Almost overnight, foot traffic in physical stores disappeared, and supply chains were left scrambled. Now at a major fork in the road, many retailers are forced to make tough decisions that were completely unforeseen. While some global retail giants are laying down their weapons and filing for bankruptcy, others are innovating to save themselves, serving their customers in new and unexpected ways. Today’s graphic uses data from Kantar’s Brand Z™ report to illustrate the retailers that are growing through adversity, and those that may struggle to survive. Editor’s note: The report compares brand value of the top 75 retailers globally between 2020 and 2019, using mid-April as a cut-off date for incorporating latest financial information. Some early effects of the pandemic are incorporated in these calculations, but the pandemic’s impact on retail going forward is uncertain.

Retailers Rising to the Top

The calculation of brand value refers to the total amount that a brand contributes to the overall business value of the parent company. In this case, it is measured by taking the financial value of a brand (latest data as of mid-April), and multiplying it by the brand’s contribution, or the ability of the brand to deliver value to the company by predisposing consumers to choose the brand over others or pay more for it, based purely on perceptions. Based on these metrics, activewear brand lululemon is the world’s fastest growing retail brand for the second year running. Famous for its culture of accountability and global community events, the brand has struck the perfect balance between a seamless online and offline experience. Explore the 10 fastest growing retail brands of 2020 below: Interestingly, Walmart holds three spots in the ranking as it also owns Flipkart and Sam’s Club. Moreover, the American retail giant purchased a stake in Chinese e-commerce platform JD.com, which has grown from 5% to 12%. The two brands entered the strategic partnership together with the goal of dominating the Chinese market and surpassing Alibaba.

The Recipe for Retail Success

While every retailer has a unique growth strategy, according to the authors of the report, there are three factors that are undeniably crucial for success.

Value: Offering value for money through fair pricing for all products or services. Uniqueness: Having a clear purpose and standing for something that consumers find meaningful. Premium: Being perceived as being worth more than the price consumers pay.

Further, research also suggests that successful brands dominate their respective category when it comes to brand awareness and consistently provide experiences that enrich their customers’ lives, as demonstrated by lululemon. As retailers continue to shift their focus towards digital transformation, consumers are still finding great value in having the best of both worlds when it comes to combining e-commerce and brick-and-mortar, otherwise known as “brick and click”.

Retailers Struggling to Stay Relevant

Unfortunately, there are several brands that haven’t yet mastered this winning combination, and the ruthless pandemic economy has only emphasized their struggles. Here are the 10 fastest declining retail brands of 2020: Under Armour’s distribution relies heavily on third party retailers and department stores, so the brand has understandably been negatively impacted by the mass store closures. While the brand focuses on expanding its personalized and connected fitness product offerings, it faces huge pressure from powerful competitors such as Nike and Adidas who already dominate this space.

A Rising Tide Lifts All Shipments

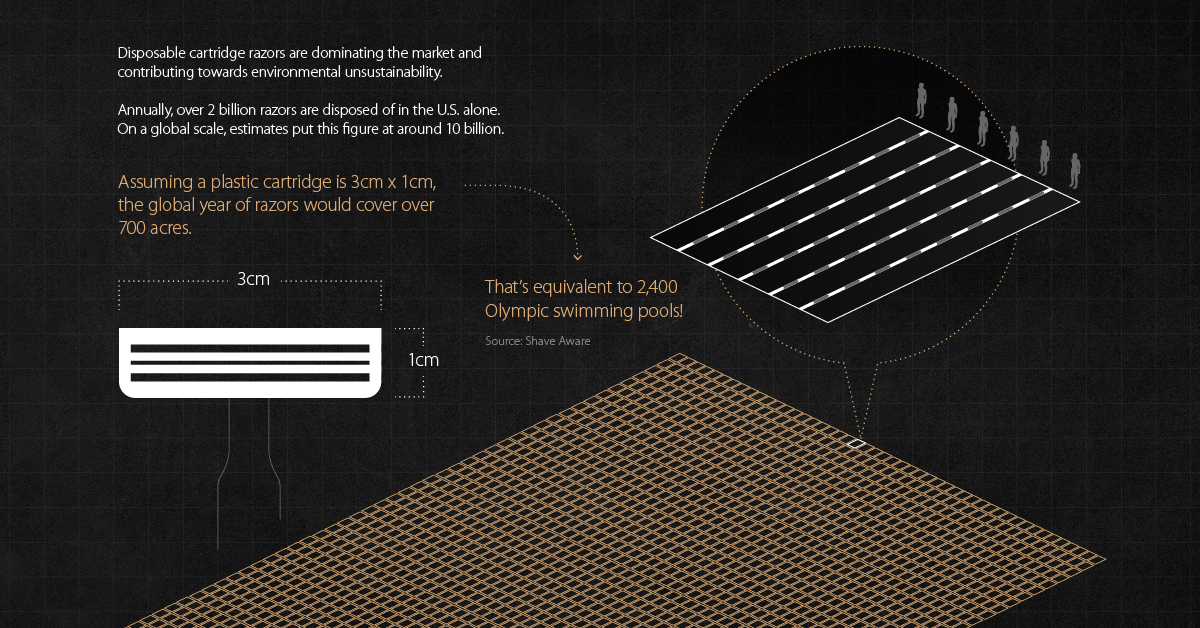

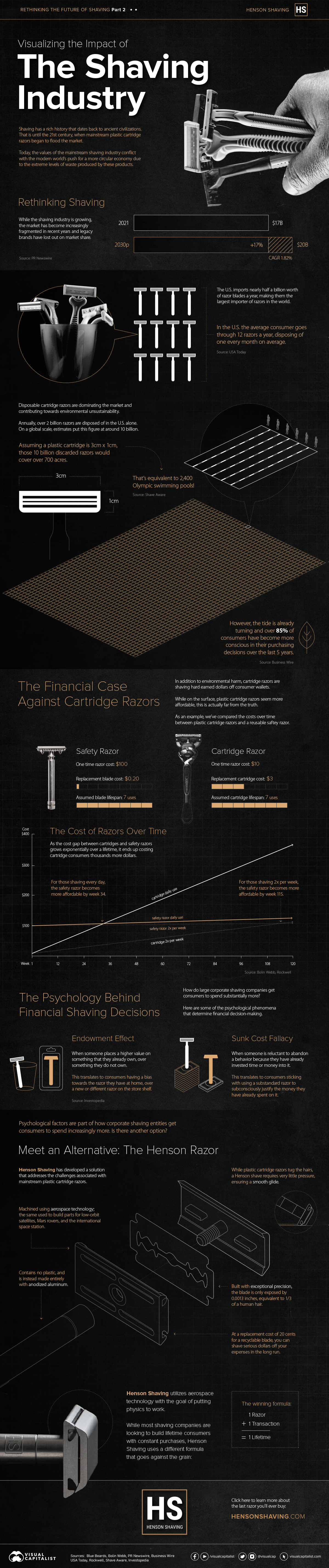

2020 has instigated a retail renaissance of epic proportions through accelerated digitization and changing consumer values. Ultimately, some brands will be better positioned than others to benefit from these changes. As retailers begin reopening for business, they are presented with an opportunity to recalibrate the current retail landscape by setting new standards for the industry. on This graphic from Henson Shaving shows how mainstream plastic cartridge razors conflict with expectations of the modern world by being huge contributors to pollution. The data also suggests that consumers could significantly benefit from switching over to using a safety razor. Let’s dive in.

Rethinking Shaving

The shaving industry is dominated by several corporate entities that rake in billions of dollars every year. In fact, the majority of razors on the market today are optimized for profit rather than sustainability and affordability. The industry was worth $17 billion in 2021 and is poised to grow by 17%, reaching $20 billion by 2030. Within this large market, the U.S. is a key player. The country imports over half a billion razors a year—more than any other country. Overall, U.S. shavers go through 2 billion razors a year, which is roughly 12 per consumer on average. How much waste does this create? As it turns out, quite a lot. The 2 billion razors discarded annually cover an area of 700 acres—assuming the average disposable cartridge razor (without a handle) has a dimension of about 3 cm by 1 cm. To put that into context, that’s 2,400 Olympic sized swimming pools.

The Financial Case Against Cartridge Razors

The other inefficiency involves consumer wallets. While on the surface disposable cartridge razors seem more affordable, this is far from the truth. While cartridge razors have a cheaper cost up front, they become more expensive incrementally over time. In fact, most consumers do not detect this, but they may actually end up paying 5-10 times more than safety razors over their lifetime. On the other hand, safety razors require a larger upfront investment, but become progressively cheaper over the months and years. How is this possible? A cartridge razor costs between $2-4 in most markets, while a safety razor blade is a fraction of that at around 10-20 cents. What’s more, both typically last last for an average of 7 shaves. We can better understand the total cost of ownership associated with shaving by looking at the costs over a few years. Eventually, daily shavers see safety razors become cheaper at the 35th week, while those who shave twice a week recognize the savings around week 115. But given people spend an average of 3,000 hours in a lifetime shaving, the compounding effect translates into huge cost savings for the consumer no matter how often they shave.

The Psychology Behind Financial Shaving Decisions

There are several psychological phenomena at play that shape the financial decision making behind shaving. First the endowment effect, which is when consumers place a higher perceived value on an item they own, over something they don’t. The endowment effect states that we assign a positive psychological bias to our possessions. For shaving, this means consumers are more likely to have a positive view towards their own razor over alternatives. Next, is the sunk cost fallacy, which suggests that people are reluctant to abandon a behavior if they have already invested time or money into it. For shavers, this may mean sticking to a substandard shaving method or product because time or money has been spent acquiring the item, thus making us reluctant to change and accept potentially better ways. These psychological factors are part of how the large corporate shaving companies build profitable lifetime consumers—but it’s time for change.

Meet an Alternative: The Henson Razor

There’s evidence to suggest the modern day cartridge razors can lead to suboptimal outcomes for your wallet and the environment at large. The Henson razor addresses these challenges head on.

Made with anodized aluminum, contains zero plastic.Machined using aerospace technology.Exceptional precision, blades exposed to .0013 inches, equivalent to 1/3 of a human hair.Affordably priced, replacement blades cost 10-20 cents.

Henson Shaving is going against the grain by selling one razor for one consumer to last a lifetime.

Learn more about the last razor you’ll ever buy with Henson Shaving.