When it comes to supporting new businesses, not all jurisdictions are created equal. Whether it’s the basics, like hooking up electricity and registering the business, or more complex regulatory hurdles, your location can impact the success of your venture in a big way. What makes a country business-friendly, and where are the most hassle-free places to open up shop? The Ease of Doing Business ranking, by World Bank, breaks countries’ complex regulatory ecosystems down into quantifiable components. The resulting index and ranking system is a global look at who’s making it easy to do business, and which countries are struggling.

A Global View of Doing Business

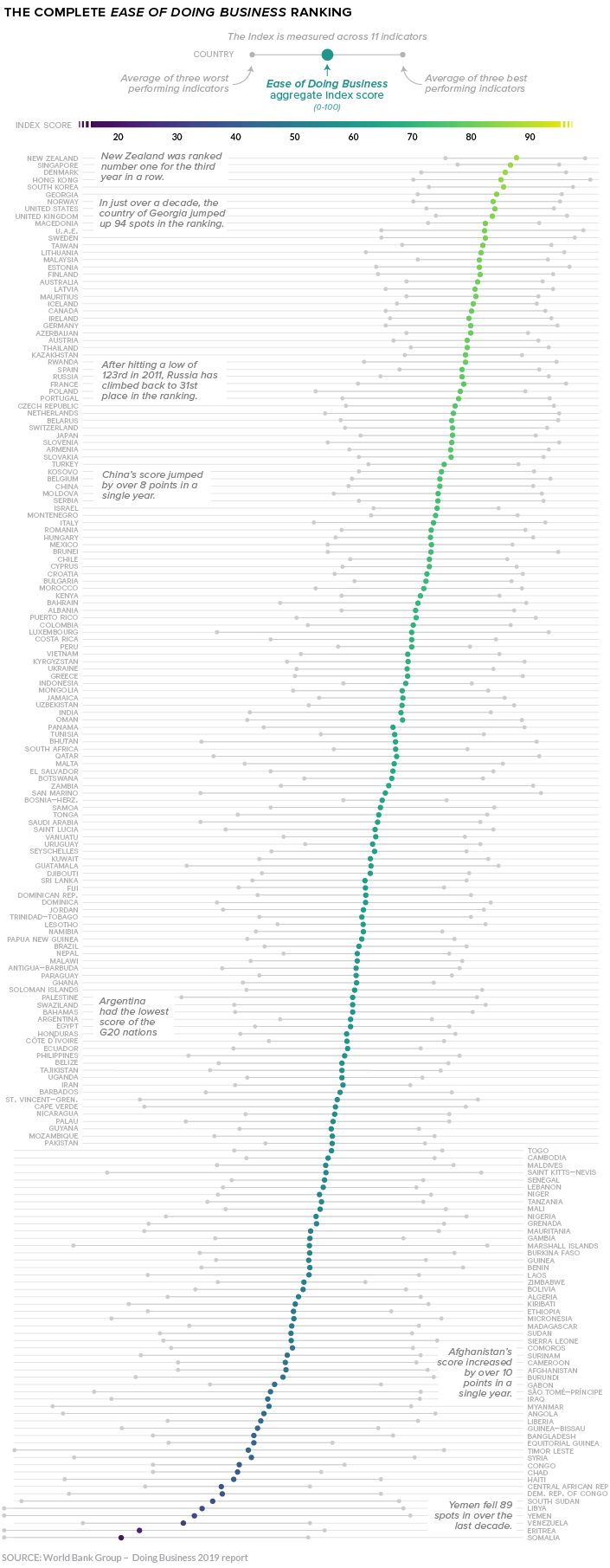

The visualization below looks at the score (0-100) of 190 economies around the world, as well as a spread between high and low scoring factors in the subindices. While two countries may have the same score, one might have a much wider “spread” which points to outlaying successes or serious challenges in their regulatory framework. Luxembourg, for example, ranked number one in the Trading Across Borders factor, but 173rd in Getting Credit. Note: click the graphic below of the full list to expand to a higher resolution. View a high resolution version of this graphic. Of the 190 economies covered in the report, New Zealand comes out on top for the third year in a row. Singapore and Denmark round out the top three. The United States, whose ranking has been slipping in recent years, came in at 8th spot. This ranking offers up some surprises, such as Macedonia and Georgia, which are both in the top 10. Georgia makes it easy to start a new business, and has the lowest number of procedures to get the process going. Afghanistan had the biggest year-over-year score increase after making big strides in enhancing the legal framework for businesses. Rwanda is ranked at a very respectable 29th place – the only low-income economy to crack the top 50.

Building the Index

The data for the ranking is compiled from over 12,500 expert contributors in 190 countries who deal with business regulations on a daily basis. The final score is based on the average of 11 factors:

Starting a business – Procedures, time, cost, and minimum capital to open a new business Dealing with construction permits – Procedures, time, and cost to build a warehouse Access to electricity – Procedures, time, and cost required to obtain an electricity connection for a new warehouse Registering property – Procedures, time, and cost to register commercial real estate Procuring credit – Strength of legal rights index, depth of credit information index Protecting investors – Indices on the extent of disclosure, extent of director liability and ease of shareholder suits Paying taxes – Number of taxes paid, total tax payable as share of gross profit, and hours per year spent preparing tax returns Trading across borders – Number of documents, cost, and time necessary to import and export Enforcing contracts – Procedures, time, and cost to enforce a debt contract Resolving insolvency – The time, cost, and recovery rate (%) under bankruptcy proceeding Labor market regulation – Flexibility in employment regulation and aspects of job quality

on Today’s chart measures the extent to which 41 major economies are reopening, by plotting two metrics for each country: the mobility rate and the COVID-19 recovery rate: Data for the first measure comes from Google’s COVID-19 Community Mobility Reports, which relies on aggregated, anonymous location history data from individuals. Note that China does not show up in the graphic as the government bans Google services. COVID-19 recovery rates rely on values from CoronaTracker, using aggregated information from multiple global and governmental databases such as WHO and CDC.

Reopening Economies, One Step at a Time

In general, the higher the mobility rate, the more economic activity this signifies. In most cases, mobility rate also correlates with a higher rate of recovered people in the population. Here’s how these countries fare based on the above metrics. Mobility data as of May 21, 2020 (Latest available). COVID-19 case data as of May 29, 2020. In the main scatterplot visualization, we’ve taken things a step further, assigning these countries into four distinct quadrants:

1. High Mobility, High Recovery

High recovery rates are resulting in lifted restrictions for countries in this quadrant, and people are steadily returning to work. New Zealand has earned praise for its early and effective pandemic response, allowing it to curtail the total number of cases. This has resulted in a 98% recovery rate, the highest of all countries. After almost 50 days of lockdown, the government is recommending a flexible four-day work week to boost the economy back up.

2. High Mobility, Low Recovery

Despite low COVID-19 related recoveries, mobility rates of countries in this quadrant remain higher than average. Some countries have loosened lockdown measures, while others did not have strict measures in place to begin with. Brazil is an interesting case study to consider here. After deferring lockdown decisions to state and local levels, the country is now averaging the highest number of daily cases out of any country. On May 28th, for example, the country had 24,151 new cases and 1,067 new deaths.

3. Low Mobility, High Recovery

Countries in this quadrant are playing it safe, and holding off on reopening their economies until the population has fully recovered. Italy, the once-epicenter for the crisis in Europe is understandably wary of cases rising back up to critical levels. As a result, it has opted to keep its activity to a minimum to try and boost the 65% recovery rate, even as it slowly emerges from over 10 weeks of lockdown.

4. Low Mobility, Low Recovery

Last but not least, people in these countries are cautiously remaining indoors as their governments continue to work on crisis response. With a low 0.05% recovery rate, the United Kingdom has no immediate plans to reopen. A two-week lag time in reporting discharged patients from NHS services may also be contributing to this low number. Although new cases are leveling off, the country has the highest coronavirus-caused death toll across Europe. The U.S. also sits in this quadrant with over 1.7 million cases and counting. Recently, some states have opted to ease restrictions on social and business activity, which could potentially result in case numbers climbing back up. Over in Sweden, a controversial herd immunity strategy meant that the country continued business as usual amid the rest of Europe’s heightened regulations. Sweden’s COVID-19 recovery rate sits at only 13.9%, and the country’s -93% mobility rate implies that people have been taking their own precautions.

COVID-19’s Impact on the Future

It’s important to note that a “second wave” of new cases could upend plans to reopen economies. As countries reckon with these competing risks of health and economic activity, there is no clear answer around the right path to take. COVID-19 is a catalyst for an entirely different future, but interestingly, it’s one that has been in the works for a while. —Carmen Reinhart, incoming Chief Economist for the World Bank Will there be any chance of returning to “normal” as we know it?