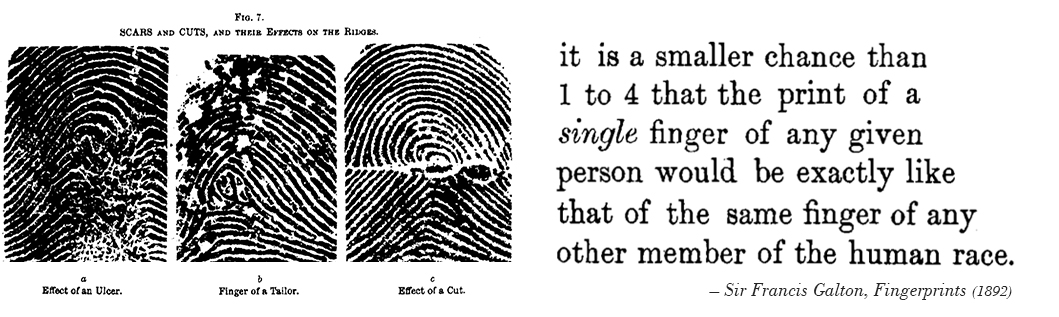

Modern biometrics can seem like science fiction, but the concept is far from new. Sir Francis Galton, cousin of the famous Charles Darwin, used an analysis of over 8,000 fingerprint samples to publish what would become the first fingerprint classification system in history.

Source Building on the work of Sir Francis Galton, the Metropolitan Police of London used shapes like whorls and loops identify individuals based on fingerprint patterns at the beginning of the 20th century. The resulting Henry Classification System is so effective, it’s still the foundation for the most common form of biometrics used around the world today – the Automated Fingerprint Identification System (AFIS). Today’s infographic, from Computer Science Zone, covers biometric security from a number of angles, from current use cases to the ways people are outsmarting existing security measures.

Biometric Security 101

There are three possible ways of proving one’s identity:

Using something you possess (e.g. keys, badge, documentation) Using something you know (e.g. password, code, security question) Using an intrinsic identifying feature (e.g. fingerprint, face)

Biometrics are an example of the third type, using biological measurements to identify individuals. Typically, these measurements are derived from physical characteristics, such as irises, fingerprints, facial features, or even a person’s voice. When used in a security application, biometrics are theoretically more secure than traditional passwords since detailed physical characteristics are unique to each person.

Augmenting Passwords

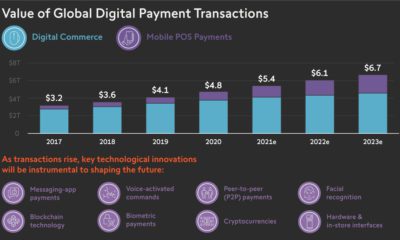

By now, we’re all well aware that solely using text passwords leaves our information at risk. Even in 2019, the top passwords are still “123456” and “password”. Passwords are still the default method of accessing accounts though, so a process called two-factor authentication was introduced to add a new layer of security. The most common type of two-factor authentication involves sending an email or text message to help ensure that only the rightful owner of an account can log in. Increasingly though, biometric security measures are replacing one or both of those steps. Apple’s introduction of a fingerprint scanner in the iPhone 5S was a high-profile example of biometrics moving into widely available consumer products. Today, every new smartphone on the market has some sort of biometric feature.

The Internet of Faces

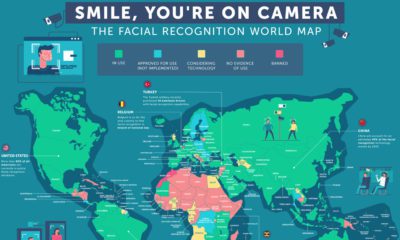

Today, the majority of consumers are now comfortable with using fingerprint recognition to access their device, but they’re still skeptical about facial recognition — only 14% of people prefer using that method to access their device. Soon, however, they may not have a choice. Consumer technology is bullish on facial recognition, and government entities are happy to come along for the ride. Correctly and efficiently identifying citizens has always proved a struggle for law enforcement, border control, airport security, and other highly regulated systems, so facial recognition is a very appealing option to quickly and cheaply identify people at scale. One real world example is the Schengen Entry-Exit System, which will use a mix of fingerprint and facial recognition to alleviate security bottlenecks at European airports. In China, a new rule that went into effect across the country making the submission of facial recognition scans a prerequisite for registering a new SIM card — just one of the ways China is populating its biometric database. Of course, the trade-off is a loss of privacy as that technology spills over from airport security into public spaces. According to a recent study, facial recognition accuracy jumped 20x between 2013 and 2018. Just 0.2% of searches, in a database of of over 26 million photos, failed to match the correct image.

Peering into the Digital Reflection

Another aspect of biometric security looks beyond physical features, and instead relies on changes in behavioral patterns to detect fraud or unauthorized access. Money laundering and fraud cost the global economy upwards of $2 trillion per year, so financial institutions in particular have a big incentive to invest in early fraud detection. To this end, behavioral biometrics is proving to be an effective way of detecting suspicious login attempts earlier and flagging transfers that deviate from expected patterns.

Growing Pains

Biometric security in consumer products is still in its early stages, so the technology is far from bulletproof. There have been several examples of fooling systems, from fingerprint cloning to using masks to unlock devices. As with any security measure, there will continue to an arms race between companies and hackers looking to slip past defenses. Another issue raised by increasing biometric use is in the realm of privacy. Critics of biometrics point out that iris scans and FaceID don’t enjoy the same protection from law enforcement as a traditional password. Because a defendant would have to say something, text passwords fall under the protection of the Fifth Amendment, while biometric locks do not. This is a debate that will continue to rage on as consumer products continue to implement biometrics. In the meantime, our physical attributes will increasingly become our key to the digital world. on But fast forward to the end of last week, and SVB was shuttered by regulators after a panic-induced bank run. So, how exactly did this happen? We dig in below.

Road to a Bank Run

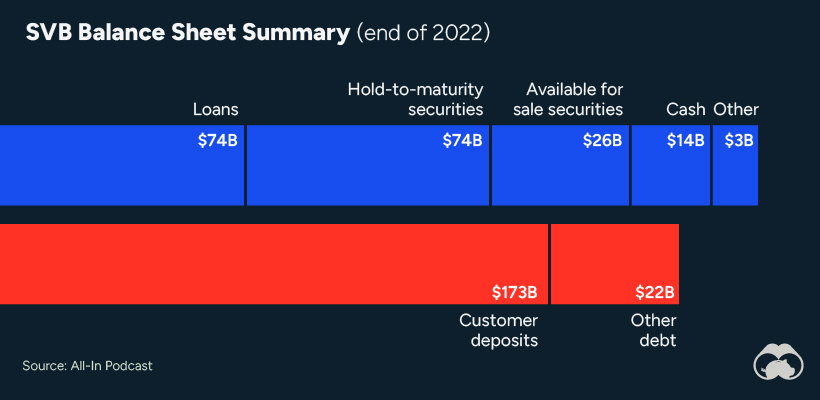

SVB and its customers generally thrived during the low interest rate era, but as rates rose, SVB found itself more exposed to risk than a typical bank. Even so, at the end of 2022, the bank’s balance sheet showed no cause for alarm.

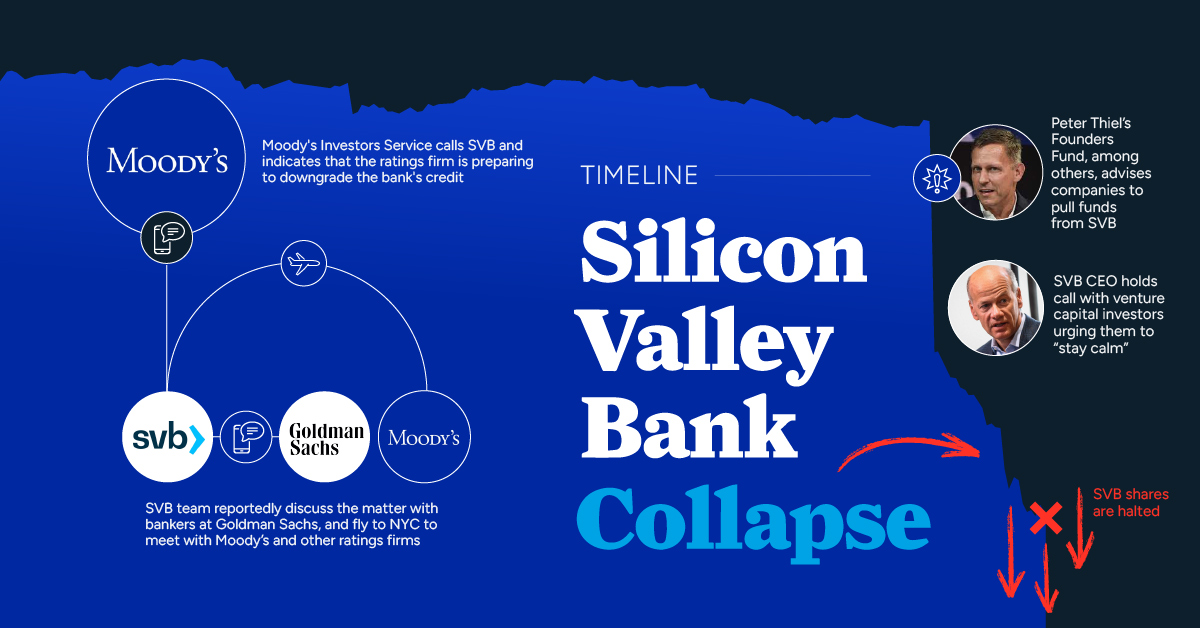

As well, the bank was viewed positively in a number of places. Most Wall Street analyst ratings were overwhelmingly positive on the bank’s stock, and Forbes had just added the bank to its Financial All-Stars list. Outward signs of trouble emerged on Wednesday, March 8th, when SVB surprised investors with news that the bank needed to raise more than $2 billion to shore up its balance sheet. The reaction from prominent venture capitalists was not positive, with Coatue Management, Union Square Ventures, and Peter Thiel’s Founders Fund moving to limit exposure to the 40-year-old bank. The influence of these firms is believed to have added fuel to the fire, and a bank run ensued. Also influencing decision making was the fact that SVB had the highest percentage of uninsured domestic deposits of all big banks. These totaled nearly $152 billion, or about 97% of all deposits. By the end of the day, customers had tried to withdraw $42 billion in deposits.

What Triggered the SVB Collapse?

While the collapse of SVB took place over the course of 44 hours, its roots trace back to the early pandemic years. In 2021, U.S. venture capital-backed companies raised a record $330 billion—double the amount seen in 2020. At the time, interest rates were at rock-bottom levels to help buoy the economy. Matt Levine sums up the situation well: “When interest rates are low everywhere, a dollar in 20 years is about as good as a dollar today, so a startup whose business model is “we will lose money for a decade building artificial intelligence, and then rake in lots of money in the far future” sounds pretty good. When interest rates are higher, a dollar today is better than a dollar tomorrow, so investors want cash flows. When interest rates were low for a long time, and suddenly become high, all the money that was rushing to your customers is suddenly cut off.” Source: Pitchbook Why is this important? During this time, SVB received billions of dollars from these venture-backed clients. In one year alone, their deposits increased 100%. They took these funds and invested them in longer-term bonds. As a result, this created a dangerous trap as the company expected rates would remain low. During this time, SVB invested in bonds at the top of the market. As interest rates rose higher and bond prices declined, SVB started taking major losses on their long-term bond holdings.

Losses Fueling a Liquidity Crunch

When SVB reported its fourth quarter results in early 2023, Moody’s Investor Service, a credit rating agency took notice. In early March, it said that SVB was at high risk for a downgrade due to its significant unrealized losses. In response, SVB looked to sell $2 billion of its investments at a loss to help boost liquidity for its struggling balance sheet. Soon, more hedge funds and venture investors realized SVB could be on thin ice. Depositors withdrew funds in droves, spurring a liquidity squeeze and prompting California regulators and the FDIC to step in and shut down the bank.

What Happens Now?

While much of SVB’s activity was focused on the tech sector, the bank’s shocking collapse has rattled a financial sector that is already on edge.

The four biggest U.S. banks lost a combined $52 billion the day before the SVB collapse. On Friday, other banking stocks saw double-digit drops, including Signature Bank (-23%), First Republic (-15%), and Silvergate Capital (-11%).

Source: Morningstar Direct. *Represents March 9 data, trading halted on March 10.

When the dust settles, it’s hard to predict the ripple effects that will emerge from this dramatic event. For investors, the Secretary of the Treasury Janet Yellen announced confidence in the banking system remaining resilient, noting that regulators have the proper tools in response to the issue.

But others have seen trouble brewing as far back as 2020 (or earlier) when commercial banking assets were skyrocketing and banks were buying bonds when rates were low.