The History of Currency in 10 Different Countries

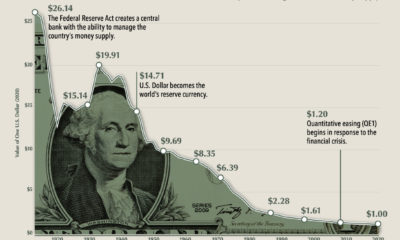

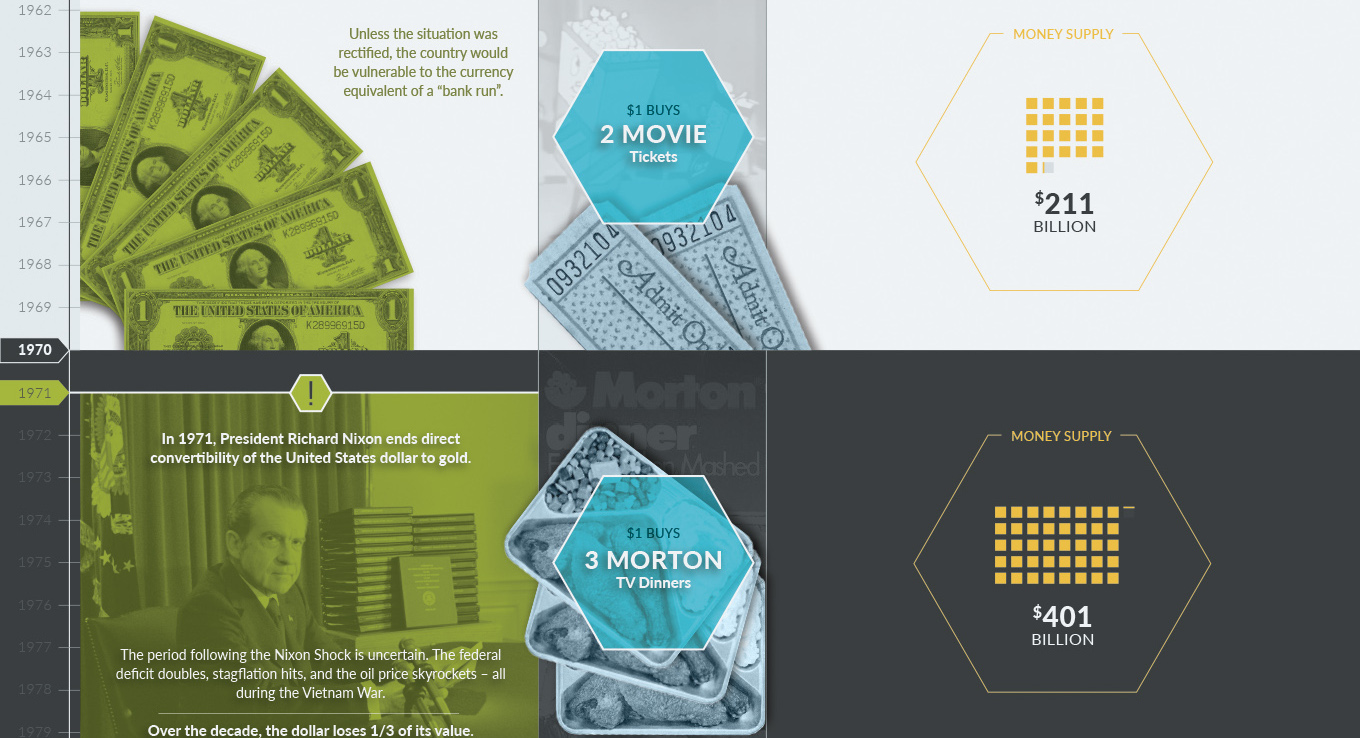

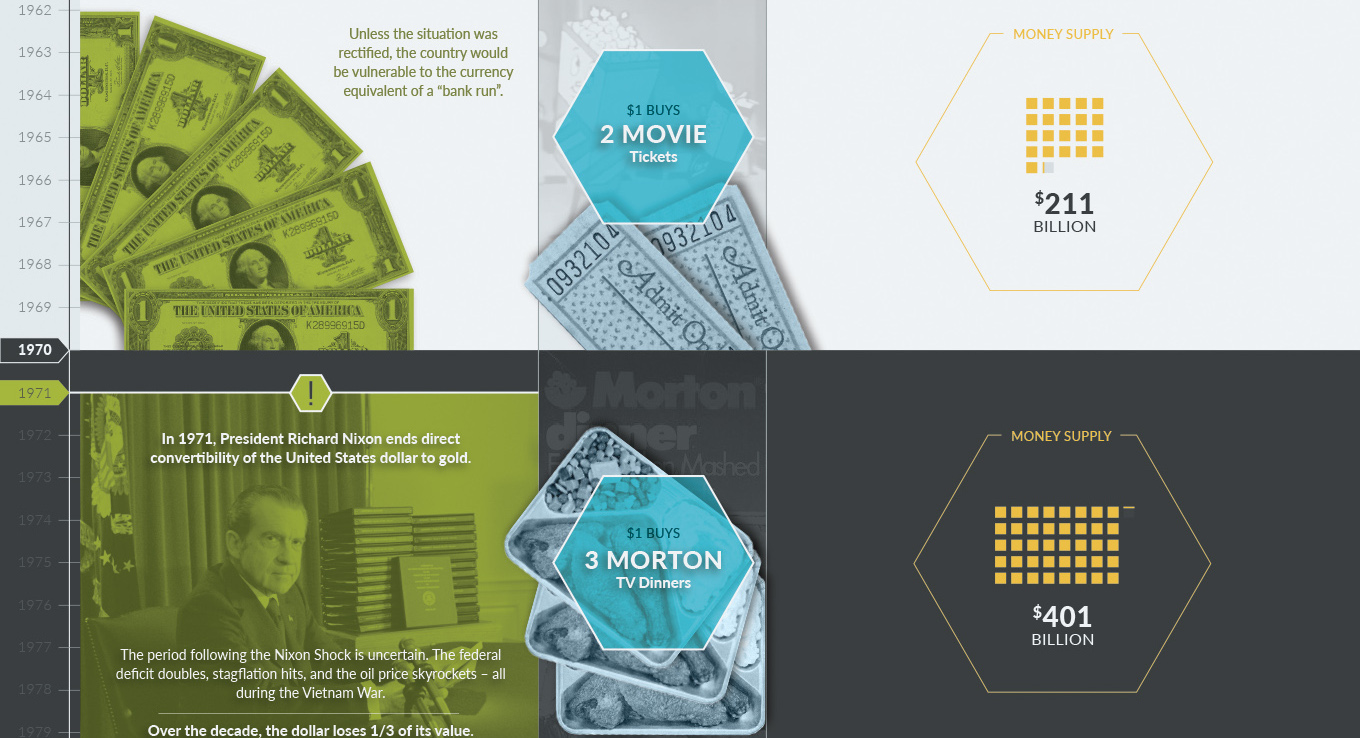

Even though there are short of 200 official fiat currencies today, throughout history there have been thousands of currencies that were once used for trade. The above infographic documents the history of currency in 10 different countries of significance. There are some interesting lessons to be learned from this lengthy and often tumultuous history. For example, the Romans were really the first to debase their currency in a significant way, and many historians believe that this was a key factor in contributing to the downfall of the empire. Unfortunately, we have not learned from tragic events such as this (which helped cause the Dark Ages), and countless other currencies have also bit the dust since then. One study of 775 fiat currencies found the average lifespan of a currency to be just 27 years. Here’s the breakdown:

20% currencies failed through hyperinflation 21% were destroyed through war 12% were destroyed through independence 24% were “monetarily reformed” 23% are still in circulation

It seems like a foregone conclusion that some of the currencies listed in the above infographic may not exist in 10 years, or perhaps they get “monetarily reformed”. In any case, it’s worth noting that in today’s interconnected world, it may be easier to stave off the death of one currency through global intervention. However, systematically there is far greater risk. If one currency fails, the possibility also exists for many others to share the same fate through the domino effect. Investors should study currency history, and as part of a smart portfolio they should protect their hard earned wealth and savings in a defensive fashion. Black swans do happen, and even the crisis in the tiny country of Cyprus had people reeling. The potential for something much bigger is inevitably a possibility – it is just a matter of when and how. Original graphic from: ZH

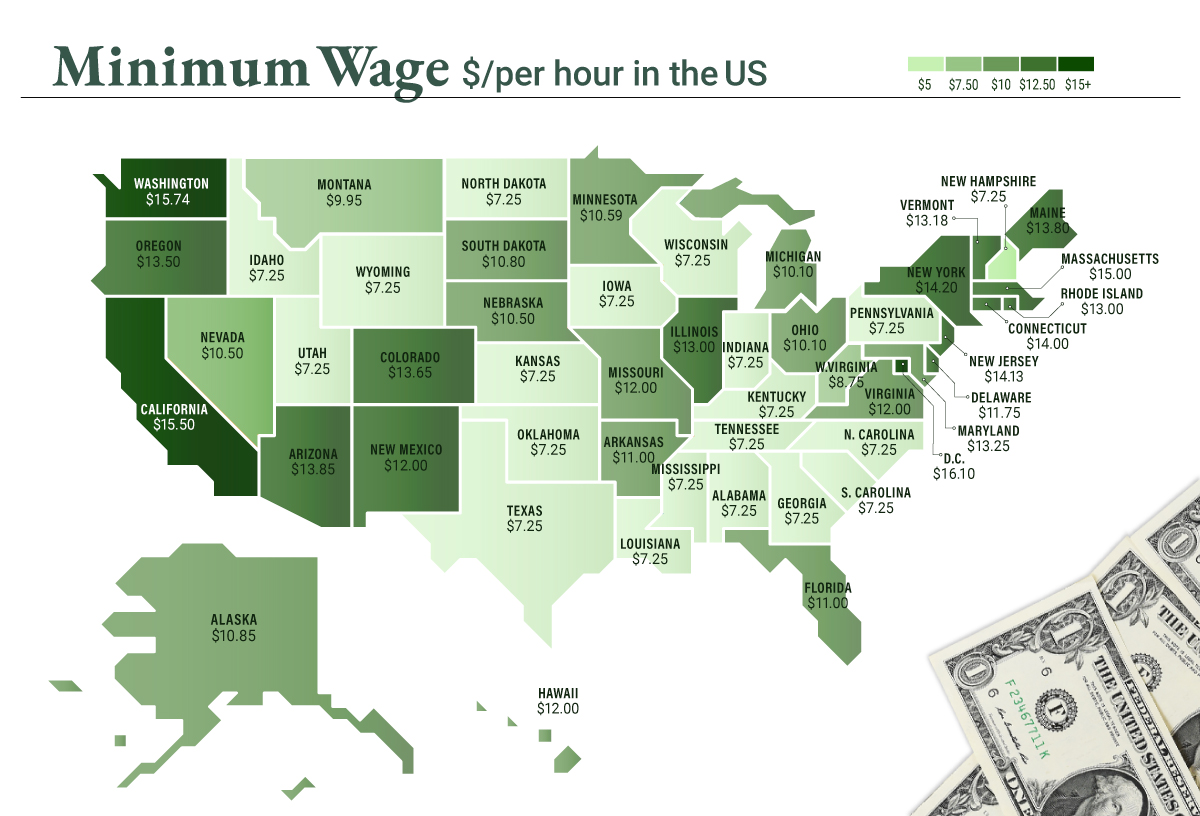

on To see how the minimum wage differs around the world, we’ve visualized data from Picodi, which includes values for 67 countries as of January 2023.

Monthly Minimum Wage, by Country

The following table includes all of the data used in this infographic. Each value represents the monthly minimum wage a full-time worker would receive in each country. Picodi states that these figures are net of taxes and have been converted to USD. Generally speaking, developed countries have a higher cost of living, and thus require a higher minimum wage. Two outliers in this dataset are Argentina and Turkey, which have increased their minimum wages by 100% or more from January 2022 levels. Turkey is suffering from an ongoing currency crisis, with the lira losing over 40% of its value in 2021. Prices of basic goods have increased considerably as the Turkish lira continues to plummet. In fact, a 2022 survey found that 70% of people in Turkey were struggling to pay for food. Argentina, South America’s second-biggest economy, is also suffering from very high inflation. In response, the country announced three minimum wage increases throughout 2022.

Minimum Wage in the U.S.

Within the U.S., minimum wage varies significantly by state. We’ve visualized each state’s basic minimum rate (hourly) using January 2023 data from the U.S. Department of Labor.

2023-03-17 Update: This map was updated to fix several incorrect values. We apologize for any confusion this may have caused. America’s federal minimum wage has remained unchanged since 2009 at $7.25 per hour. Each state is allowed to set their own minimum wage, as long as it’s higher than the federal minimum. In states that do not set their own minimum, the federal minimum applies. If we assume someone works 40 hours a week, the federal minimum wage of $7.25 translates to an annual figure of just $15,080 before taxes. California’s minimum wage of $15.50 translates to $32,240 before taxes. For further perspective, check out our 2022 infographic on the salary needed to buy a home across 50 U.S. cities.