If 2021 taught us anything, it’s that things can change at the drop of the hat. Amidst all this uncertainty, how many of the highlighted predictions came to fruition, and which ones didn’t pan out exactly as expected? Before we start, it’s worth revisiting the prediction bingo board for 2021:

Below, we’ve evaluated a handful of the predictions for 2021 to determine whether or not they actually materialized.

The Easy-to-Quantify Predictions for 2021

Some of the predictions were easy to quantify—like the price of Bitcoin, or GDP targets.

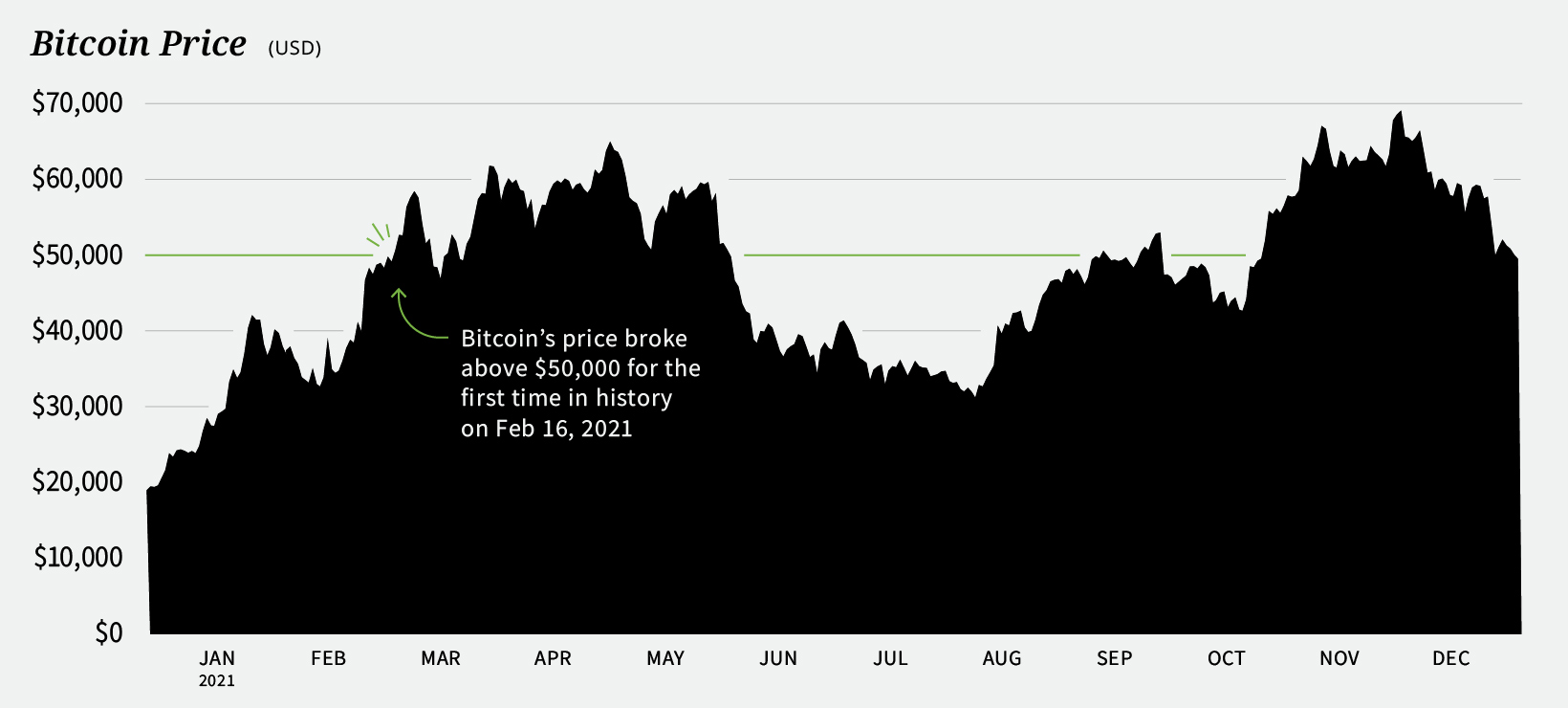

Bitcoin hits the $50,000 mark

Did it happen? Yes As many of the experts forecasted, Bitcoin, and the crypto space in general, had another explosive year in 2021.

Bitcoin’s price rose 72%—from $29,000 at the start of 2021 to roughly $50,000 today (after reaching an all-time high of $69,000 in November). The price increase wasn’t without its fair share of volatility, with Bitcoin suffering three different pullbacks of at least 30%, the greatest being a 50% correction in May. Bitcoin’s ascent is impressive considering the amount of attention and capital that poured into other cryptocurrencies and sectors in the space. Layer one blockchains like Ethereum (+483% in 2021) and Solana (+12,500% in 2021) greatly outpaced bitcoin’s price growth, and NFTs emerged as one of the hottest markets this year.

Global GDP grows 5-6%

Did it happen? Yes By the end of 2021, Euromonitor International expects global real GDP to increase by 5.7%, which aligns perfectly with expert predictions from last year. However, despite the global economy’s overall growth, this year hasn’t come without its challenges. Supply chain issues have triggered a rise in global commodity prices. And since supply constraints are likely to continue into 2022 or beyond, global inflation is expected to keep rising, which could create a drag on real GDP growth.

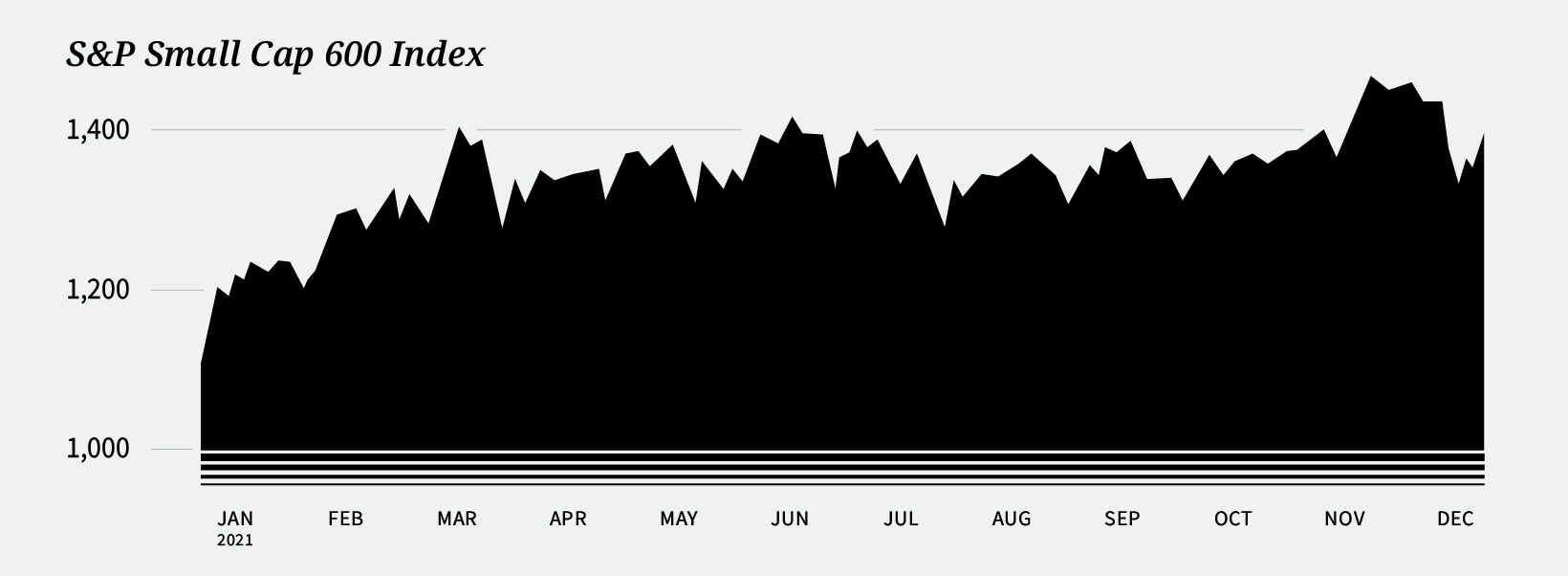

Positive growth for small cap stocks

Did it happen? Yes The S&P Small Cap 600 Index generated a return of 24.6% from December 31, 2020, to December 7, 2021. This mimics the performance of the S&P 500 Index, which grew by 24.8% over the same time period.

Many analysts expect U.S. small caps to continue their momentum into 2022. Historically, the asset class enjoys significant gains during times of robust economic growth. For context, the International Monetary Fund (IMF) expects U.S. GDP to grow by 5.2% in 2022, outpacing many other developed economies.

The Harder-to-Quantify Predictions

Many of the predictions were more subjective than GDP or stock-market growth, and therefore, were harder to measure. So, for these predictions, we polled nine members of our editorial team to gauge whether or not they panned out as expected. We also sifted through hundreds of individual predictions from last year to see which experts got it right, and we’ll be highlighting some of them below. Let’s dive in.

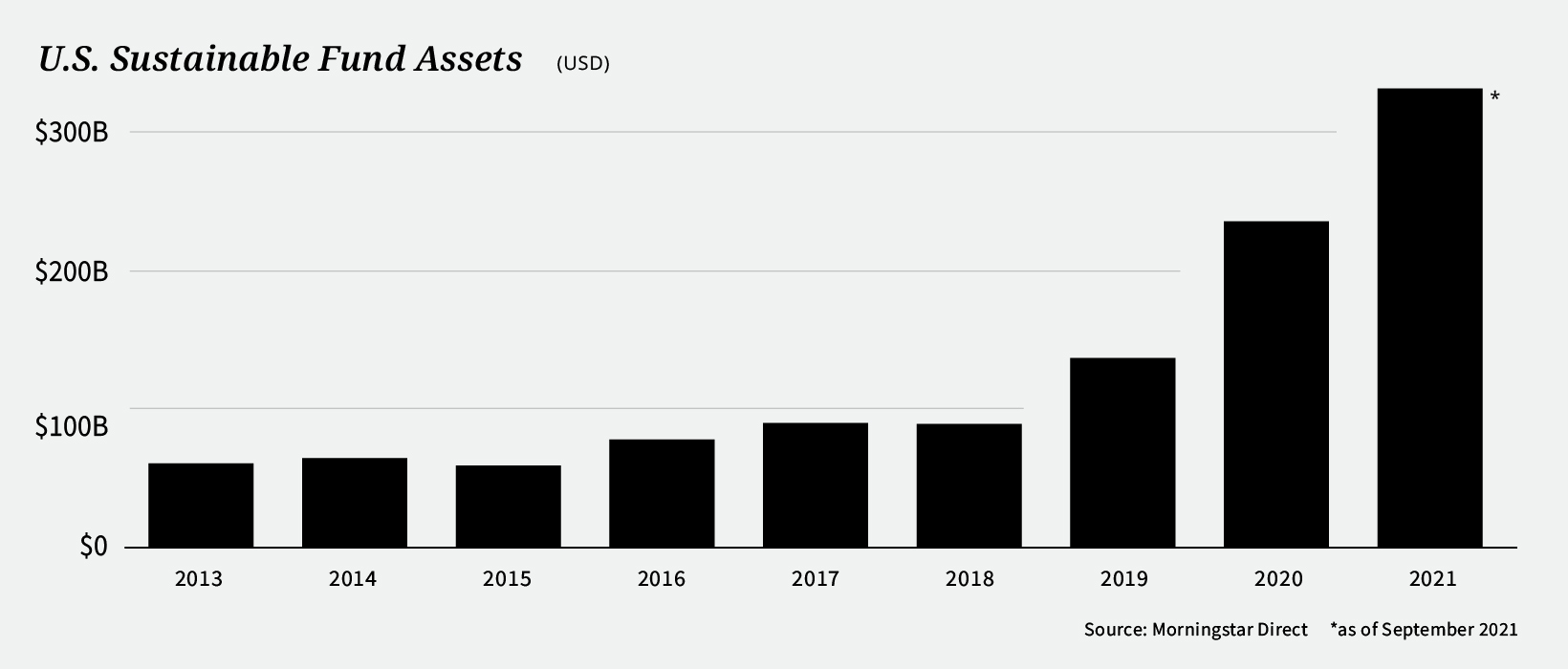

ESG reaches a tipping point in 2021

ESG continued its upward trajectory in 2021. In Q3 2021 alone, the number of sustainable funds jumped 51% to roughly 7,500 worldwide, and assets under management hit a record $3.9 trillion. In the U.S., sustainable fund assets surpassed the $300B mark.

As sustainable investing continues to become a top priority among investors, companies are starting to be held accountable for their sustainability efforts. And those that don’t get on board could see it negatively affect their bottom line. Who saw this coming? DWS Asset Management Group said, “ESG will continue to play an increasingly important role in investing.” Fidelity Investments, an American financial services company also got it right, claiming “ESG and climate funds have outperformed conventional funds throughout 2020 and are likely to continue to do so in 2021.”

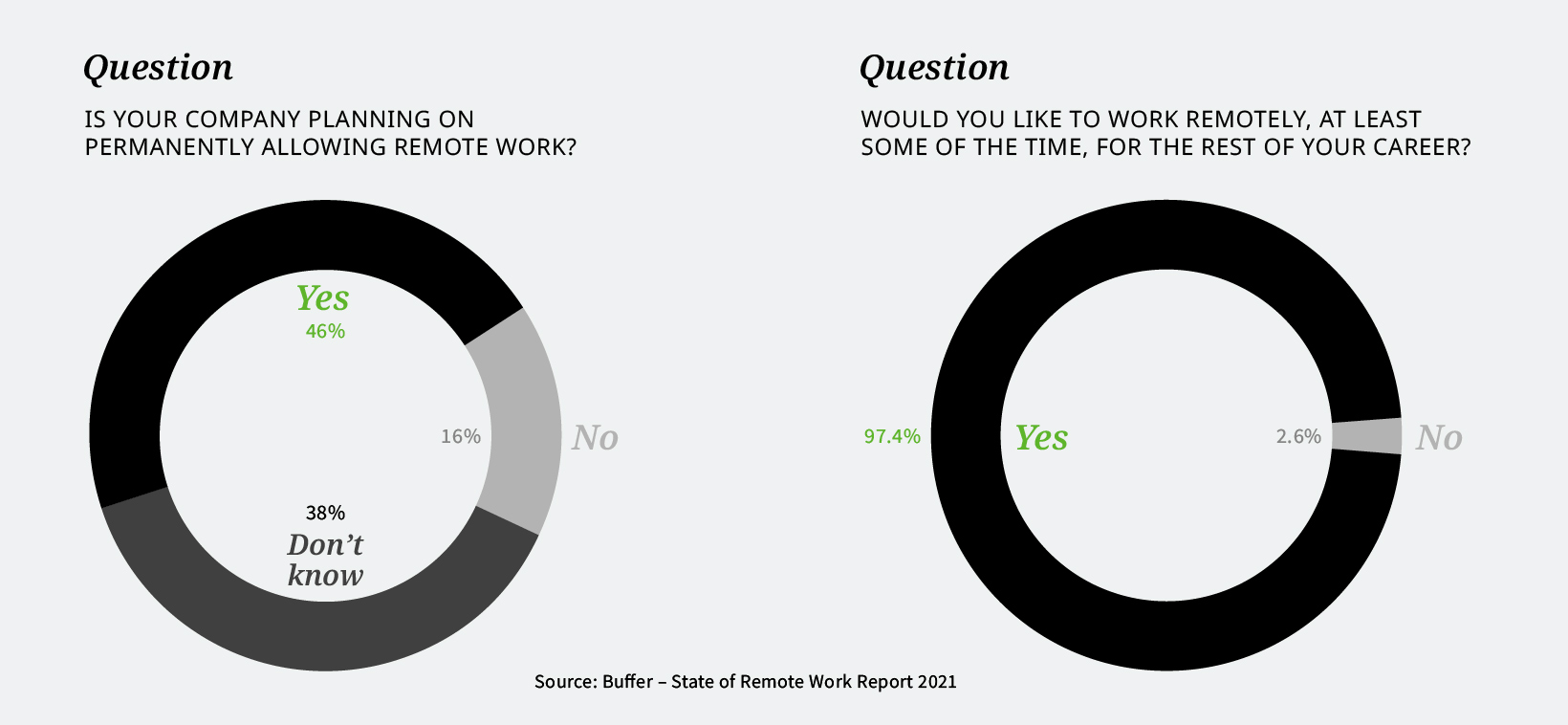

Work from home is here to stay

Even as lockdown restrictions eased, and the world took small steps towards normalcy, workers across the globe continued to work from home. By the end of the year, Gartner predicts that 51% of knowledge workers worldwide will be working remotely, up from 27% in 2019.

Luckily, remote work hasn’t seemed to have a negative impact on employee engagement. In fact, a recent Gallup survey found that 36% of American respondents felt engaged at work, a near all-time high. Who predicted this? Forrester did: “Hybrid work models will become the norm for information workers.” Blue Frontier also predicted this, “Most companies will employ a hybrid work model, with fewer people in the office and more full-time remote employees.”

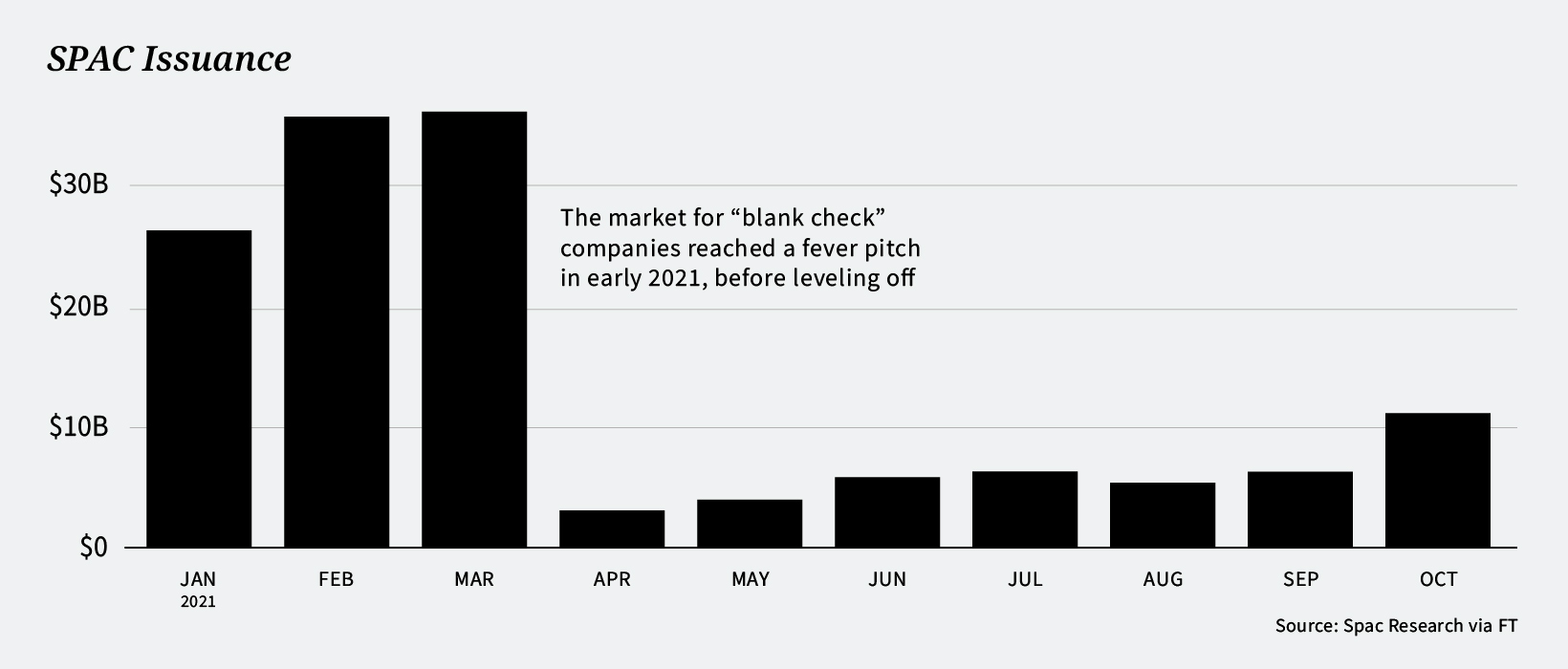

SPACs will fall out of favor

Special Purpose Acquisition Companies (SPACs) waned in 2021—despite a strong start to the year. The market for “blank check” companies peaked in March of 2021, when a record 109 SPACs were issued.

The SEC cracked down on accounting practices, and Rep. Maxine Waters, chair of the House Financial Services Committee remarked she had “deep concerns about the lack of transparency and accountability that is a hallmark of the SPAC process”. However, blank check firms haven’t disappeared completely. Singaporean startup, Grab launched on the Nasdaq in late 2021, reaching a roughly $40 billion valuation—a record according to data from Dealogic. As well, issuance is creeping back upward, a sign that the SPAC market could be staging a comeback. Who saw this coming? John Battelle, co-founder of Wired Magazine, wrote “In 2021, SPACs will lose their luster.”

China will have a strong 2021

China had an impressive first half of the year, but growth slowed down by Q3. Interestingly, it wasn’t so much COVID-19 that ended up hurting the Chinese economy. Rather, the country struggled with supply chain issues, along with a drastic regulation crackdown by the CCP that ended up hamstringing domestic industries. Investors were so spooked by the Chinese government’s crackdown, that from Oct 2020 to Oct 2021, investors sold more than $1 trillion in Chinese equities. Who got this right? James McGregor, China chair of public affairs firm APCO Worldwide, said that “China is going to be ahead of everyone economically, however, its global reputation is not going to improve.”

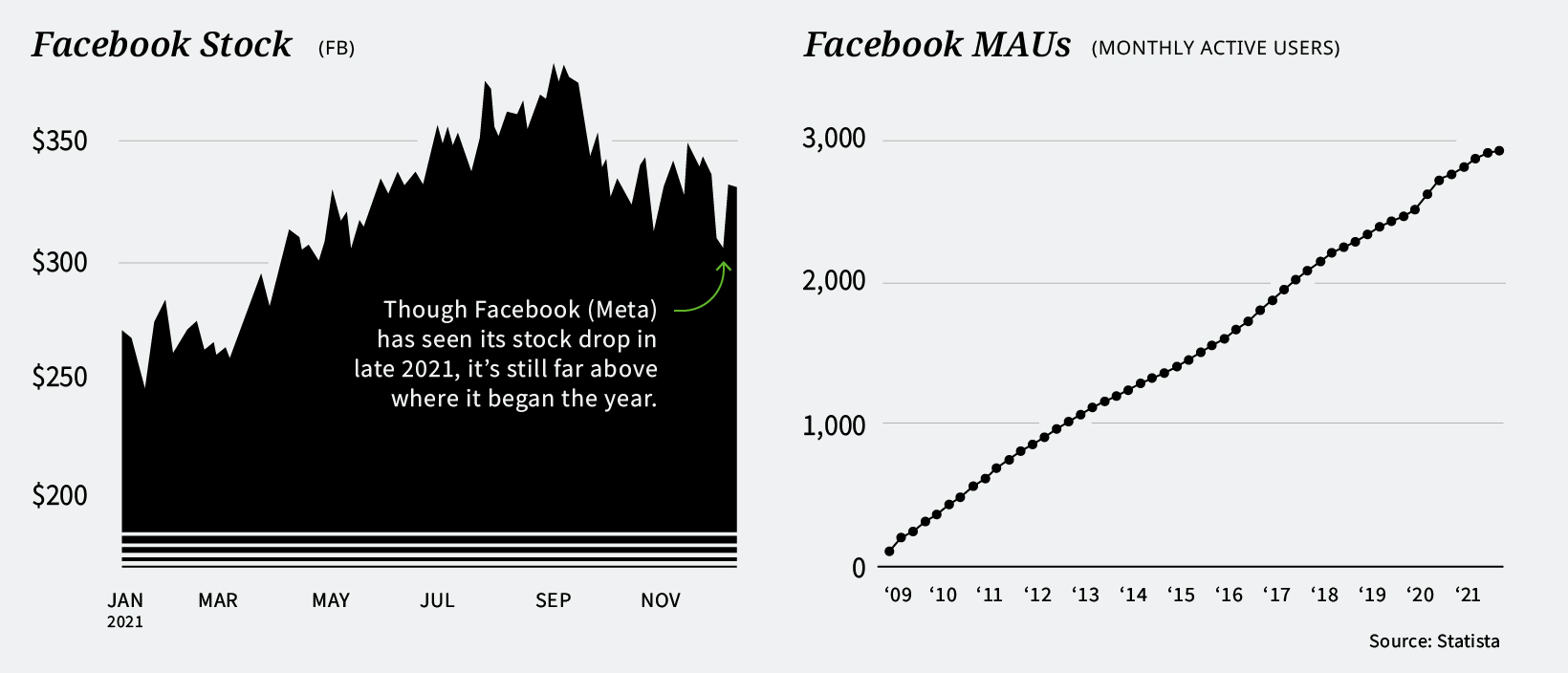

Big Tech backlash will continue

From congressional hearings to massive fines, the tech backlash continued into 2021. While Big Tech in general faced plenty of criticism, it was Facebook (now Meta) that bore the brunt of the scorn. This was especially the case after former Facebook employee Frances Haugen leaked thousands of internal documents to the Wall Street Journal, which Haugen claimed shows that the company prioritizes profits over the wellbeing of its users. The pressure is on for U.S. lawmakers to enact new regulations that hold social media companies more accountable, but decisions on what these new regulations would look like haven’t been made. In contrast, European regulators have managed to get a plan in motion. The EU plans on enacting the Digital Services Act by 2022, which would require tech companies to immediately remove hate speech and other illegal content from their platforms, or pay significant fines.

Two powerful counterpoints to the bluster directed at tech companies are that stock prices are largely up and users still continue to use these services. Even Facebook, which is arguably the most heavily-criticized brand has never seen a drop in users, quarter-on-quarter. Who predicted this? John Battelle saw this one coming, too: “Nothing will get done on tech regulation in the US.”

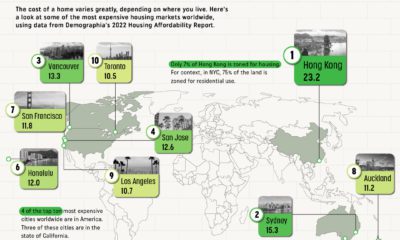

Millennials answer the call of the suburbs

Millennials did move away from the city, but not so much to the suburbs. Rather, small towns and rural areas saw the most growth as people streamed away from large, expensive cities. As people migrated from cities, businesses followed suit. According to data from the National Association of Realtors, urban centers in America experienced a net migration loss (meaning more businesses left the area than moved in) while small towns and rural areas in the U.S. experienced a net migration gain. Who saw this coming? Joe Tyrrell, president, ICE Mortgage Technology “People are shifting away from metropolitan areas to more rural ones. We expect this migration trend to continue as people redefine what home means for them.”

What’s in Store for 2022?

We publish our annual Predictions Consensus to give readers a big-picture understanding of what experts predict for the coming year. With supply chain issues, climate woes, and geopolitical tensions continuing to simmer, 2022 is set to be just as uncertain as 2021 was. To help prep you for another turbulent year, keep an eye out for our 2022 Predictions Consensus, which will be published in early January.

Sign up for VC+ to gain access to our 2022 Global Forecast series

on To reach net-zero by 2050, immediate action and $9.2 trillion in annual investment is required, or about 7-9% of global GDP. This would be $3.5 trillion annually more than today, which in 2020 was equal to roughly:

50% of corporate profits25% of tax revenues7% of household spending

This infographic sponsored by Carbon Streaming Corporation shows how carbon credits can help accelerate a net-zero future by funding climate action.

Closing the Funding Gap With Carbon Credits

Carbon credits play a vital role in channelling finance to help close this funding gap. Here are some ways in which carbon credits can be used: Thanks to a growing number of initiatives listed below, 2023 is anticipated to bring greater credibility and transparency to the carbon credit market.

The Integrity Council for the Voluntary Carbon MarketScience Based Targets initiative (SBTi)Climate Action Data TrustVoluntary Carbon Markets Integrity Initiative

Not Every Carbon Credit is Equal

Identifying high-quality carbon credits is important because not every type of credit offers the same scope of benefits. Carbon credit buyers look for credits that offer tangible benefits that go beyond CO₂ reduction or removal, such as:

Advancing Sustainable Development GoalsCreating jobs in local communitiesProtecting biodiversityProviding education and job training

Often, credits that offer these types of benefits command a price premium. At the same time, demand for carbon credits is expected to increase. Within the decade, the value of the voluntary carbon market could grow from $2 billion up to $50 billion. Voluntary carbon markets refer to the transactions in which carbon credits are purchased by corporate and other buyers that voluntarily (not required by a regulatory act) want to compensate for their emissions or advance sustainability goals.

Source: Ecosystem Marketplace, McKinsey, UNFCCC Today, over 8,300 corporate, 1,100 municipal, and 52 regional net-zero commitments are set to drive market growth.

Carbon Streaming’s Innovative Approach to Climate Action

Carbon Streaming is a publicly listed company that invests capital in high integrity carbon credit projects on a global scale. It uses the proven, flexible streaming model to create long-term partnerships. This model aligns interests to benefit all stakeholders. Carbon Streaming’s growing portfolio of carbon credits includes over 20 projects across six different project types in 12 countries that aim to accelerate a net-zero future.

Transformative Year Ahead

By the end of 2023, carbon credits are expected to be issued from 10 or more projects. Importantly, all of Carbon Streaming’s carbon projects aim to advance multiple UN Sustainable Development Goals. Carbon Streaming intends to continue growing and diversifying its portfolio while selling carbon credits received to maximize value for all stakeholders.

Interested in learning more about Carbon Streaming? Click here to learn more.