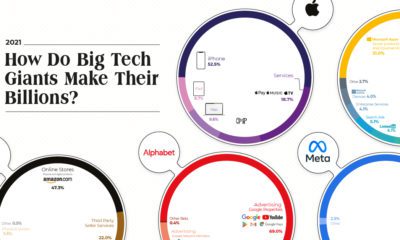

Nintendo Switch is the most searched product keyword, with approximately one million monthly searches. This makes sense, considering the console’s recent surge in popularity—in March 2020, U.S. sales of the Nintendo Switch more than doubled compared to a year prior. Here’s a look at the full ranking of all product keywords, by monthly search volume: Two different Apple products make the top 10—Airpods and iPad. It’s interesting that Airpods and iPads have their own search term distinctive from their broader categories (wireless headphones and tablets), demonstrating Apple’s strong brand recognition in America. Of course, Apple is also dominant in the personal tech market more broadly. For instance, iPhones make up 46% of the U.S. smartphone market by number of devices sold. Like the U.S. top searches, Nintendo Switch comes in at number one worldwide, with over 2 million approximate monthly searches. Interestingly, three different Apple products appear in the top 10 global searches—Airpods, iPad, and iPhone. Additionally, a couple of older iPhone models make the overall ranking—iPhone 7 comes in at 21st place, and iPhone 8 takes the 28th spot. On the U.S. list, these older iPhone models don’t even make the top 100.

Keyword Category Rankings

When it comes to top-ranking keywords, the electronics category appears to be the most important to Americans. Over half the U.S. top product searches fall under electronics, with the home category in second place. Here’s a look at the full U.S. category breakdown:

Interestingly, when comparing the order of categories in the U.S versus worldwide, the sections remain mostly the same: Like the U.S., electronics comes in at number one worldwide. However, it’s an even larger portion for the global ranking—70 keyword searches on the global list are for electronics. The home category is more popular in the U.S. than across the globe, with 22 in the U.S. versus 12 worldwide. In America, air fryer is the most popular keyword search under this section—possibly because people were looking for a quick way to make their meals while they were busy playing Animal Crossing on their Switches. The second most popular U.S. keyword under the home category is toilet paper. Considering the toilet paper shortages in the spring of 2020, this makes sense, as stores began limiting the number of rolls a person could purchase.

What Will 2021 Bring?

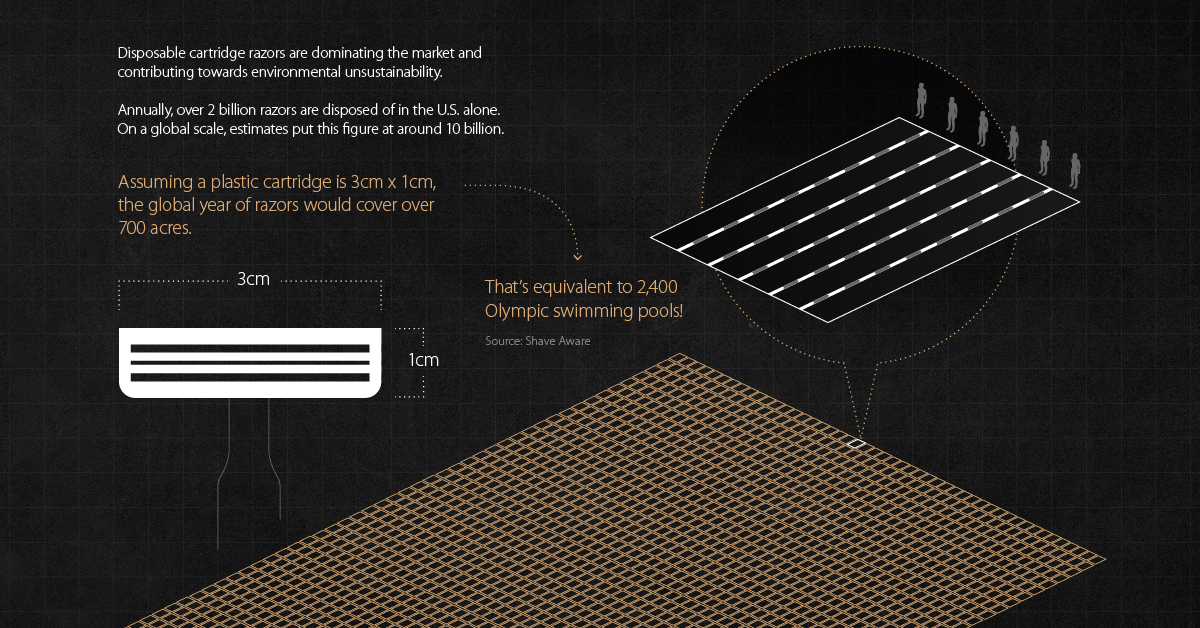

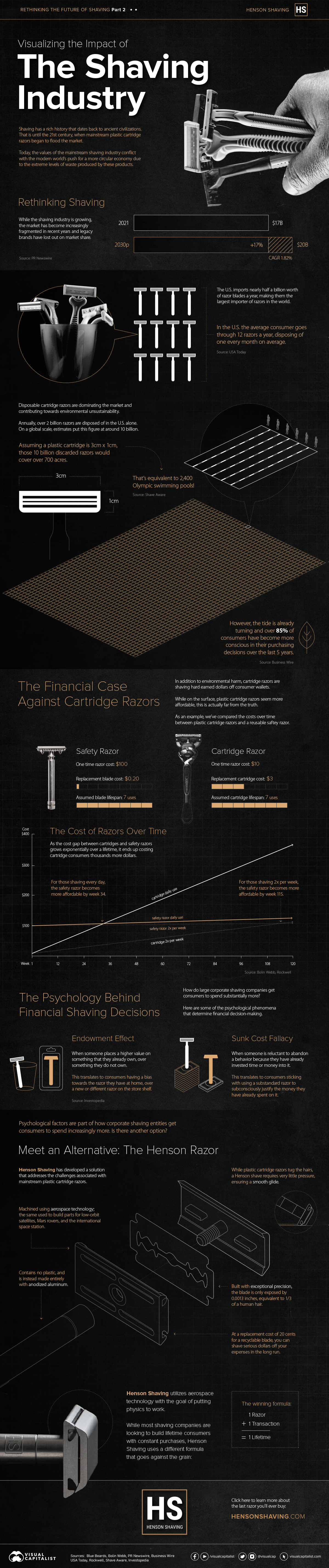

However, the specific electronics they’re searching for (such as iPhones and Nintendo Switches), helps to provide some context around the products people are interested in, as well as the particular brands that are currently on everyone’s radar. Will the Switch get switched out of the top spot in 2021? Because electronics tend to update so frequently, it’s very possible. on This graphic from Henson Shaving shows how mainstream plastic cartridge razors conflict with expectations of the modern world by being huge contributors to pollution. The data also suggests that consumers could significantly benefit from switching over to using a safety razor. Let’s dive in.

Rethinking Shaving

The shaving industry is dominated by several corporate entities that rake in billions of dollars every year. In fact, the majority of razors on the market today are optimized for profit rather than sustainability and affordability. The industry was worth $17 billion in 2021 and is poised to grow by 17%, reaching $20 billion by 2030. Within this large market, the U.S. is a key player. The country imports over half a billion razors a year—more than any other country. Overall, U.S. shavers go through 2 billion razors a year, which is roughly 12 per consumer on average. How much waste does this create? As it turns out, quite a lot. The 2 billion razors discarded annually cover an area of 700 acres—assuming the average disposable cartridge razor (without a handle) has a dimension of about 3 cm by 1 cm. To put that into context, that’s 2,400 Olympic sized swimming pools.

The Financial Case Against Cartridge Razors

The other inefficiency involves consumer wallets. While on the surface disposable cartridge razors seem more affordable, this is far from the truth. While cartridge razors have a cheaper cost up front, they become more expensive incrementally over time. In fact, most consumers do not detect this, but they may actually end up paying 5-10 times more than safety razors over their lifetime. On the other hand, safety razors require a larger upfront investment, but become progressively cheaper over the months and years. How is this possible? A cartridge razor costs between $2-4 in most markets, while a safety razor blade is a fraction of that at around 10-20 cents. What’s more, both typically last last for an average of 7 shaves. We can better understand the total cost of ownership associated with shaving by looking at the costs over a few years. Eventually, daily shavers see safety razors become cheaper at the 35th week, while those who shave twice a week recognize the savings around week 115. But given people spend an average of 3,000 hours in a lifetime shaving, the compounding effect translates into huge cost savings for the consumer no matter how often they shave.

The Psychology Behind Financial Shaving Decisions

There are several psychological phenomena at play that shape the financial decision making behind shaving. First the endowment effect, which is when consumers place a higher perceived value on an item they own, over something they don’t. The endowment effect states that we assign a positive psychological bias to our possessions. For shaving, this means consumers are more likely to have a positive view towards their own razor over alternatives. Next, is the sunk cost fallacy, which suggests that people are reluctant to abandon a behavior if they have already invested time or money into it. For shavers, this may mean sticking to a substandard shaving method or product because time or money has been spent acquiring the item, thus making us reluctant to change and accept potentially better ways. These psychological factors are part of how the large corporate shaving companies build profitable lifetime consumers—but it’s time for change.

Meet an Alternative: The Henson Razor

There’s evidence to suggest the modern day cartridge razors can lead to suboptimal outcomes for your wallet and the environment at large. The Henson razor addresses these challenges head on.

Made with anodized aluminum, contains zero plastic.Machined using aerospace technology.Exceptional precision, blades exposed to .0013 inches, equivalent to 1/3 of a human hair.Affordably priced, replacement blades cost 10-20 cents.

Henson Shaving is going against the grain by selling one razor for one consumer to last a lifetime.

Learn more about the last razor you’ll ever buy with Henson Shaving.