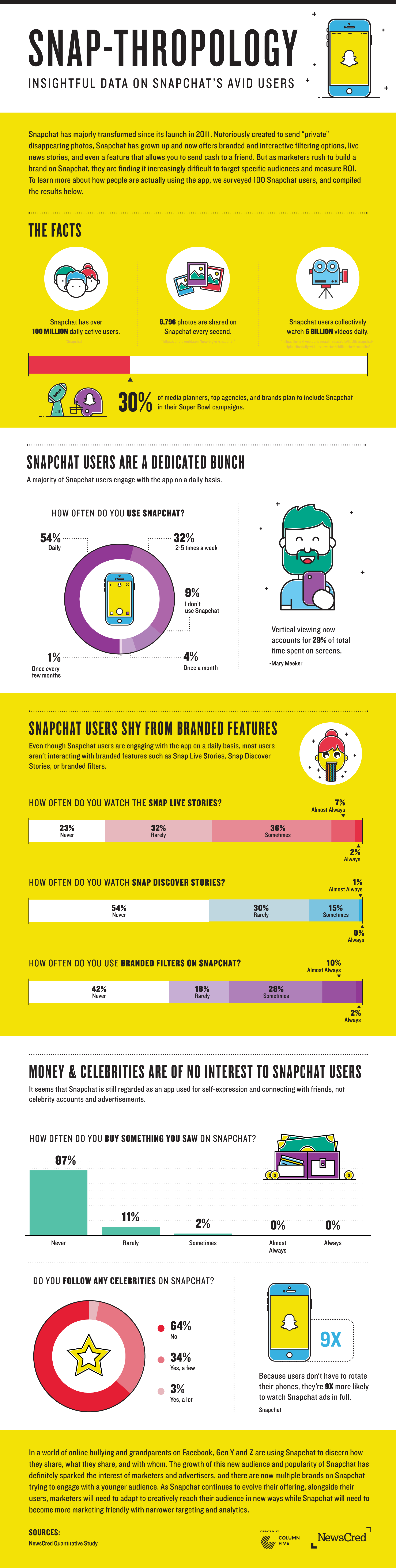

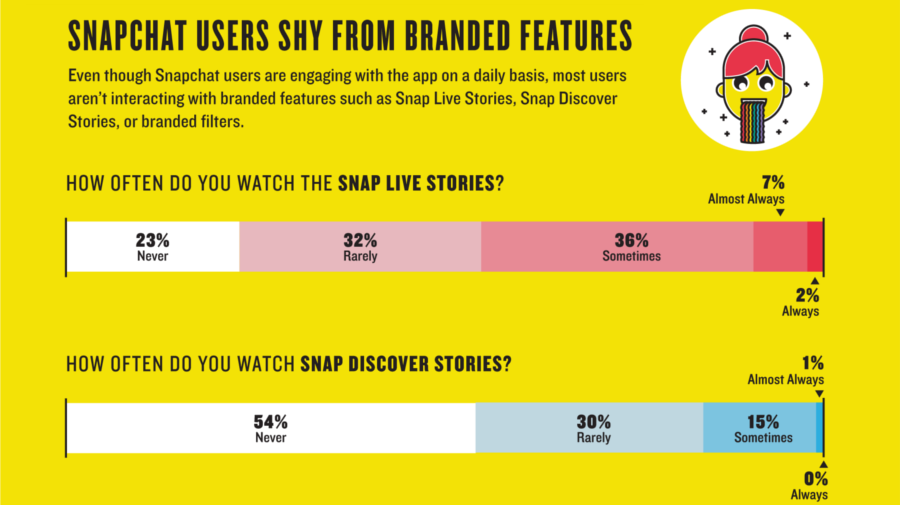

Today’s infographic shows the results from a survey of Snapchat users by NewsCred, a content marketing platform. The data paints a picture of Snapchat as an app that engages users, while whiffing on the branded content it needs to generate revenue.

Courtesy of: NewsCred In other words, if Snapchat is counting on advertising as its main monetization driver, it is going to need to get more users engaging with branded content. Then, Snapchat must able to prove that to advertisers through targeting, analytics, and other useful metrics.

Snapchat is Getting Serious

In the first half of 2016, Snapchat raised $1.8 billion in its Series F round at a flat valuation of $16 billion. This says two things. First, with an estimated $59 million in revenue in 2015, investors are worried about the Snapchat monetization problem. Otherwise, the company’s valuation would have risen from the previous Series E which took place over a year prior. Second, this war chest of new capital is going to be used to pounce on revenue opportunities, as well as providing better analytics to advertisers. To the latter point, Snapchat is now making major moves to deliver on the revenue front. The company recently poached a key ad exec from Facebook. The app also launched a revamped Snapchat Discover portal that allows major publishers like Cosmopolitan or BuzzFeed to get in on the action to share ad revenue. Snapchat is also finally getting serious about metrics, and that’s why the company signed with Nielsen to start measuring the performance of ads like a television network would. Will Snapchat’s revenues ever measure up to its user growth and marketing promise to advertisers? For now, the Snapchat monetization challenge remains, and investors are divided on the company’s future prospects.

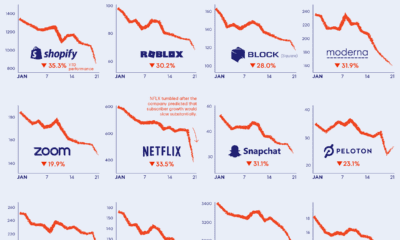

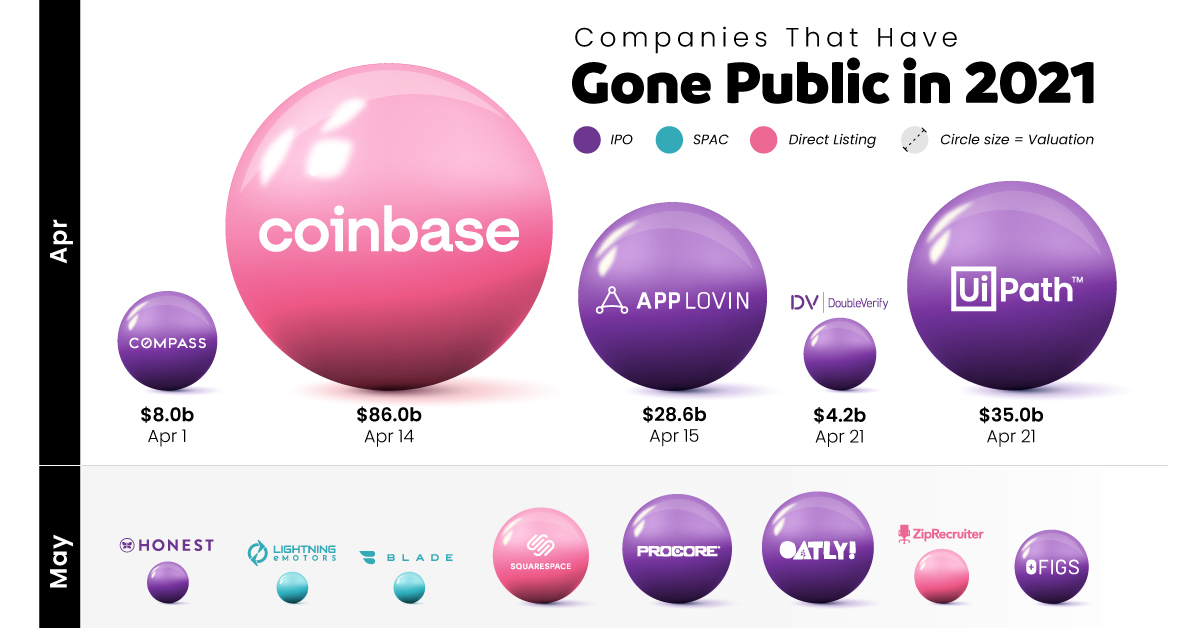

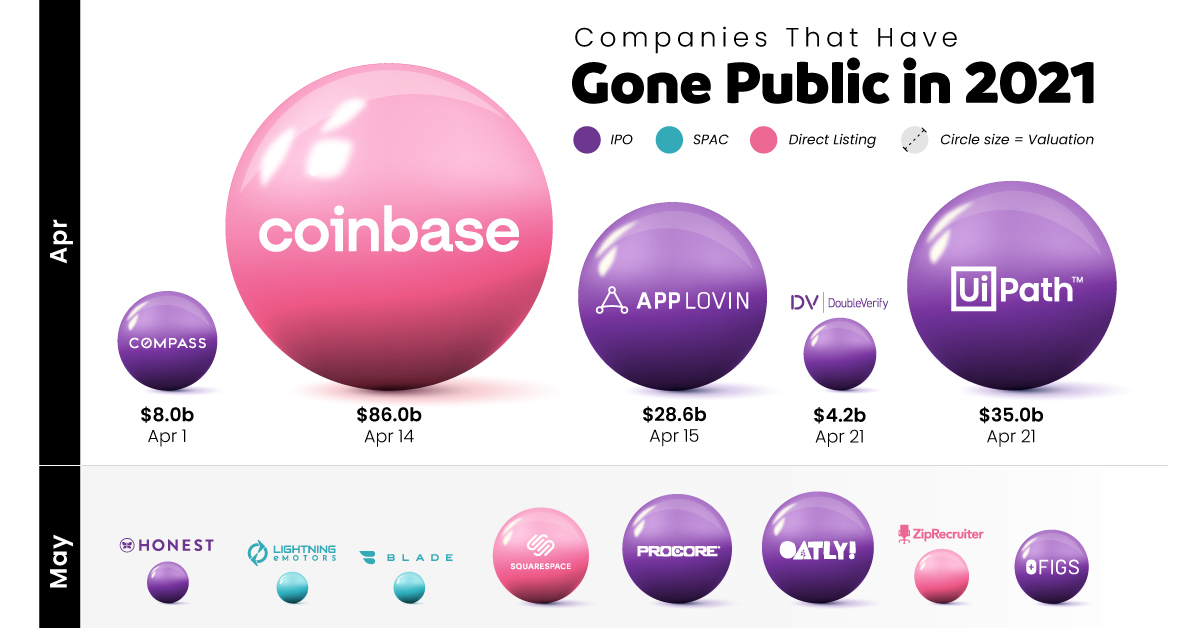

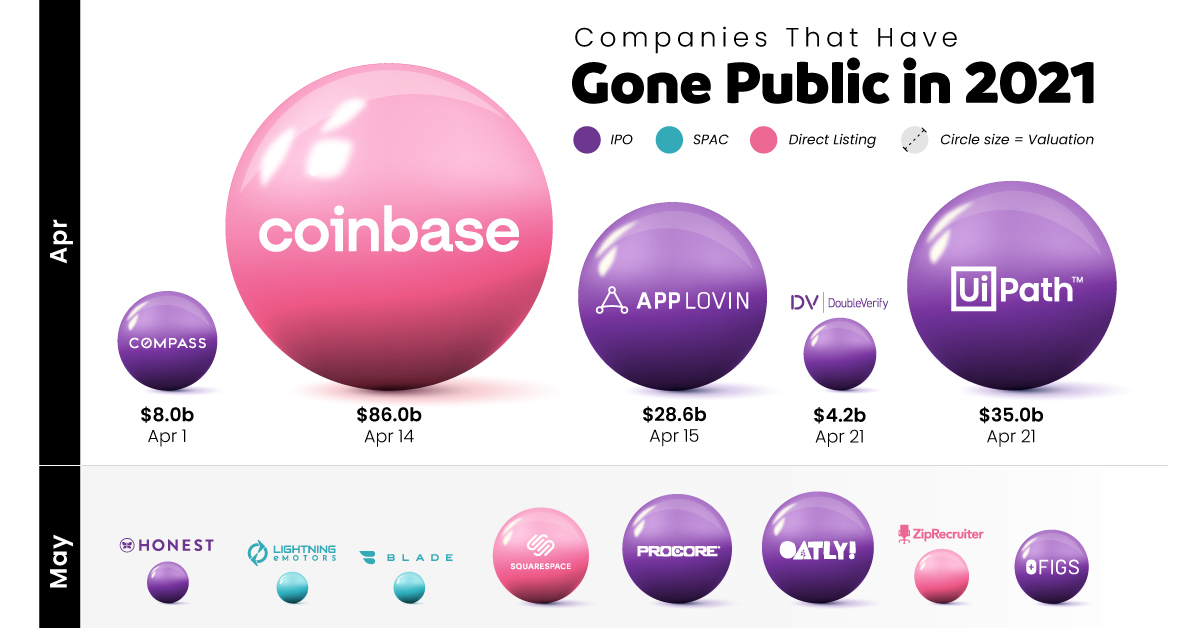

on From much-hyped tech initial public offerings (IPOs) to food and healthcare services, many companies with already large followings have gone public this year. Some were supposed to go public in 2020 but got delayed due to the pandemic, and others saw the opportunity to take advantage of a strong current market. This graphic measures 68 companies that have gone public in 2021 — including IPOs, SPACs, and Direct Listings—as well as their subsequent valuations after listing.

Who’s Gone Public in 2021?

Historically, companies that wanted to go public employed one main method above others: the initial public offering (IPO). But companies going public today readily choose from one of three different options, depending on market situations, associated costs, and shareholder preference:

Initial Public Offering (IPO): A private company creates new shares which are underwritten by a financial organization and sold to the public. Special Purpose Acquisition Company (SPAC): A separate company with no operations is created strictly to raise capital to acquire the company going public. SPACs are the fastest method of going public, and have become popular in recent years. Direct Listing: A private company enters a market with only existing, outstanding shares being traded and no new shares created. The cost is lower than that of an IPO, since no fees need to be paid for underwriting.

The majority of companies going public in 2021 chose the IPO route, but some of the biggest valuations resulted from direct listings. Though there are many well-known names in the list, one of the biggest through lines continues to be the importance of tech. A majority of 2021’s newly public companies have been in tech, including multiple mobile apps, websites, and online services. The two biggest IPOs so far were South Korea’s Coupang, an online marketplace valued at $60 billion after going public, and China’s ride-hailing app Didi Chuxing, the year’s largest post-IPO valuation at $73 billion. And there were many apps and services going public through other means as well. Gaming company Roblox went public through a direct listing, earning a valuation of $30 billion, and cryptocurrency platform Coinbase has earned the year’s largest valuation so far, with an $86 billion valuation following its direct listing.

Big Companies Going Public in 2022

As with every year, some of the biggest companies going public were lined up for the later half. Tech will continue to be the talk of the markets. Payment processing firm Stripe was setting up to be the year’s biggest IPO with an estimated valuation of $95 billion, but got delayed. Likewise, online grocery delivery platform InstaCart, which saw a big upswing in traction due to the pandemic, has been looking to go public at a valuation of at least $39 billion. Of course, it’s common that potential public listings and offerings fall through. Whether they get delayed due to weak market conditions or cancelled at the last minute, anything can happen when it comes to public markets. This post has been updated as of January 1, 2022.