Yet, while social media’s audience is widespread and diverse, just a handful of companies control a majority of the world’s most popular social media platforms. Meta, the tech giant formerly known as Facebook, owns four of the five most widely used platforms. This graphic highlights the biggest social networks across the globe, measured by their monthly active users (MAUs). Note: We’ll be using terms like “social network” and “social platform” interchangeably to refer to various messaging, video, and image-sharing platforms that have social attributes built in.

Top Social Platforms by Monthly Active Users

To measure each platform’s MAUs, we dug into various sources, including the most recent company SEC filings, and quarterly earnings reports. A majority of Meta’s user base comes from its most popular platform, Facebook—the social media giant currently has around 2.9 billion MAUs worldwide. Where in the world are Facebook users located? The platform’s biggest user base comes from India, with an audience size of almost 350 million. Its second-largest user base is the United States, with 193.9 million users, while Indonesia comes in third with 142.5 million. But Facebook isn’t the only social giant in Meta’s network of platforms. WhatsApp has approximately 2 billion MAUs, making it Meta’s second-largest platform, and the third-largest social network overall. Like Facebook, a significant number of WhatsApp users are located in India, with roughly 390 million users. Brazil has a large portion of WhatsApp users as well, with an audience size of 108 million.

The Billion Users Club

Meta currently dominates the social network landscape, with a combined total of 7.5 billion MAUs across all four of its platforms. However, a few other companies also hit the one billion MAU mark across all their platforms on the list: After Meta, Tencent has the second-highest reach thanks to its three platforms—WeChat, Qzone, and QQ. Of the three, WeChat is currently the most popular. On average, WeChat users send about 45 billion messages a day. Third on the list is Alphabet, thanks to its one platform, YouTube. Founded in 2005, this video streaming platform currently has over 50 million content creators, who share approximately 500 hours of video content every minute. Close behind Alphabet is Bytedance, with a combined 1.6 billion MAUs across its two platforms—Douyin and its international counterpart TikTok. While the apps share a lot of similarities, they function as completely separate entities, with different registration, content policies, and regulations.

Global Social Networks? Not Always

While social media networks often transcend country borders, it’s worth noting that the online realm does not completely escape the constraints and regulations of our physical world. Since 2009, Facebook has been banned in China for not complying with censorship rules. Facebook was also blocked in Iran and Syria around the same time and has been blocked sporadically since. In 2020, the Trump administration tried to enact a similar ban against TikTok, but the order was blocked by a federal judge and eventually revoked by the Biden administration a year later. Despite various bans and roadblocks, it’s clear that social media platforms have seeped into the lives (and onto the screens) of users across the globe. And as internet access worldwide continues to grow, so too will the number of social media users. on But fast forward to the end of last week, and SVB was shuttered by regulators after a panic-induced bank run. So, how exactly did this happen? We dig in below.

Road to a Bank Run

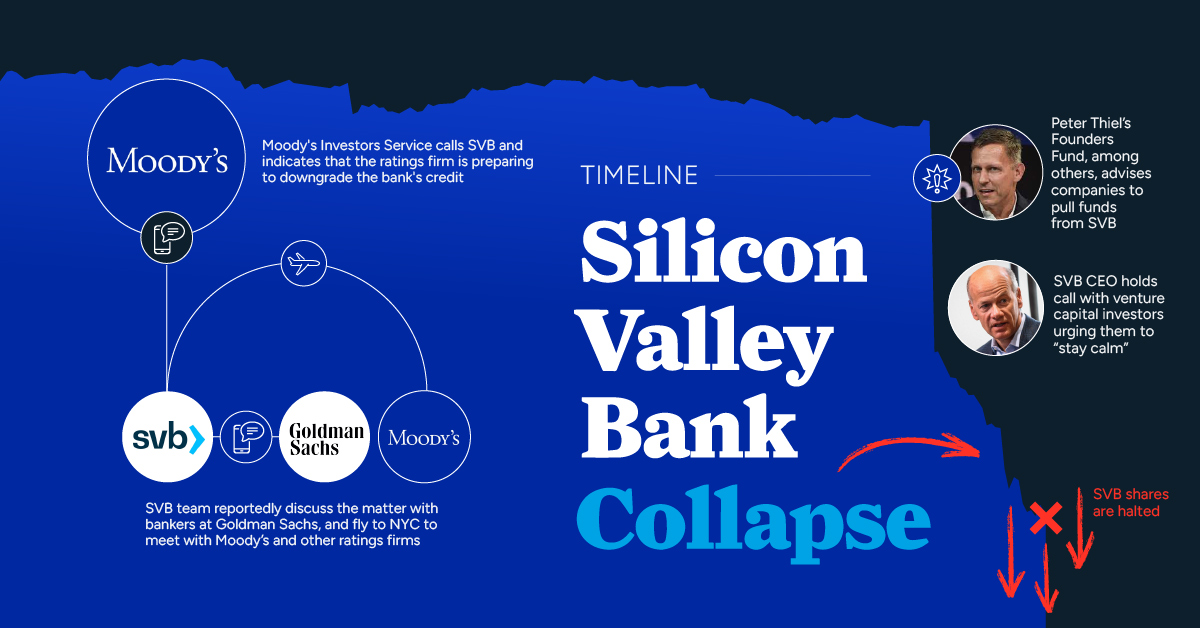

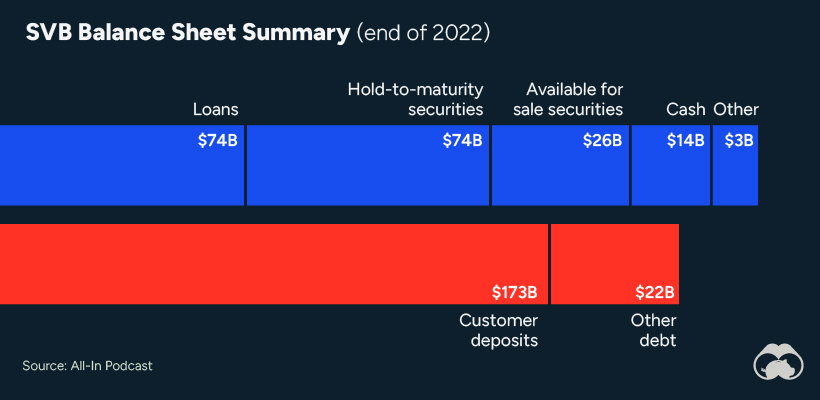

SVB and its customers generally thrived during the low interest rate era, but as rates rose, SVB found itself more exposed to risk than a typical bank. Even so, at the end of 2022, the bank’s balance sheet showed no cause for alarm.

As well, the bank was viewed positively in a number of places. Most Wall Street analyst ratings were overwhelmingly positive on the bank’s stock, and Forbes had just added the bank to its Financial All-Stars list. Outward signs of trouble emerged on Wednesday, March 8th, when SVB surprised investors with news that the bank needed to raise more than $2 billion to shore up its balance sheet. The reaction from prominent venture capitalists was not positive, with Coatue Management, Union Square Ventures, and Peter Thiel’s Founders Fund moving to limit exposure to the 40-year-old bank. The influence of these firms is believed to have added fuel to the fire, and a bank run ensued. Also influencing decision making was the fact that SVB had the highest percentage of uninsured domestic deposits of all big banks. These totaled nearly $152 billion, or about 97% of all deposits. By the end of the day, customers had tried to withdraw $42 billion in deposits.

What Triggered the SVB Collapse?

While the collapse of SVB took place over the course of 44 hours, its roots trace back to the early pandemic years. In 2021, U.S. venture capital-backed companies raised a record $330 billion—double the amount seen in 2020. At the time, interest rates were at rock-bottom levels to help buoy the economy. Matt Levine sums up the situation well: “When interest rates are low everywhere, a dollar in 20 years is about as good as a dollar today, so a startup whose business model is “we will lose money for a decade building artificial intelligence, and then rake in lots of money in the far future” sounds pretty good. When interest rates are higher, a dollar today is better than a dollar tomorrow, so investors want cash flows. When interest rates were low for a long time, and suddenly become high, all the money that was rushing to your customers is suddenly cut off.” Source: Pitchbook Why is this important? During this time, SVB received billions of dollars from these venture-backed clients. In one year alone, their deposits increased 100%. They took these funds and invested them in longer-term bonds. As a result, this created a dangerous trap as the company expected rates would remain low. During this time, SVB invested in bonds at the top of the market. As interest rates rose higher and bond prices declined, SVB started taking major losses on their long-term bond holdings.

Losses Fueling a Liquidity Crunch

When SVB reported its fourth quarter results in early 2023, Moody’s Investor Service, a credit rating agency took notice. In early March, it said that SVB was at high risk for a downgrade due to its significant unrealized losses. In response, SVB looked to sell $2 billion of its investments at a loss to help boost liquidity for its struggling balance sheet. Soon, more hedge funds and venture investors realized SVB could be on thin ice. Depositors withdrew funds in droves, spurring a liquidity squeeze and prompting California regulators and the FDIC to step in and shut down the bank.

What Happens Now?

While much of SVB’s activity was focused on the tech sector, the bank’s shocking collapse has rattled a financial sector that is already on edge.

The four biggest U.S. banks lost a combined $52 billion the day before the SVB collapse. On Friday, other banking stocks saw double-digit drops, including Signature Bank (-23%), First Republic (-15%), and Silvergate Capital (-11%).

Source: Morningstar Direct. *Represents March 9 data, trading halted on March 10.

When the dust settles, it’s hard to predict the ripple effects that will emerge from this dramatic event. For investors, the Secretary of the Treasury Janet Yellen announced confidence in the banking system remaining resilient, noting that regulators have the proper tools in response to the issue.

But others have seen trouble brewing as far back as 2020 (or earlier) when commercial banking assets were skyrocketing and banks were buying bonds when rates were low.