The next generation of investors will be younger and much more diverse, with women taking an increasingly prominent role in building and growing family and personal wealth. Today’s infographic comes to us from New York Life Investments, and it showcases how this new paradigm will shape the future of products and services on offer in the industry, as well as how wealth managers can cater to these changing needs.

Growing Economic Might

Women are underrepresented in the investing world, but this is changing fast. While various cultural and societal reasons are contributors to this, there is also a more simple driver: rising economic might.

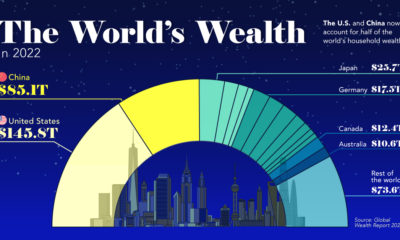

Women-controlled wealth in the U.S. will increase from $14 trillion to $22 trillion between 2015-2020 Women control 51% of all personal wealth in the United States today Women are set to inherit $28.7 trillion in intergenerational wealth over the next 40 years

Women are becoming more important drivers of income and wealth for their families, as well:

Women are now the primary breadwinners in 40% of U.S. households – a 4x increase from 1960. Women own 30% of all private businesses in the U.S. Women now hold the majority of management, professional, and related positions (52%)

Finally, women now make up the majority of recipients of Associate’s degrees (61%), Bachelor’s degrees (57%), Master’s degrees (60%), and Doctoral degrees (52%) in the United States.

The Wealth Management Gap

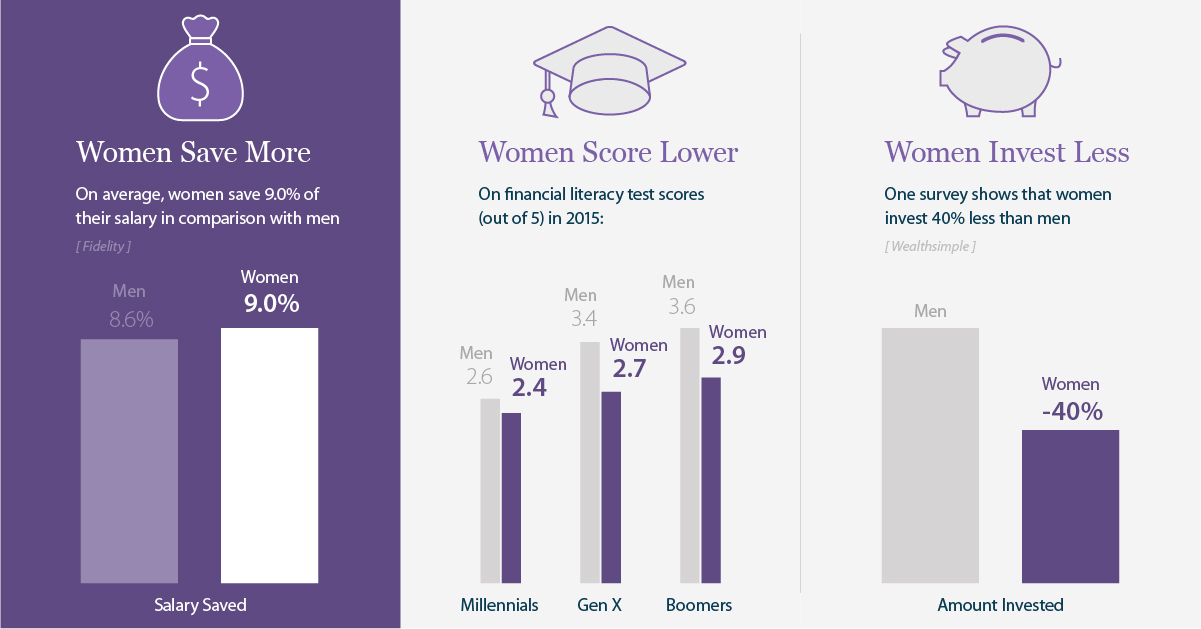

As women increase raise their level of economic influence to new levels, how will they manage this wealth? Interestingly, studies show that women think about money and wealth differently than men – and differently from precedents already set in the financial services industry:

Changing Concerns

Data from a recent survey by New York Life Investments sheds light on why women may be underserved by the financial services industry. Reasons why women switch financial advisors:

33% poor performance 29% lack of personal connection 27% poor customer services

In other words, women don’t switch investment advisors simply because of poor performance – there are other, more complex factors involved. Part of this is likely because 62% of women say they have unique investment needs and challenges: Perceptions of women and investing:

Financial professionals treat women differently – 40% Women feel patronized by financial advisors – 36% Financial advisors are less likely to listen to investing ideas from a woman – 30% Financial advisors push women out of financial conversations – 28% Women have less access to financial education – 26% Financial professionals find it hard to relate to women – 26% Financial advising is a man’s world – 24%

A Deeper Dive

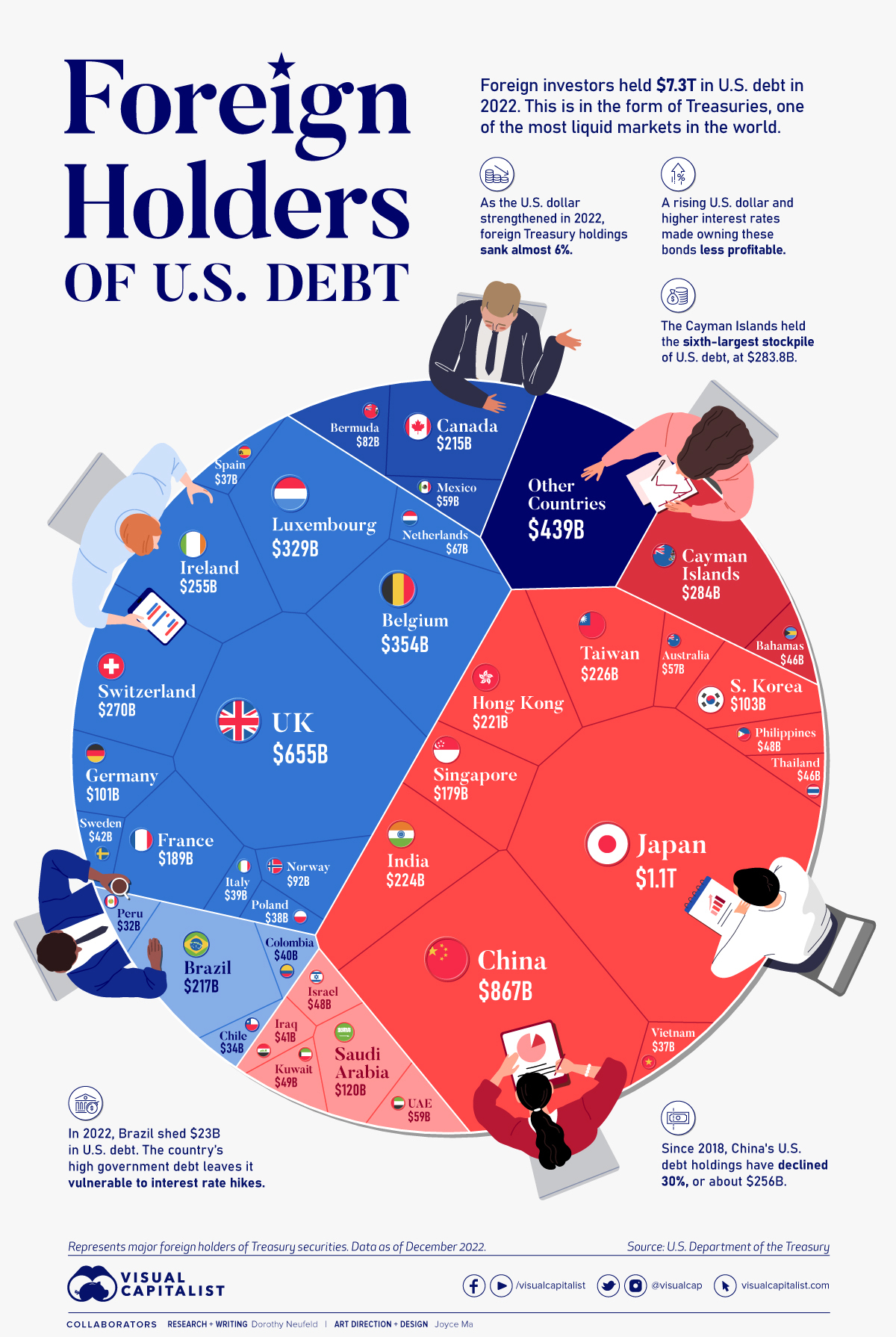

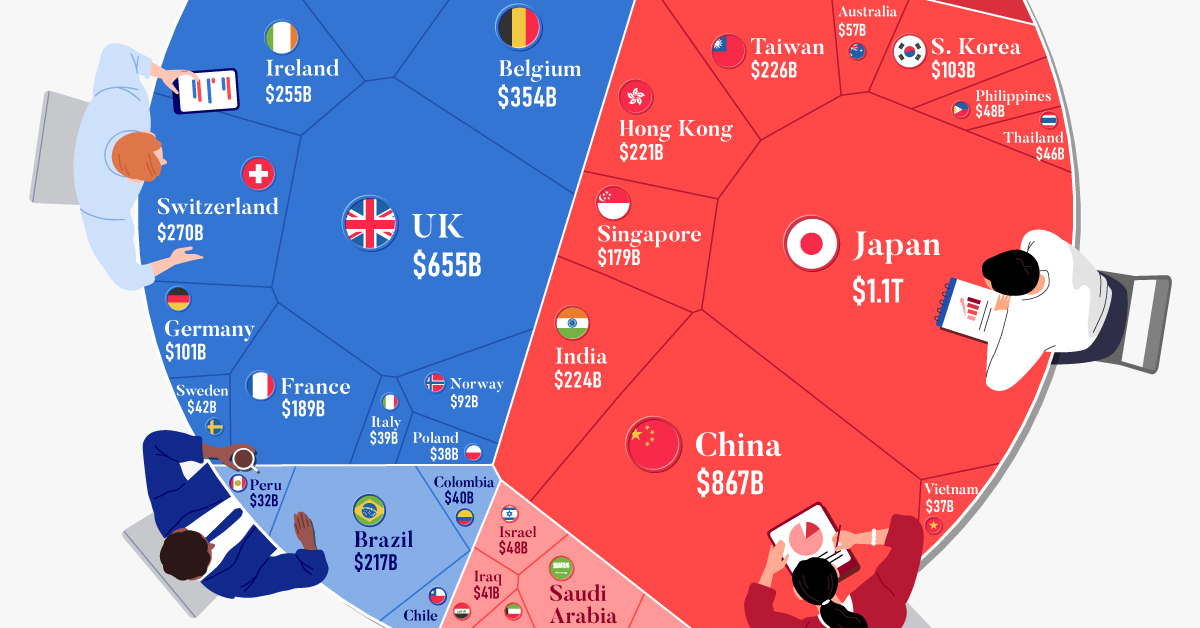

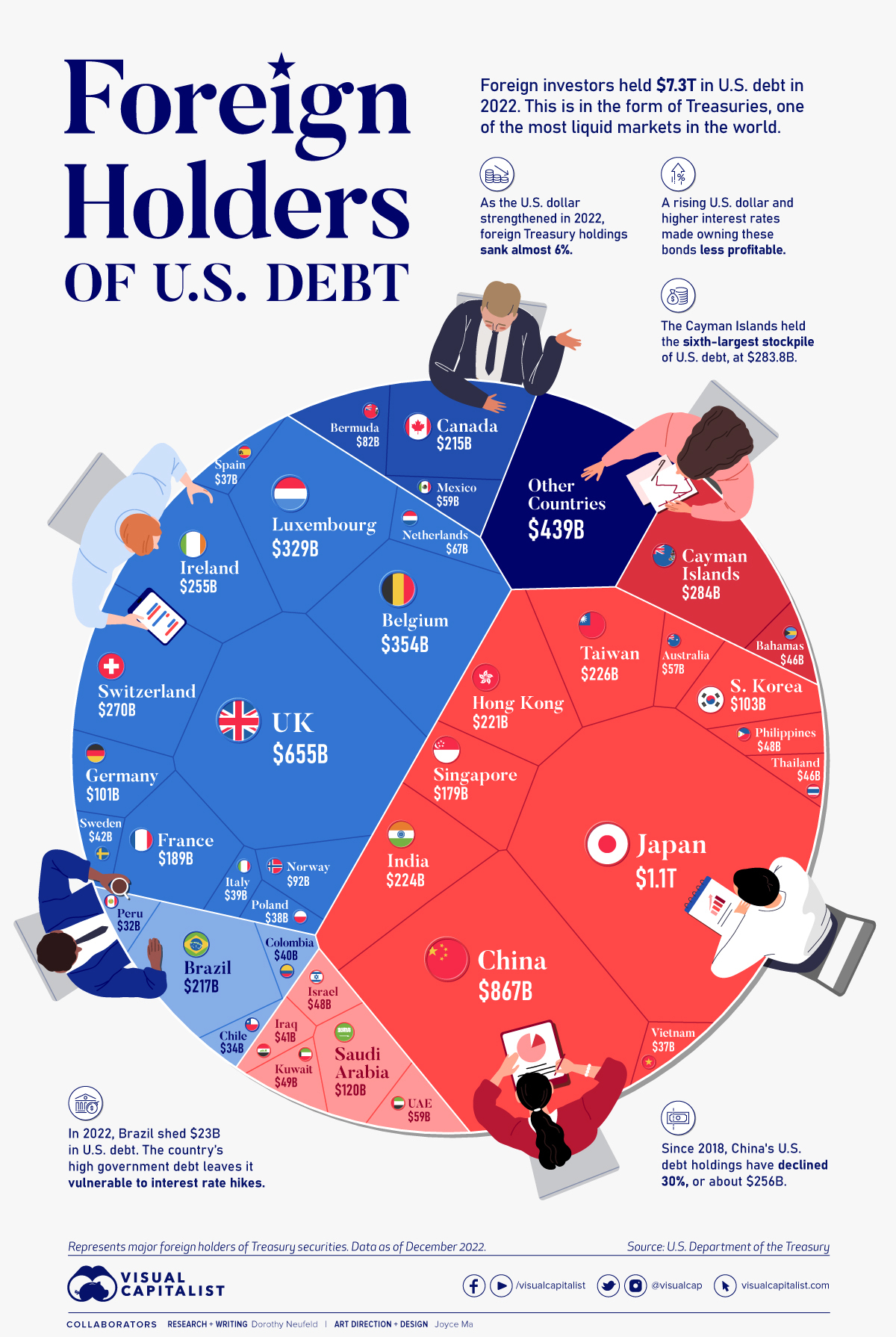

It is crucial for advisors to understand that women are not one large, homogeneous group. In fact, research shows that there are four unique segments of women that each approach investing differently – and they all have different sets of needs. Stay tuned for Part 2 of this infographic series, which will detail the differences between these segments. on These are in the form of Treasury securities, some of the most liquid assets worldwide. Central banks use them for foreign exchange reserves and private investors flock to them during flights to safety thanks to their perceived low default risk. Beyond these reasons, foreign investors may buy Treasuries as a store of value. They are often used as collateral during certain international trade transactions, or countries can use them to help manage exchange rate policy. For example, countries may buy Treasuries to protect their currency’s exchange rate from speculation. In the above graphic, we show the foreign holders of the U.S. national debt using data from the U.S. Department of the Treasury.

Top Foreign Holders of U.S. Debt

With $1.1 trillion in Treasury holdings, Japan is the largest foreign holder of U.S. debt. Japan surpassed China as the top holder in 2019 as China shed over $250 billion, or 30% of its holdings in four years. This bond offloading by China is the one way the country can manage the yuan’s exchange rate. This is because if it sells dollars, it can buy the yuan when the currency falls. At the same time, China doesn’t solely use the dollar to manage its currency—it now uses a basket of currencies. Here are the countries that hold the most U.S. debt: As the above table shows, the United Kingdom is the third highest holder, at over $655 billion in Treasuries. Across Europe, 13 countries are notable holders of these securities, the highest in any region, followed by Asia-Pacific at 11 different holders. A handful of small nations own a surprising amount of U.S. debt. With a population of 70,000, the Cayman Islands own a towering amount of Treasury bonds to the tune of $284 billion. There are more hedge funds domiciled in the Cayman Islands per capita than any other nation worldwide. In fact, the four smallest nations in the visualization above—Cayman Islands, Bermuda, Bahamas, and Luxembourg—have a combined population of just 1.2 million people, but own a staggering $741 billion in Treasuries.

Interest Rates and Treasury Market Dynamics

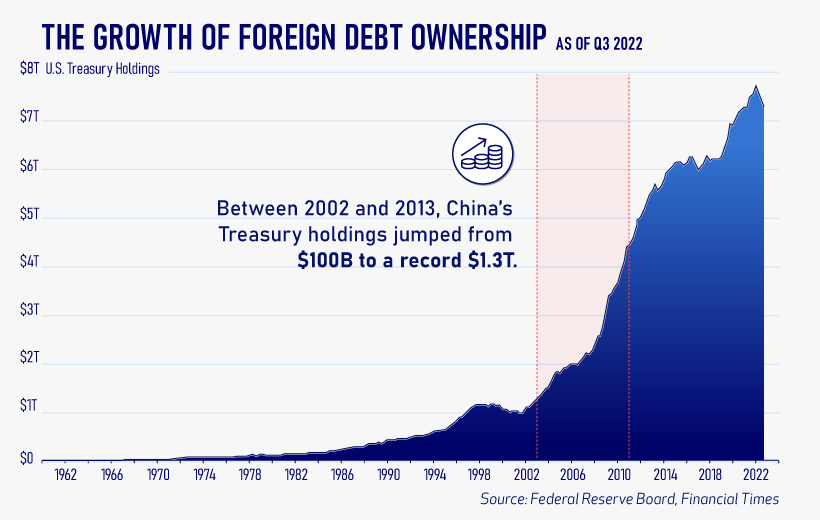

Over 2022, foreign demand for Treasuries sank 6% as higher interest rates and a strong U.S. dollar made owning these bonds less profitable. This is because rising interest rates on U.S. debt makes the present value of their future income payments lower. Meanwhile, their prices also fall. As the chart below shows, this drop in demand is a sharp reversal from 2018-2020, when demand jumped as interest rates hovered at historic lows. A similar trend took place in the decade after the 2008-09 financial crisis when U.S. debt holdings effectively tripled from $2 to $6 trillion.

Driving this trend was China’s rapid purchase of Treasuries, which ballooned from $100 billion in 2002 to a peak of $1.3 trillion in 2013. As the country’s exports and output expanded, it sold yuan and bought dollars to help alleviate exchange rate pressure on its currency. Fast-forward to today, and global interest-rate uncertainty—which in turn can impact national currency valuations and therefore demand for Treasuries—continues to be a factor impacting the future direction of foreign U.S. debt holdings.