The sustainable use of the ocean and its resources for economic development and livelihoods have such far-reaching effects, that its protection is a significant goal of the United Nations, as well as for many other countries and organizations throughout the world. However, these vital ocean assets are in danger of sinking quickly. Ahead of World Oceans Day on June 8, 2020, we look at the total value of assets that come from our ocean, and how various human activities are affecting these resources.

Global Ocean Asset Value

Economic value from all the oceans is measured both by their direct output, as well as any indirect impacts they produce. According to the World Wildlife Fund, these combined assets are valued at over $24 trillion. Here’s how they break down:

Direct Output: Marine fisheries, coral reefs, seagrass, and mangroves Total value: $6.9T Examples of direct output: Fishing, agriculture Trade and Transport: Shipping lanes Total value: $5.2T Adjacent Assets: Productive coastline, carbon absorption Total value: $7.8T, and $4.3T respectively Examples of services enabled: Tourism, education/conservation (such as jobs created)

In fact, the annual gross marine product of the oceans is comparable to the Gross Domestic Product (GDP) of countries, coming in at $2.5 trillion per year—making it the world’s eighth largest economy in country terms. Unfortunately, experts warn that various human activities are endangering these ocean assets and their reliant ecosystems.

The Cumulative Human Impact on Oceans

An 11-year long scientific study tracked the global effect of multiple human activities across diverse marine environments. The researchers identified four main categories of stressors between 2003-2013. Across the board, climate stressors were the most dominant drivers of change in a majority of marine environments. Similarly, pollution levels have also increased for many ecosystems. Plastic pollution is especially damaging, as it continues to grow at unprecedented rates, with a significant amount ending up in the oceans. The World Economic Forum estimates that by 2050, there could be more plastic in the ocean than fish by weight. Among the various marine environments, coral reefs, seagrasses, and mangroves proved to be most at-risk, experiencing the fastest increase in cumulative human impact. However, these are also the same ecosystems that we rely on for their direct economic output. Overall, climate-induced declines in ocean health could cost the global economy $428 billion annually by 2050.

The Ocean Economy is in Hot Water

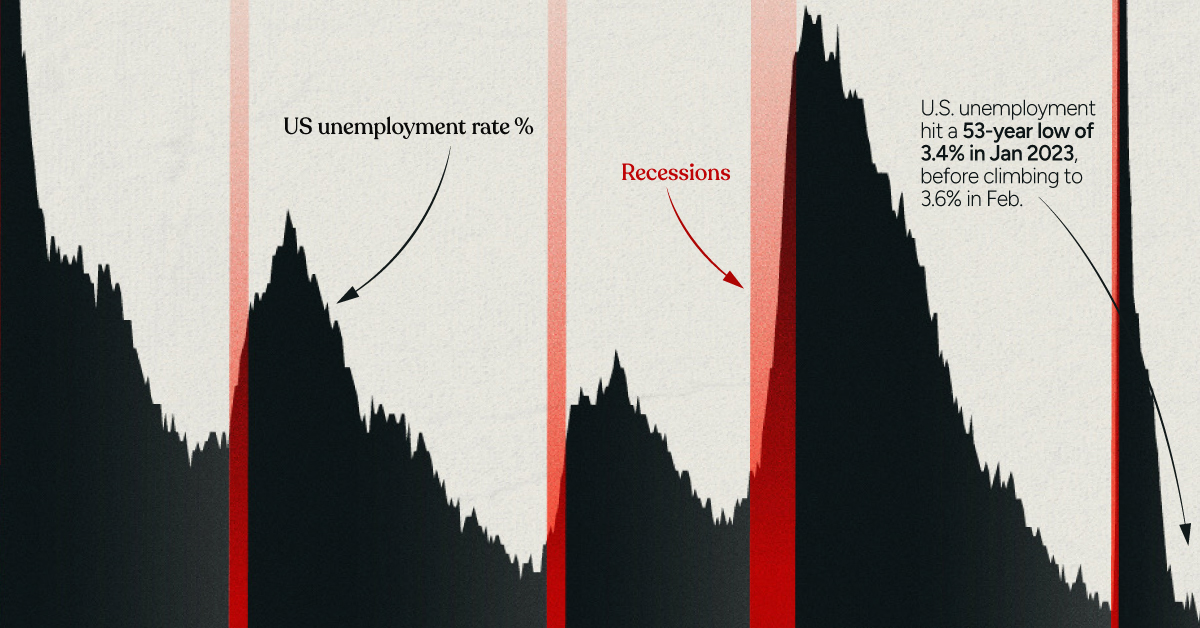

It can be difficult to truly understand the scale at which we rely on the ocean for climate regulation. The ocean is a major “carbon sink”, absorbing nearly 30% of the carbon emitted by human activity. But acidity levels and rising sea surface temperatures are changing its chemistry, and reducing its ability to dissolve CO₂. According to the UN, ocean acidification has grown by 26% since pre-industrial times. At our current rates, it could rise to 100-150% by the end of the century. Overfishing is another urgent threat that shows no signs of slowing down, with sustainable fish stocks declining from 90% to 66.9% in just over 40 years. To try and counteract these issues, this year’s virtual World Oceans Day is focused on “Innovation for a Sustainable Oceans” to discuss various solutions, including how the private sector can work with communities to maintain the blue economy. In addition, there’s a petition in place to urge world leaders to help protect 30% of the natural world by 2030. Will our human activities continue to stress the ocean economy, or will we be able to positively reverse these trends in the years to come? on Both figures surpassed analyst expectations by a wide margin, and in January, the unemployment rate hit a 53-year low of 3.4%. With the recent release of February’s numbers, unemployment is now reported at a slightly higher 3.6%. A low unemployment rate is a classic sign of a strong economy. However, as this visualization shows, unemployment often reaches a cyclical low point right before a recession materializes.

Reasons for the Trend

In an interview regarding the January jobs data, U.S. Treasury Secretary Janet Yellen made a bold statement: While there’s nothing wrong with this assessment, the trend we’ve highlighted suggests that Yellen may need to backtrack in the near future. So why do recessions tend to begin after unemployment bottoms out?

The Economic Cycle

The economic cycle refers to the economy’s natural tendency to fluctuate between periods of growth and recession. This can be thought of similarly to the four seasons in a year. An economy expands (spring), reaches a peak (summer), begins to contract (fall), then hits a trough (winter). With this in mind, it’s reasonable to assume that a cyclical low in the unemployment rate (peak employment) is simply a sign that the economy has reached a high point.

Monetary Policy

During periods of low unemployment, employers may have a harder time finding workers. This forces them to offer higher wages, which can contribute to inflation. For context, consider the labor shortage that emerged following the COVID-19 pandemic. We can see that U.S. wage growth (represented by a three-month moving average) has climbed substantially, and has held above 6% since March 2022. The Federal Reserve, whose mandate is to ensure price stability, will take measures to prevent inflation from climbing too far. In practice, this involves raising interest rates, which makes borrowing more expensive and dampens economic activity. Companies are less likely to expand, reducing investment and cutting jobs. Consumers, on the other hand, reduce the amount of large purchases they make. Because of these reactions, some believe that aggressive rate hikes by the Fed can either cause a recession, or make them worse. This is supported by recent research, which found that since 1950, central banks have been unable to slow inflation without a recession occurring shortly after.

Politicians Clash With Economists

The Fed has raised interest rates at an unprecedented pace since March 2022 to combat high inflation. More recently, Fed Chairman Jerome Powell warned that interest rates could be raised even higher than originally expected if inflation continues above target. Senator Elizabeth Warren expressed concern that this would cost Americans their jobs, and ultimately, cause a recession. Powell remains committed to bringing down inflation, but with the recent failures of Silicon Valley Bank and Signature Bank, some analysts believe there could be a pause coming in interest rate hikes. Editor’s note: just after publication of this article, it was confirmed that U.S. interest rates were hiked by 25 basis points (bps) by the Federal Reserve.