As the electric vehicle market continues to expand, having enough EV charging stations is essential to enable longer driving ranges and lower wait times at chargers. Currently, the U.S. has about 140,000 public EV chargers distributed across almost 53,000 charging stations, which are still far outnumbered by the 145,000 gas fueling stations in the country. This graphic maps out EV charging stations across the U.S. using data from the National Renewable Energy Lab. The map has interactive features when viewed on desktop, showing pricing structures and the connector types when hovering over a charging station, along with filtering options.

Which States Lead in EV Charging Infrastructure?

As seen in the map above, most electric vehicle charging stations in the U.S. are located on the west and east coasts of the nation, while the Midwest strip is fairly barren aside from the state of Colorado. California has the highest number of EV charging stations at 15,182, making up an impressive 29% of all charging stations in America. In fact, the Golden State has nearly double the chargers of the following three states, New York (3,085), Florida (2,858), and Texas (2,419) combined. It’s no surprise the four top states by GDP have the highest number of EV chargers, and California’s significant lead is also unsurprising considering its ambition to completely phase out the sale of new gas vehicles by 2035.

The Best States for EV Charging Speeds and Cost

While having many charging stations distributed across a state is important, two other factors determine charging convenience: cost and charger level availability. EV charger pricing structures and charger level availability across the nation are a Wild West with no set rules and few clear expectations.

Finding Free Electric Vehicle Chargers Across States

Generous electric vehicle charging locations will offer unlimited free charging or a time cap between 30 minutes and 4 hours of free charging before payment is required. Some EV charging stations located in parking structures simply require a parking fee, while others might have a flat charging fee per session, charge by kWh consumed, or have an hourly rate. While California leads in terms of the raw amount of free chargers available in the state, it’s actually the second-worst in the top 10 states when it comes to the share of chargers, at only 11% of them free for 30 minutes or more. Meanwhile, Maryland leads with almost 30% of the chargers in the state that offer a minimum of 30 minutes of free charging. On the other hand, Massachusetts is the stingiest state of the top 10, with only 6% of charging stations (150 total) in the state offering free charging for electric vehicle drivers.

The States with the Best DC Fast Charger Availability

While free EV chargers are great, having access to fast chargers can matter just as much, depending on how much you value your time. Most EV drivers across the U.S. will have access to level 2 chargers, with more than 86% of charging stations in the country having level 2 chargers available. Although level 2 charging (4-10 hours from empty to full charge) beats the snail’s pace of level 1 charging (40-50 hours from empty to full charge), between busy schedules and many charging stations that are only free for the first 30 minutes, DC fast charger availability is almost a necessity. Direct current fast chargers can charge an electric vehicle from empty to 80% in 20-60 minutes but are only available at 12% of America’s EV charging stations today. Just like free stations, Maryland leads the top 10 states in having the highest share of DC fast chargers at 16%. While Massachusetts was the worst state for DC charger availability at 6%, the state of New York was second worst at 8% despite its large number of chargers overall. All other states in the top 10 have DC chargers available in at least one in 10 charging stations. As for the holy grail of charging stations, with free charging and DC fast charger availability, almost 1% of the country’s charging stations are there. So if you’re hoping for free and DC fast charging, the chances in most states are around one in 100.

The Future of America’s EV Charging Infrastructure

As America works towards Biden’s goal of having half of all new vehicles sold in 2030 be zero-emissions vehicles (battery electric, plug-in hybrid electric, or fuel cell electric), charging infrastructure across the nation is essential in improving accessibility and convenience for drivers. The Biden administration has given early approval to 35 states’ EV infrastructure plans, granting them access to $900 million in funding as part of the $5 billion National Electric Vehicle Infrastructure (NEVI) Formula Program set to be distributed over the next five years. Along with this program, a $2.5 billion Discretionary Grant Program aims to increase EV charging access in rural, undeserved, and overburdened communities, along with the Inflation Reduction Act’s $3 billion dedicated to supporting access to EV charging for economically disadvantaged communities. With more than $10 billion being invested into EV charging infrastructure over the next five years and more than half the sum focused on communities with poor current access, charger availability across America is set to continue improving in the coming years. on Keeping track of which companies have adopted these technologies can be difficult. Thankfully, the EPA’s 2022 Automotive Trends Report includes data that shows which automakers have adopted what technologies.

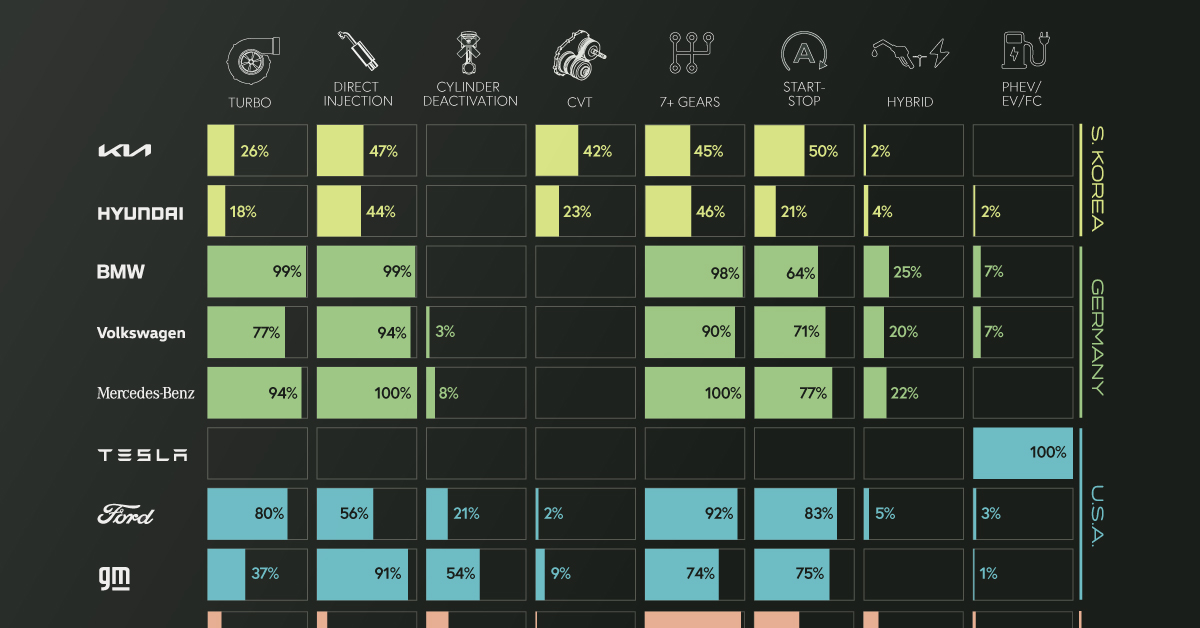

Understanding the Data

The percentages in this infographic show how 14 major automakers have adopted various fuel-saving technologies into their lineups. The report did not specify if this data is for North American models only. There are several geographical trends hidden within this dataset. To make them more obvious, we color-coded the 14 automakers by their nationality.

Asian Automakers

Starting from the top of the graphic, we can see that Japanese automakers are big proponents of gasoline direct injection (GDI) engines, as well as continuously variable transmissions (CVT). With a GDI engine, fuel is injected directly into the combustion chamber at high pressure. This is more precise than the traditional method known as port injection, which results in greater fuel efficiency and lower emissions. CVT transmissions use pulleys instead of gears to improve fuel efficiency. CVTs are best paired with smaller, lower output engines, which may explain why Japanese automakers (who have a history of building smaller cars) have adopted them so widely. Note that Toyota is listed as having 0% adoption of direct injection, but this isn’t exactly true. The automaker uses its D4-S system, which is a combination of both port and direct fuel injection. South Korean automakers, on the other hand, have a more balanced technology profile, adopting a wider number of technologies, but each to a lesser degree.

German Automakers

German automakers are well-known for their expertise in building combustion engines, so it’s no surprise they use turbocharging and direct injection in nearly every model. They’ve also heavily adopted high gear-count transmissions (7 or more gears), which can not only enable better fuel efficiency, but also faster acceleration. The downside to these transmissions is that they can be very heavy and complex. Furthermore, German automakers utilize the auto start-stop feature in many of their vehicles, and are tied with Toyota in terms of hybrid adoption.

American & Other Automakers

Ford and GM’s technology profile is similar to the Germans, using turbocharging and direct injection combined with 7+ gear transmissions. GM uses turbocharging less frequently, but stands out with its high usage of cylinder deactivation technology, at 54% of models. Referred to by GM as Active Fuel Management (AFM), this feature shuts down half of the engine’s cylinders during light driving. GM is known for its small-block V8 engines, which can be had in many of the company’s models. Given the high cylinder count of a V8, AFM is a clever trick for improving fuel efficiency. Stellantis, which is a merger between Italian-American Fiat Chrysler and French Peugeot, has not widely adopted many technologies except for the 7+ gear transmission. Finally there’s Tesla, which does not use any of the aforementioned technologies due to it being a pure electric automaker.

Going The Way of the Dinosaur

The technologies shown in this infographic have helped to bring the average mpg of a new car to record highs in recent years. Many of these innovations could become obsolete as automakers slowly phase out gasoline engines. In 2021, six major automakers including Ford, Mercedes-Benz, and GM pledged to phase out the sale of new gasoline and diesel-powered cars by 2040. Other companies such as Porsche believe that the combustion engine still has a future, pointing to synthetic fuels as a means of significantly reducing CO2 emissions.