And in 2014, when oil prices crashed and burned, the tide was gone – and it was shown that too many countries were relying on frothy oil revenues to balance out their trade deficits.

A Lingering Crisis

Fast forward to today, and low oil prices are still causing big problems for many countries. The above interactive visualization from the Council of Foreign Relations shows how the world economies most reliant on oil exports have fared since the 2014 crash. The end results are not pretty – and even in 2016, there were 18 economies that had breakeven prices (based on spending on imports) that were above the average oil price for the year: The oil price crash made many oil-reliant economies more fragile, and this fragility can be triggered in different ways. One interesting case study is Venezuela, which is currently embroiled in an ongoing economic, currency, and humanitarian crisis.

Bad Timing for Maduro

During the Hugo Chávez era, sky-high oil prices enabled fiscal and trade policies that subsidized Venezuelan life in many ways. That all changed in 2014, which was only one year after Nicolás Maduro took office. Despite having largely the same policies as his predecessor, low oil prices have hammered the Venezuelan economy. Even with today’s prices, oil generates an estimated 95% of export revenues for the country. This has resulted in a disaster for the socialist nation, and Venezuela is now stuck with shortages in essential goods, crushing unemployment, a contracting economy, skyrocketing crime and murder rates, and even widespread malnutrition. At the root of much of this, arguably, is an uncontrollable cycle of hyperinflation:

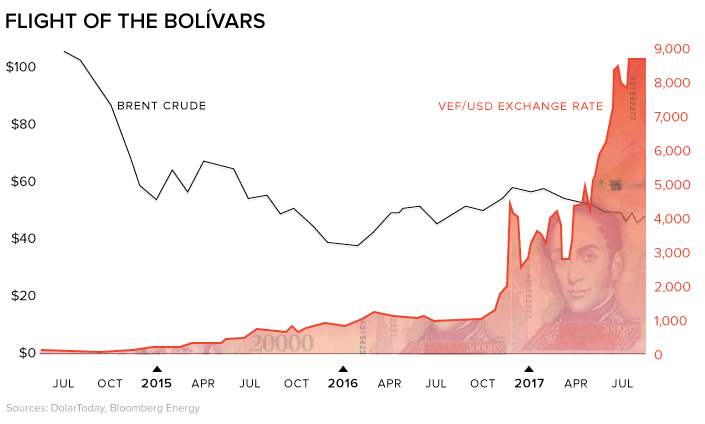

With an economy that is a runaway train, the government prints more and more cash to try to maintain the status quo. This almost never works, and last year it even led us to publish a chart comparing Venezuelan hyperinflation with that of Weimar Germany. According to DolarToday.com, a website that tracks the black market rate for Venezuelan currency, it takes 8,470 bolívars to buy US$1 today. Right before the oil crash this was closer to 65 bolívars.

A Lost Cause

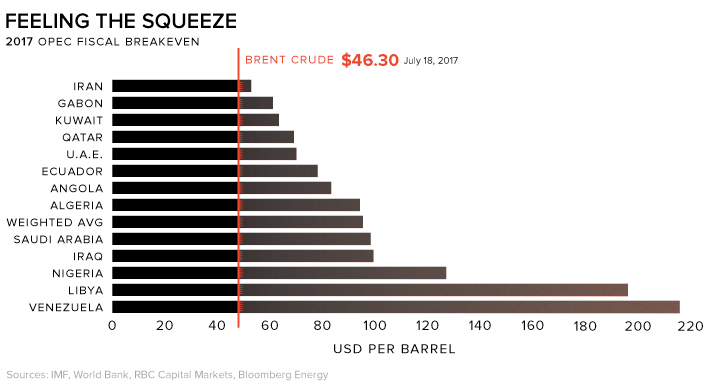

While many oil dependent nations are working to diversify or ride out low oil prices in other ways, it seems unlikely that the crisis in Venezuela will be reversed anytime soon. Here’s the full fiscal breakeven needed by OPEC producers, including Venezuela, to help normalize things:

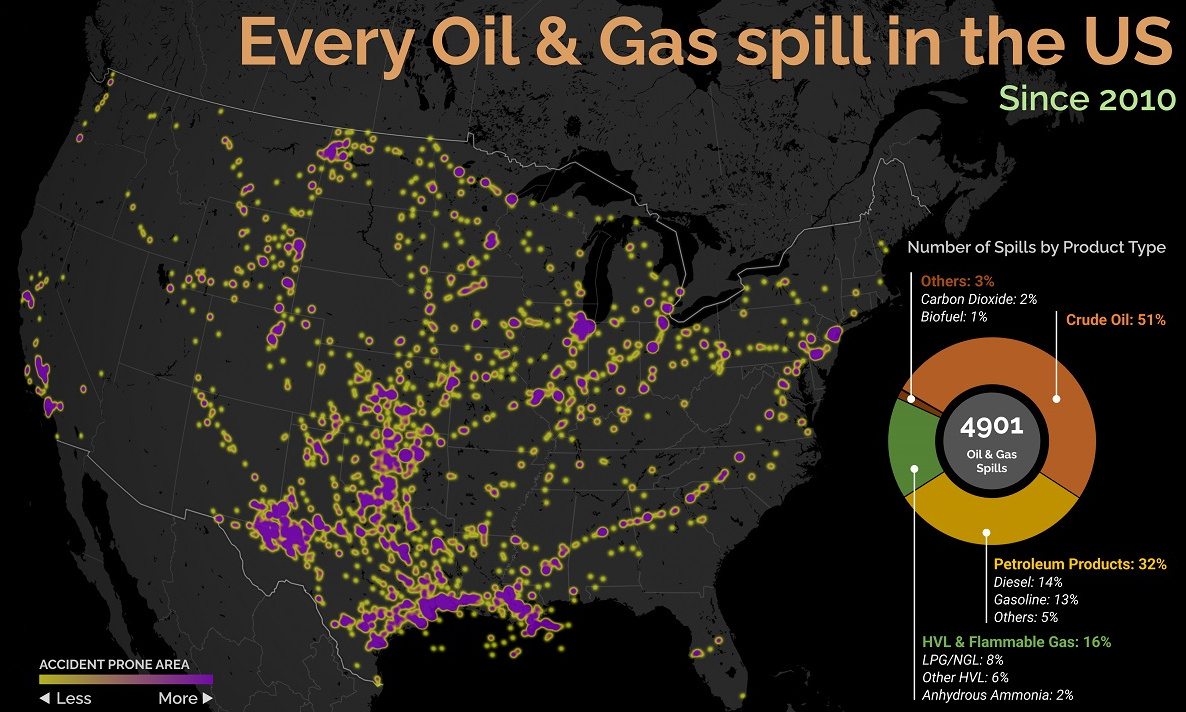

on Aside from the obvious climate impact they bring, one other downside in particular is spills, which can lead to ecological and economic damage. These can happen due to pipeline leaks, train derailments, or other industrial disasters. This graphic from Preyash Shah provides a visual overview of every oil and gas spill in the contiguous U.S. since 2010. Data is tracked by the U.S. government’s Pipeline and Hazardous Materials Safety Administration (PHMSA).

U.S. Oil and Gas Spills (2010‒2022)

The majority of spills that have occurred come mostly from crude oil, followed by petroleum products and gas. Note that this data covers the quantity of spills and not damages or volume.

Crude oil, which makes up just over half of documented spills, is also one of the most costly. Contaminations can persist for years after a spill, and its impact on local mammals and waterfowl is particularly harsh. This has been the case with the Deepwater Horizon spill (also known as the “BP oil spill”), which experts say is still causing harm in the Gulf of Mexico. Other products with lots of spills include petroleum products such as diesel or gasoline, as well as liquefied natural gas or other volatile liquids. Interestingly, liquefied carbon dioxide can also be transported in pipelines, commonly used for carbon capture storage, but requires high pressure to maintain its state. When looking at the location of spills, it’s clear that the South Central states have experienced the highest number of disasters. In contrast, the West Coast has had substantially less activity. However, this makes much more sense when looking at the dominant oil producing states, where Texas and surrounding neighbors reign supreme. Of the 4,901 spills during this period, Texas accounts for 1,936 or roughly 40% of all oil and gas spills. This is followed by Oklahoma, which has had 407 spills and is one of the largest net exporters of oil and gas in the country.

What Causes Spills?

Oil and gas spills actually have a surprisingly long history, with one of the earliest dating back to 1889, when a spill was reported on the coast between Los Angeles and San Diego. Causes have consisted primarily of weather, natural disasters, equipment and technological malfunction, as well as human error. However, they only became a widespread problem around the halfway mark of the 20th century, when petroleum extraction and production really began to take off. This era also saw the emergence of supertankers, which can transport half a million tons of oil but therefore make the risk of spills even costlier. In fact, the biggest spill off U.S. waters after the Deepwater Horizon disaster is the 1989 Exxon Valdez spill in Alaska, when a tanker crashed into a reef and 11 million gallons of oil spilled into the Pacific Ocean.