The last time the U.S. labor market was this strong was in 1969. Unemployment fell to 3.3%, incomes were soaring to historic levels, and inflation was rising at a fast clip. Like today, the Federal Reserve was tightening monetary policy to stifle inflation. Yet much of the wage increases were washed out by rising consumer prices. The above graphic looks at the industries driving today’s robust job market using data from the Bureau of Labor Statistics. Later, we look into the impact on inflation, and whether today’s market can be sustained.

What is Driving the U.S. Labor Market?

Broadly, service-led industries witnessed the highest share of job growth in January.

Still, as the table below shows, a key part of the services sector—leisure and hospitality employment—remains under pre-pandemic levels. A similar trend is seen in retail services.

Adding 1.5 million jobs since 2020 is professional and business services, the highest overall. This sector covers legal, accounting, veterinary, engineering and other specialized services.

We are also seeing strong gains in transportation and warehousing. Last year, the sector added an average of 23,000 jobs, totaling almost 955,000 over the course of the pandemic. Today, trucking jobs exceed 2019 levels and warehouse employment is roughly 50% higher.

Although manufacturing hasn’t seen the highest gains, the sector has one of the lowest unemployment rates across job sectors, at 2.4%. Yet the industry faces an acute labor shortage—if every skilled unemployed worker were to fill open job vacancies, a third of jobs in durable manufacturing would remain open.

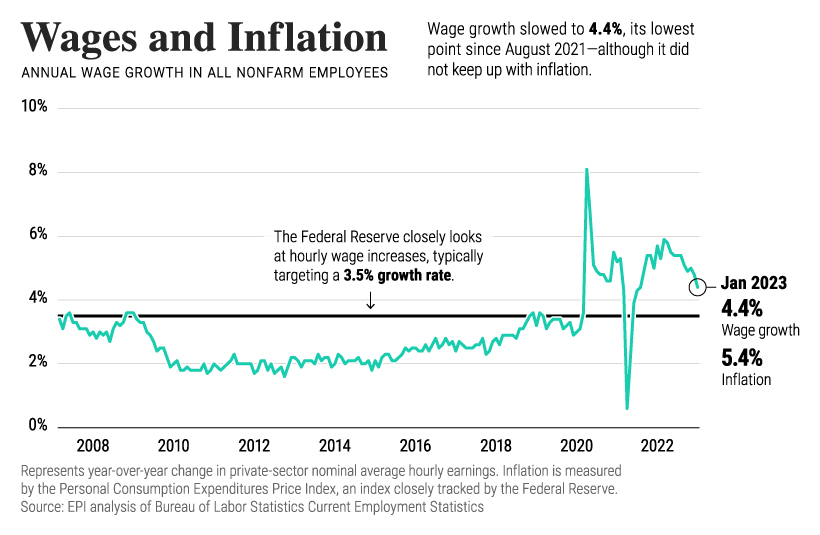

Cooling Wage Growth

Despite rock-bottom unemployment numbers, wage growth is slowing. In January, it fell to 4.4% annually, down from a multi-decade high of 5.9% in March last year. At the same time, wage growth falls below inflation by about 1%.

Wage growth is carefully watched by the Federal Reserve. Typically, their annual wage growth target is 3.5% to be compatible with 2% inflation. In the current environment, this wage growth trend serves as a double-edged sword. As wage growth slows, workers are less likely to see wages keep up with inflation. On the other hand, slower wage growth could help prevent inflation from rising in the first place—and interest rates from climbing higher.

Where is the Job Market Heading?

The question on everyone’s minds is whether today’s job market will stay resilient. According to Fitch Ratings, slowing aggregate demand in response to higher interest rates will begin to weigh on the U.S. labor market, and the 517,000 new jobs created in January—three times the level expected by analysts— won’t last long. Eventually, both higher borrowing costs and elevated compensation costs could weigh on corporate profits. On the other hand, the pandemic has changed the labor market. Relief legislation may continue to buoy the job market and workers may also remain scarce as people retire or leave for other reasons. Given how unemployment serves as a lagging indicator, the material effects in the economy will likely appear before cracks begin to show in the U.S. labor market. on Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard.

How Has Asset Allocation Impacted Returns?

Based on data between 1926 and 2019, the table below looks at the spectrum of market returns of different asset allocations:

We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

A traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of 8.8%. As interest rates have climbed in recent years, this may widen its appeal once again as bond returns may rise.

Meanwhile, a 100% bond portfolio averaged 5.3% in annual returns over the period. Bonds typically serve as a hedge against portfolio losses thanks to their typically negative historical correlation to stocks.

A Closer Look at Historical Correlations

To understand how 2022 was an outlier in terms of asset correlations we can look at the graphic below:

The last time stocks and bonds moved together in a negative direction was in 1969. At the time, inflation was accelerating and the Fed was hiking interest rates to cool rising costs. In fact, historically, when inflation surges, stocks and bonds have often moved in similar directions. Underscoring this divergence is real interest rate volatility. When real interest rates are a driving force in the market, as we have seen in the last year, it hurts both stock and bond returns. This is because higher interest rates can reduce the future cash flows of these investments. Adding another layer is the level of risk appetite among investors. When the economic outlook is uncertain and interest rate volatility is high, investors are more likely to take risk off their portfolios and demand higher returns for taking on higher risk. This can push down equity and bond prices. On the other hand, if the economic outlook is positive, investors may be willing to take on more risk, in turn potentially boosting equity prices.

Current Investment Returns in Context

Today, financial markets are seeing sharp swings as the ripple effects of higher interest rates are sinking in. For investors, historical data provides insight on long-term asset allocation trends. Over the last century, cycles of high interest rates have come and gone. Both equity and bond investment returns have been resilient for investors who stay the course.