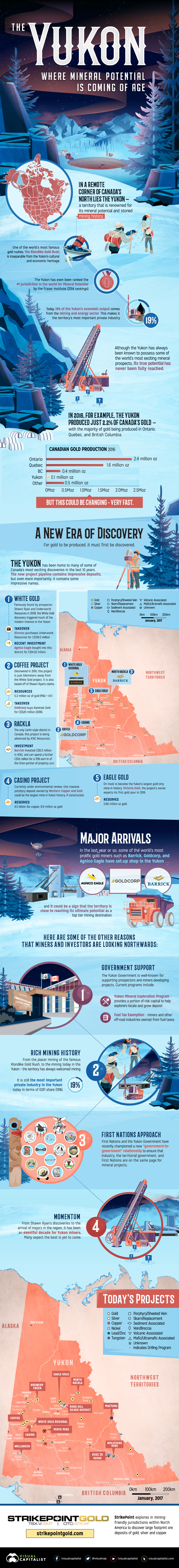

But while the Yukon only produced 2.2% of Canada’s gold in 2016, the territory’s considerable potential may finally be getting realized in a big way. In the last few years, globally significant discoveries have been made, and now mining giants such as Barrick, Goldcorp, and Agnico Eagle are making their move into the Yukon to get in on the action.

A Coming of Age Story

Today’s infographic comes from Strikepoint Gold, and it showcases some of the reasons on why the most important chapter in the Yukon’s mining story may just be beginning.

Although the Yukon has been known to possess incredible mineral potential for a long time, it is only in the last few years that signs have been pointing towards this being realized in the form of globally significant discoveries, investment from major players, and mines being built.

A New Era in the Yukon

For gold to be produced, it must first be discovered. The Yukon has been home to many of some of Canada’s most exciting discoveries in the last 10 years. The new project pipeline contains impressive deposits, but even more importantly – it contains some impressive names. White Gold Famously found by prospector Shawn Ryan and Underworld Resources in 2008, the White Gold discovery triggered much of the modern interest in the Yukon. Kinross purchased Underworld Resources for C$139.2 million at the height of the gold market. More recently, major Agnico Eagle has bought into the district for C$14.52 million. Coffee Project Discovered in 2010, this project is just kilometers away from the White Gold project. It too is based off of Shawn Ryan’s claims. Most recently, Goldcorp bought the project for C$520 million through its acquisition of Kaminak Gold. It currently has 5.2 million oz of gold (M&I + Inf.) in resources. Casino Project Currently under environmental review, this massive porphyry deposit owned by Western Copper and Gold could be the largest mine in Yukon history, if constructed. Right now, the deposit has reserves of 4.5 billion lbs of copper, and 8.9 million oz of gold. Rackla The only Carlin-style district in Canada, this project is being advanced by ATAC Resources. Recently, ATAC Resources generated headlines with an investment from major Barrick Gold, who put in C$8.3 million while also committing up to a further C$55 million to earn-in 70% of the property’s Orion project. Eagle Gold Eagle Gold is on track to become the Yukon’s largest gold-only mine in history. Victoria Gold, the project’s owner, expects its first gold pour in 2019. Currently the mine has 2.66 million oz of gold in reserves.

Major Arrivals

In the last year or so, some of the world’s most prolific gold miners such as Barrick, Goldcorp, and Agnico Eagle have set up shop in the Yukon – and it could be a sign that the territory is close to reaching its ultimate potential as a top tier mining destination. Here are some of the other reasons that miners and investors are looking northwards:

- Government Support The Yukon Government is well-known for supporting prospectors and miners developing projects. Current programs include the Yukon Mineral Exploration Program, which provides a portion of risk capital to help explorers locate and grow deposits, as well as the Fuel Tax Exemption, which makes miners and other off-road industries exempt from fuel taxes.

- A Rich Mining History From the placer mining of the famous Klondike Gold Rush, to the mining today in the Yukon – the territory has always welcomed mining. In fact, mining is still the most important private industry today in the Yukon by GDP share (19%).

- First Nations Approach First Nations and the Yukon Government have recently championed a new “government-to-government” relationship to ensure that industry, the territorial government, and First Nations are on the same page for mineral projects.

- Momentum From Shawn Ryan’s discoveries to the arrival of majors in the region, it has been an eventful decade for Yukon miners. Many expect the best is yet to come.

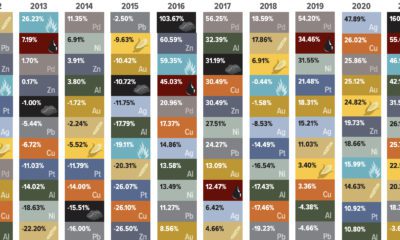

on Did you know that nearly one-fifth of all the gold ever mined is held by central banks? Besides investors and jewelry consumers, central banks are a major source of gold demand. In fact, in 2022, central banks snapped up gold at the fastest pace since 1967. However, the record gold purchases of 2022 are in stark contrast to the 1990s and early 2000s, when central banks were net sellers of gold. The above infographic uses data from the World Gold Council to show 30 years of central bank gold demand, highlighting how official attitudes toward gold have changed in the last 30 years.

Why Do Central Banks Buy Gold?

Gold plays an important role in the financial reserves of numerous nations. Here are three of the reasons why central banks hold gold:

Balancing foreign exchange reserves Central banks have long held gold as part of their reserves to manage risk from currency holdings and to promote stability during economic turmoil. Hedging against fiat currencies Gold offers a hedge against the eroding purchasing power of currencies (mainly the U.S. dollar) due to inflation. Diversifying portfolios Gold has an inverse correlation with the U.S. dollar. When the dollar falls in value, gold prices tend to rise, protecting central banks from volatility. The Switch from Selling to Buying In the 1990s and early 2000s, central banks were net sellers of gold. There were several reasons behind the selling, including good macroeconomic conditions and a downward trend in gold prices. Due to strong economic growth, gold’s safe-haven properties were less valuable, and low returns made it unattractive as an investment. Central bank attitudes toward gold started changing following the 1997 Asian financial crisis and then later, the 2007–08 financial crisis. Since 2010, central banks have been net buyers of gold on an annual basis. Here’s a look at the 10 largest official buyers of gold from the end of 1999 to end of 2021: Rank CountryAmount of Gold Bought (tonnes)% of All Buying #1🇷🇺 Russia 1,88828% #2🇨🇳 China 1,55223% #3🇹🇷 Türkiye 5418% #4🇮🇳 India 3956% #5🇰🇿 Kazakhstan 3455% #6🇺🇿 Uzbekistan 3115% #7🇸🇦 Saudi Arabia 1803% #8🇹🇭 Thailand 1682% #9🇵🇱 Poland1282% #10🇲🇽 Mexico 1152% Total5,62384% Source: IMF The top 10 official buyers of gold between end-1999 and end-2021 represent 84% of all the gold bought by central banks during this period. Russia and China—arguably the United States’ top geopolitical rivals—have been the largest gold buyers over the last two decades. Russia, in particular, accelerated its gold purchases after being hit by Western sanctions following its annexation of Crimea in 2014. Interestingly, the majority of nations on the above list are emerging economies. These countries have likely been stockpiling gold to hedge against financial and geopolitical risks affecting currencies, primarily the U.S. dollar. Meanwhile, European nations including Switzerland, France, Netherlands, and the UK were the largest sellers of gold between 1999 and 2021, under the Central Bank Gold Agreement (CBGA) framework. Which Central Banks Bought Gold in 2022? In 2022, central banks bought a record 1,136 tonnes of gold, worth around $70 billion. Country2022 Gold Purchases (tonnes)% of Total 🇹🇷 Türkiye14813% 🇨🇳 China 625% 🇪🇬 Egypt 474% 🇶🇦 Qatar333% 🇮🇶 Iraq 343% 🇮🇳 India 333% 🇦🇪 UAE 252% 🇰🇬 Kyrgyzstan 61% 🇹🇯 Tajikistan 40.4% 🇪🇨 Ecuador 30.3% 🌍 Unreported 74165% Total1,136100% Türkiye, experiencing 86% year-over-year inflation as of October 2022, was the largest buyer, adding 148 tonnes to its reserves. China continued its gold-buying spree with 62 tonnes added in the months of November and December, amid rising geopolitical tensions with the United States. Overall, emerging markets continued the trend that started in the 2000s, accounting for the bulk of gold purchases. Meanwhile, a significant two-thirds, or 741 tonnes of official gold purchases were unreported in 2022. According to analysts, unreported gold purchases are likely to have come from countries like China and Russia, who are looking to de-dollarize global trade to circumvent Western sanctions.

There were several reasons behind the selling, including good macroeconomic conditions and a downward trend in gold prices. Due to strong economic growth, gold’s safe-haven properties were less valuable, and low returns made it unattractive as an investment.

Central bank attitudes toward gold started changing following the 1997 Asian financial crisis and then later, the 2007–08 financial crisis. Since 2010, central banks have been net buyers of gold on an annual basis.

Here’s a look at the 10 largest official buyers of gold from the end of 1999 to end of 2021:

Source: IMF

The top 10 official buyers of gold between end-1999 and end-2021 represent 84% of all the gold bought by central banks during this period.

Russia and China—arguably the United States’ top geopolitical rivals—have been the largest gold buyers over the last two decades. Russia, in particular, accelerated its gold purchases after being hit by Western sanctions following its annexation of Crimea in 2014.

Interestingly, the majority of nations on the above list are emerging economies. These countries have likely been stockpiling gold to hedge against financial and geopolitical risks affecting currencies, primarily the U.S. dollar.

Meanwhile, European nations including Switzerland, France, Netherlands, and the UK were the largest sellers of gold between 1999 and 2021, under the Central Bank Gold Agreement (CBGA) framework.

Which Central Banks Bought Gold in 2022?

In 2022, central banks bought a record 1,136 tonnes of gold, worth around $70 billion. Türkiye, experiencing 86% year-over-year inflation as of October 2022, was the largest buyer, adding 148 tonnes to its reserves. China continued its gold-buying spree with 62 tonnes added in the months of November and December, amid rising geopolitical tensions with the United States. Overall, emerging markets continued the trend that started in the 2000s, accounting for the bulk of gold purchases. Meanwhile, a significant two-thirds, or 741 tonnes of official gold purchases were unreported in 2022. According to analysts, unreported gold purchases are likely to have come from countries like China and Russia, who are looking to de-dollarize global trade to circumvent Western sanctions.