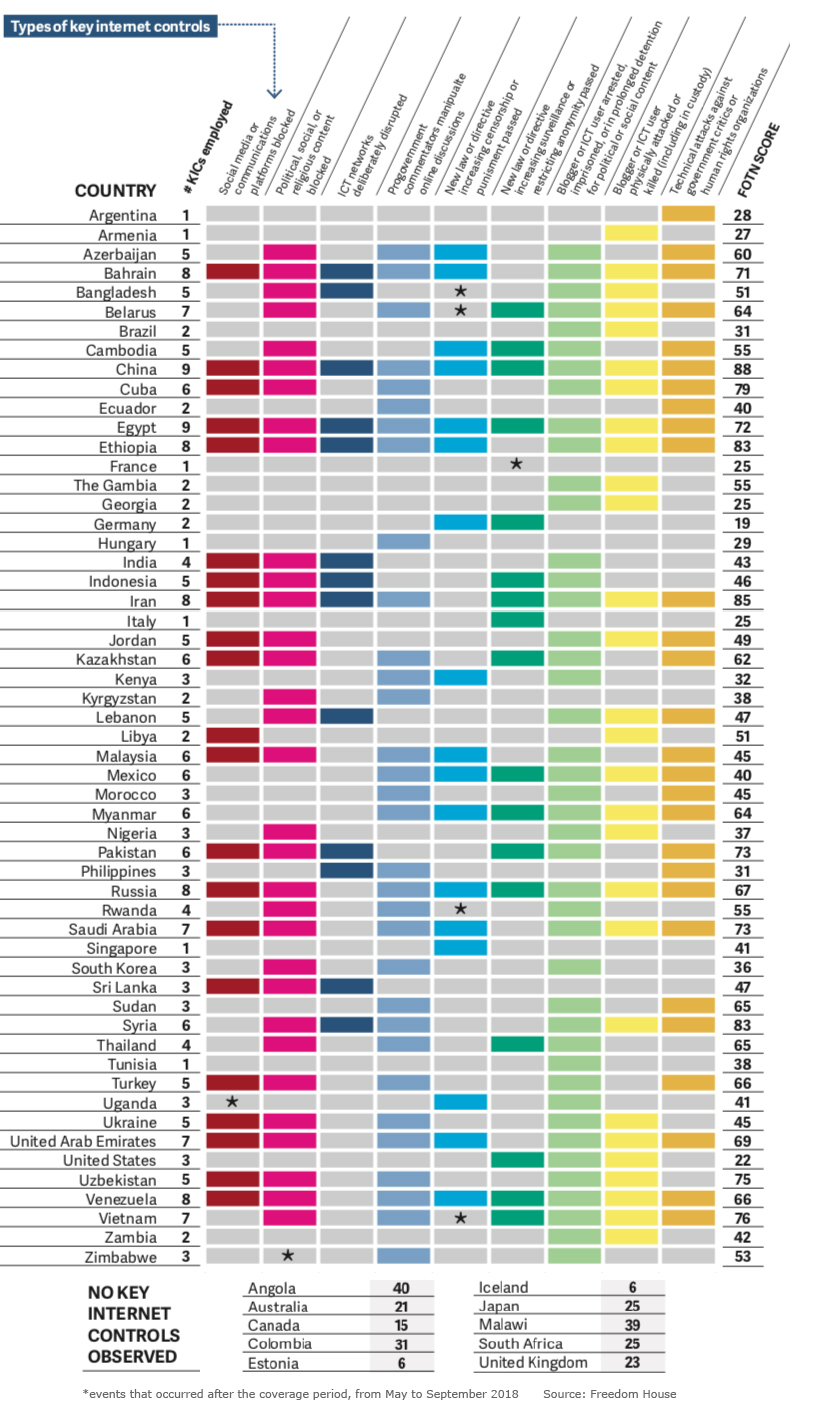

When people think of freedom, they often think it in the physical sense, such as the ability to act and behave in certain ways without fear of punishment, or freedom of movement within one’s country. When a nation chooses to restrict freedom in the physical world, the results are often hard to ignore. Protests are met with tear gas and rubber bullets. Road checks pop up along transportation routes. Journalists are detained. In the digital world, creeping control often appears in more subtle ways. Personal data is accessed without us knowing, and swarms of suspiciously like-minded accounts begin to overwhelm meaningful conversations on social media platforms. The Freedom on the Net Report, by Freedom House, breaks internet suppression down into a number of elements, from content filtering to detention of online publishers. Here’s how a number of countries around the world stack up:

According to the report, internet freedom around the world has been falling steadily for eight consecutive years. Today’s graphic is an international look at the state of internet freedom.

First World Problems

At its best, the internet allows us to seek out information and make choices free from coercion or hidden manipulation. Even in countries with relatively open access to information this is becoming increasingly difficult. In Western countries, internet suppression often rears its head in the form of misinformation and excessive data collection. The Cambridge Analytica scandal was a potent example of how the vast amounts of data collected by platforms and third parties can be used to manipulate public opinion. The backlash to this data collection by tech companies also produced one of the most promising developments in the past year – the EU’s General Data Protection Regulation (GDPR). While the regulations are not applicable to government and military entities, it does create a pathway to increased transparency and accountability for companies collecting user data.

Control Creep

Around one-third of the people in the world live in countries that are considered “partly free”. For most users, access to online information may not look too different from the internet experience in Iceland or Estonia, but there are creeping controls in specific areas. In Turkey, Wikipedia was blocked and social media companies were compelled to censor political commentary. The country had one of the largest declines in internet freedom in recent years. In Nigeria, data localization requirements have been enacted. This follows the lead of places like China and Vietnam, where servers must be located within the country for “the inspection, storage, and provision of information at the request of competent state management agencies.”

Access Denied

For many people around the world – particularly in Asia – accessing information online is a fundamentally different experience. Content published by an individual can be monitored and censored, and online activity that would be considered benign in Western countries can result in severe real-world consequences such as imprisonment or death. As today’s data visualization vividly illustrates, China has by far the most restricted internet of the 65 countries covered in the report. Network operators in the country are obligated to store all user data within the country (which can be accessed by governmental bodies), and are required to immediately stop the transmission of “banned content”. The country is also further cracking down the use of VPNs, which are used to circumvent China’s Great Firewall. Of course, China is not alone in the desire to implement tight controls over online access. Many places, from Vietnam to Ethiopia, are eager to embrace the “China Model”. The country, which is aggressively ramping up its influence around globe, is more than happy expand its influence through exporting models of governance to new technologies, such as facial recognition. Meanwhile, in Russia, the popular messaging app, Telegram, was blocked due to its refusal to allow the country’s security service access to encrypted data. This example highlights a growing dilemma faced by tech companies operating internationally – acquiesce to government demands, or lose access to huge markets.

A Tale of Two Internets

Today, there are two prodominant flavors of internet on the menu – the Silicon Valley offering dominated by major tech companies, and the top-down, state-controlled version being spread in earnest by Beijing. It would be a mistake to believe that the former is the clear choice for jurisdictions around the world. In many countries in Africa, communications infrastructure is still being built out, so assistance from Chinese companies is accepted with open arms. – Edwin Ngonyani, Tanzania’s Deputy Minister of Works, Transport and Communication Even though the internet is now three decades old, its form is still evolving. It remains to be seen whether the divergence between free and not free jurisdictions continues to grow. on But fast forward to the end of last week, and SVB was shuttered by regulators after a panic-induced bank run. So, how exactly did this happen? We dig in below.

Road to a Bank Run

SVB and its customers generally thrived during the low interest rate era, but as rates rose, SVB found itself more exposed to risk than a typical bank. Even so, at the end of 2022, the bank’s balance sheet showed no cause for alarm.

As well, the bank was viewed positively in a number of places. Most Wall Street analyst ratings were overwhelmingly positive on the bank’s stock, and Forbes had just added the bank to its Financial All-Stars list. Outward signs of trouble emerged on Wednesday, March 8th, when SVB surprised investors with news that the bank needed to raise more than $2 billion to shore up its balance sheet. The reaction from prominent venture capitalists was not positive, with Coatue Management, Union Square Ventures, and Peter Thiel’s Founders Fund moving to limit exposure to the 40-year-old bank. The influence of these firms is believed to have added fuel to the fire, and a bank run ensued. Also influencing decision making was the fact that SVB had the highest percentage of uninsured domestic deposits of all big banks. These totaled nearly $152 billion, or about 97% of all deposits. By the end of the day, customers had tried to withdraw $42 billion in deposits.

What Triggered the SVB Collapse?

While the collapse of SVB took place over the course of 44 hours, its roots trace back to the early pandemic years. In 2021, U.S. venture capital-backed companies raised a record $330 billion—double the amount seen in 2020. At the time, interest rates were at rock-bottom levels to help buoy the economy. Matt Levine sums up the situation well: “When interest rates are low everywhere, a dollar in 20 years is about as good as a dollar today, so a startup whose business model is “we will lose money for a decade building artificial intelligence, and then rake in lots of money in the far future” sounds pretty good. When interest rates are higher, a dollar today is better than a dollar tomorrow, so investors want cash flows. When interest rates were low for a long time, and suddenly become high, all the money that was rushing to your customers is suddenly cut off.” Source: Pitchbook Why is this important? During this time, SVB received billions of dollars from these venture-backed clients. In one year alone, their deposits increased 100%. They took these funds and invested them in longer-term bonds. As a result, this created a dangerous trap as the company expected rates would remain low. During this time, SVB invested in bonds at the top of the market. As interest rates rose higher and bond prices declined, SVB started taking major losses on their long-term bond holdings.

Losses Fueling a Liquidity Crunch

When SVB reported its fourth quarter results in early 2023, Moody’s Investor Service, a credit rating agency took notice. In early March, it said that SVB was at high risk for a downgrade due to its significant unrealized losses. In response, SVB looked to sell $2 billion of its investments at a loss to help boost liquidity for its struggling balance sheet. Soon, more hedge funds and venture investors realized SVB could be on thin ice. Depositors withdrew funds in droves, spurring a liquidity squeeze and prompting California regulators and the FDIC to step in and shut down the bank.

What Happens Now?

While much of SVB’s activity was focused on the tech sector, the bank’s shocking collapse has rattled a financial sector that is already on edge.

The four biggest U.S. banks lost a combined $52 billion the day before the SVB collapse. On Friday, other banking stocks saw double-digit drops, including Signature Bank (-23%), First Republic (-15%), and Silvergate Capital (-11%).

Source: Morningstar Direct. *Represents March 9 data, trading halted on March 10.

When the dust settles, it’s hard to predict the ripple effects that will emerge from this dramatic event. For investors, the Secretary of the Treasury Janet Yellen announced confidence in the banking system remaining resilient, noting that regulators have the proper tools in response to the issue.

But others have seen trouble brewing as far back as 2020 (or earlier) when commercial banking assets were skyrocketing and banks were buying bonds when rates were low.