Presented by: Nevada Energy Metals, eCobalt Solutions Inc., and Great Lakes Graphite

The Future of Battery Technology

This is the last installment of the Battery Series. For a recap of what has been covered so far, see the evolution of battery technology, the energy problem in context, the reasons behind the surge in lithium-ion demand, and the critical materials needed to make lithium-ion batteries. There’s no doubt that the lithium-ion battery has been an important catalyst for the green revolution, but there is still much work to be done for a full switch to renewable energy. The battery technology of the future could:

Make electric cars a no-brainer choice for any driver. Make grid-scale energy storage solutions cheap and efficient. Make a full switch to renewable energy more feasible.

Right now, scientists see many upcoming battery innovations that have the promise to do this. However, the road to commercialization is long, arduous, and filled with many unexpected obstacles.

The Near-Term: Improving the Li-Ion

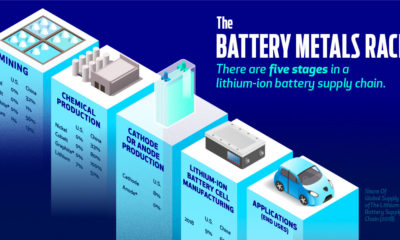

For the foreseeable future, the improvement of battery technology relies on modifications being made to already-existing lithium-ion technology. In fact, experts estimate that lithium-ions will continue to increase capacity by 6-7% annually for a number of years. Here’s what’s driving those advances: Efficient Manufacturing Tesla has already made significant advances in battery design and production through its Gigafactory:

Better engineering and manufacturing processes. Wider and longer cell design allows more materials packaged into each cell. New battery cooling system allows to fit more cells into battery pack.

Better Cathodes Most of the recent advances in lithium-ion energy density have come from manipulating the relative quantities of cobalt, aluminum, manganese, and nickel in the cathodes. By 2020, 75% of batteries are expected to contain cobalt in some capacity. For scientists, its about finding the materials and crystal structures that can store the maximum amount of ions. The next generation of cathodes may be born from lithium-rich layered oxide materials (LLOs) or similar approaches, such as the nickel-rich variety. Better Anodes While most lithium-ion progress to date has come from cathode tinkering, the biggest advances might happen in the anode. Current graphite anodes can only store one lithium atom for every six carbon atoms – but silicon anodes could store 4.4 lithium atoms for every one silicon atom. That’s a theoretical 10x increase in capacity! However, the problem with this is well-documented. When silicon houses these lithium ions, it ends up bloating in size up to 400%. This volume change can cause irreversible damage to the anode, making the battery unusable. To get around this, scientists are looking at a few different solutions.

- Encasing silicon in a graphene “cage” to prevent cracking after expansion. 2. Using silicon nanowires, which can better handle the volume change. 3. Adding silicon in tiny amounts using existing manufacturing processes – Tesla is rumored to already be doing this. Solid-State Lithium-Ion Lastly, a final improvement that is being worked on for the lithium-ion battery is to use a solid-state setup, rather than having liquid electrolytes enabling the ion transfer. This design could increase energy density in the future, but it still has some problems to resolve first, such as ions moving too slowing through the solid electrolyte.

The Long-Term: Beyond the Lithium-ion

Here are some new innovations in the pipeline that could help enable the future of battery technology: Lithium-Air Anode: Lithium Cathode: Porous carbon (Oxygen) Promise: 10x greater energy density than Li-ion Problems: Air is not pure enough and would need to be filtered. Lithium and oxygen form peroxide films that produce a barrier, ultimately killing storage capacity. Cycle life is only 50 cycles in lab tests. Variations: Scientists also trying aluminum-air and sodium-air batteries as well. Lithium-Sulphur Anode: Lithium Cathode: Sulphur, Carbon Promise: Lighter, cheaper, and more powerful than li-ion Problems: Volume expansion of up to 80%, causing mechanical stress. Unwanted reactions with electrolytes. Poor conductivity and poor stability at higher temperatures. Variations: Many different variations exist, including using graphite/graphene, and silicon in the chemistry. Vanadium Flow Batteries Catholyte: Vanadium Anolyte: Vanadium Promise: Using vanadium ions in different oxidation states to store chemical potential energy at scale. Can be expanded simply by using larger electrolyte tanks. Problems: Poor energy-to-volume ratio. Very heavy; must be used in stationary applications. Variations: Scientists are experimenting with other flow battery chemistries as well, such as zinc-bromine.

Battery Series: Conclusion

While the future of battery technology is very exciting, for the near and medium terms, scientists are mainly focused on improving the already-commercialized lithium-ion. What does the battery market look like 15 to 20 years from now? It’s ultimately hard to say. However, it’s likely that some of these new technologies above will help in leading the charge to a 100% renewable future. Thanks for taking a look at The Battery Series.

on But fast forward to the end of last week, and SVB was shuttered by regulators after a panic-induced bank run. So, how exactly did this happen? We dig in below.

Road to a Bank Run

SVB and its customers generally thrived during the low interest rate era, but as rates rose, SVB found itself more exposed to risk than a typical bank. Even so, at the end of 2022, the bank’s balance sheet showed no cause for alarm.

As well, the bank was viewed positively in a number of places. Most Wall Street analyst ratings were overwhelmingly positive on the bank’s stock, and Forbes had just added the bank to its Financial All-Stars list. Outward signs of trouble emerged on Wednesday, March 8th, when SVB surprised investors with news that the bank needed to raise more than $2 billion to shore up its balance sheet. The reaction from prominent venture capitalists was not positive, with Coatue Management, Union Square Ventures, and Peter Thiel’s Founders Fund moving to limit exposure to the 40-year-old bank. The influence of these firms is believed to have added fuel to the fire, and a bank run ensued. Also influencing decision making was the fact that SVB had the highest percentage of uninsured domestic deposits of all big banks. These totaled nearly $152 billion, or about 97% of all deposits. By the end of the day, customers had tried to withdraw $42 billion in deposits.

What Triggered the SVB Collapse?

While the collapse of SVB took place over the course of 44 hours, its roots trace back to the early pandemic years. In 2021, U.S. venture capital-backed companies raised a record $330 billion—double the amount seen in 2020. At the time, interest rates were at rock-bottom levels to help buoy the economy. Matt Levine sums up the situation well: “When interest rates are low everywhere, a dollar in 20 years is about as good as a dollar today, so a startup whose business model is “we will lose money for a decade building artificial intelligence, and then rake in lots of money in the far future” sounds pretty good. When interest rates are higher, a dollar today is better than a dollar tomorrow, so investors want cash flows. When interest rates were low for a long time, and suddenly become high, all the money that was rushing to your customers is suddenly cut off.” Source: Pitchbook Why is this important? During this time, SVB received billions of dollars from these venture-backed clients. In one year alone, their deposits increased 100%. They took these funds and invested them in longer-term bonds. As a result, this created a dangerous trap as the company expected rates would remain low. During this time, SVB invested in bonds at the top of the market. As interest rates rose higher and bond prices declined, SVB started taking major losses on their long-term bond holdings.

Losses Fueling a Liquidity Crunch

When SVB reported its fourth quarter results in early 2023, Moody’s Investor Service, a credit rating agency took notice. In early March, it said that SVB was at high risk for a downgrade due to its significant unrealized losses. In response, SVB looked to sell $2 billion of its investments at a loss to help boost liquidity for its struggling balance sheet. Soon, more hedge funds and venture investors realized SVB could be on thin ice. Depositors withdrew funds in droves, spurring a liquidity squeeze and prompting California regulators and the FDIC to step in and shut down the bank.

What Happens Now?

While much of SVB’s activity was focused on the tech sector, the bank’s shocking collapse has rattled a financial sector that is already on edge.

The four biggest U.S. banks lost a combined $52 billion the day before the SVB collapse. On Friday, other banking stocks saw double-digit drops, including Signature Bank (-23%), First Republic (-15%), and Silvergate Capital (-11%).

Source: Morningstar Direct. *Represents March 9 data, trading halted on March 10.

When the dust settles, it’s hard to predict the ripple effects that will emerge from this dramatic event. For investors, the Secretary of the Treasury Janet Yellen announced confidence in the banking system remaining resilient, noting that regulators have the proper tools in response to the issue.

But others have seen trouble brewing as far back as 2020 (or earlier) when commercial banking assets were skyrocketing and banks were buying bonds when rates were low.