Every team’s general manager starts off with the same goal: to build a franchise that contends for championships year in and year out. However, with the nature of the business being what it is, the odds are stacked against any team trying to achieve this. Out of close to 30 teams in most leagues, only one franchise can come out on top with a championship. And with unprecedented parity in most major leagues, every management decision is a crucial one. One smart draft choice or trade can put a team in a position to win, but a single mistake can also make a team a perennial bottom dweller. Owners have a similar perspective, but they also want to build a franchise that is worth money in the long-run. To do that, they need to consider factors outside of winning: merchandise sales, sponsorships, costs, and other business decisions need to be made. They need to figure out how to capture the imagination of fans, and how to salvage the value of a franchise even when they are losing most games. Today’s chart, using data from Forbes, is a hat tip to the teams that are lucky enough to count themselves among the most valuable in the world. Further, we also look at how the list has changed over time, and what happens to the valuations of franchises that are fortunate to be contenders on an ongoing basis.

What Makes a Team Valuable?

Multi-billion dollar sports teams don’t just grow on trees. Instead, the massive value assigned to teams like the Dallas Cowboys or Manchester United is the culmination of a variety of important factors: market size, fan appeal, sport economics, international cross-over potential, profit, success, history, and many others. Here’s a Top 10 List of the world’s most valuable sports teams – and how that list has changed since 2010.

The ranking list has a few big takeaways on what is needed to become a valuation monster: Market size matters: New York and Los Angeles do very well for valuation, even without many recent championships. These places are home to millions of fans, as well as massive amounts of dollars to be made from sponsors and media rights. Recent success helps: The Patriots have made seven Super Bowl appearances since 2000, cementing the franchise as one of the most valuable sports teams in the world. Recent failures hurt: The Redskins haven’t won a playoff series since 2005 (Wildcard) – and partially as a result, they have fallen out of the Top 10 ranking for the most valuable sports teams in 2017. History is a factor: Manchester United hasn’t won the EPL in the last few years, but the club’s history speaks for itself. The Yankees have been mediocre in the last five years, but fans know they’ll be back eventually. Sport economics are key: Why are there so many NFL teams on the Top 50 list? The economics just work better, and it translates to team valuations. Cross-over appeal: What’s unique about Manchester United, the Yankees, or the Patriots? You’ll see people wearing their gear all around the world – they have rare cross-over appeal to international markets, and this means more dough.

Championships and Team Value

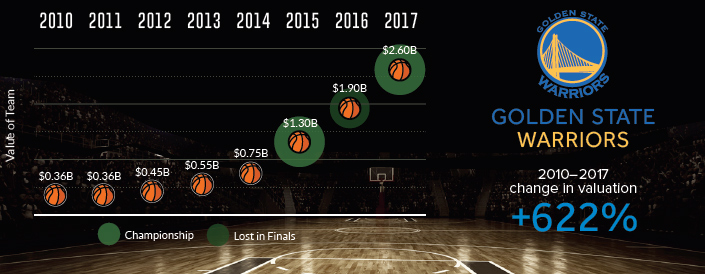

It’s clear that winning has a role in team value – but how big of a difference can it make? Next, we’ll look at how value has changed for teams that have been particularly successful in recent years, like the Golden State Warriors, New England Patriots, and Chicago Blackhawks. Golden State Warriors The Warriors franchise is worth +622% more than it was back in 2010, thanks to recent success. The team has made the finals in each of the last three years – and they’ve taken home the Larry O’Brien NBA Championship Trophy twice.

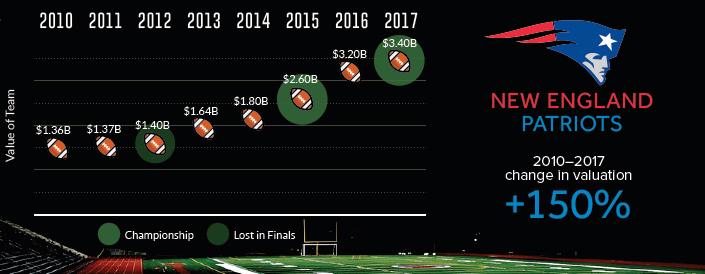

New England Patriots Like other perennial champions, the Pats have their fair share of detractors. Team owner Robert Kraft likely doesn’t care though – his team is now worth $3.4 billion, a 150% increase in value since 2010. They also have the hardware to show for it.

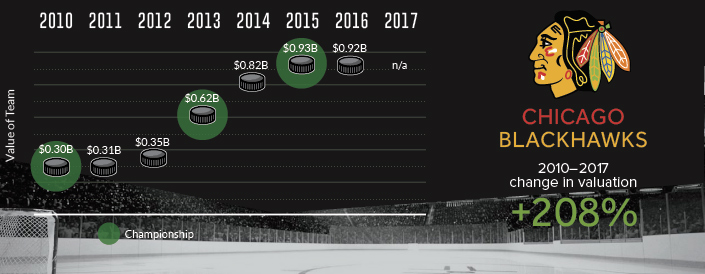

Chicago Blackhawks Despite a storied history as an “Original 6” team in the NHL, the Blackhawks found themselves in a bit of a funk in the 2000s. That all changed in 2006 and 2007, when the Blackhawks drafted Jonathan Toews and Patrick Kane – and now the team has won three Stanley Cups since 2010.

Recent winning streaks do help – and championships translate to other value categories as well. Winning builds the team’s history and brand, converts bandwagon fans, and helps teams create an international presence. Or as the late Al Davis often said, “Just win, baby.”

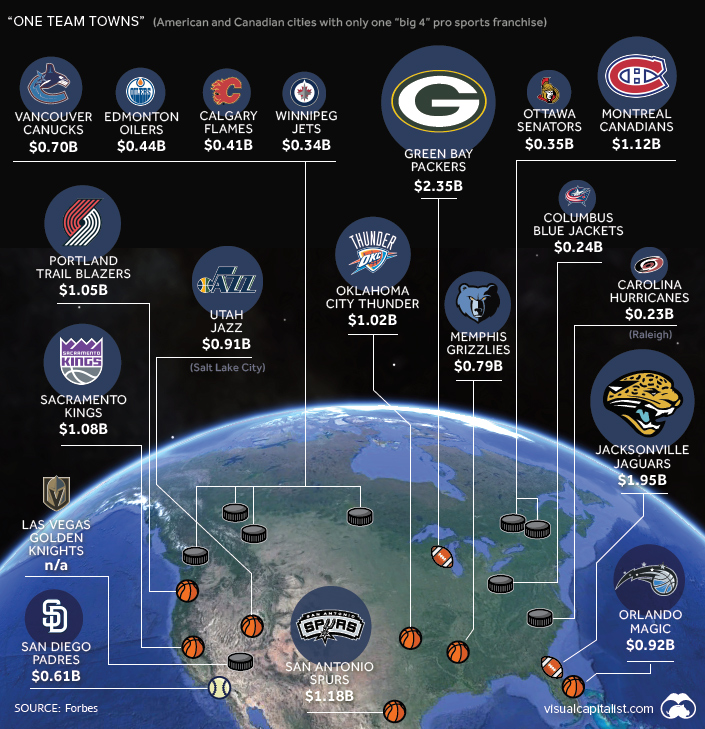

One Team Towns

To finish, here’s a final visualization that highlights the valuations of franchises in “One Team Towns” – cities in North America that each hold only one of the Big Four (NFL, NBA, MLB, NHL) franchises.

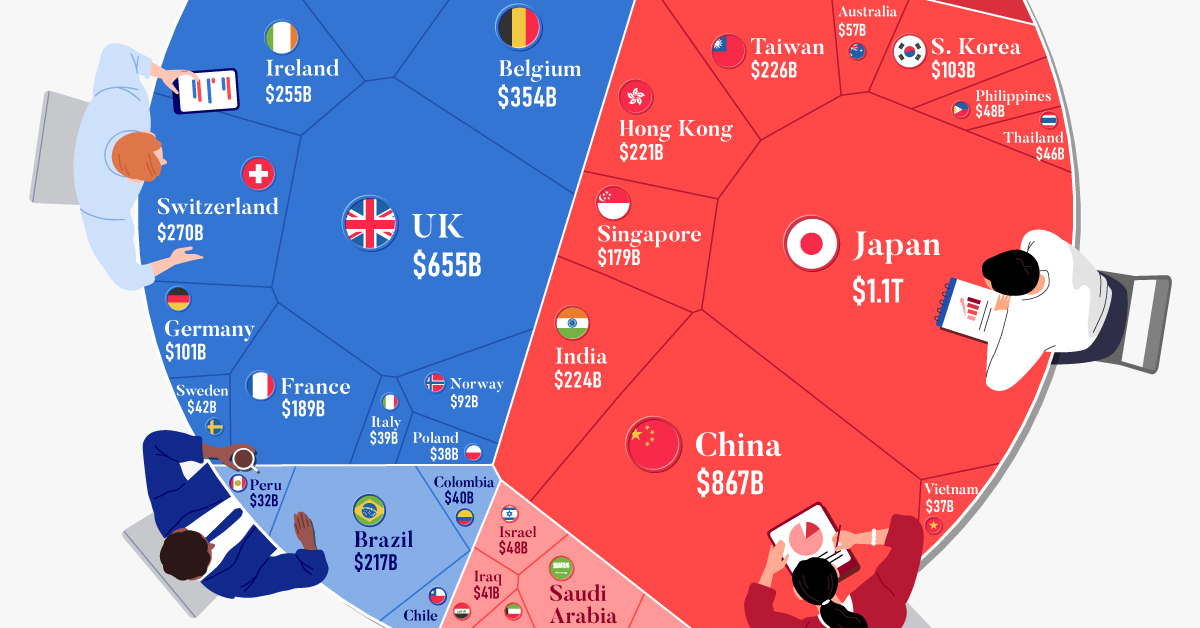

Of course, once the Raiders move to Las Vegas after their current lease expires, this map will change once again. on These are in the form of Treasury securities, some of the most liquid assets worldwide. Central banks use them for foreign exchange reserves and private investors flock to them during flights to safety thanks to their perceived low default risk. Beyond these reasons, foreign investors may buy Treasuries as a store of value. They are often used as collateral during certain international trade transactions, or countries can use them to help manage exchange rate policy. For example, countries may buy Treasuries to protect their currency’s exchange rate from speculation. In the above graphic, we show the foreign holders of the U.S. national debt using data from the U.S. Department of the Treasury.

Top Foreign Holders of U.S. Debt

With $1.1 trillion in Treasury holdings, Japan is the largest foreign holder of U.S. debt. Japan surpassed China as the top holder in 2019 as China shed over $250 billion, or 30% of its holdings in four years. This bond offloading by China is the one way the country can manage the yuan’s exchange rate. This is because if it sells dollars, it can buy the yuan when the currency falls. At the same time, China doesn’t solely use the dollar to manage its currency—it now uses a basket of currencies. Here are the countries that hold the most U.S. debt: As the above table shows, the United Kingdom is the third highest holder, at over $655 billion in Treasuries. Across Europe, 13 countries are notable holders of these securities, the highest in any region, followed by Asia-Pacific at 11 different holders. A handful of small nations own a surprising amount of U.S. debt. With a population of 70,000, the Cayman Islands own a towering amount of Treasury bonds to the tune of $284 billion. There are more hedge funds domiciled in the Cayman Islands per capita than any other nation worldwide. In fact, the four smallest nations in the visualization above—Cayman Islands, Bermuda, Bahamas, and Luxembourg—have a combined population of just 1.2 million people, but own a staggering $741 billion in Treasuries.

Interest Rates and Treasury Market Dynamics

Over 2022, foreign demand for Treasuries sank 6% as higher interest rates and a strong U.S. dollar made owning these bonds less profitable. This is because rising interest rates on U.S. debt makes the present value of their future income payments lower. Meanwhile, their prices also fall. As the chart below shows, this drop in demand is a sharp reversal from 2018-2020, when demand jumped as interest rates hovered at historic lows. A similar trend took place in the decade after the 2008-09 financial crisis when U.S. debt holdings effectively tripled from $2 to $6 trillion.

Driving this trend was China’s rapid purchase of Treasuries, which ballooned from $100 billion in 2002 to a peak of $1.3 trillion in 2013. As the country’s exports and output expanded, it sold yuan and bought dollars to help alleviate exchange rate pressure on its currency. Fast-forward to today, and global interest-rate uncertainty—which in turn can impact national currency valuations and therefore demand for Treasuries—continues to be a factor impacting the future direction of foreign U.S. debt holdings.