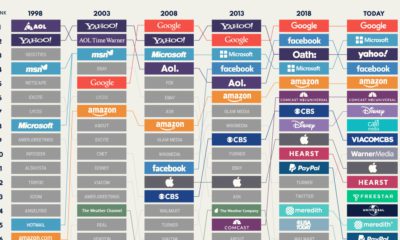

On March 12, the World Wide Web celebrated its 30th birthday. Over the last three decades, we’ve seen it mature from the first webpage to having a ubiquitous presence in our lives.

Visualizing the History of the World Wide Web

Today’s infographic comes to us from the App Institute, and highlights key milestones since the inception of the web. We’ll look at some major developments on this timeline that defined what the web is today.

Tim Berners-Lee Proposes The World Wide Web on March 12, 1989

Although the giant network of computers that formed the Internet – and its “ARPANET” predecessor – already existed, there was no universal way of writing, transmitting, storing, and accessing the Internet in a clean and organized manner. A computer scientist named Tim Berners-Lee is credited with the first formalized proposal of what he would later call the “World Wide Web”. A flow chart of Berners-Lee’s vision in 1989. Source: W3 From this vision, his work would go on to develop and influence assets the web still uses today like hypertext (links), webpages, and browsers. The founder of the World Wide Web is still around, and most recently Berners-Lee has been fighting for his vision of an open and decentralized Internet.

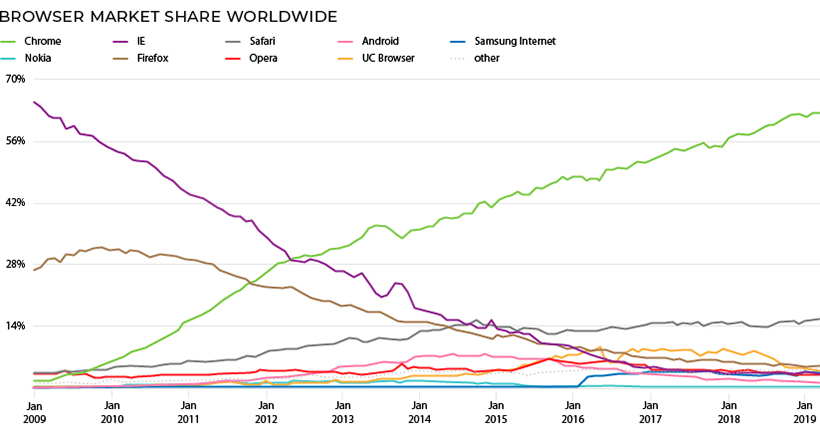

Browser Wars

Mosaic was the first browser to popularize “surfing the web”. Launched in 1993, Mosaic’s graphical user interface (GUI) made it easy for the average user to browse multimedia webpages. Soon after, developers from Mosaic launched Netscape Navigator in 1994, introducing features used today like HTTP cookies and JavaScript. The first browser war began when Microsoft launched Internet Explorer in 1995. Unlike Netscape, Internet Explorer was free of charge. Microsoft overtook Netscape with help from their deep pockets and the fact that they held over 90% of the desktop operating system market share. This would eventually lead to the U.S. government filing an anti-trust case against Microsoft for engaging in anti-competitive practices – but Internet Explorer escaped mostly unaffected, with it’s market share climbing to 96% by 2002. Today, the second browser war has largely been dominated by Google Chrome, which launched in 2008 and overtook Internet Explorer by 2012. Source: StatCounter

Web Crawling: Search

Search engines helped popularize the web by making information easily accessible and searchable. Web Crawler was the first search engine that allowed users to search for words and terms on a webpage. Source: App Institute Since then, dozens of search engines have launched, but one player has dominated the search market. Today, over 90% of searches online are made through Google.

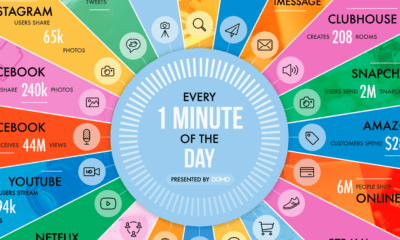

The Social Internet

In the late 1990s, online diaries and “blogging” websites like Open Diary, LiveJournal and Blogger popularized people sharing their thoughts to an audience online. This evolved into social networking sites like Friendster, MySpace, and Facebook, which allowed people to “add” their friends and follow their lives online. Today, of course, Facebook dominates the Social Media Universe with over 2.2 billion users.

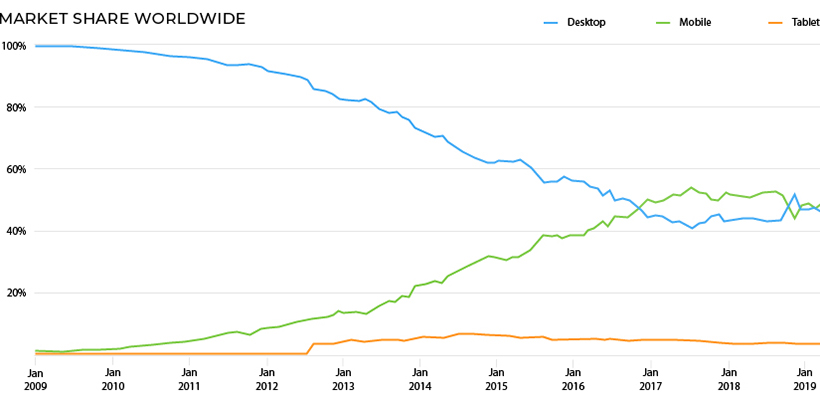

Smartphone Revolution

The launch of iPhones and Androids in 2007 – 2008 ushered in a new era where people could access the web from their phones. Before this, websites on phones were clunky to use and mostly resembled their desktop counterparts. Third-party apps and websites designed for mobile touchscreens changed the way we browsed the web. By 2016, mobile phones surpassed desktops and laptops as our favorite way to access the web: Source: StatCounter

Privacy: You’re the Product Now

With billions of people accessing the web, the trail of data left behind has become extremely profitable for tech giants like Google and Facebook. The data they collect from people’s private information, online behaviors, and demographics allow advertisers to perfectly target consumers. With ever growing privacy scandals, and even the creation of surveillance states, how people’s privacy and data is handled will likely be the most important issue for the future of the web. on But fast forward to the end of last week, and SVB was shuttered by regulators after a panic-induced bank run. So, how exactly did this happen? We dig in below.

Road to a Bank Run

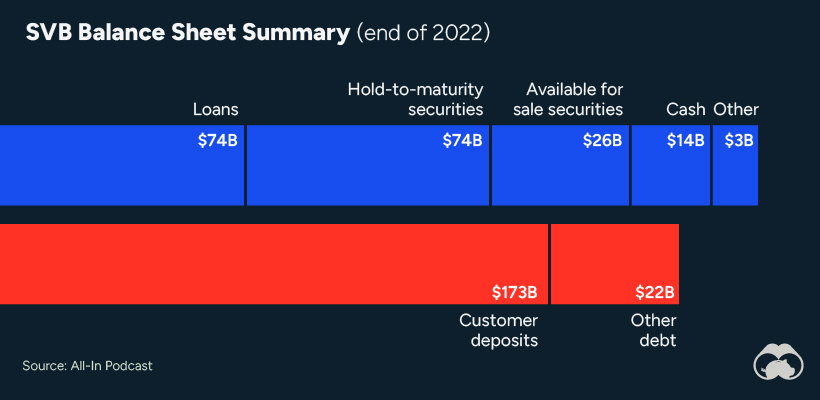

SVB and its customers generally thrived during the low interest rate era, but as rates rose, SVB found itself more exposed to risk than a typical bank. Even so, at the end of 2022, the bank’s balance sheet showed no cause for alarm.

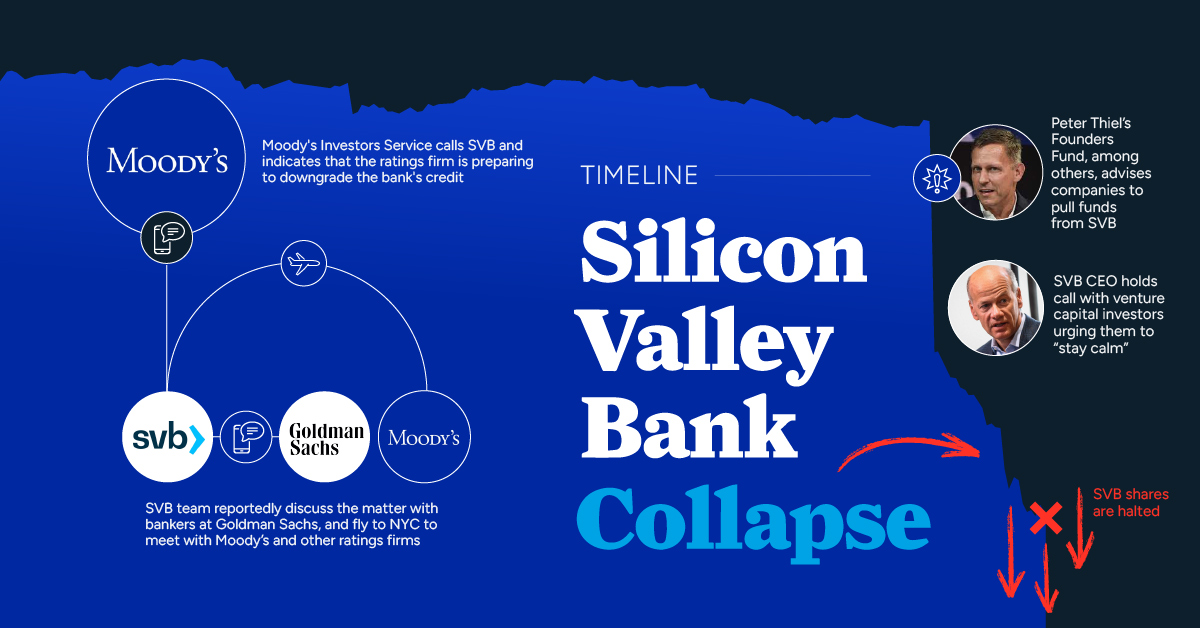

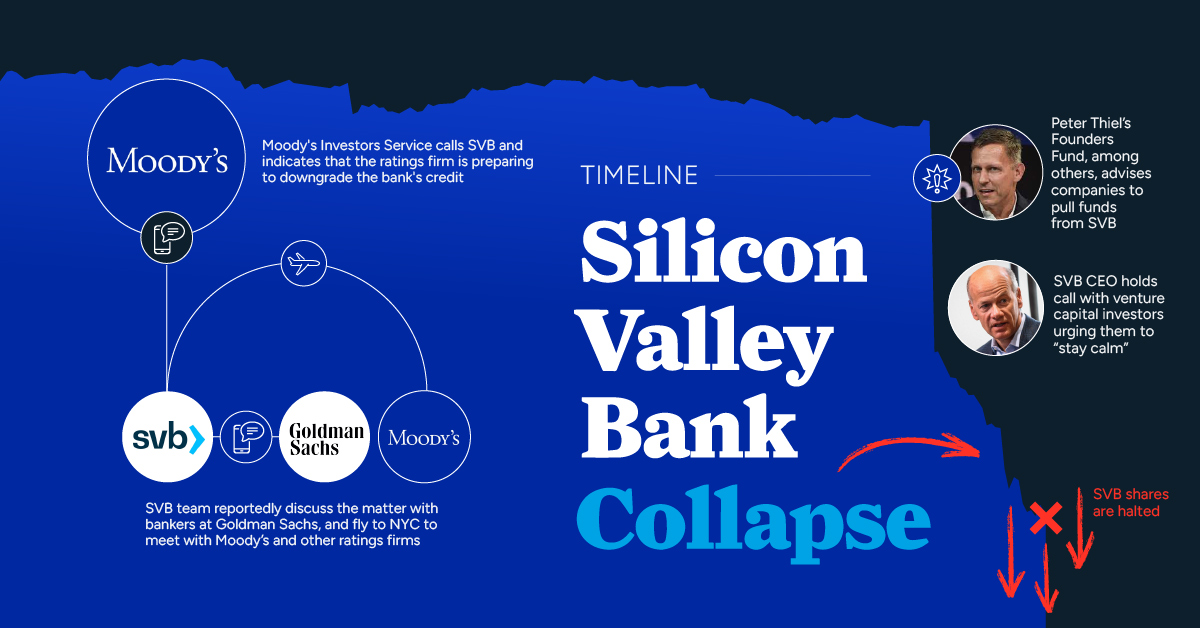

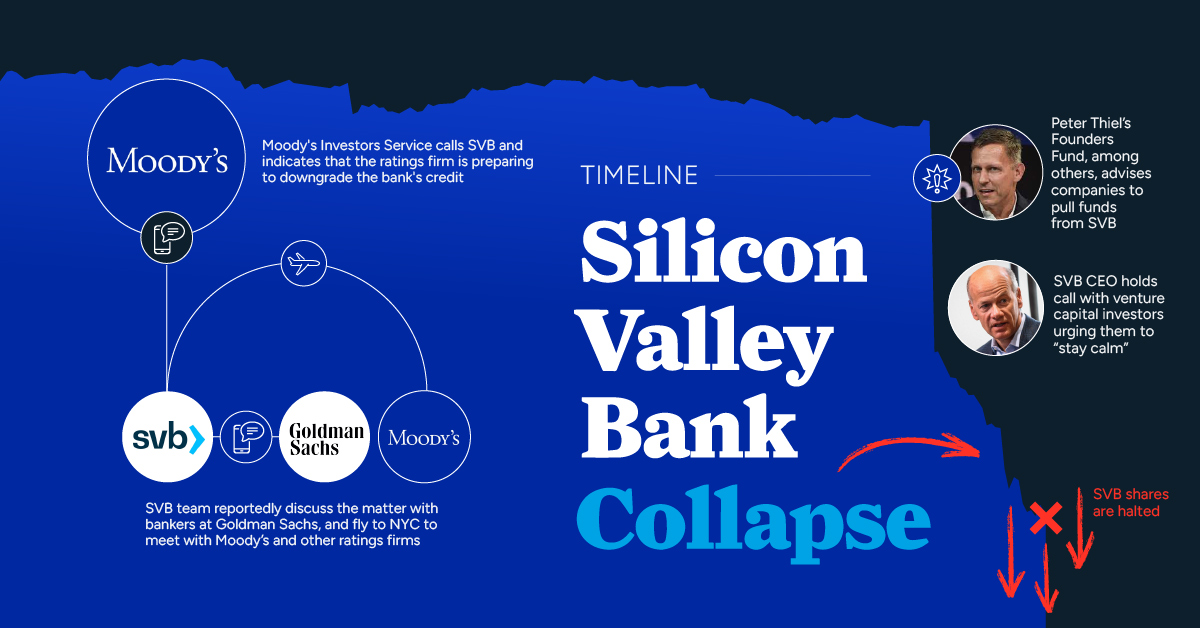

As well, the bank was viewed positively in a number of places. Most Wall Street analyst ratings were overwhelmingly positive on the bank’s stock, and Forbes had just added the bank to its Financial All-Stars list. Outward signs of trouble emerged on Wednesday, March 8th, when SVB surprised investors with news that the bank needed to raise more than $2 billion to shore up its balance sheet. The reaction from prominent venture capitalists was not positive, with Coatue Management, Union Square Ventures, and Peter Thiel’s Founders Fund moving to limit exposure to the 40-year-old bank. The influence of these firms is believed to have added fuel to the fire, and a bank run ensued. Also influencing decision making was the fact that SVB had the highest percentage of uninsured domestic deposits of all big banks. These totaled nearly $152 billion, or about 97% of all deposits. By the end of the day, customers had tried to withdraw $42 billion in deposits.

What Triggered the SVB Collapse?

While the collapse of SVB took place over the course of 44 hours, its roots trace back to the early pandemic years. In 2021, U.S. venture capital-backed companies raised a record $330 billion—double the amount seen in 2020. At the time, interest rates were at rock-bottom levels to help buoy the economy. Matt Levine sums up the situation well: “When interest rates are low everywhere, a dollar in 20 years is about as good as a dollar today, so a startup whose business model is “we will lose money for a decade building artificial intelligence, and then rake in lots of money in the far future” sounds pretty good. When interest rates are higher, a dollar today is better than a dollar tomorrow, so investors want cash flows. When interest rates were low for a long time, and suddenly become high, all the money that was rushing to your customers is suddenly cut off.” Source: Pitchbook Why is this important? During this time, SVB received billions of dollars from these venture-backed clients. In one year alone, their deposits increased 100%. They took these funds and invested them in longer-term bonds. As a result, this created a dangerous trap as the company expected rates would remain low. During this time, SVB invested in bonds at the top of the market. As interest rates rose higher and bond prices declined, SVB started taking major losses on their long-term bond holdings.

Losses Fueling a Liquidity Crunch

When SVB reported its fourth quarter results in early 2023, Moody’s Investor Service, a credit rating agency took notice. In early March, it said that SVB was at high risk for a downgrade due to its significant unrealized losses. In response, SVB looked to sell $2 billion of its investments at a loss to help boost liquidity for its struggling balance sheet. Soon, more hedge funds and venture investors realized SVB could be on thin ice. Depositors withdrew funds in droves, spurring a liquidity squeeze and prompting California regulators and the FDIC to step in and shut down the bank.

What Happens Now?

While much of SVB’s activity was focused on the tech sector, the bank’s shocking collapse has rattled a financial sector that is already on edge.

The four biggest U.S. banks lost a combined $52 billion the day before the SVB collapse. On Friday, other banking stocks saw double-digit drops, including Signature Bank (-23%), First Republic (-15%), and Silvergate Capital (-11%).

Source: Morningstar Direct. *Represents March 9 data, trading halted on March 10.

When the dust settles, it’s hard to predict the ripple effects that will emerge from this dramatic event. For investors, the Secretary of the Treasury Janet Yellen announced confidence in the banking system remaining resilient, noting that regulators have the proper tools in response to the issue.

But others have seen trouble brewing as far back as 2020 (or earlier) when commercial banking assets were skyrocketing and banks were buying bonds when rates were low.